Transatlantic Subnational Innovation Competitiveness Index 2.0

For policymakers to bolster the global competitiveness of their nations and regions, they first must know where they stand. This report benchmarks the 121 regions of Austria, Germany, Hungary, Italy, Poland, Sweden, and the United States using 13 commonly available indicators of strength in the knowledge economy, globalization, and innovation capacity.

KEY TAKEAWAYS

Key Takeaways

Contents

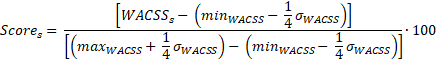

Appendix A: Composite and Category Scores Methodology. 50

Appendix B: Indicator Methodologies and Weights. 51

Appendix C: Estimation Methodologies. 52

Introduction

In this report, member think tanks of the Global Trade and Innovation Policy Alliance (GTIPA) analyze the subnational innovation competitiveness of the states and regions of seven nations: Austria, Germany, Hungary, Italy, Poland, Sweden, and the United States.[1] Most of these countries exhibit growth in innovation, yet it is imperative to understand the subnational aspect of competitiveness as well as to recommend targeted policies for further development.[2]

Competitiveness and innovation play a pivotal role in determining a nation’s—or state’s—ability to thrive in the fiercely competitive global marketplace. Competitiveness encompasses not only the capacity to produce high-quality goods and services at competitive costs but also the ability to create an environment that fosters productivity, attracts investments, and nurtures a skilled workforce. In an era marked by rapid globalization and digitalization, nations and states alike must consistently seek avenues to enhance their competitive edge to secure their position in the global economic hierarchy.[3]

Innovation ecosystems encompass intricate networks of stakeholders, including research institutions, universities, startups, corporations, investors, and government bodies, collaborating to foster the creation, diffusion, and application of novel knowledge and technologies.[4] Regional hubs such as Silicon Valley in the United States and Stockholm in Sweden stand as exemplars of this paradigm, showcasing remarkable success in cultivating vibrant innovation ecosystems. The availability of state-of-the-art infrastructure, coupled with a talent-rich environment, attracts and retains skilled individuals crucial to advance these ecosystems’ vitality. By offering fertile ground for multidisciplinary collaboration, resource sharing, and risk mitigation, these regional hubs epitomize the success of innovation ecosystems.[5]

Understanding the components of innovation ecosystems at both national and subnational levels is vital for fostering a holistic and tailored approach to innovation-driven development. At the national level, such understanding allows governments to formulate comprehensive policies that leverage synergies among various actors such as research institutions, regulatory policies, funding mechanisms, and education systems.[6] This facilitates the creation of an enabling environment conducive to research, entrepreneurship, and technology diffusion. On the subnational level, recognizing the unique strengths and assets of specific regions enables targeted interventions that capitalize on local expertise, resources, and industries. This localized approach fosters the emergence of vibrant innovation clusters, encourages collaboration among local stakeholders, and bolsters regional economic growth.[7]

Overall, a dual understanding of the innovation ecosystem ensures that strategies align with both national priorities and local dynamics, thereby maximizing the potential for sustainable innovation and economic advancement at regional and national levels alike.

The Global Innovation Index (GII) and the European Innovation Scorecard (EIS) are prominent tools that provide comprehensive assessments of innovation performance on a global and regional scale. The GII offers a multidimensional perspective on innovation, evaluating factors such as R&D investments, human capital, and business sophistication, which collectively contribute to a country’s innovation capacity.[8] Similarly, the EIS provides a detailed analysis of innovation trends and capabilities within European Union member states, facilitating benchmarking and policy evaluation.[9]

In line with GII and EIS, the Information Technology and Innovation Foundation (ITIF) has contributed significantly to the discourse on innovation competitiveness through its series of insightful subnational innovation competitiveness reports, which provide nuanced insights into the intricate relationships between innovation, economic development, and regional competitiveness, offering valuable perspectives for policymakers, businesses, and researchers alike. ITIF’s “State New Economy Index” report series delves into the role of innovation in driving U.S. state-level economic growth and highlights the transformation of industries through technological advancements.[10] The “North American Subnational Innovation Competitiveness” report delves into innovation dynamics within the North American region, emphasizing the significance of local ecosystems in enhancing competitiveness. Furthermore, the GTIPA’s 2022 “Transatlantic Subnational Innovation Competitiveness” report examines innovation landscapes across Europe (Germany and Italy) and North America (Canada and the United States), shedding light on the interplay between subnational entities and cross-border collaboration.[11] This new report, the Transatlantic Subnational Innovation Competitiveness Index 2.0 (“TASICI 2.0”), examines the innovation competitiveness of the 121 regions of Austria, Germany, Hungary, Italy, Poland, Sweden, and the United States.

The following section of this report first introduces the index’s indicators and then assesses each country’s regions’ performance thereon. The report concludes by providing policy recommendations to the seven countries on how to boost their subnational innovation competitiveness based on their unique strengths and weaknesses.

The Index

The TASICI 2.0 captures the innovation performance of 121 regions across 7 countries and 2 continents: Austria (8 regions), Germany (13 regions), Hungary (7 regions), Italy (20 regions), Poland (16 regions), Sweden (7 regions), and the United States (50 states). In this report, we refer to the U.S. states as regions to simplify the comparative analysis.

This report considers 13 indicators (which were found to be commonly available across the 121 regions of these seven countries) representing the relevant determinants of a successful innovation ecosystem, grouped into three categories:

▪ Knowledge-Based Workforce: Indicators measure the educational attainment of the workforce; immigration of knowledge workers; employment in professional, technical, and scientific (PTS) activities; and manufacturing sector productivity.

▪ Globalization: Indicators measure high-tech exports and inward foreign direct investment (FDI).

▪ Innovation Capacity: Indicators measure a state’s share of households subscribing to broadband Internet, expenditures on R&D, the number of R&D personnel, the creation of new businesses, patent output, the extent of progress toward decarbonization, and venture capital (VC) investment.

The most important category of the TASICI 2.0 is innovation capacity, which accounts for 56 percent of the index’s weight, while the knowledge economy indicators account for 31 percent of the index’s weight, and the globalization indicators account for the remaining 13 percent.

Rankings

Table 1: Overall and component performance of regions in TASICI 2.0

|

Overall Rank |

Overall Score |

Knowledge |

Globalization |

Innovation |

|||||

|

Country |

Region |

Score |

Rank |

Score |

Rank |

Score |

Rank |

||

|

1 |

USA |

Massachusetts |

95.3 |

94.9 |

1 |

31.9 |

38 |

95.4 |

1 |

|

2 |

USA |

California |

88.8 |

89.1 |

4 |

21.3 |

69 |

92.0 |

2 |

|

3 |

Germany |

Baden-Württemberg |

85.3 |

64.4 |

19 |

49.6 |

8 |

90.9 |

3 |

|

4 |

USA |

Washington |

80.3 |

71.6 |

11 |

15.6 |

87 |

90.1 |

4 |

|

5 |

Sweden |

Greater Metropolitan Region |

79.2 |

91.6 |

3 |

28.1 |

45 |

75.2 |

5 |

|

6 |

Sweden |

West Sweden |

69.8 |

71.4 |

12 |

32.8 |

31 |

70.5 |

8 |

|

7 |

Germany |

Bavaria |

69.5 |

63.6 |

20 |

44.6 |

11 |

70.5 |

7 |

|

8 |

Sweden |

South Sweden |

65.7 |

67.5 |

16 |

33.9 |

25 |

66.3 |

9 |

|

9 |

Germany |

Hesse |

64.5 |

71.6 |

10 |

38.4 |

17 |

61.4 |

11 |

|

10 |

USA |

Maryland |

62.9 |

86.3 |

5 |

15.7 |

86 |

58.4 |

13 |

|

11 |

Germany |

Berlin/Brandenburg |

61.9 |

82.4 |

7 |

17.7 |

80 |

58.3 |

14 |

|

12 |

USA |

New Jersey |

58.2 |

91.9 |

2 |

13.1 |

100 |

49.9 |

23 |

|

13 |

USA |

Oregon |

57.0 |

55.3 |

30 |

25.9 |

55 |

62.2 |

10 |

|

14 |

Austria |

Lower Austria/Vienna |

55.6 |

66.4 |

18 |

4.2 |

121 |

61.1 |

12 |

|

15 |

USA |

Connecticut |

53.1 |

74.2 |

8 |

25.9 |

54 |

47.6 |

28 |

|

16 |

Austria |

Styria |

52.7 |

34.1 |

78 |

10.2 |

106 |

70.9 |

6 |

|

17 |

USA |

Delaware |

52.1 |

62.2 |

22 |

22.8 |

63 |

53.0 |

20 |

|

18 |

USA |

Colorado |

51.1 |

68.9 |

15 |

27.2 |

49 |

47.0 |

29 |

|

19 |

Germany |

Hamburg/Schleswig-Holstein |

50.9 |

69.5 |

13 |

28.4 |

44 |

46.1 |

31 |

|

20 |

USA |

Michigan |

48.8 |

50.6 |

38 |

17.8 |

79 |

55.4 |

18 |

|

21 |

Italy |

Emilia-Romagna |

48.2 |

45.8 |

48 |

36.9 |

21 |

51.3 |

21 |

|

22 |

Germany |

North Rhine-Westphalia |

47.8 |

57.6 |

26 |

32.0 |

37 |

46.4 |

30 |

|

23 |

USA |

New Hampshire |

47.5 |

48.3 |

42 |

30.9 |

41 |

50.9 |

22 |

|

24 |

USA |

New Mexico |

47.3 |

44.1 |

50 |

15.2 |

90 |

57.1 |

15 |

|

25 |

USA |

New York |

47.3 |

69.4 |

14 |

22.5 |

64 |

42.7 |

36 |

|

26 |

USA |

Minnesota |

47.0 |

58.7 |

25 |

21.5 |

68 |

47.8 |

26 |

|

27 |

USA |

Utah |

46.9 |

54.5 |

31 |

22.4 |

65 |

49.5 |

24 |

|

28 |

Germany |

Bremen/Lower Saxony |

46.2 |

55.5 |

28 |

23.5 |

59 |

47.7 |

27 |

|

29 |

USA |

Virginia |

44.3 |

83.2 |

6 |

23.0 |

62 |

31.7 |

62 |

|

30 |

Germany |

Rhineland-Palatinate |

44.0 |

50.7 |

37 |

26.8 |

50 |

46.0 |

32 |

|

31 |

USA |

Illinois |

43.8 |

67.2 |

17 |

27.4 |

46 |

37.5 |

49 |

|

32 |

USA |

Texas |

43.7 |

73.4 |

9 |

32.4 |

34 |

32.9 |

61 |

|

33 |

Hungary |

Central Hungary |

43.4 |

31.0 |

84 |

49.0 |

9 |

48.1 |

25 |

|

34 |

Germany |

Saxony |

42.5 |

49.3 |

41 |

30.2 |

42 |

43.5 |

34 |

|

35 |

Austria |

Upper Austria |

42.1 |

33.0 |

81 |

11.1 |

105 |

56.3 |

17 |

|

36 |

Italy |

Lombardy |

41.8 |

52.3 |

33 |

43.7 |

12 |

37.2 |

50 |

|

37 |

Germany |

Saarland |

41.1 |

46.4 |

44 |

36.5 |

22 |

41.2 |

38 |

|

38 |

Austria |

Tyrol |

41.1 |

31.3 |

83 |

6.7 |

119 |

57.0 |

16 |

|

39 |

Austria |

Vorarlberg |

40.6 |

30.5 |

87 |

11.6 |

103 |

55.2 |

19 |

|

40 |

USA |

North Carolina |

40.3 |

60.3 |

23 |

12.1 |

102 |

40.2 |

40 |

|

41 |

Sweden |

Upper Norrland |

39.8 |

49.4 |

40 |

23.0 |

61 |

41.7 |

37 |

|

42 |

Italy |

Lazio |

38.8 |

55.4 |

29 |

21.5 |

67 |

37.8 |

47 |

|

43 |

USA |

Pennsylvania |

38.5 |

56.1 |

27 |

18.6 |

74 |

37.9 |

46 |

|

44 |

Italy |

Piedmont |

38.2 |

40.4 |

58 |

38.2 |

18 |

39.5 |

42 |

|

45 |

USA |

Arizona |

37.4 |

51.5 |

36 |

20.2 |

71 |

38.0 |

45 |

|

46 |

Germany |

Thuringia |

37.2 |

43.6 |

51 |

27.4 |

47 |

39.6 |

41 |

|

47 |

Italy |

Friuli-Venezia Giulia |

36.8 |

38.2 |

66 |

35.6 |

24 |

39.3 |

43 |

|

48 |

USA |

Idaho |

35.9 |

34.2 |

74 |

18.9 |

73 |

44.7 |

33 |

|

49 |

Poland |

Dolnośląskie |

35.8 |

31.0 |

85 |

56.5 |

7 |

35.4 |

53 |

|

50 |

Austria |

Salzburg |

35.0 |

46.0 |

47 |

8.1 |

114 |

40.9 |

39 |

|

51 |

Sweden |

Småland and the Islands |

34.9 |

39.4 |

61 |

42.8 |

13 |

34.0 |

57 |

|

52 |

USA |

Wisconsin |

33.7 |

38.3 |

65 |

26.6 |

52 |

37.5 |

48 |

|

53 |

USA |

Rhode Island |

33.5 |

46.3 |

45 |

22.2 |

66 |

34.5 |

54 |

|

54 |

Hungary |

Central Transdanubia |

33.5 |

19.2 |

103 |

95.8 |

2 |

26.5 |

73 |

|

55 |

Italy |

Veneto |

33.4 |

35.9 |

72 |

31.5 |

39 |

36.8 |

52 |

|

56 |

Poland |

Małopolskie |

33.1 |

21.2 |

100 |

31.5 |

40 |

43.5 |

35 |

|

57 |

USA |

Missouri |

32.4 |

44.6 |

49 |

32.4 |

32 |

30.9 |

63 |

|

58 |

USA |

Ohio |

32.3 |

47.2 |

43 |

18.3 |

76 |

33.6 |

58 |

|

59 |

Italy |

Tuscany |

32.0 |

37.5 |

70 |

21.2 |

70 |

37.0 |

51 |

|

60 |

Hungary |

Western Transdanubia |

30.6 |

19.9 |

102 |

95.8 |

2 |

22.2 |

88 |

|

61 |

Germany |

Mecklenburg-Vorpommern |

30.6 |

41.5 |

54 |

17.5 |

81 |

34.2 |

56 |

|

62 |

Austria |

Carinthia |

30.5 |

38.7 |

63 |

8.0 |

115 |

38.2 |

44 |

|

63 |

USA |

Indiana |

30.3 |

42.6 |

53 |

14.0 |

93 |

34.3 |

55 |

|

64 |

Italy |

Liguria |

29.2 |

41.2 |

55 |

24.5 |

57 |

30.2 |

64 |

|

65 |

Poland |

Pomorskie |

29.1 |

26.6 |

93 |

37.9 |

20 |

33.4 |

60 |

|

66 |

Sweden |

North Middle Sweden |

28.5 |

40.5 |

57 |

33.0 |

28 |

27.2 |

69 |

|

67 |

USA |

Kansas |

28.4 |

50.3 |

39 |

15.9 |

84 |

27.3 |

68 |

|

68 |

USA |

Georgia |

28.4 |

51.6 |

34 |

13.2 |

99 |

27.3 |

67 |

|

69 |

USA |

Florida |

27.9 |

54.4 |

32 |

13.3 |

98 |

25.3 |

79 |

|

70 |

Hungary |

Southern Great Plain |

27.3 |

21.7 |

99 |

62.9 |

4 |

26.1 |

77 |

|

71 |

Poland |

Mazowieckie |

26.6 |

51.6 |

35 |

36.0 |

23 |

18.3 |

103 |

|

72 |

Italy |

Marche |

26.2 |

29.7 |

90 |

18.1 |

78 |

33.5 |

59 |

|

73 |

Hungary |

Northern Hungary |

26.0 |

18.7 |

105 |

95.8 |

2 |

16.2 |

109 |

|

74 |

USA |

Wyoming |

25.6 |

58.8 |

24 |

9.6 |

110 |

21.0 |

94 |

|

75 |

Italy |

Trentino |

24.6 |

32.2 |

82 |

18.6 |

75 |

29.8 |

65 |

|

76 |

Italy |

Abruzzo |

24.5 |

34.2 |

76 |

26.8 |

51 |

26.4 |

74 |

|

77 |

Poland |

Śląskie |

24.5 |

23.4 |

97 |

45.8 |

10 |

26.1 |

76 |

|

78 |

Sweden |

Middle Norrland |

24.5 |

40.3 |

59 |

26.4 |

53 |

23.5 |

84 |

|

79 |

Germany |

Saxony-Anhalt |

24.1 |

40.3 |

60 |

14.5 |

91 |

26.4 |

75 |

|

80 |

Italy |

Umbria |

23.8 |

34.2 |

75 |

16.9 |

83 |

28.3 |

66 |

|

81 |

Hungary |

Northern Great Plain |

23.6 |

18.4 |

106 |

62.8 |

5 |

22.5 |

87 |

|

82 |

USA |

Iowa |

22.9 |

37.0 |

71 |

12.2 |

101 |

27.0 |

71 |

|

83 |

USA |

Vermont |

22.7 |

37.7 |

69 |

32.8 |

29 |

20.4 |

95 |

|

84 |

USA |

Tennessee |

22.6 |

42.6 |

52 |

15.3 |

89 |

22.9 |

85 |

|

85 |

USA |

Maine |

22.4 |

37.8 |

68 |

32.8 |

30 |

20.0 |

97 |

|

86 |

Hungary |

Southern Transdanubia |

21.9 |

11.4 |

117 |

58.1 |

6 |

24.8 |

80 |

|

87 |

USA |

Nevada |

21.4 |

39.1 |

62 |

15.9 |

85 |

22.8 |

86 |

|

88 |

USA |

Nebraska |

21.3 |

46.1 |

46 |

13.8 |

94 |

19.8 |

99 |

|

89 |

Poland |

Lubuskie |

20.1 |

12.8 |

113 |

39.6 |

16 |

26.9 |

72 |

|

90 |

Poland |

Wielkopolskie |

19.7 |

17.2 |

108 |

39.6 |

15 |

24.3 |

81 |

|

91 |

USA |

Kentucky |

19.0 |

34.0 |

79 |

32.1 |

36 |

17.3 |

104 |

|

92 |

USA |

South Carolina |

18.3 |

37.9 |

67 |

13.6 |

96 |

19.7 |

102 |

|

93 |

Italy |

Campania |

18.3 |

23.9 |

96 |

11.2 |

104 |

27.1 |

70 |

|

94 |

USA |

North Dakota |

18.0 |

35.8 |

73 |

15.6 |

88 |

19.7 |

101 |

|

95 |

USA |

Louisiana |

17.5 |

62.8 |

21 |

9.5 |

111 |

7.7 |

120 |

|

96 |

Poland |

Podkarpackie |

17.2 |

11.1 |

119 |

38.0 |

19 |

24.1 |

82 |

|

97 |

USA |

Alabama |

17.2 |

34.1 |

77 |

8.8 |

113 |

21.3 |

93 |

|

98 |

Poland |

Lubelskie |

17.0 |

11.8 |

115 |

29.2 |

43 |

26.1 |

78 |

|

99 |

Italy |

Aosta Valley |

15.9 |

30.5 |

88 |

13.7 |

95 |

19.9 |

98 |

|

100 |

Poland |

Zachodniopomorskie |

15.8 |

15.2 |

112 |

32.2 |

35 |

21.9 |

89 |

|

101 |

Poland |

Kujawsko-Pomorskie |

15.8 |

11.2 |

118 |

32.4 |

33 |

23.7 |

83 |

|

102 |

USA |

Montana |

15.2 |

40.6 |

56 |

7.1 |

116 |

15.9 |

112 |

|

103 |

Italy |

Basilicata |

14.9 |

27.7 |

92 |

23.8 |

58 |

16.9 |

106 |

|

104 |

USA |

Hawaii |

14.7 |

38.6 |

64 |

6.7 |

118 |

16.2 |

110 |

|

105 |

USA |

Oklahoma |

14.2 |

33.5 |

80 |

17.5 |

82 |

15.0 |

113 |

|

106 |

Poland |

Podlaskie |

13.8 |

12.7 |

114 |

27.3 |

48 |

21.6 |

92 |

|

107 |

Italy |

Molise |

13.7 |

23.2 |

98 |

9.0 |

112 |

21.7 |

91 |

|

108 |

Italy |

Sardinia |

13.0 |

24.0 |

95 |

9.7 |

109 |

20.1 |

96 |

|

109 |

Poland |

Łódzkie |

12.7 |

20.2 |

101 |

33.4 |

26 |

14.8 |

114 |

|

110 |

Poland |

Opolskie |

12.6 |

11.6 |

116 |

42.2 |

14 |

16.2 |

111 |

|

111 |

USA |

Alaska |

11.2 |

30.1 |

89 |

13.5 |

97 |

13.5 |

116 |

|

112 |

Poland |

Warmińsko-Mazurskie |

11.1 |

5.1 |

121 |

33.3 |

27 |

19.8 |

100 |

|

113 |

Austria |

Burgenland |

10.6 |

15.3 |

111 |

6.7 |

117 |

21.7 |

90 |

|

114 |

USA |

South Dakota |

10.3 |

24.8 |

94 |

19.4 |

72 |

13.1 |

117 |

|

115 |

USA |

Arkansas |

9.2 |

27.9 |

91 |

14.2 |

92 |

11.6 |

118 |

|

116 |

Italy |

Apulia |

9.2 |

19.2 |

104 |

9.8 |

108 |

17.0 |

105 |

|

117 |

Italy |

Sicily |

8.1 |

16.8 |

109 |

9.9 |

107 |

16.5 |

107 |

|

118 |

Poland |

Świętokrzyskie |

7.7 |

11.0 |

120 |

25.6 |

56 |

14.3 |

115 |

|

119 |

USA |

West Virginia |

7.2 |

30.8 |

86 |

23.5 |

60 |

4.6 |

121 |

|

120 |

Italy |

Calabria |

7.0 |

16.6 |

110 |

5.4 |

120 |

16.4 |

108 |

|

121 |

USA |

Mississippi |

4.7 |

17.4 |

107 |

18.2 |

77 |

9.0 |

119 |

Index Scores

Overall

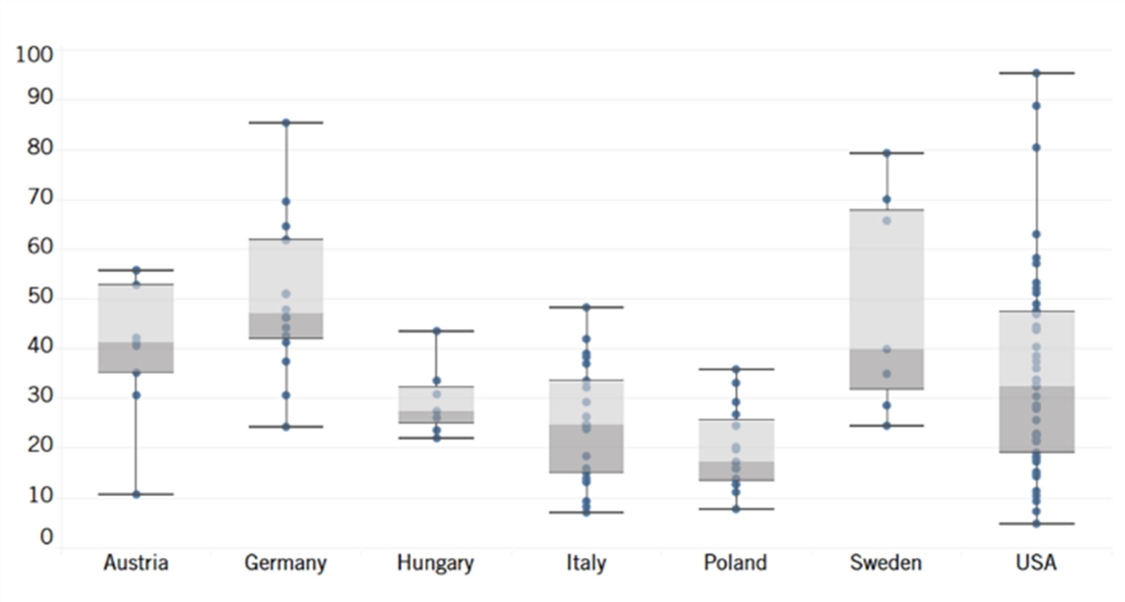

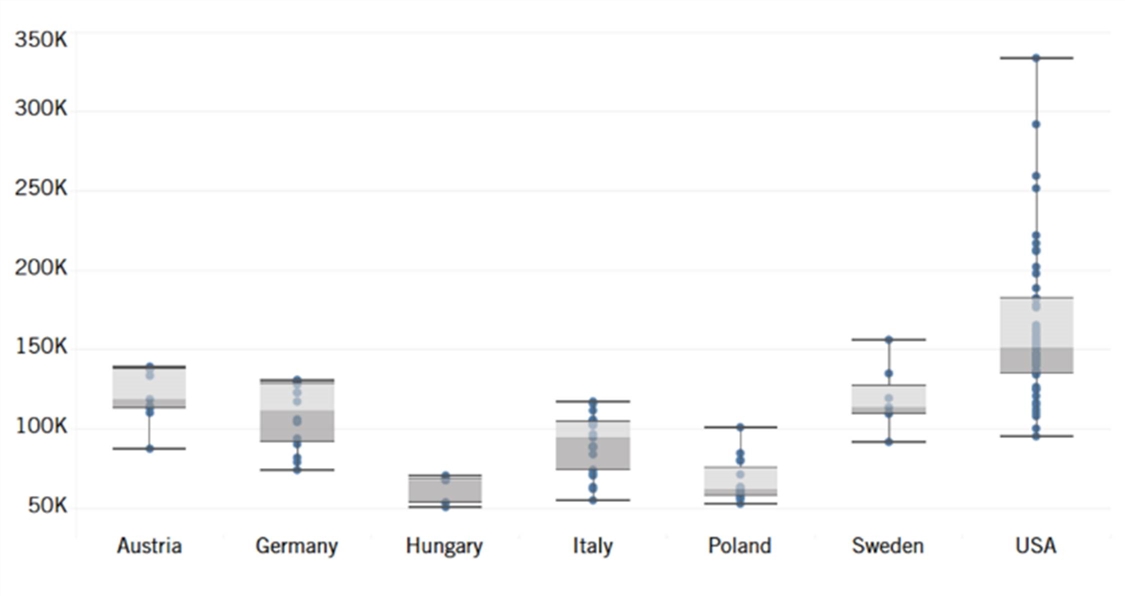

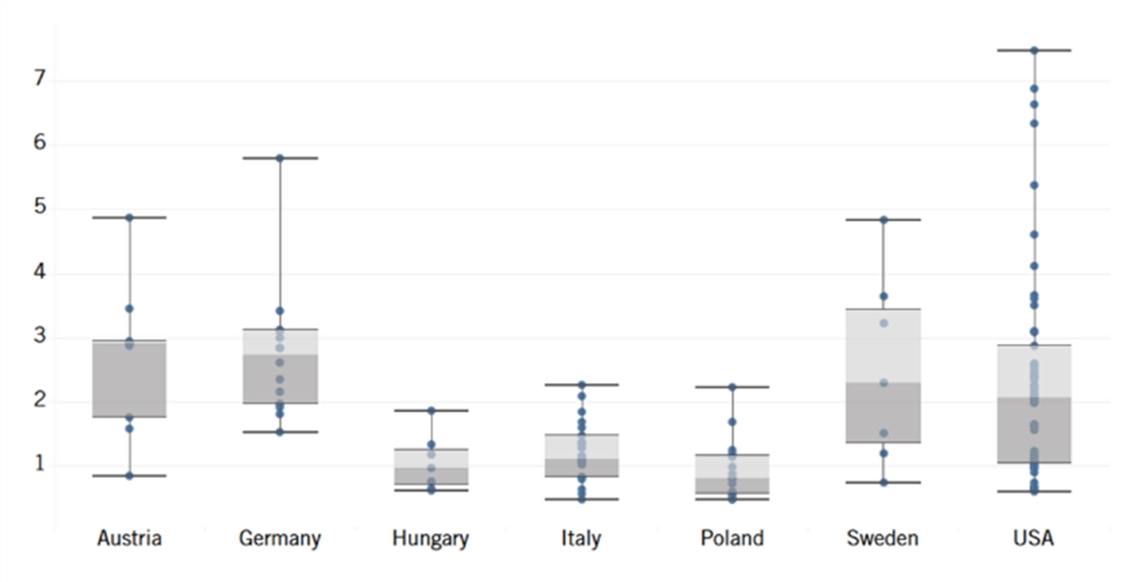

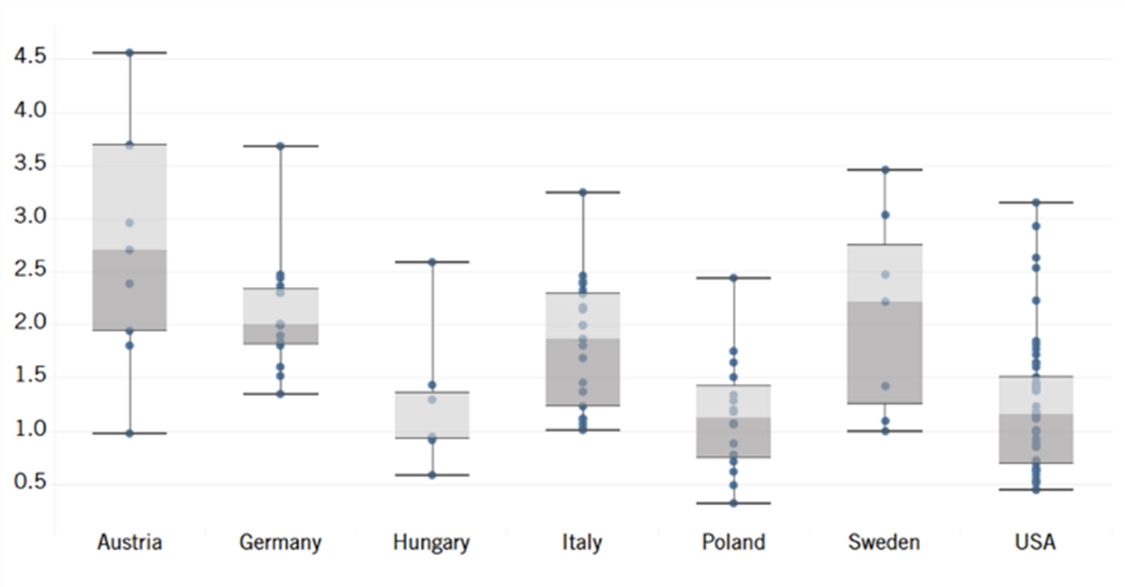

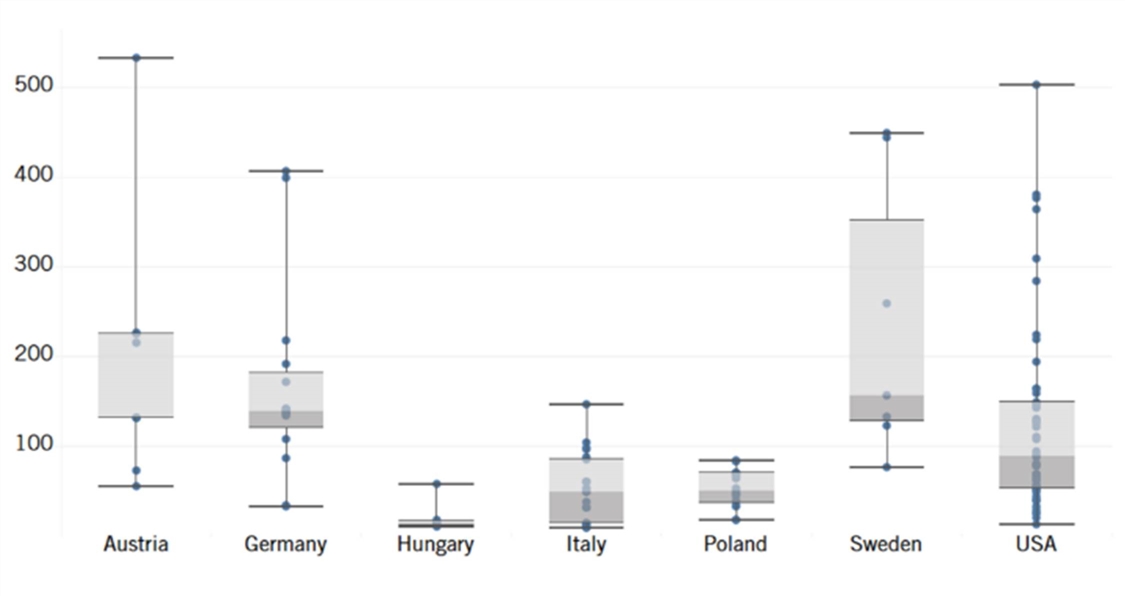

The United States leads in subnational innovation competitiveness, claiming the top two regions, Massachusetts and California (although it is also home to the lowest-performing region in the index, Mississippi, as well) (see figure 1 and figure 2). Germany and Sweden each place three regions in the top 10, and overall display less variability than does the United States in regional performance. The difference between the maximum and the minimum subnational innovation competitiveness score is the smallest in Hungary and Poland, although the best-performing regions in Hungary and Poland rank lower than those of Italy. Austrian regions also showcase varied performance with two regions in the top 20 and one region in the bottom 10.

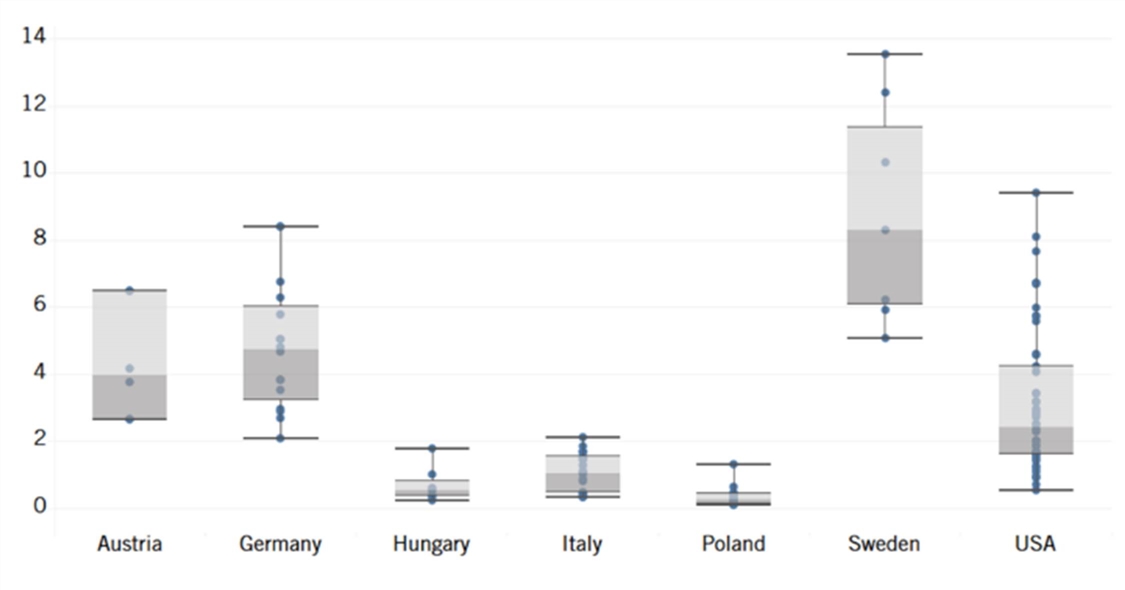

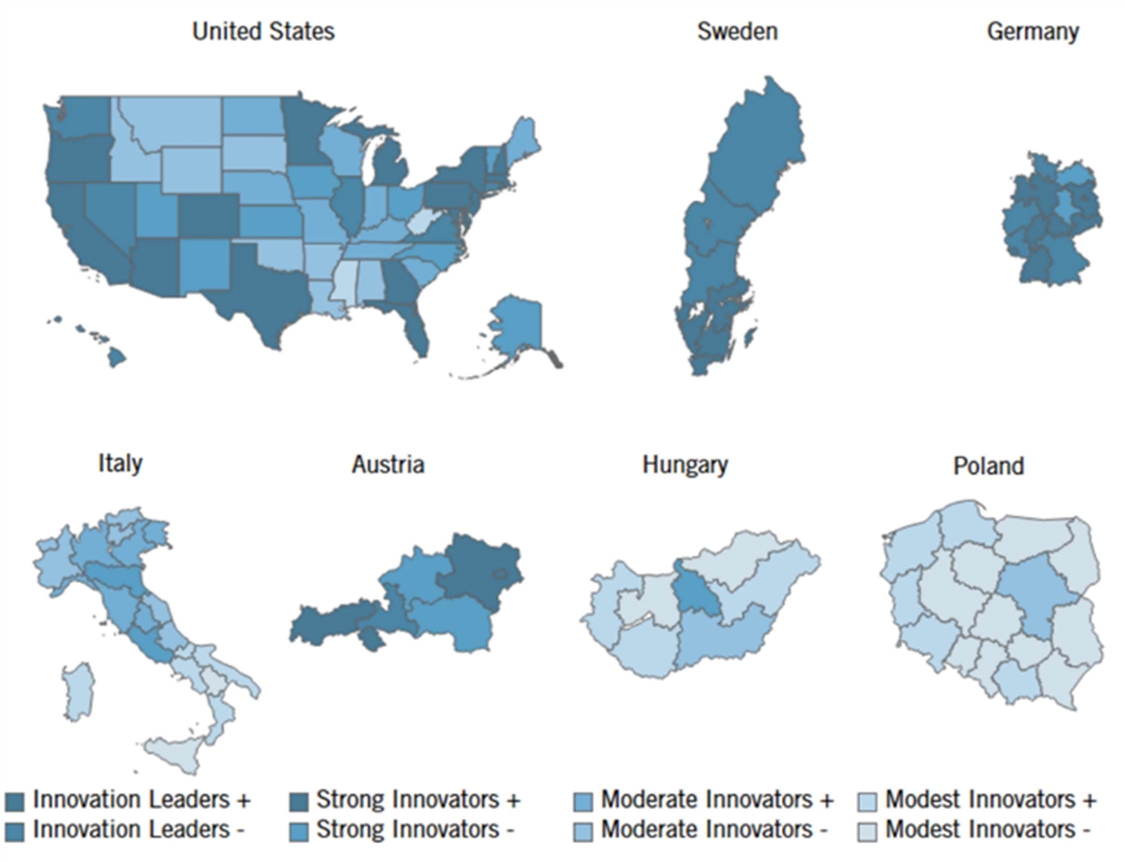

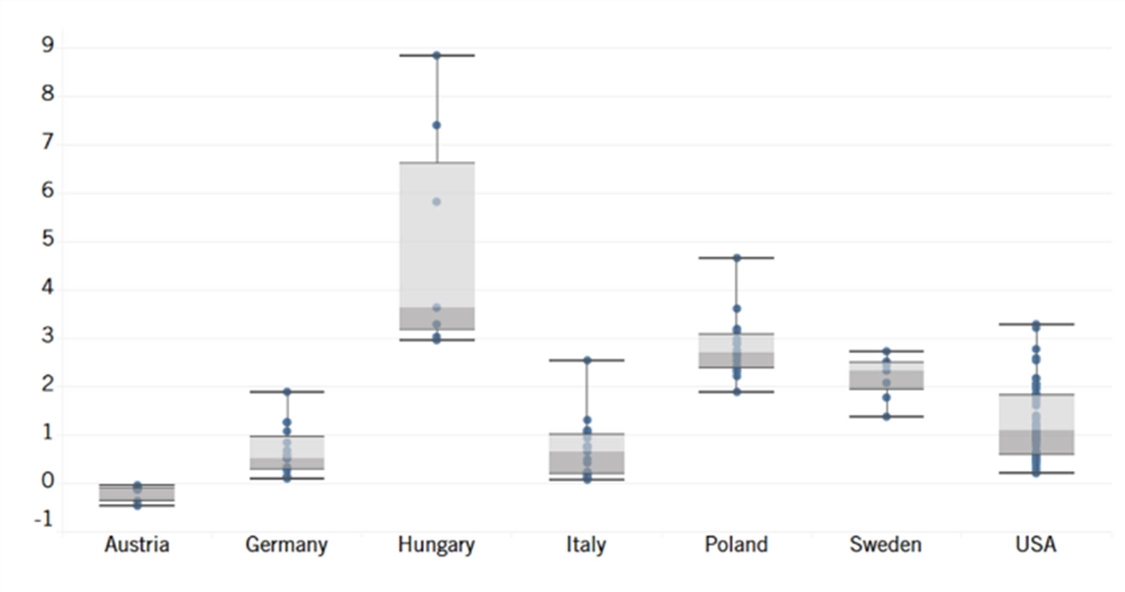

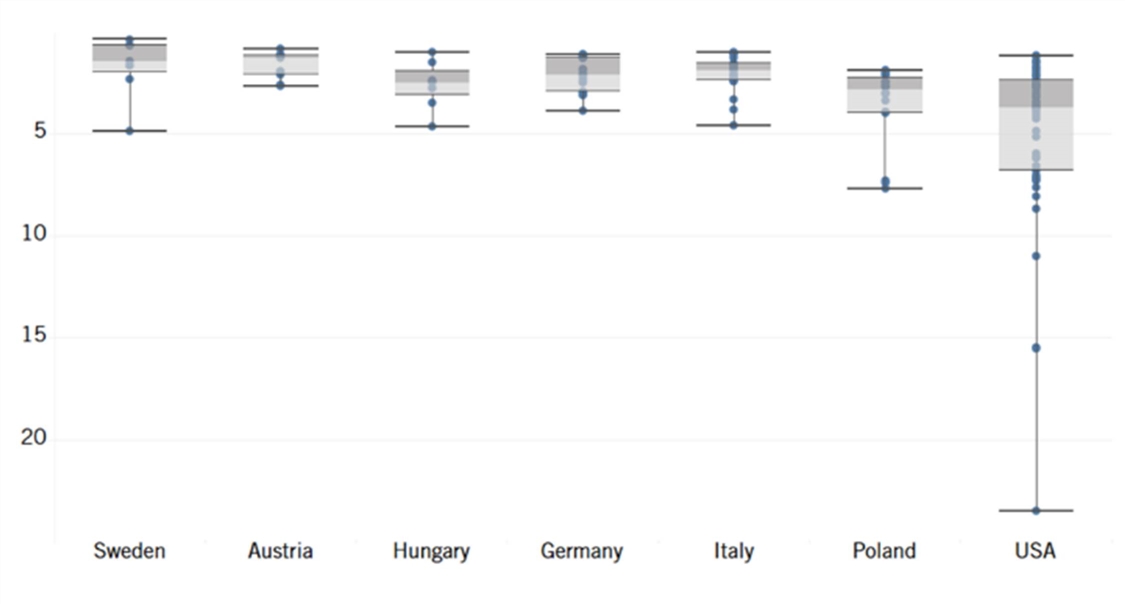

Figure 1: Maximum, minimum, quartiles, and median of overall subnational innovation competitiveness scores by country (dots denote the regions)[12]

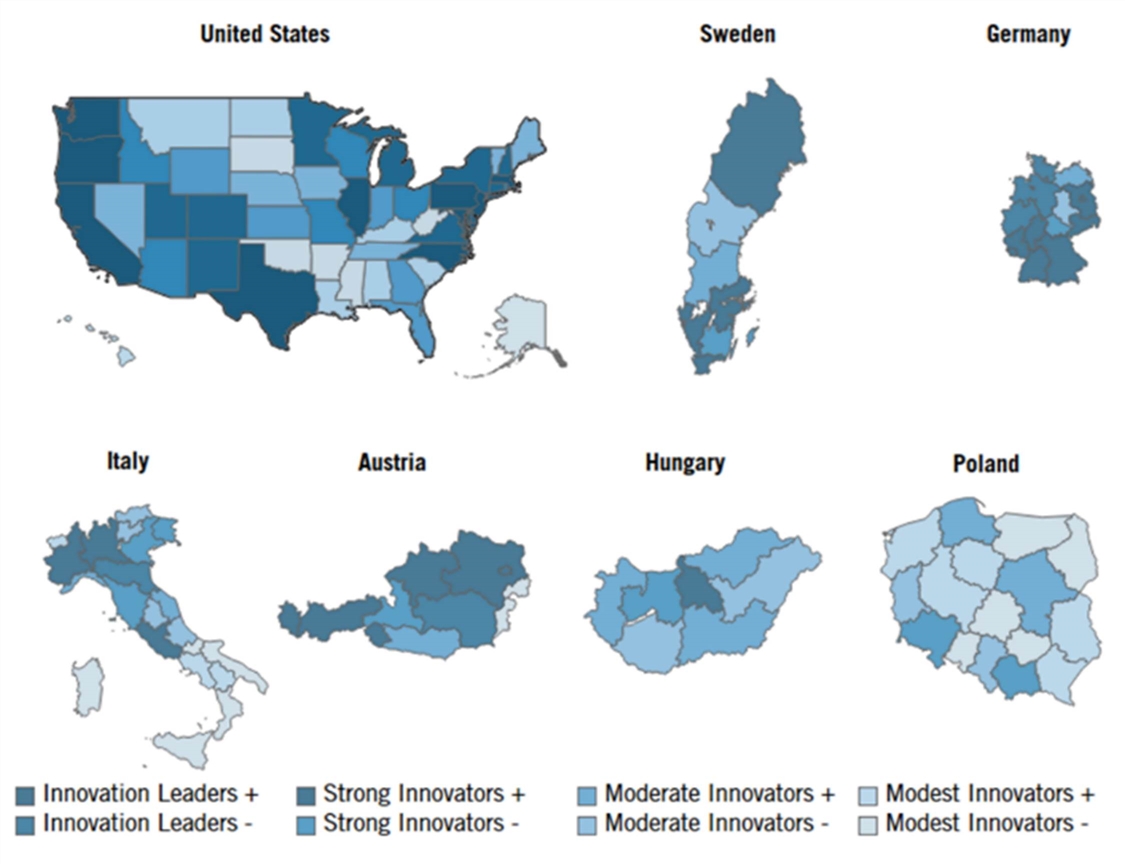

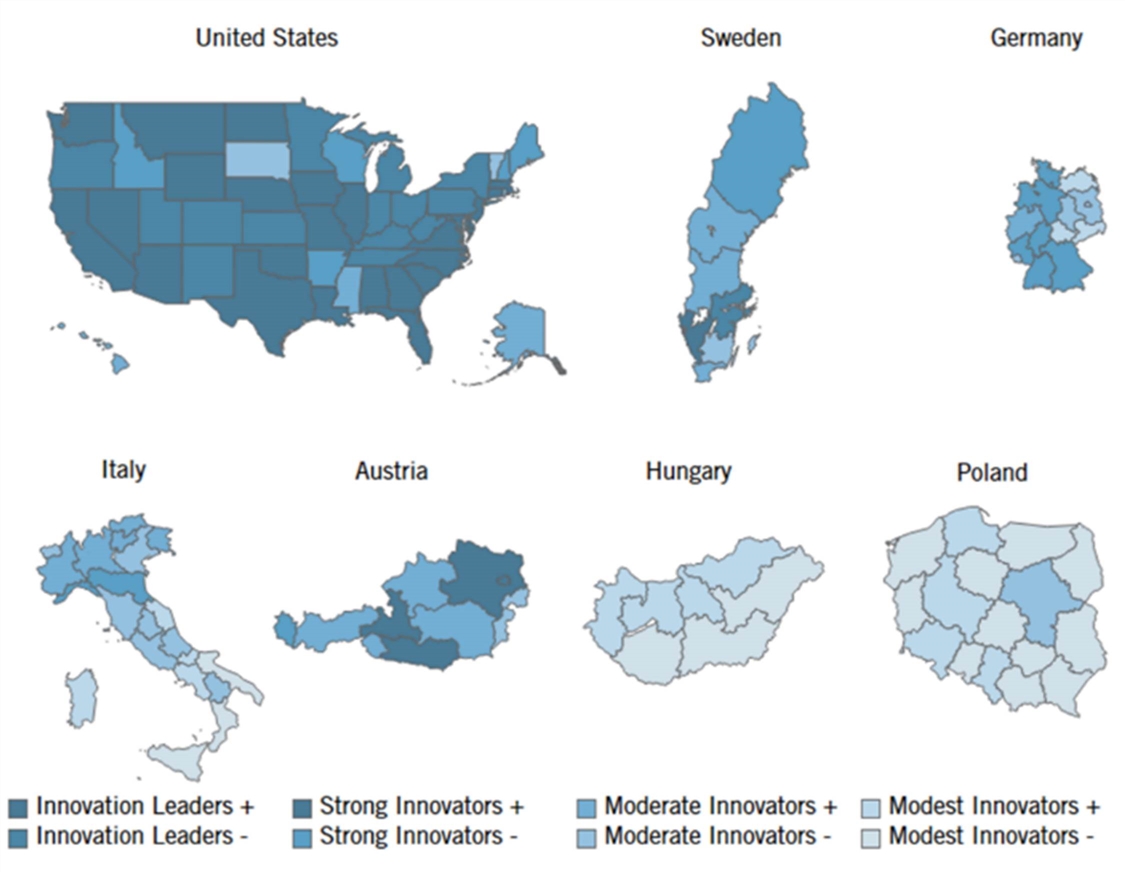

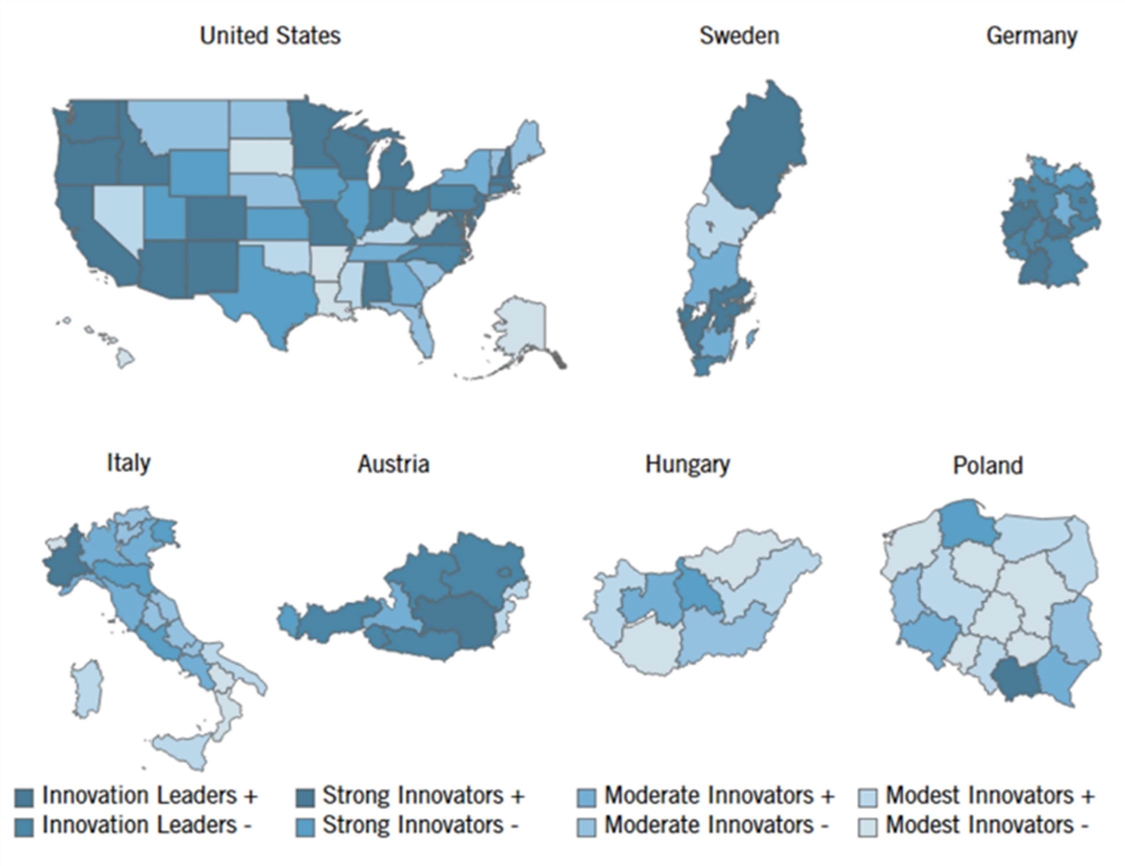

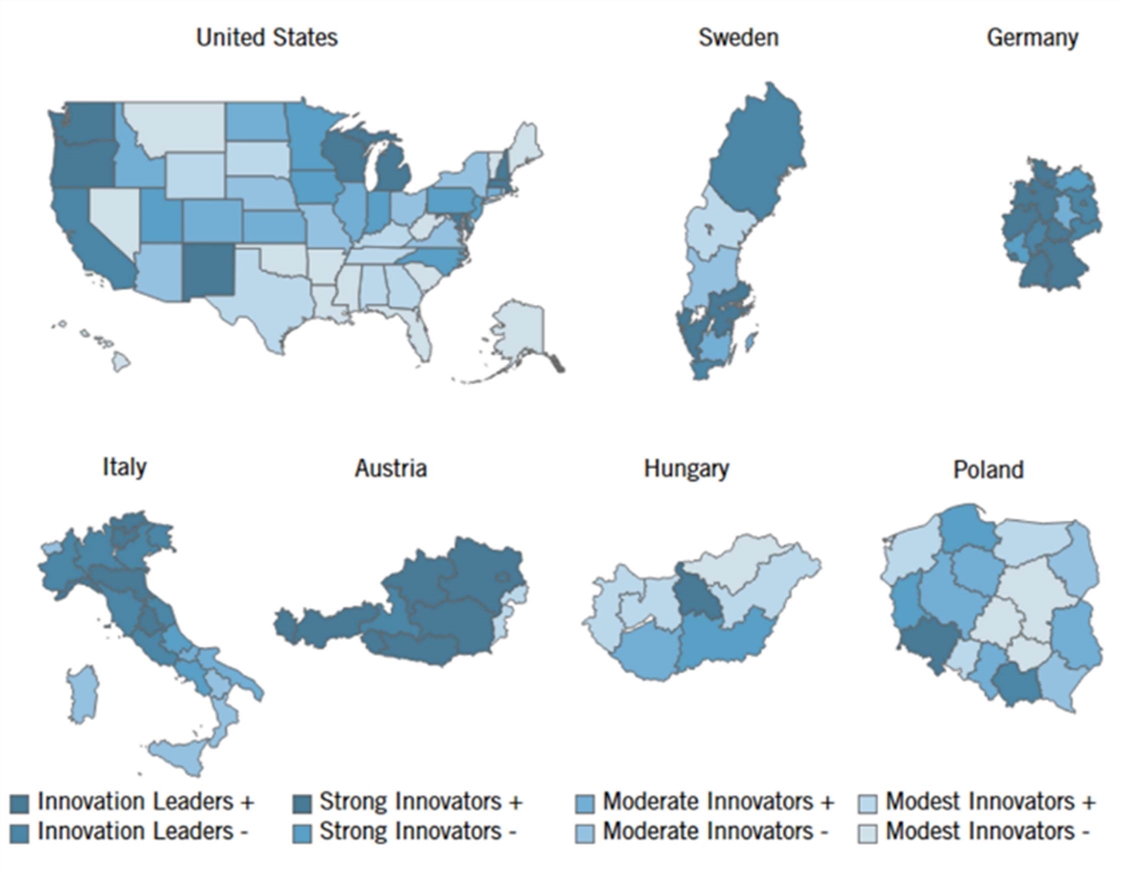

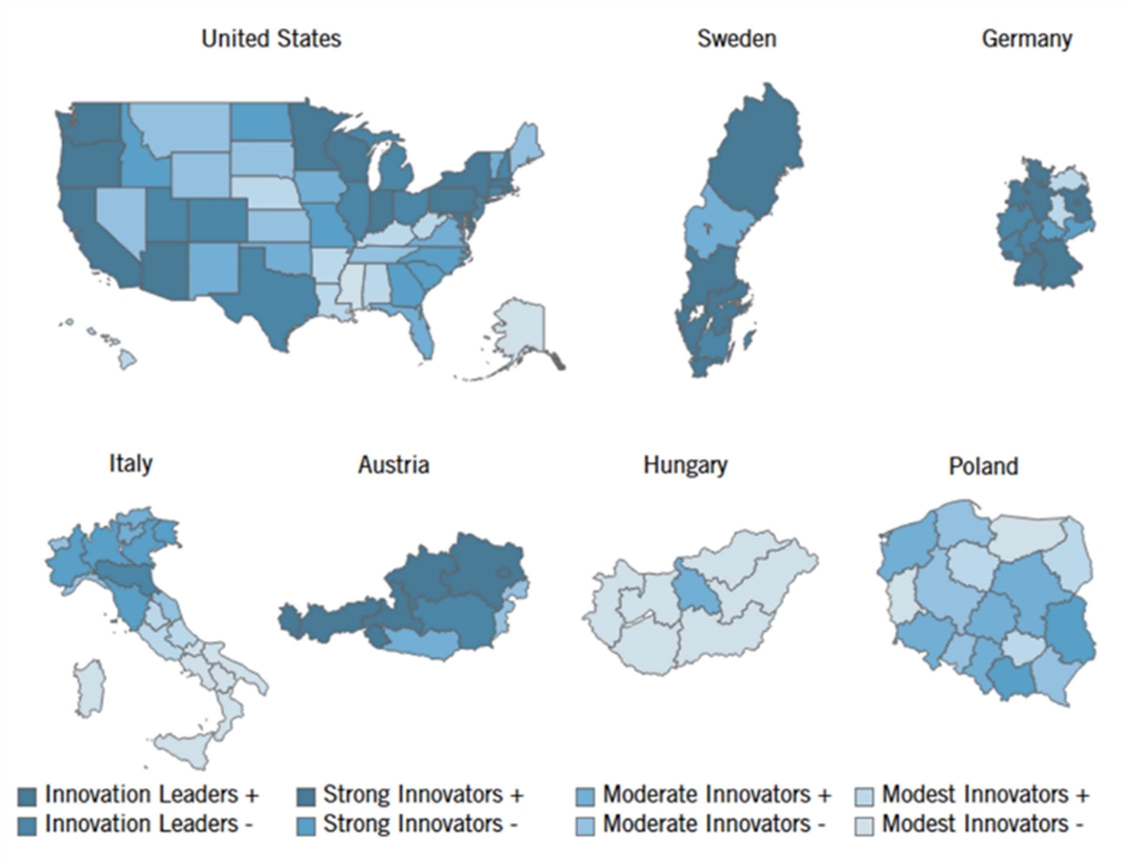

Regions were sorted into eight innovation competitiveness categories: modest innovator -, modest innovator +, moderate innovator -, moderate innovator +, strong innovator -, strong innovator +, innovation leader -, and innovation leader +, based on the regions’ positions in the ranking. The number of regions in each category was selected to be 15 to place an equal number of regions in each category given that there are 121 regions in total. The minus sign in the name of the category indicates that its regions fall into a lower category than those regions that are in the respective category with a positive sign. As the colors of the charts indicate, the categories’ ascending order is modest innovator, moderate innovator, strong innovator, and innovation leader, in line with the ranking methodology of the European Innovation Scorecard.

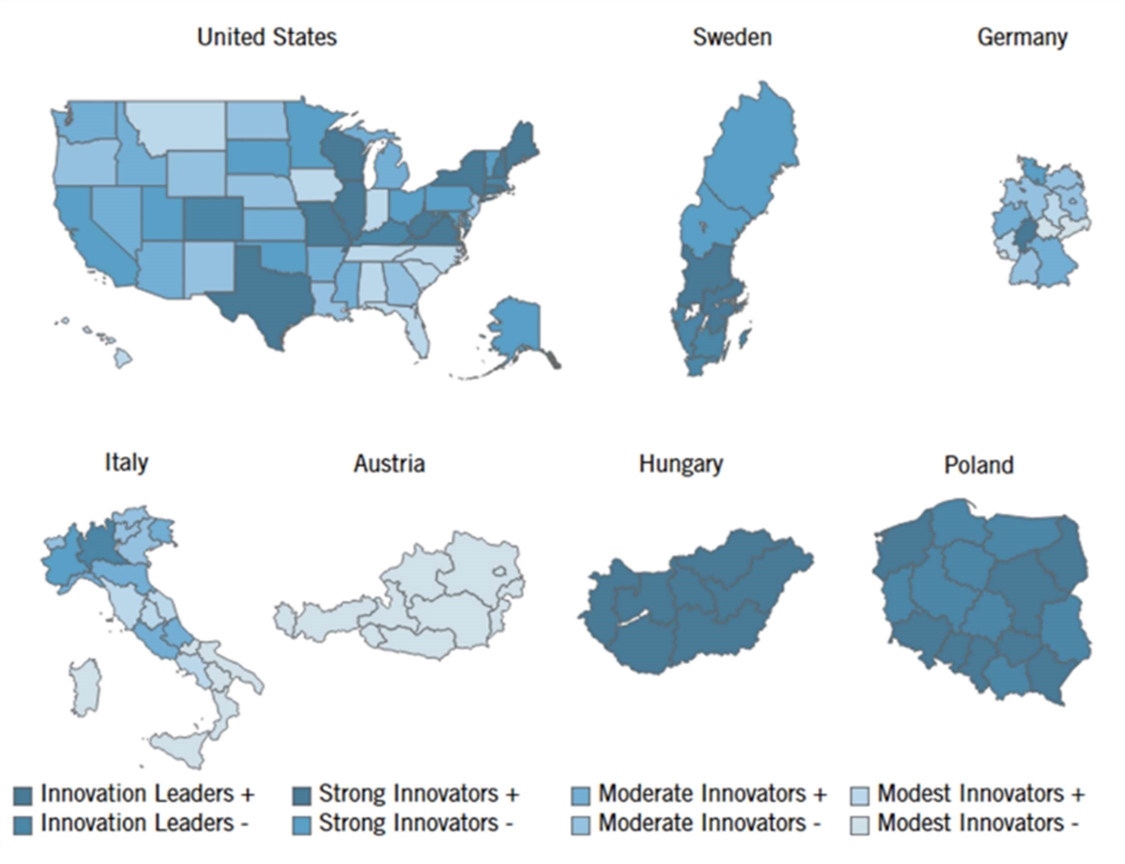

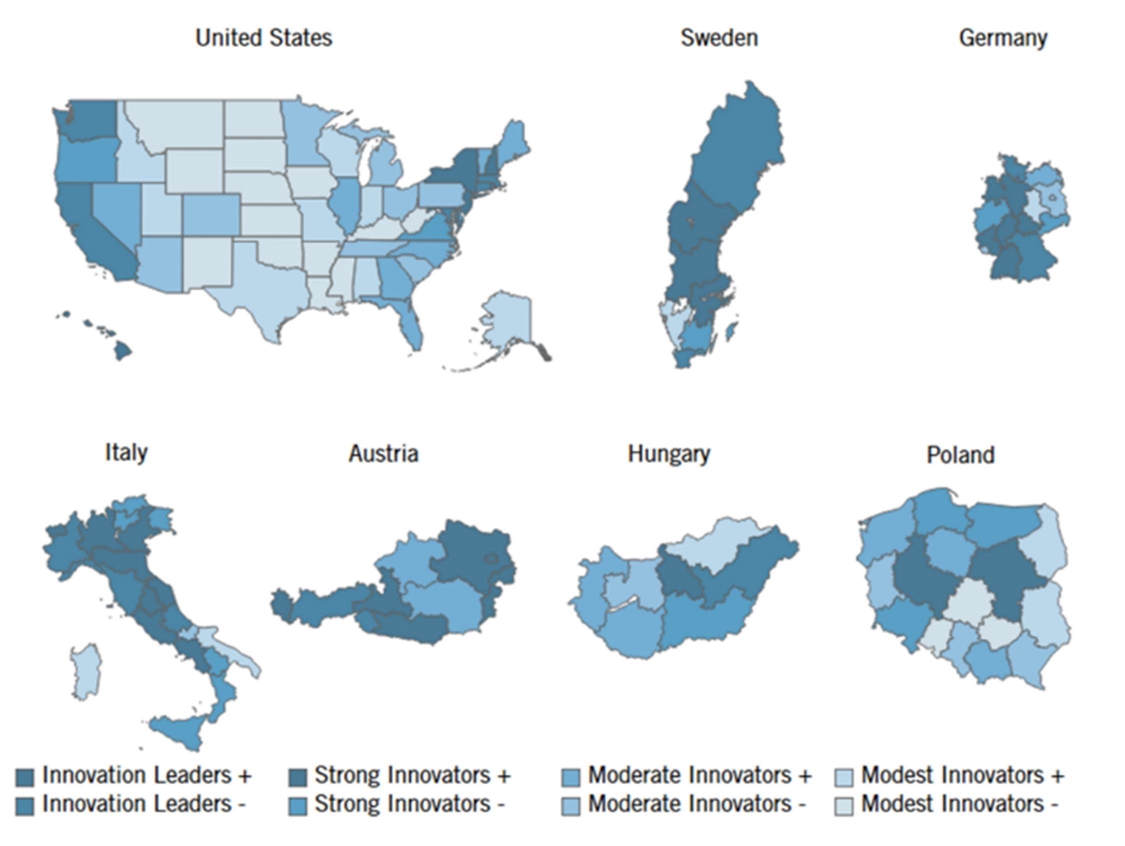

The east and west coasts of the United States exhibit strong innovation performance, while states in the middle and Southeast of the country are lagging modest innovators such as Oklahoma, Arkansas, and South Dakota. The United States scores diversely as it has states in all eight innovation categories. In Sweden, the leading regions are the Greater Metropolitan Region, West Sweden, and South Sweden, which all score in the top ten and are close to the capital of Sweden, Stockholm. Upper Norrland is a strong innovator region despite being furthest from the capital, while Middle Norrland comes in as being a moderate innovator. Germany has several regions that are innovation leaders, but the best-performing thereof are Baden-Württemberg, Bavaria, and Hesse. The moderate innovator regions in Germany are Saxony-Anhalt and Mecklenburg-Vorpommern, which were both part of the Eastern Bloc during the Cold War. In Italy, the north-south disparity is apparent, as most regions in the south are modest innovators such as Sicily or Calabria, while in the north there are many strong innovator regions as well as an innovation leader, Emilia-Romagna. Most Hungarian regions fall in the moderate innovators category; however, Central Hungary and Central Transdanubia are strong innovators due to their globalized economy and strong innovation capacity. The Polish strong innovator regions are Małopolskie and Dolnośląskie, while the region around the capital, Mazowieckie, is only a moderate innovator. Most Austrian regions rank in the top half, but performance diversity is significant. While Styria and Lower Austria are innovation leaders, Burgenland ranks in the lowest innovation competitiveness category.

Figure 2: Overall TASICI 2.0 subnational innovation competitiveness scores[13]

Knowledge Economy

Highly Educated Population

Why is this important? This indicator measures the share of a region’s 25–64-year-old (“prime age”) population with a bachelor’s degree (or equivalent) or higher. Education provides citizens with the skills and knowledge necessary to compete and innovate in the modern economy. While more time spent in school does not necessarily guarantee sufficient applied skills to compete in the modern global innovation economy—for example, the Council for Aid to Education found that 44 percent of current U.S. university graduates are not proficient in essential career skills—the proportion of highly educated residents remains a strong indicator of human capital.[14] Moreover, evidence suggests that more educated individuals are more likely and willing to adopt new technological innovations.[15]

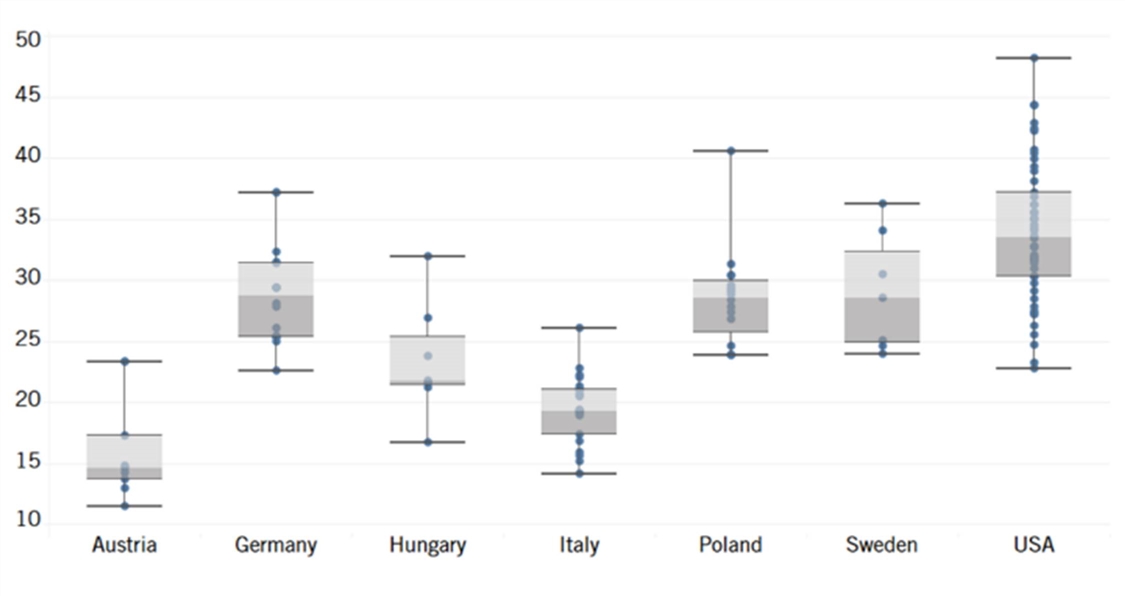

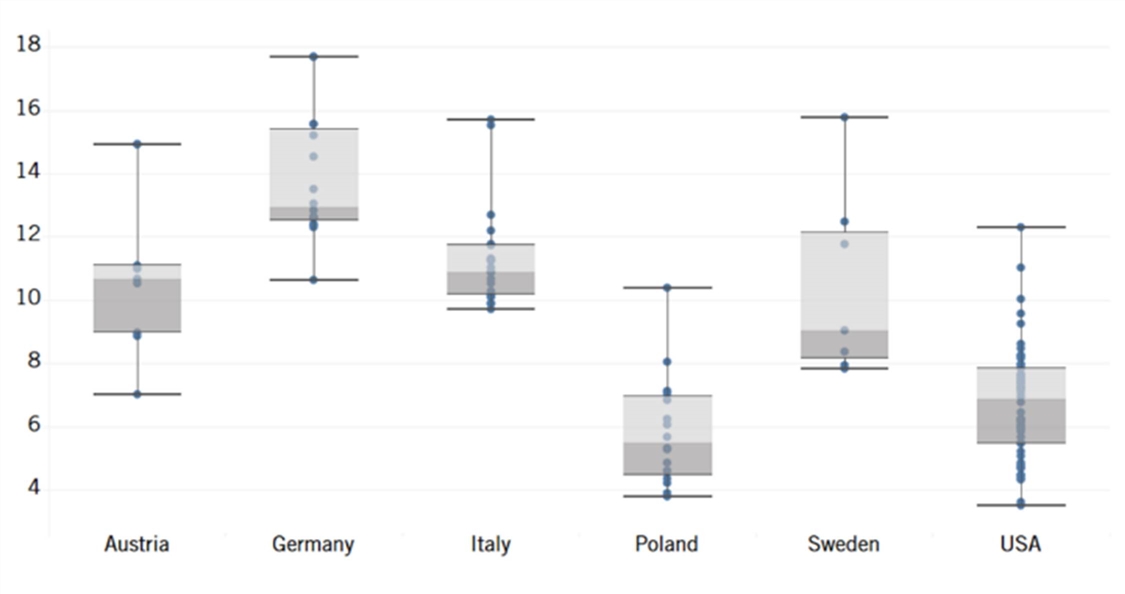

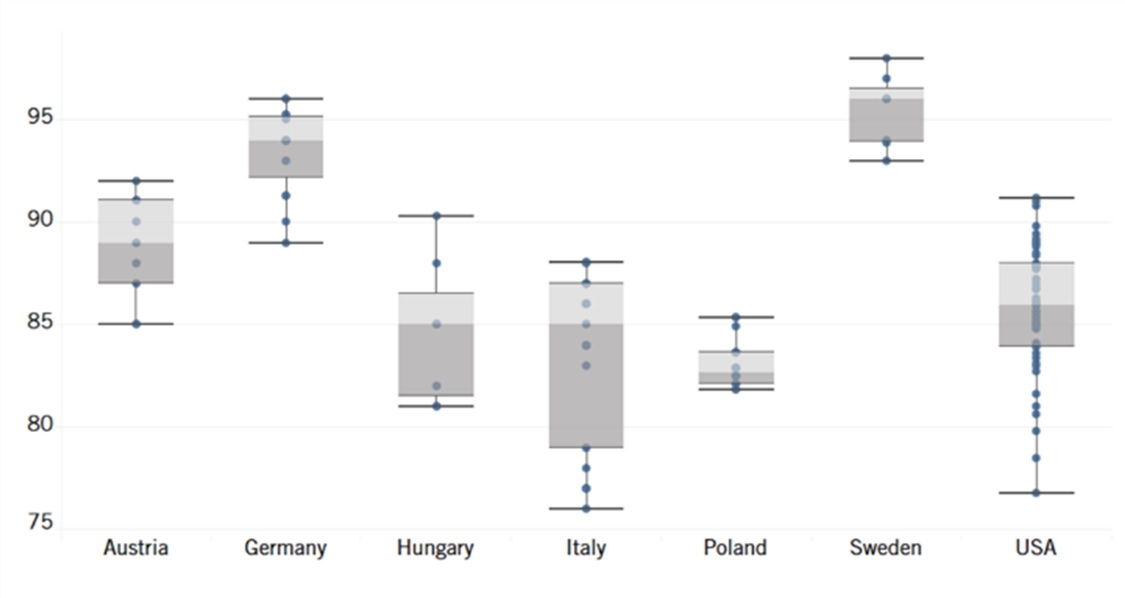

Figure 3: Share of the 25–64-year-old population with a bachelor’s degree (or equivalent) or higher, 2019 (%)[16]

The rankings: The data illuminate distinct patterns and trends that underscore the varying approaches countries—and states therein—take to cultivate highly educated populations and drive innovation (see figure 3 and figure 4). Across the United States, states such as Massachusetts, California, and Washington stand as beacons of high educational achievement, boasting percentages of highly educated populations exceeding 35 percent. These regions have harnessed their strong education systems and innovation ecosystems to fuel technological progress. Conversely, states such as Mississippi (23 percent) face educational challenges rooted in socioeconomic disparities and limited resources.

Interestingly, the data exposes regions grappling with educational challenges. Italy’s southern regions, such as Sicily and Calabria, demonstrate lower percentages of highly educated populations, indicating potential disparities in access to quality education, which inhibits their full participation in the global knowledge economy. In Italy, an intriguing pattern emerges between the northern and southern regions. Regions like Lazio (26 percent) and Emilia-Romagna (23 percent) in the north exhibit higher percentages of highly educated populations compared to regions in the south, such as Calabria (16 percent) and Sicily (14 percent). This disparity mirrors the broader socioeconomic gaps between northern and southern Italy, potentially influencing educational access and attainment.

Sweden’s innovative prowess shines through the Greater Metropolitan Region, with a highly educated population percentage exceeding 36 percent. Sweden’s focus on a robust education system and forward-thinking policies has positioned it as a leader in fostering human capital for innovation. In contrast to the Greater Metropolitan Region’s beacon of educational excellence in Sweden, other regions present varying levels of educational attainment. South Sweden (34 percent) and West Sweden (31 percent) demonstrate substantial education levels, reflective of the nation’s emphasis on accessible and quality education. Meanwhile, North Middle Sweden (25 percent) and Middle Norrland (25 percent) exhibit lower percentages, potentially indicating unique challenges or disparities that impact educational access in these areas.

Germany’s Berlin and Brandenburg combined region (37 percent) highlights the impact of targeted policies and collaboration between academia and industry, driving technological advancements and propelling the region to the forefront of innovation. Germany’s regional trends highlight the impact of historical divisions. The Berlin and Brandenburg combined region (37 percent) showcases the successful fusion of education and technology, emblematic of the region’s historical role as a hub of innovation. In contrast, regions such as Saxony-Anhalt (23 percent) grapple with the legacy of economic restructuring and transition.

Similarly, Austria displays regional variations, with Lower Austria and Vienna (23 percent) standing out as a hub of educational achievement compared to Burgenland (11 percent). This suggests a divide in educational resources and opportunities, reflecting the impact of regional economic disparities and access to quality education.

In the context of less-developed countries, regions in Hungary and Poland showcase diverse educational trajectories. While certain regions struggle to exceed a highly educated population percentage of 25 percent (such as Southern Transdanubia in Hungary or Lubuskie in Poland), Poland’s Mazowieckie region (41 percent) serves as an example of how strategic investment and educational reforms can uplift national performance and foster innovation.

In Poland, the data showcases a divergence between regions such as Mazowieckie (41 percent) and Lubuskie (24 percent). This reveals a regional contrast in educational attainment and innovation potential, possibly influenced by varying economic conditions, educational infrastructure, and policy priorities. While Mazowieckie demonstrates a strong emphasis on education and research, Lubuskie faces hurdles in fostering a highly educated populace.

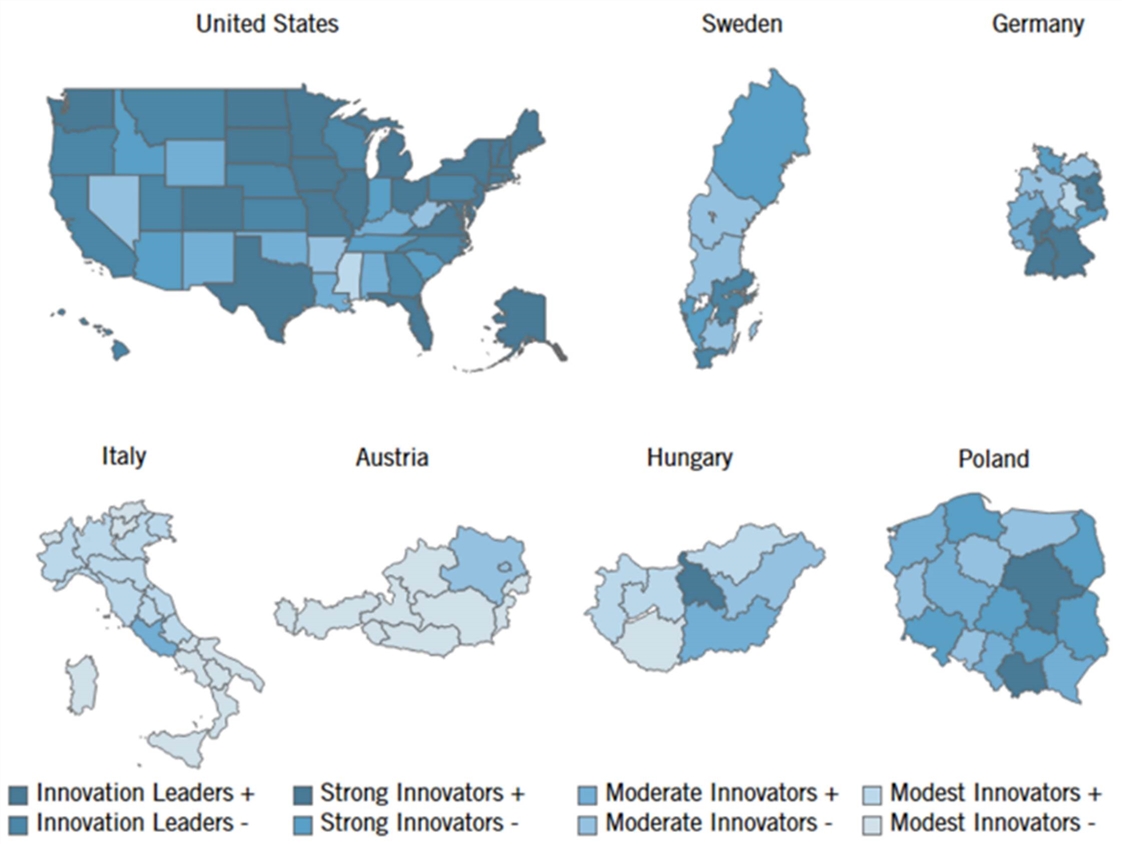

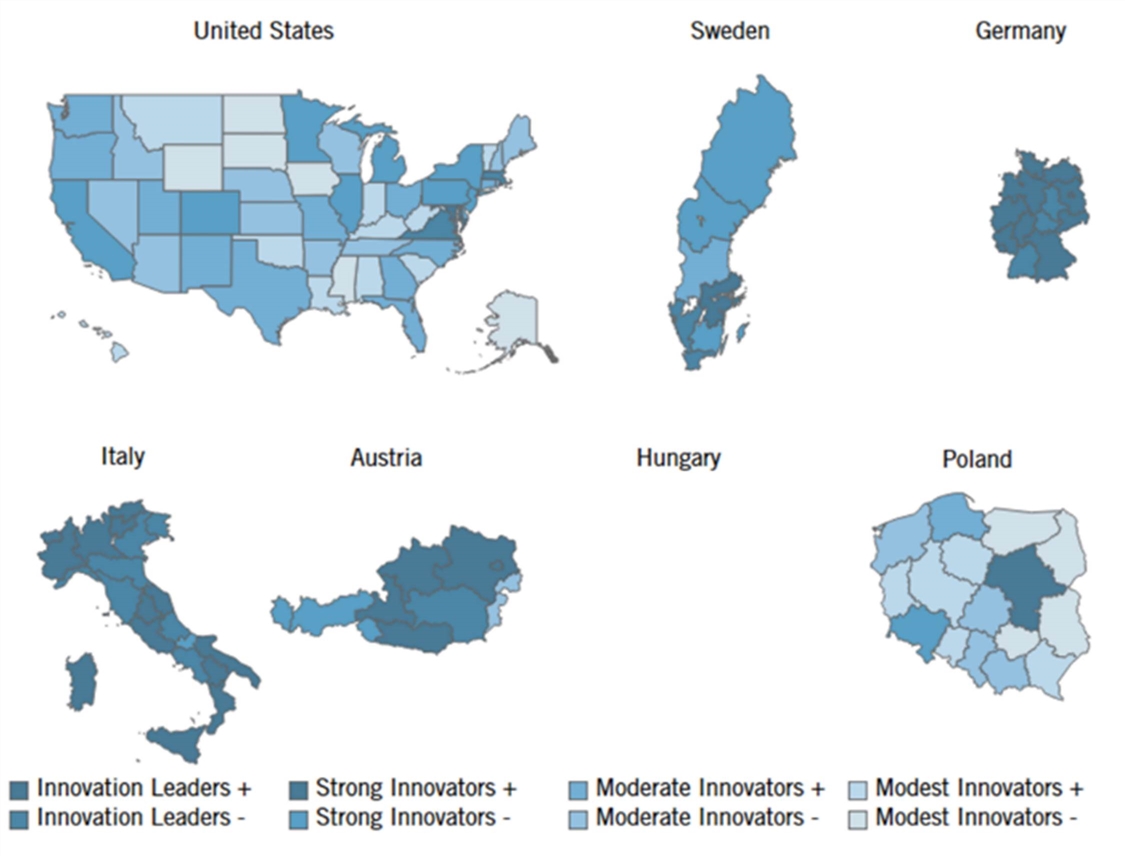

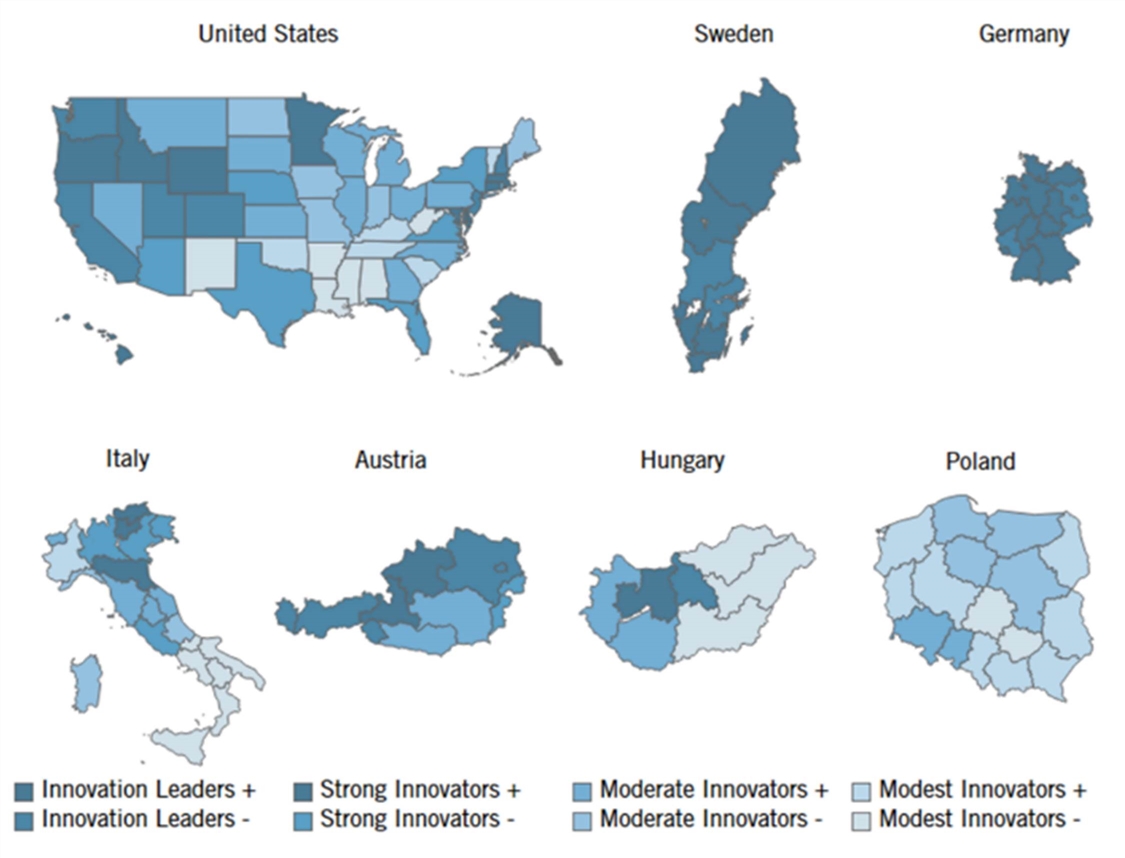

Figure 4: Performance map in highly skilled workforce indicator[17]

Skilled Immigration

Why is this important? Skilled immigration brings together workers with unique educational experiences and backgrounds as a driver of innovative ideas. Level of skill can be difficult to quantify, so this indicator is instead measured via educational attainment, calculated as a region’s share of foreign-born workers with at least some tertiary education relative to the total regional population. A 2016 ITIF study found that foreign-born workers living in the United States are highly represented in the number of scientists and engineers producing meaningful innovations, compared with the overall levels of immigration in the United States.[18] Similarly, half of Silicon Valley’s artificial intelligence (AI) start-ups have foreign-born founders.[19] A separate study found that 52 percent of all Silicon Valley start-ups have at least one foreign-born founder.[20] In addition to contributing to a state’s stock of skilled human capital, highly educated immigrant populations raise wages for both domestic- and foreign-born workers.[21]

Figure 5: Share of population that is foreign-born and has some tertiary education, 2019[22]

The rankings: Austria, Sweden, and the United States tend to have higher levels of skilled immigrants (see figure 5 and figure 6). On the other hand, countries such as Hungary, Italy, and Poland generally exhibit lower levels.

While the Mazowieckie and Dolnośląskie regions lead the way in Poland with higher skilled immigration indicators (1.3 percent and 0.6 percent respectively), other areas like Świętokrzyskie and Podkarpackie display relatively lower levels (0.1 percent and 0.1 percent). This diverse trend underscores Poland’s mixed appeal to skilled migrants, with certain regions standing out as magnets for skilled professionals.

Austria’s skilled immigration landscape portrays more consistent patterns. Lower Austria and Vienna (6.5 percent) stand out with higher skilled immigration indicators, while others indicate less of their allure to skilled migrants, such as Styria and Upper Austria (2.7 percent and 2.6 percent). Overall, most regions in Austria offer promising opportunities, drawing skilled individuals seeking to enhance their careers and quality of life.

The data highlights Sweden’s compelling ability to attract skilled migrants. Regions like the Greater Metropolitan Region (13.5 percent), South Sweden (12.4 percent), and West Sweden (10.3 percent) emerge as strong magnets for skilled immigrants. These regions offer a combination of robust job markets and high living standards, which is appealing to skilled professionals seeking better employment prospects.

Hungary’s skilled immigration trend showcases regional disparities. Central Hungary (1.8 percent) and Southern Great Plain (1 percent) demonstrate relatively high skilled immigration, potentially due to economic opportunities in urban centers. Meanwhile, Northern Hungary (0.2 percent) and Central Transdanubia (0.3 percent) reflect comparatively lower levels of skilled immigration.

Italy’s skilled immigration landscape exhibits a mix of patterns. Regions like Emilia-Romagna (2.1 percent), Lazio (1.8 percent), and Tuscany (1.7 percent) stand out in skilled immigration, possibly driven by economic activity and cultural attractions. Conversely, regions like Basilicata (0.34 percent) and Sicily (0.34 percent) showcase underperformance in skilled immigration.

Germany’s skilled immigration trend reflects consistent patterns. Regions like Berlin and Brandenburg (8.4 percent), Hesse (6.7 percent), and Baden-Württemberg (6.3 percent) present good skilled immigration levels, indicating their status as major hubs for skilled migrants. Other regions, like Saxony-Anhalt (2.1 percent) and Mecklenburg-Vorpommern (2.7 percent), exhibit relatively lower levels of skilled immigration.

In the United States, the skilled immigration landscape is marked by diversity. States like California (9.4 percent), New Jersey (8.1 percent), and New York (7.7 percent) score well in skilled immigration, reflecting their thriving economies and opportunities. Contrastingly, states like Mississippi (0.5 percent) and West Virginia (0.7 percent) exhibit lower scores, signifying a lesser appeal to skilled migrants.

Figure 6: Performance map in skilled immigration indicator[23]

Professional, Scientific, and Technical Employment

Why is this important? This indicator measures the share of employees working in PTS activities in each region. This includes, for example, engineers, researchers, and lawyers. PTS services include those needed to facilitate the development, implementation, and commercialization of innovations. Automation and globalization also make high-value-added professional services increasingly important in the modern economy. These occupations are highly knowledge-intensive and therefore harder to offshore. States with greater concentrations in these occupations are thus somewhat-less threatened by increased levels of globalization.

Figure 7: Share of employees in professional, technical, and scientific services fields, 2019[24]

The rankings: The data reveals a range of professional, technical, and scientific employment levels across Poland’s regions (see figure 7 and figure 8). Regions like Mazowieckie (10.4 percent), Dolnośląskie (8 percent), and Pomorskie (7.1 percent) showcase higher levels of skilled employment. These regions demonstrate Poland’s growing capacity to attract and accommodate skilled professionals in diverse fields.

Austria exhibits a similar trend with certain regions leading in PTS employment. Notably, Lower Austria and Vienna (14.9 percent), Styria (11.1 percent), and Upper Austria (10.7 percent) stand out as hubs for skilled labor. These regions’ higher percentages signal Austria’s allure as a destination for professionals seeking advanced career opportunities.

Sweden displays a consistent pattern, with regions like the Greater Metropolitan Region (15.8 percent), West Sweden (12.5 percent), and South Sweden (11.8 percent) prominently featuring PTS employment. These regions emphasize Sweden’s reputation for high-quality education and innovation, attracting professionals from diverse fields.

Italy’s employment landscape reflects varying degrees of PTS employment. Regions like Lazio (15.7 percent) and Lombardy (15.5 percent) lead in this aspect, indicating their role as economic and cultural centers. The data underscores Italy’s capacity to provide skilled opportunities in sectors ranging from technology to the arts.

Germany presents a dynamic picture, with regions such as Berlin and Brandenburg (17.7 percent), Hamburg and Schleswig-Holstein (15.6 percent), and Hesse (15.2 percent) featuring prominently in PTS employment. These regions highlight Germany’s renowned research and innovation ecosystem, contributing to a robust employment landscape.

The United States’ PTS employment trends vary across its states. Virginia (12.3 percent), Massachusetts (11 percent), and Maryland (10 percent) stand out with high PTS employment indicators, signifying the country’s technological and economic prowess. The data underscores the United States’ appeal to professionals seeking diverse career opportunities.

Figure 8: Performance map in professional, technical, and scientific employment indicator[25]

Manufacturing Labor Productivity

Why is this important? Gross value added (GVA) measures the contribution to gross domestic product (GDP) made by an individual producer, industry, or sector. This indicator measures the average GVA per manufacturing worker on a purchasing power parity (PPP) basis. Within manufacturing, high-value-added firms are most often capital-intensive, producing more technologically complex products and organizing their workers to take better advantage of their skills. They typically pay higher wages because their workers are more productive, generating greater value for each hour worked. All else being equal, firms with higher value-added levels are more likely to be able to meet global competitiveness challenges. Unfortunately, U.S. manufacturing labor productivity has been in decline for some time, falling by 1.34 percent between 2012 and 2019.[26]

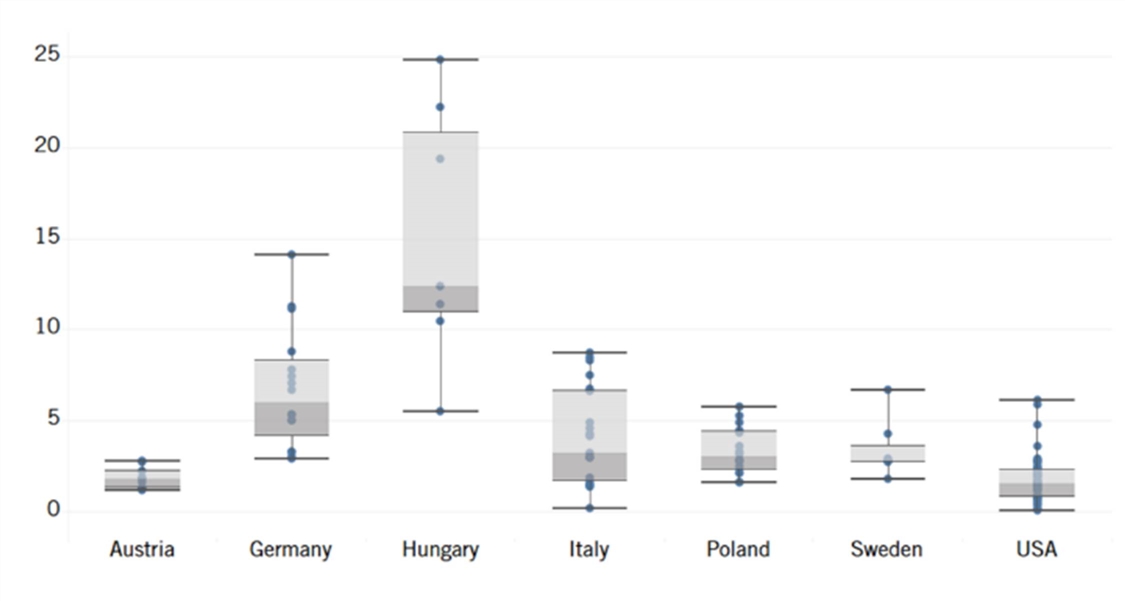

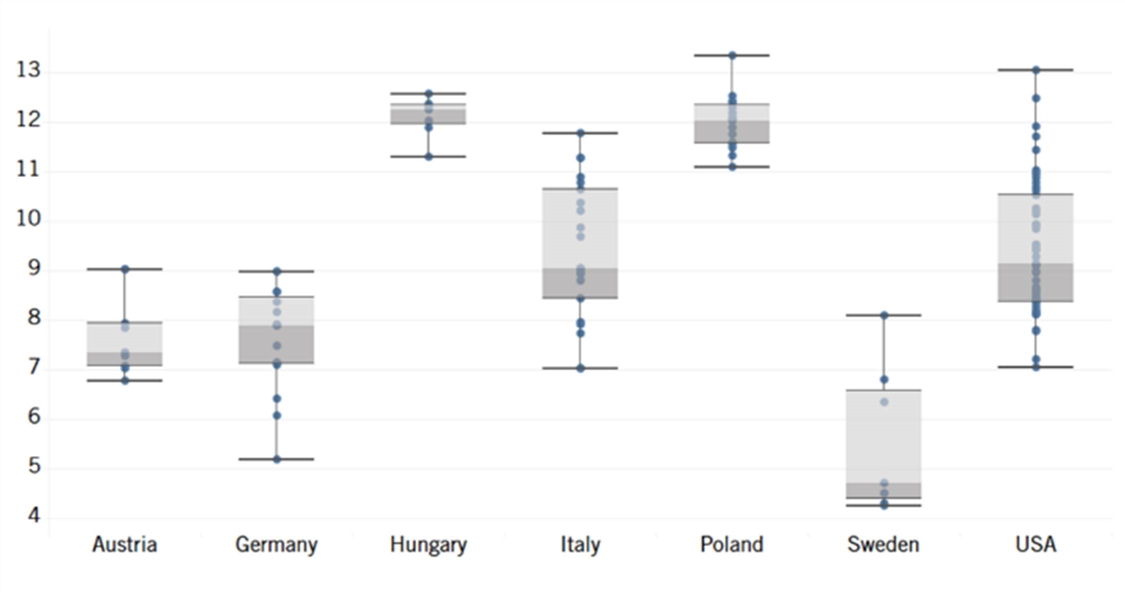

Figure 9: PPP-adjusted gross value added per worker in the manufacturing sector, 2019[27]

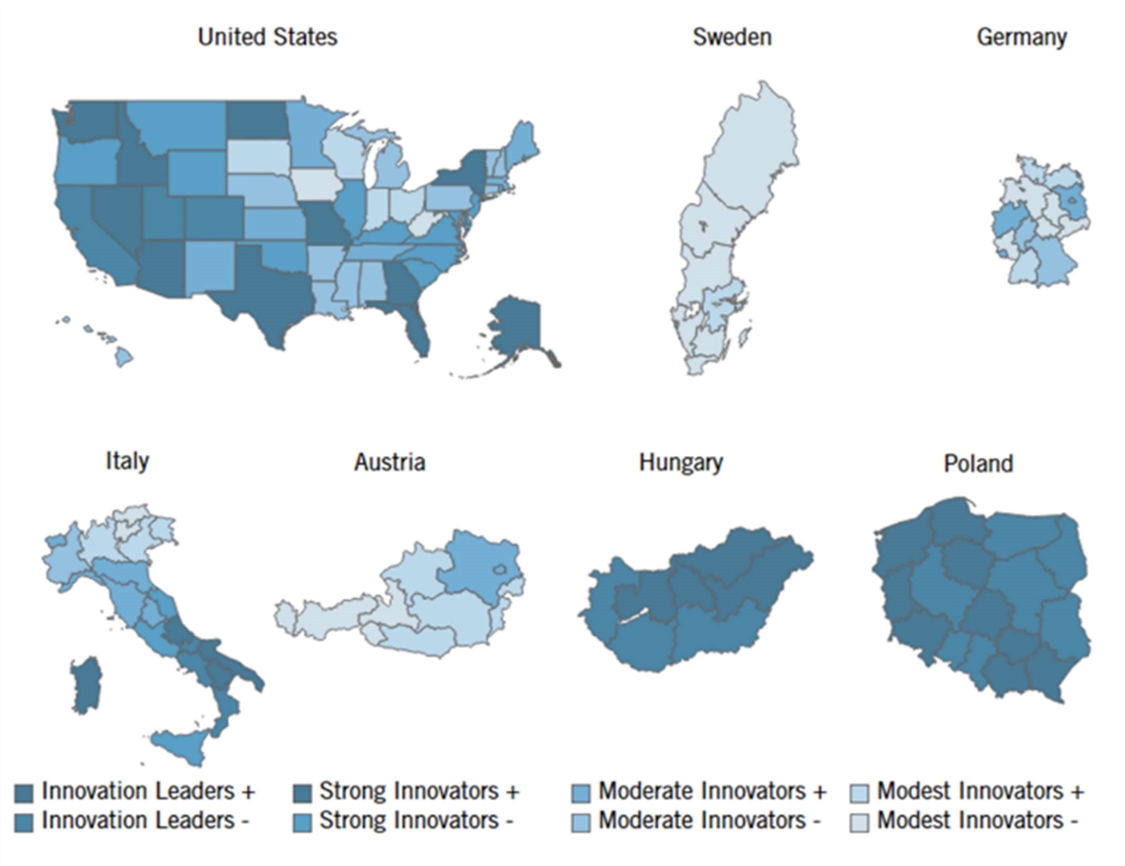

The rankings: Manufacturing labor productivity in Poland showcases regional differences (see figure 9 and figure 10). Mazowieckie stands out with an impressive value of $101,035, indicating its robust industrial performance compared to other Polish regions. Dolnośląskie ($84,779) and Śląskie ($80,115) also demonstrate strong productivity, underlining Poland’s industrial prowess.

Austria exhibits notable regional differences in manufacturing labor productivity. Salzburg ($137,394), Lower Austria and Vienna ($137,394), and Carinthia ($133,671) lead, reflecting their advanced manufacturing sectors. On the other hand, Burgenland ($87,192) lags behind in manufacturing productivity.

Sweden’s manufacturing labor productivity is characterized by consistency. Greater Metropolitan Region ($155,934) and West Sweden ($134,998) shine as productive hubs, underlining Sweden’s high-tech manufacturing strength. This trend echoes Sweden’s reputation as an innovative manufacturing leader.

Hungary’s regions display mixed productivity figures. Central Hungary ($69,068) is one of the leading regions in Hungary, possibly due to Budapest’s economic influence. Although some regions like the Northern Great Plain ($53,575) lag, these variations could reflect different industrial profiles.

Italy’s manufacturing productivity varies widely across regions. Liguria ($116,913) and Emilia-Romagna ($115,841) excel, aligning with their reputation for high-quality manufacturing. Regions like Sicily ($63,129) and Calabria ($54,669) exhibit lower productivity, potentially indicating challenges in their manufacturing sectors.

Germany also showcases robust manufacturing productivity across its states. Hamburg and Schleswig-Holstein ($129,721) and Bremen and Lower Saxony ($130,497) lead, reflecting the strength of these regions. Southern states like Baden-Württemberg ($127,622) and Bavaria ($123,028) also stand out, mirroring Germany’s overall industrial prowess.

U.S. states exhibit significant diversity in their levels of manufacturing productivity. The data reports that states such as Louisiana ($333,712) and Wyoming ($291,511) have the highest levels of manufacturing productivity, although this data is significantly skewed by the prevalence of the oil and gas sectors (such as refining) in these states’ economies. (Unfortunately, to maintain the international comparisons needed for this study, it was not possible to back out the distortive effects of these states’ large energy sectors.) That said, Indiana, Ohio, and Michigan—which are more indicative of the actual performance of the more manufacturing-oriented U.S. states—perform much more in line ($176,518; $152,458; and $147,100, respectively) with top regions in Austria, Germany, or Sweden, and still outperform regions in Italy, Hungary, and Poland. States such as Hawaii ($108,148) and Vermont ($100,084) display comparatively lower manufacturing output, possibly due to their smaller industrial bases.

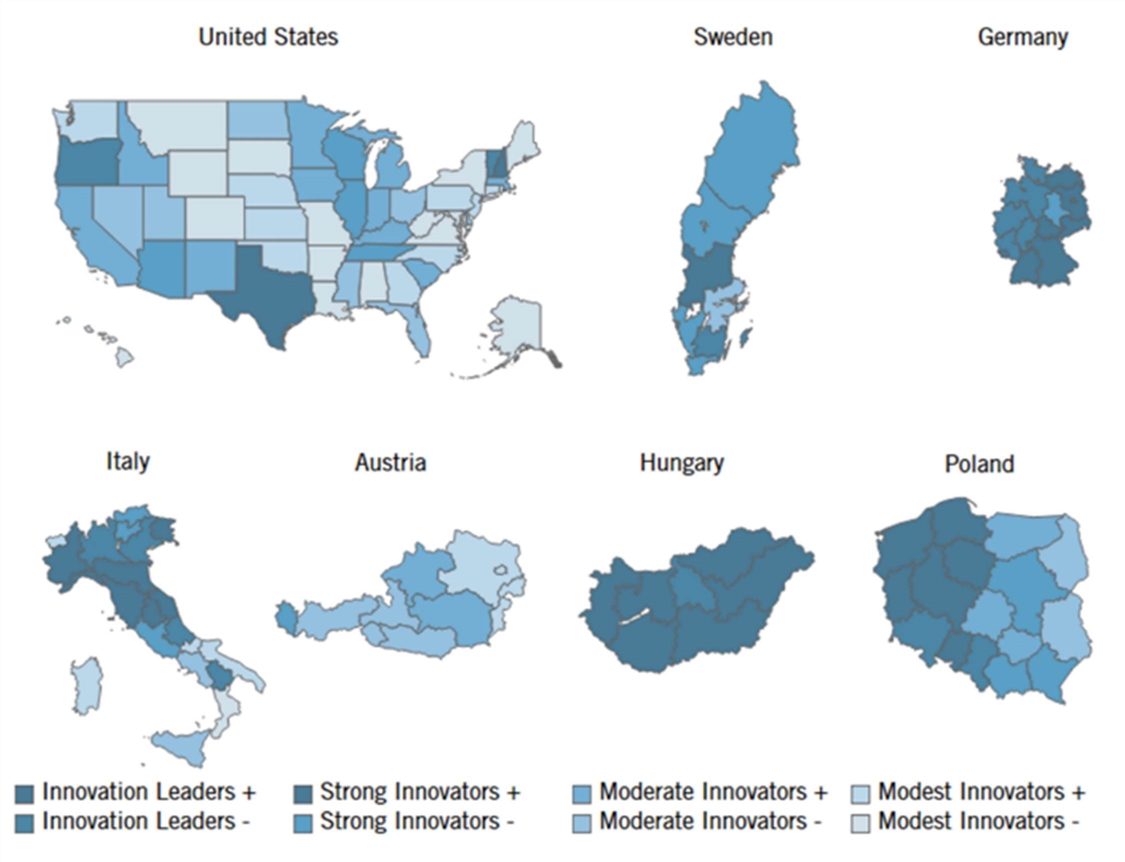

Figure 10: Performance map in manufacturing labor productivity indicator[28]

Globalization

High-Tech Exports

Why is this important? This indicator measures a region’s exports in the machinery manufacturing; computer and electronic products manufacturing; and electrical equipment, appliances, and components manufacturing industries (North American Industry Classification System “NAICS” 333–335 or equivalent) as a share of GDP. These represent high-value-added goods that are crucial in the modern global economy. Considering a region’s exports of these goods as a share of its GDP shows to what extent a region has a comparative advantage in high-tech production and export. Moreover, this indicator represents a region’s position in global value chains for the production of these goods.

Figure 11: Exports in NAICS 333–335 (or equivalent) as a share of GDP, 2017[29]

The rankings: High-tech exports in Poland showcase interesting regional disparities (see figure 11 and figure 12). Śląskie (5.7 percent) and Dolnośląskie (5.3 percent) stand out with significant percentages, indicating robust technological advancement in these regions. Other regions like Pomorskie (4.4 percent) and Wielkopolskie (4.3 percent) also demonstrate noteworthy high-tech export contributions.

Austria exhibits diverse high-tech export distribution. Central regions like Carinthia (1.6 percent) show robust potential in technology exports, while Vorarlberg (2.8 percent) and Upper Austria (2.7 percent) lead the way. Lower Austria and Vienna (1.3 percent) and Burgenland (1.2 percent) slightly lag behind in high-tech exports.

Sweden’s high-tech exports are notable for regional variations. Småland and the Islands (6.7 percent) shine as a technology-driven hub, while other regions like North Middle Sweden (4.3 percent) and West Sweden (2.9 percent) also contribute significantly, reinforcing Sweden’s reputation for innovation.

Hungary displays a diverse landscape in high-tech exports. Regions like Central Transdanubia (24.8 percent) and Western Transdanubia (22.2 percent) excel, suggesting a remarkable presence in technology-driven supply chains. Northern Hungary (19.3 percent) also contributes substantially to Hungary’s technological exports.

Italy’s high-tech exports vary across regions. Emilia-Romagna (8.7 percent) and Piedmont (8.3 percent) stand out, demonstrating advanced technological capabilities. On the other hand, Calabria (0.2 percent) and Molise (1.3 percent) exhibit lower percentages, indicating the need for technological development in these regions.

Germany showcases solid high-tech exports, with regions like Baden-Württemberg (14.1 percent) and Bavaria (11.2 percent) leading the way. Eastern regions like Berlin and Brandenburg (3.3 percent) contribute slightly less, reflecting Germany’s imbalanced trade levels.

The United States demonstrates a wide range of high-tech export levels among its states. States such as Oregon (5.8 percent) excel due to their technology-driven sectors. However, there are variations, with states like Alaska (0.1 percent) and Wyoming (0.3 percent) indicating room for technological expansion. Wyoming’s very weak performance on this indicator reinforces the point that its high performance on the prior manufacturing labor productivity indicator is highly distorted by its energy sector.

Figure 12: Performance map in high-tech exports indicator[30]

Inward FDI

Why is this important? This indicator measures the inward FDI a region receives relative to its GDP measured as the funds an entity in the region receives from a foreign-based entity to purchase, establish, or expand enterprises. Inward FDI not only spurs domestic economic activity but also facilitates technology transfer between foreign-owned enterprises and local establishments. Foreign owners can also introduce domestic firms to new international markets and help regions carve out positions in global supply chains. Inward FDI has also been associated with greater economic growth in market economies and tends to be more productive and induce greater levels of investment by domestic firms.[31]

Because FDI can be very volatile from year to year, regions’ averages over the period of three years are considered. Measures for each country required varying degrees of estimation, with the methods described in the appendix.

Figure 13: Inward foreign direct investment as a percentage of GDP, 2017–2018 (average)[32]

The rankings: Poland’s regions exhibit varying degrees of FDI attractiveness (see figure 13 and figure 14). Opolskie (3.6 percent) and Śląskie (3.2 percent) lead the way in terms of FDI inflow, showcasing their appeal to foreign investors. Other regions, such as Małopolskie (2.4 percent) and Warmińsko-Mazurskie (2.7 percent), also demonstrate positive FDI trends.

Austria’s FDI trends show exhibit more limited outcomes, with several regions experiencing negative FDI inflow percentages. Notably, Lower Austria and Vienna (minus 0.5 percent) and Tyrol (minus 0.4 percent) indicate potential challenges in attracting foreign investment.

Sweden’s regions generally exhibit positive FDI inflow trends. Småland and the Islands (2.5 percent) and South Sweden (2.7 percent) showcase their attractiveness to foreign investors. The Greater Metropolitan Region (2.3 percent) and West Sweden (2.5 percent) also contribute to Sweden’s positive FDI landscape.

Hungary showcases a diverse FDI picture across its regions. Central Transdanubia (8.8 percent) and Northern Hungary (7.4 percent) stand out as highly attractive regions for foreign investors because of their highly educated workforce, well-established infrastructure, and open economy. Automotive, electronics, and food industries are dominant in FDI, but plentiful jobs could be linked to high-value-added service sector investments.[33] However, Southern Transdanubia (3 percent) and Southern Great Plain (3 percent) exhibit more modest FDI inflows.

Italy’s FDI landscape presents a range of performances across its regions. Lombardy (2.5 percent) leads the way, reflecting its economic significance. Emilia-Romagna (1 percent) and Lazio (1.1 percent) also demonstrate positive FDI inflow, while regions like Calabria (0.1 percent) and Basilicata (0.1 percent) indicate relatively lower foreign investment.

Germany showcases a diverse FDI landscape as well. Hesse (1.9 percent) along with Hamburg and Schleswig-Holstein (1.3 percent) demonstrate higher FDI inflows, reflecting their economic strength. North Rhine-Westphalia (0.8 percent) and Berlin and Brandenburg (0.5 percent) also contribute to Germany’s positive FDI environment.

The United States, being a major global player, exhibits diverse FDI trends across its states. States like Maine (3.3 percent) and Missouri (3.2 percent) indicate their attractiveness to foreign investors. However, some states like Montana (0.2 percent) and Iowa (0.2 percent) show significantly less FDI inflow.

Figure 14: Performance map in inward FDI indicator[34]

Innovation Capacity

Broadband Adoption

Why is this important? This indicator measures broadband adoption—that is, the share of households within each region that subscribe to a broadband Internet connection, either mobile or fixed.[35] (All measures of broadband adoption used include satellite adoption as well). The Internet is now essential to full participation in today’s increasingly digitalized global economy. The COVID-19 pandemic vividly demonstrated how crucial widespread Internet adoption is for societies, enabling telework, tele-education, telehealth, etc. Increased access to the Internet has also been associated with greater productivity and economic growth.[36]

Figure 15: Share of households that have adopted broadband Internet, 2019[37]

The rankings: Poland showcases a relatively high level of broadband adoption across its regions (see figure 15 and figure 16). The Greater Poland region (85.3 percent) leads the way, closely followed by Lower Silesia (85.3 percent) and Mazovia (84.9 percent). These numbers highlight Poland’s commitment to digital connectivity and the accessibility of broadband services.

Austria’s regions demonstrate a strong commitment to digital infrastructure. Vorarlberg (92 percent) and Lower Austria and Vienna (91.1 percent) stand out as leaders in broadband adoption, indicating their advanced digital connectivity and technological integration.

Sweden’s commitment to technological advancement is evident through its high broadband adoption rates. Småland and the Islands (98 percent) and Middle Norrland (97 percent) showcase the country’s emphasis on providing widespread broadband access.

Hungary’s broadband adoption varies across its regions. Central Hungary (90.3 percent) leads the way, highlighting its focus on digital connectivity. However, regions like Southern Great Plain (81 percent) and Northern Hungary (81 percent) suggest a need for enhanced efforts to improve broadband access.

Italy’s regions exhibit mixed broadband adoption rates. Regions like Trentino (88 percent) and Emilia-Romagna (88 percent) lead the way, while others like Sicily (76 percent) and Apulia (77 percent) show room for improvement in digital infrastructure.

Germany demonstrates a commitment to digital connectivity, with most regions showcasing high broadband adoption rates. Hamburg and Schleswig-Holstein (96 percent) and Bremen and Lower Saxony (95.2 percent) stand out as leaders in digital integration.

The United States evinces a diverse range of broadband adoption rates across its states. Washington (91.2 percent) and California (89.8 percent) lead the way, indicating their strong digital infrastructure. States like Mississippi (76.8 percent) and Louisiana (80.6 percent) show room for considerable improvement in broadband adoption.

Figure 16: Performance map in broadband adoption indicator[38]

R&D Intensity

Why is this important? This indicator measures R&D expenditures in a region relative to its GDP considering R&D expenditures by all sectors: business, government, and higher education. R&D lies at the heart of innovation, as it represents the source of the new knowledge needed to discover, design, and implement innovative technologies and products. R&D results in slightly higher private returns and much larger social returns than other types of investment as new knowledge and technology spill over to the rest of an economy.[39]

Figure 17: R&D expenditures as a share of GDP, 2019[40]

The rankings: Poland’s regions display varying levels of R&D intensity (see figure 17 and figure 18). Małopolskie (2.2 percent) and Pomorskie (1.7 percent) lead in prioritizing research and innovation, while Łódzkie (0.5 percent) and Świętokrzyskie (0.5 percent) have lower R&D intensity, suggesting potential areas for increased focus on research-driven growth.

Austria showcases a commitment to R&D across most regions. Styria (4.9 percent) and Upper Austria (3.5 percent) lead the way, indicating a strong innovation culture and investments in technological advancements.

Sweden’s regions emphasize R&D activities, with West Sweden (4.8 percent) and Greater Metropolitan Region (3.6 percent) standing out. However, regions like Middle Norrland (0.8 percent) and North Middle Sweden (1.2 percent) exhibit areas for improvement.

Hungary’s regions demonstrate varying degrees of R&D intensity. Central Hungary (1.87 percent) and Central Transdanubia (1.34 percent) lead in research focus, while regions like Southern Transdanubia (0.7 percent) and Northern Hungary (0.6 percent) exhibit lower emphasis on research activities.

Italy’s regions reflect a diverse approach to R&D. Piedmont (2.3 percent) and Emilia-Romagna (2.1 percent) lead Italian states in R&D intensity, while regions like Aosta Valley (0.5 percent) and Calabria (0.6 percent) have room for improvement in boosting their research activities.

Germany emphasizes R&D across its regions. Baden-Württemberg (5.8 percent) and Bavaria (3.4 percent), in particular, lead in R&D Intensity, underscoring their innovative economies.

The United States exhibits varied R&D intensity across its states. New Mexico (7.5 percent) and Massachusetts (6.6 percent) lead in R&D intensity, reflecting the strong presence of national laboratories and leading research universities in their states, while states like Louisiana (0.6 percent) and South Dakota (0.6 percent) have a comparatively lower focus on research activities.

Figure 18: Performance map in R&D intensity indicator[41]

R&D Personnel

Why is this important? This indicator measures the number of R&D personnel as a share of all employees in each region. R&D personnel are indispensable to conducting R&D activities and turning investments into new productivity-enhancing knowledge and technologies.

Figure 19: R&D personnel as a share of total employees, 2017–2018 (%)[42]

The rankings: Poland’s regions exhibit differing levels of R&D personnel (see figure 19 and figure 20). Małopolskie (2.4 percent) and Dolnośląskie (1.8 percent) lead in terms of human resources dedicated to R&D, while Łódzkie (0.5 percent) and Mazowieckie (0.3 percent) have lower levels, suggesting potential areas for increased investment in skilled researchers.

Austria demonstrates a commitment to R&D with high levels of personnel dedicated to this field. Styria (4.6 percent) and Lower Austria and Vienna (3.7 percent) excel in human resources for R&D, indicating a strong workforce dedicated to innovation and scientific advancements.

Sweden’s regions emphasize R&D personnel, with West Sweden (3.5 percent) and Greater Metropolitan Region (3 percent) leading the way. However, regions like Middle Norrland (1 percent) and North Middle Sweden (1.1 percent) exhibit room for improvement in human resources allocated to research activities.

Hungary’s regions display differing levels of R&D personnel. Central Hungary (2.6 percent) and Southern Great Plain (1.4 percent) allocate significant human resources to research, while regions like Northern Hungary (0.6 percent) and Western Transdanubia (0.9 percent) have comparatively fewer personnel dedicated to R&D.

Italy’s regions showcase diverse approaches to R&D personnel. Emilia-Romagna (3.3 percent) and Friuli-Venezia Giulia (2.5 percent) stand out with high levels of human resources allocated to research, while regions like Aosta Valley (1.1 percent) and Calabria (1 percent) demonstrate a lesser emphasis on R&D employment.

German regions exhibit a commitment to research with substantial human resource allocation. Baden-Württemberg (3.7 percent) and Bavaria (2.5 percent) stand at the forefront of R&D personnel, highlighting their dedication to innovation and technological advancement.

The United States showcases varying levels of R&D personnel across its states. Washington (3.2 percent) and Massachusetts (2.6 percent) lead in human resources dedicated to research, while states such as Arkansas (0.5 percent) and Louisiana (0.5 percent) have relatively fewer personnel engaged in R&D activities.

Figure 20: Performance map in R&D personnel indicator[43]

Patent Applications

Why is this important? This indicator measures international Patent Cooperation Treaty (PCT) patent applications filed by residents or entities within a region per one million residents. Patent output measures the “inventiveness” of a population. Patents also secure private returns on investment in R&D activities, which are necessary to incentivize these activities and their socially desirable spillover effects. By considering PCT patents, this indicator focuses on internationally filed patents to mitigate differences in patent qualifications between countries’ patent offices.

Figure 21: PCT patent applications per million residents, 2015[44]

The rankings: Patent applications per capita vary across Poland’s regions, with Małopolskie (84.1) and Lubelskie (82.3) leading in terms of innovation efforts through patent filings (see figure 21 and figure 22). Lubuskie (17.1) and Warmińsko-Mazurskie (18) show lower levels of patent applications, suggesting potential areas for increased focus on innovation.

Austria’s commitment to innovation is evident in the Austrian regions’ high levels of patent applications. Vorarlberg (532.7) and Upper Austria (225.1) are standout regions in terms of patent filings, showcasing strong efforts in intellectual property (IP) creation and technological advancement.

Sweden places a significant emphasis on innovation, with Greater Metropolitan Region (449.2) and South Sweden (443.8) leading in patent applications. Middle Norrland (75.9) and Upper Norrland (122.6) have relatively lower levels, indicating opportunities for growth in IP creation.

Hungary demonstrates varying levels of innovation across its regions. Central Hungary (57.1) and Southern Great Plain (17.3) lead in patent filings, while regions like Northern Hungary (10.7) and Northern Great Plain (9.6) exhibit room for potential improvement in innovation efforts.

Italy’s regions exhibit diverse approaches to innovation. Emilia-Romagna (146.7) and Friuli-Venezia Giulia (103.7) excel in patent applications, while Molise (8.5) and Sicily (8.1) show lower levels, suggesting opportunities for an increased focus on IP creation.

Germany showcases a strong commitment to innovation across its regions. Baden-Württemberg (406.1) and Bavaria (398.3) lead in patent applications, underscoring their dedication to technological advancement and IP creation.

The United States demonstrates varying levels of patenting per capita across its states. Massachusetts (502.4) and California (379.9) perform outstandingly in patent applications, while states such as Mississippi (20) and Alaska (12.2) have comparatively fewer patent filings, highlighting areas with potential for growth in IP development.

Figure 22: Performance map in patent applications indicator[45]

Business Creation

Why is this important? A thriving business ecosystem should experience a high volume of business start-ups. This indicator measures the share of a region’s business enterprises that were established in the past year. The business creation indicator is limited in scope to new businesses, without capturing business turnover resulting from the market disruption and creative destruction that forces incumbents to innovate or leave the market. Thus, the full impact of business competition on innovation is not captured. Moreover, this metric does not differentiate between industries, so there is no differentiation between creation rates in advanced, innovative industries and those in less advanced industries. Absent a better alternative at the cross-national regional level, this indicator reflects a region’s overall economic resilience and regional competitiveness.

Figure 23: Economy-wide enterprise birth rate, 2016–2018 (%)[46]

The rankings: Business creation rates are quite diverse across Polish regions, with Zachodniopomorskie (12.5 percent) and Dolnośląskie (12.4 percent) leading in fostering new businesses (see figure 23 and figure 24). Lubelskie (11.6 percent) and Silesia (11.5 percent) show relatively lower rates, suggesting potential for increased entrepreneurial efforts.

Austria demonstrates a balanced entrepreneurial environment, with all regions having moderate business creation rates. Burgenland (7.9 percent) and Lower Austria and Vienna (9 percent) have relatively higher rates, indicating favorable conditions for startups.

Sweden showcases a diverse entrepreneurial landscape. Greater Metropolitan Region (8.1 percent) leads in business creation, while North Middle Sweden (4.5 percent) and Middle Norrland (4.3 percent) have lower rates, suggesting room for growth in start-up activities.

Hungary exhibits consistent entrepreneurial efforts across its regions. Central Hungary (12.6 percent) and Central Transdanubia (12.4 percent) stand out, showing a strong commitment to new business ventures.

Italy’s regions show varying levels of business creation. Molise (11.8 percent) and Calabria (11.3 percent) demonstrate higher rates, while Lombardy (7.7 percent) and Trentino (7 percent) have comparatively lower rates, indicating diverse entrepreneurial ecosystems.

Germany’s regions exhibit balanced entrepreneurial activities. Berlin and Brandenburg (9 percent) and North Rhine-Westphalia (8.6 percent) lead, highlighting their vibrant startup ecosystems, while Saxony (6.1 percent) and Thuringia (5.2 percent) show potential for further development.

The United States displays diverse entrepreneurial dynamics. Nevada (13.1 percent) and Florida (12.5 percent) score outstandingly in business creation, showcasing their entrepreneurial appeal, while Iowa (7.2 percent) and West Virginia (7 percent) have comparatively lower rates, indicating scope for growth in startups.

Figure 24: Performance map in business creation indicator[47]

Carbon Efficiency

Why is this important? As the world endeavors to combat climate change, decarbonization is of paramount importance. Regions’ abilities to innovate sustainably to achieve a reduction in and the efficient use of carbon and other greenhouse gases will determine their long-term competitiveness, as well as their national economic prosperity. This indicator measures carbon dioxide (CO2) and other greenhouse gas efficiency per unit of output (as measured by PPP-adjusted GDP). It is noted that more-developed regions may have a slight advantage in this indicator due to their more service-oriented economies. As policymakers look to improve efficiency and reduce overall emissions, they will take their lead from those regions that are devising new solutions and innovative technologies.

Figure 25: Metric tons of greenhouse gas (measured in CO2 equivalents) emitted per $10,000 of PPP-adjusted GDP, 2018[48]

The rankings: Poland’s regions exhibit contrasting levels of carbon efficiency, with some regions like Łódzkie (7.3) and Świętokrzyskie (7.4) showcasing significant carbon emissions (see figure 25 and figure 26). This indicates a need for commitment to sustainable development across various parts of the country.

Austria demonstrates a consistent approach to carbon efficiency across its regions. Regions like Vorarlberg (0.8) and Salzburg (1.1) lead in carbon efficiency, displaying a national commitment to environmental responsibility.

Sweden showcases an emphasis on carbon efficiency across its regions. However, Småland and the Islands (2.4) and West Sweden (4.9) are slightly behind in carbon efficiency despite a nationwide commitment to sustainable practices.

Hungary displays diverse carbon efficiency levels across its regions. Regions such as Central Transdanubia (3.5) and Northern Hungary (4.7) could focus more on reducing their carbon footprints to achieve better carbon efficiency, as it appears that regions such as Central Hungary (1) and Northern Great Plain (1.5) have achieved.

Italy demonstrates a range of carbon efficiency levels. Regions like Lombardy (1.1) and Lazio (1.1) display commendable carbon efficiency efforts, highlighting a nationwide pursuit of sustainable development.

Germany showcases varying carbon efficiency across its regions. Regions like Berlin and Brandenburg (3.1) and Saxony-Anhalt (3.9) are behind in carbon efficiency despite a concerted nationwide effort toward sustainability.

The United States presents a diverse range of carbon efficiency levels across its states. While states like Massachusetts (1.2) and New York (1.2) demonstrate strong carbon efficiency, states such as North Dakota (15.6) and Wyoming (23.5) face much greater challenges in reducing their carbon footprint than regions in Europe (although this of course again reflects to some degree those states’ very large energy sectors).

Figure 26: Performance map in carbon efficiency indicator[49]

Venture Capital

Why is this important? This indicator examines a region’s total venture capital investment (measured as VC-receiving firms) relative to the size of its GDP. VC represents a form of business financing wherein investors provide funds to early-stage companies in exchange for equity in their firms. Given the considerable uncertainty regarding start-ups’ success potential, VC investment assumes higher risks than other forms of investment. Accordingly, VC investment is often intended for companies with real or perceived high-growth potential, often associated with their innovative technology use or business model design. A region’s receipt of VC investment reflects both the innovativeness of its start-up ecosystem as well as the commitment of its firms to lead in crucial technologies such as AI, biotechnology, clean energy, advanced manufacturing, and robotics. Due to the volatility of VC investment from year to year, this report considers regions’ average scores between 2017 and 2019.

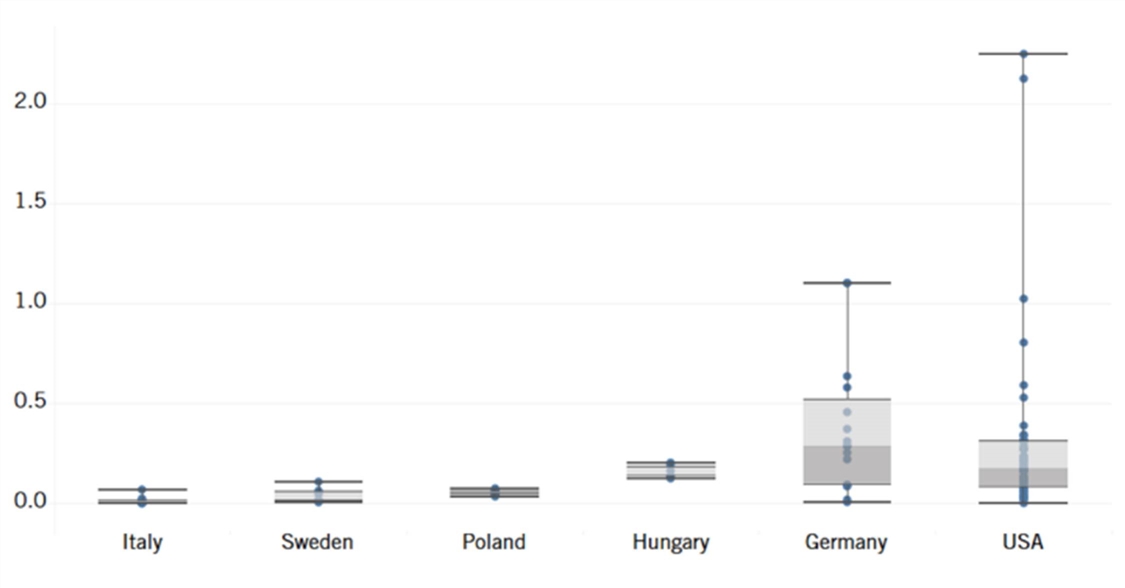

Figure 27: Venture capital investment received as a percentage of GDP, 2017–2019 (average)[50]

The rankings: Dolnośląskie (0.07 percent) and Opolskie (0.07 percent) are among the regions with notable venture capital influx in Poland, indicating an emerging entrepreneurial landscape (see figure 27 and figure 28). Meanwhile, regions like Świętokrzyskie (0.04 percent) and Małopolskie (0.05 percent) lag on this indicator.

Sweden boasts significant venture capital activity in certain regions. Greater Metropolitan Region (0.11 percent) and South Sweden (0.06 percent) stand out as hubs for attracting venture funding and fostering innovation and start-ups. On the other hand, Småland and the Islands (0.01 percent) lag among Swedish regions at IP. Overall, it’s surprising that Swedish regions so substantially lag German ones in VC investment, but as the policy recommendations section subsequently explains, difficulty in attracting VC investment is one of the weakest aspects of Sweden’s otherwise robust innovation economy.

Hungary showcases active participation in the venture capital ecosystem. Central Hungary (0.20 percent) and Northern Hungary (0.19 percent) demonstrate a thriving entrepreneurial environment. Regions like Southern Transdanubia (0.13 percent) and Northern Great Plain (0.13 percent) also contribute substantially to Hungary’s venture capital landscape.

Italy presents a mixed landscape for venture capital attraction. Regions like Lombardy (0.07 percent) and Piedmont (0.02 percent) showcase notable venture capital activities, fostering innovation and growth. However, some regions like Abruzzo, Aosta Valley, and Molise have yet to tap into the full potential of venture capital. But overall Italy lags behind both Germany and Hungary on this important indicator.

Germany demonstrates varying degrees of venture capital engagement across its regions. Berlin and Brandenburg (1.1 percent) emerge as significant hubs for start-ups and innovative ventures, while regions like Mecklenburg-Vorpommern (0.5804 percent) and Hesse (0.64 percent) also show substantial venture capital activities.

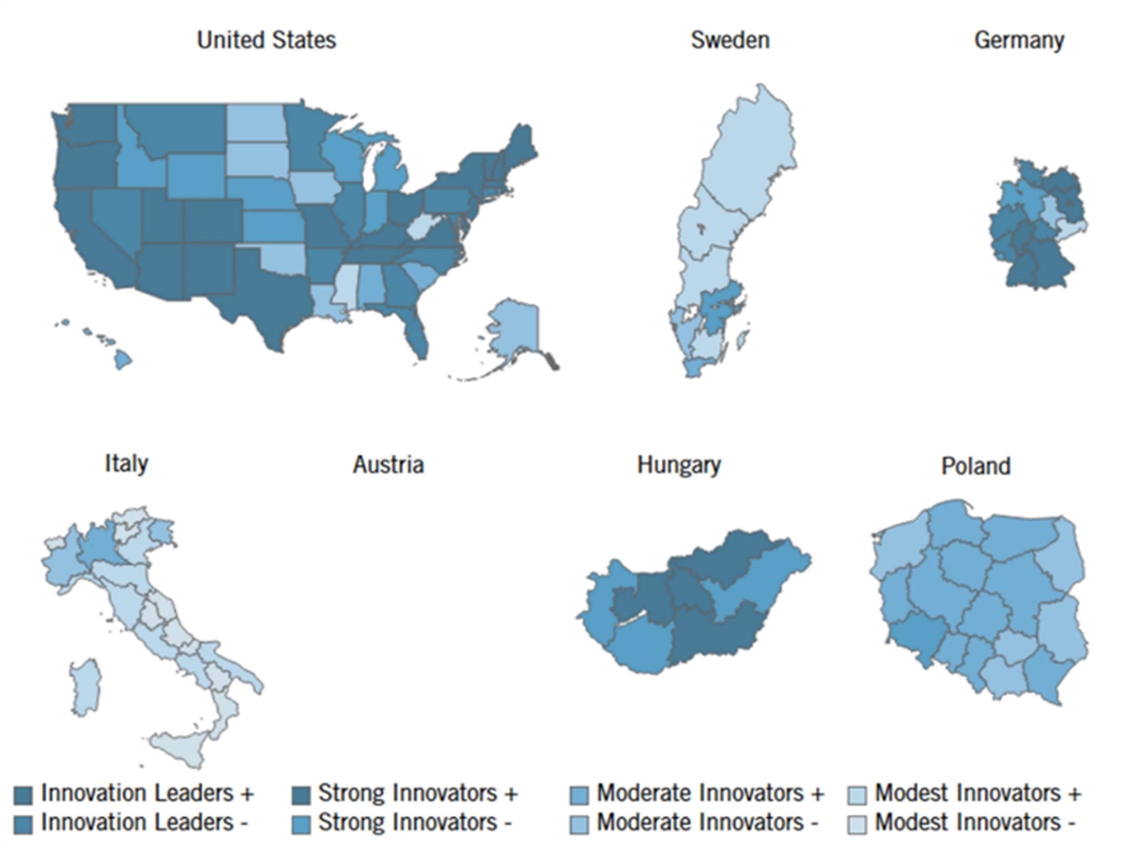

The United States showcases a robust venture capital landscape. States like Massachusetts (2.13 percent) and California (2.25 percent) lead the nation in attracting venture funding, reflecting their status as global tech and innovation hubs. Other regions like New York (1.03 percent) and Utah (0.8 percent) also display considerable venture capital activities. West Virginia (0.00 percent) and Mississippi (0.02 percent) demonstrate comparatively much lower scores in received venture capital.

Figure 28: Performance map in venture capital indicator[51]

Policy Recommendations

This section proposes policy actions to boost innovation competitiveness in the regions and states of Austria, Germany, Hungary, Italy, Poland, Sweden, and the United States.

Austria

Knowledge Economy

Austria, like Germany, is grappling with the challenges of decarbonization, digitization, and an aging population. The country’s education system emphasizes STEM subjects, but there is room for improvement in both infrastructure and teaching skills. To enhance computer literacy and information-related competencies, Austrian policymakers must enable more investment in digital infrastructure in schools and universities. As part of this, teachers’ proficiency in using digital tools should be expanded, and the subject of computer science should be integrated more extensively into the curriculum. The government should minimize regulation to allow educational institutions to innovate and tailor their curriculums to market needs. Austria can also streamline its immigration procedures for skilled workers, particularly in STEM areas, to boost innovation and productivity. Enhancing the attractiveness of the job market and simplifying administrative processes are key.

Globalization

Austria’s economy is heavily integrated with the EU’s, and its high-tech exports are competitive. However, the government can apply some specific strategies to improve performance. Austria should reduce trade barriers and regulations, allowing businesses, especially SMEs, to compete and innovate without hindrance. Austria should further align with EU policies that encourage technological innovation and trade competitiveness. Policymakers should consider boosting growth in less-developed regions of Austria, taking advantage of technological spillover effects. Austria should also pursue policies to attract more technological FDI, particularly in emerging sectors, to stimulate innovation and economic growth. The government could create a more attractive environment for foreign investment by minimizing regulations and taxes.

Innovation Capacity

Austria’s innovation landscape is rich but requires targeted policies to maintain momentum. The government should increase investment in universities and research institutions, with a focus on facilitating knowledge transfer to industry. The key is to create a friendly environment for private investment by reducing regulations and taxes on businesses and research institutions. Austria can realize its commitment to a greener future by promoting innovation in energy efficiency, renewable energy, and sustainable mobility. The government should minimize subsidies and regulations, allowing businesses to innovate and compete freely. Investing in AI technologies and digital infrastructure is crucial for Austria to remain competitive. Policies should encourage the private sector to invest in these areas. The key is for the government to reduce entry barriers and allow competition. Young and small companies in Austria often face financial challenges. Knowledge clusters and support for entrepreneurs require a more innovation-friendly environment. Less regulation and protection would be a consequential first step in this direction.

Germany

Knowledge Economy

Companies in Germany are facing the major challenges of decarbonization, demographics, and digitization. In surveys, companies want the government to invest more in digitization and education, especially in computer science and other STEM subjects, to strengthen innovation in Germany.

In relation to STEM education, it’s important to improve opportunities in the education system. This includes the expansion of all-day facilities at daycare centers and schools, the expansion of language support programs, and an increase in the quality of all-day facilities through family centers. Furthermore, additional multi-professional staff should be financed through a social index to reduce inequality of opportunity. Targeted support programs can help close COVID-related learning gaps with the help of targeted support programs. Second, Germany needs to advance the digitalization of educational institutions. Existing gaps in the digital infrastructure should be closed, with 20,000 additional information technology (IT) positions created in schools for administrative tasks. Germany plans the integration of IT-related education into teacher training, furthering training offers for digital learning formats, and the development of digitally supported teaching materials in the STEM field. Third, Germany must strengthen STEM education. The aim is to anchor digital media education in preschool and to introduce computer science as a subject from primary school onwards. To secure skilled workers, Germany must train teachers better, and lateral entrants must be qualified in the STEM field. It is essential to develop measures along the entire education chain and strengthen extracurricular offers. Bottlenecks in the German STEM sector alone would be 386,000 individuals higher without the employment successes of immigrants.

Regarding utilizing the potential of women, older citizens, and immigrants, it is first necessary to promote women. This is about a prejudice-free career and study-orientation for STEM professions, communicating the importance of STEM professions as climate-protection professions, and strengthening the STEM strengths of girls through better feedback systems. Germany should expand mentoring programs and networks. Second, German companies should meet the further training needs of employed STEM experts. Companies affected by digitalization should invest more in continuing education. Universities should expand in-service training opportunities, and legislators should be called upon to improve the framework conditions for later retirement. Third, to maximize the potential of the immigrant community to contribute to the German economy and society, immigrants should be attracted by optimizing bureaucratic processes and targeted recruitment efforts abroad.[52]

Bottlenecks in the German STEM sector alone would be 386,000 individuals higher without the employment successes of immigrants.