The Transatlantic Subnational Innovation Competitiveness Index

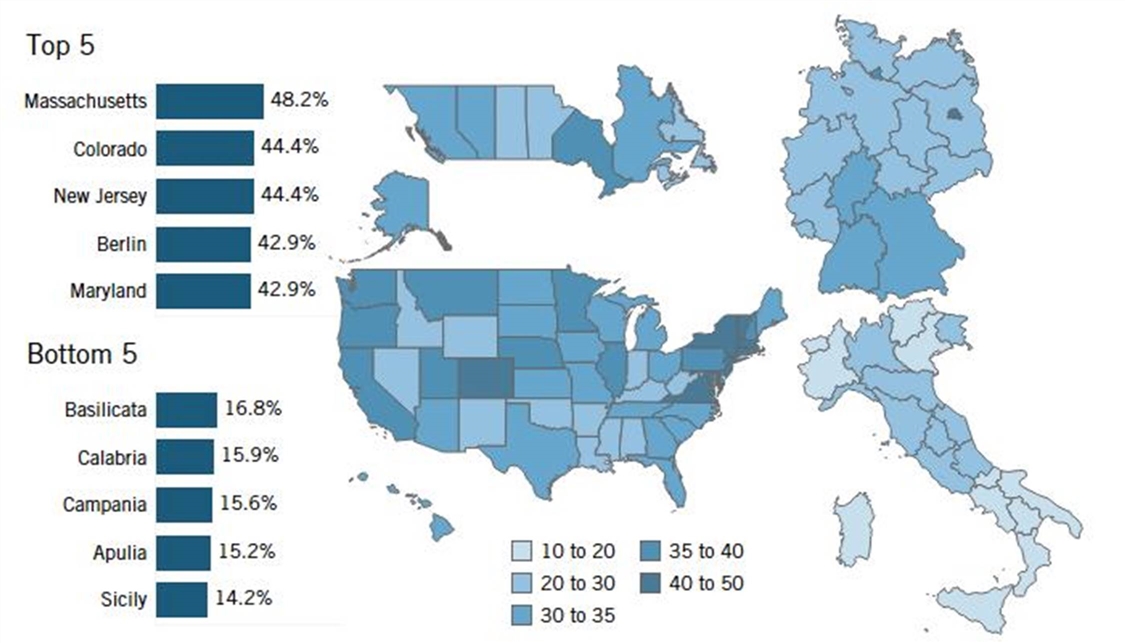

Innovation ecosystems are increasingly complex and diverse, but there are common markers of core strength. In this report, the Information Technology and Innovation Foundation, the German Economic Institute, the Institute for Competitiveness, and the Macdonald-Laurier Institute benchmark 96 states and regions across Germany, Italy, the United States, and Canada.

KEY TAKEAWAYS

Key Takeaways

Contents

The Transatlantic Subnational Innovation Competitiveness Index 5

Highly Educated Population. 15

Professional, Technical, and Scientific Employment 18

Manufacturing Labor Productivity 19

Appendix A: Composite and Category Scores Methodology 46

Appendix B: Indicator Methodologies and Weights 47

Appendix C: Estimation Methodologies 48

Appendix D: Full Dataset and Rankings Error! Bookmark not defined.

Executive Summary

Governments—at federal, state, and even regional and city levels—are realizing that they must develop innovation strategies to compete in an increasingly knowledge-, technology-, and innovation-driven global economy. Improving both national- and state-level innovation competitiveness entails governments fostering advanced industries and incentivizing the activities that lead to technological progress, such as R&D and making investments in productivity-enhancing technologies. Such strategies are becoming more common, as exemplified by Germany’s “Industry 4.0” (2011) and China’s “Made in China 2025” (2015) as well as the United States’ passage of the CHIPS and Science Act this July (2022).

As countries develop economically, they are less able to rely on simple “catch-up” growth strategies such as technology absorption from more-developed countries. While ITIF encourages further investments in advanced capital equipment (e.g., industrial robots for manufacturing), economies at the technological frontier must also be able to design and develop new technologies, products, and processes to boost productivity, the ultimate source of long-term economic growth. Rather than being “Manna from Heaven” beyond the control of economic actors, innovation-driven productivity growth is something governments and society can and should actively promote.

This report builds on its predecessor, the North American Subnational Innovation Competitiveness Index (NASICI), using 13 commonly available indicators to compare the innovative capacity and global competitiveness of the subnational regions of Canada, Germany, Italy, and the United States. The report’s goal is to provide policymakers with a comparative and evaluative tool to better understand where their regions rank among peers in terms of innovation capacity as well as how they can improve.[1] As in the predecessor of this report, Massachusetts ranks first among the 96 regions evaluated, thanks to its world-leading network of universities, highly educated population, and concentration of biotechnology and other advanced-industry firms. Although Massachusetts holds the top spot and California comes in second, Germany generally outperforms the United States. The overall score of the median German state across all indicators is 45.3, while that of the median U.S. state is 33.9. Germany claims the second-best-performing state in Baden-Württemberg, home to companies such as Mercedes-Benz and SAP, as well as 4 others in the top 10. Though Canada’s best-performing province (Ontario) scores higher than Italy’s (Emilia-Romagna), and Canada’s worst-performing province (Saskatchewan) scores better than Italy’s (Calabria), the median Italian region actually outperforms the median Canadian province. Canada’s particular weaknesses lie in measures of R&D activity, carbon efficiency of production, business creation, and high-tech exports relative to GDP.

One persistent trend is the disparity in performance among regions in Canada, Germany, Italy, and, to a lesser extent, the United States. Germany’s best performers on almost all indicators can be found in the south and west of the country (with Berlin as a common exception), while this is true as well for Italy’s northern regions. Innovative activity in Canada is concentrated in British Columbia, Ontario, and Quebec (as is Canada’s population and economic activity in general). The United States’ best performers tend to be found along the east and west coasts, though for many indicators, states in the middle of the country score very well (e.g., New Mexico scores highly in R&D intensity and personnel and Nevada in business creation).

The report contends that Germany should sustain its leadership by increasing investment in its education system and supporting businesses in adopting digital technologies and increasing R&D expenditures. Canada should incentivize greater R&D investment, attract technology-intensive FDI, boost productivity, and invest in science, technology, engineering, and mathematics (STEM) education to support employment in advanced-technology industries. Italy should work to expand access to higher education and attract more VC and FDI. The United States should increase its R&D tax credit, bolster science and R&D funding, and reconsider immigration policies in high-demand professions to help accelerate technology innovation and adoption by firms in all states.

After a brief introduction, the report proceeds by delving into overall findings before turning to an analysis of how states in the four countries perform in each of the 13 indicators across the three high-level categories of knowledge economy, globalization, and innovation capacity. It concludes by offering policy recommendations in light of the specific findings for each country.

Introduction

While the populations of Canada, Germany, Italy, and the United States are relatively small compared with the global population (512 million of the 7.9 billion people worldwide), these countries account for one-third of global economic output ($32 trillion of the $96 trillion).[2]

Governments throughout the world—at federal, state, and even regional and city levels—are realizing they must develop innovation strategies to compete in an increasingly knowledge-, technology-, and innovation-driven global economy. For any developed economy, the ability to maintain economic prowess and international relevance hinges on innovation and technological advancements, which boost per capita GDP.[3]

Multiple critical factors influence a nation’s innovation ecosystem. Among them are the quality of education and academics (especially in STEM fields), public and private R&D and innovation investments, the extent of highly trained R&D personnel, economic dynamism, and entrepreneurship.

Governments increasingly recognize the imperative of cultivating robust innovation ecosystems. As a result, many nations have introduced national technology and innovation strategies and industrial policies, such as those in Canada, China, France, Germany, Italy, Japan, and the United States.[4] Most recently, the United States’ CHIPS and Science Act of 2022 exemplified this global trend.[5]

It’s clear that countries place significant emphasis on the development of their innovation ecosystems and set ambitious goals to achieve economic prosperity. The crucial question is how individual nations and regions are progressing in this race for competitiveness, and what policymakers can do to nurture their innovation ecosystems.

Through self-reinforcing mechanisms, businesses, universities, and research facilities in specific regions specialize in certain areas. Moreover, regional policymakers may also prioritize different determinants of innovation that result in unique regional strengths and weaknesses. For instance, California and Massachusetts excel in information technology and life-sciences sectors while Arizona, New York, and Texas excel at semiconductors. As a result, it’s essential to inspect the performances of these regional ecosystems in terms of innovation competitiveness on a subnational level to understand national and regional comparative advantages and key areas that require targeted policymaking.

Several studies seek to assess national innovation competitiveness.[6] There are also reports that assess the performance of subnational regions. In the United States, for example, ITIF publishes the State New Economy Index, which measures the extent to which U.S. states’ economies are knowledge-driven, globalized, entrepreneurial, IT driven, and innovation oriented.[7] The European Commission has also published a report evaluating the effectiveness of European innovation ecosystems at a subnational level.[8]

Governments throughout the world—at federal, state, and even regional and city levels—are waking up to the fact that they must develop innovation strategies to compete in an increasingly knowledge-, technology-, and innovation-driven global economy.

However, there is insufficient data and literature comparing North American and European subnational innovation ecosystems. This report responds to that gap by providing detailed analysis of the innovation competitiveness of major economies in Europe and North America, specifically Germany, Italy, Canada, and the United States.

The Transatlantic Subnational Innovation Competitiveness Index

The Transatlantic Subnational Innovation Competitiveness Index (TASICI) captures the innovation performance of 96 regions across 4 developed countries and 2 continents: Canada (10 provinces), Germany (16 states), Italy (20 regions), and the United States (50 states).

The TASICI represents the continuation of the NASICI report and follows its structure.[9] Given the constraints that data must be available for the regions in each of the four countries for the same (or at least adjacent) years, this report consists of 13 indicators representing the relevant determinants of a successful innovation ecosystem, grouped into three categories:

▪ Knowledge-Based Workforce: Indicators measure the educational attainment of the workforce; immigration of knowledge workers; employment in professional, technical, and scientific (PTS) activities; and manufacturing sector productivity.

▪ Globalization: Indicators measure high-tech exports and inward FDI.

▪ Innovation Capacity: Indicators measure a region’s share of households subscribing to broadband Internet, expenditures on R&D, the number of R&D personnel, the creation of new businesses, patent output, the extent of progress toward decarbonization, and VC investment.

The most important category of the TASICI is innovation capacity, which accounts for 54 percent of the index’s weight, while the knowledge economy indicators account for 33 percent of the index’s weight, and the globalization indicators account for the remaining 13 percent.

Overall Score

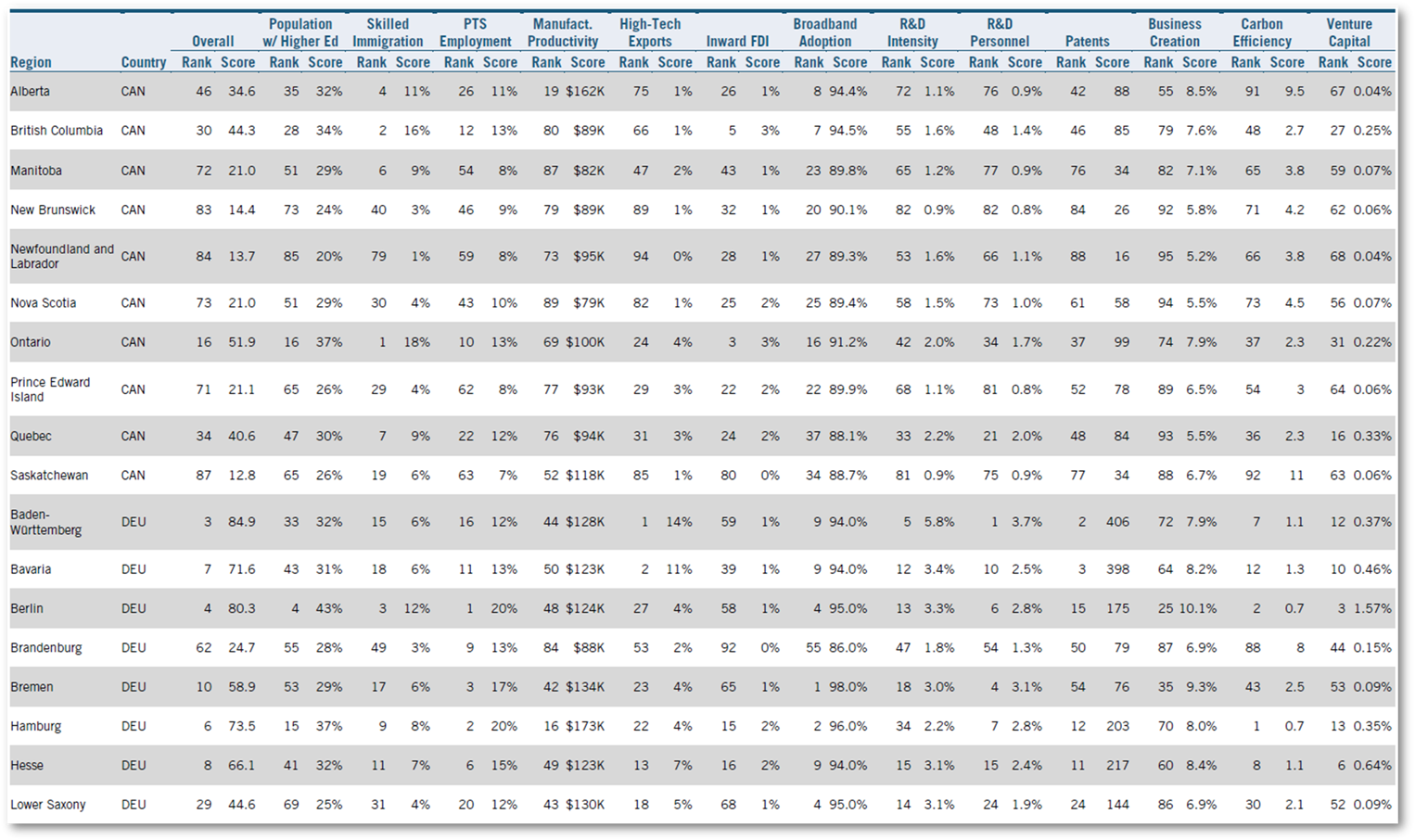

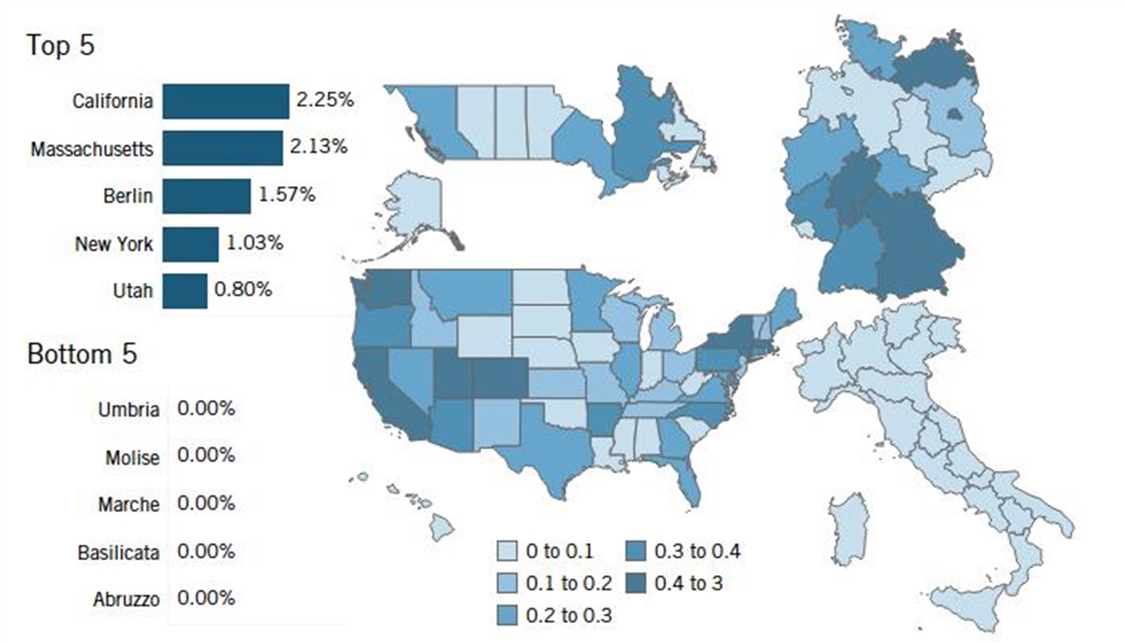

Figure 1: Overall composite TASICI scores

The Rankings

Massachusetts, California, Baden-Württemberg, Berlin, and Washington top contenders in this 96-region index, while Apulia, West Virginia, Sicily, Calabria, and Mississippi perform the weakest. (See Figure 1.) Interestingly, regional disparities are apparent in each country. Canada’s central and Atlantic regions perform poorly compared with the provinces of British Columbia, Ontario, and Quebec. (However, Canada’s population and economic activity are heavily concentrated in these three provinces.) Germany’s western and southern states predictably outperform their northeastern counterparts (except for Berlin). Likewise, Italy’s more-industrialized northern and central regions outperform its slower-developing southern regions. And the United States’ best performers can mostly be found along its coasts, while the southeast region contains the three lowest scoring U.S. states (Mississippi, West Virginia, and Arkansas). Notably, the United States claims the best-performing (Massachusetts) and worst-performing (Mississippi) states, as well as 4 of the top 10 and 5 of the bottom 10.

Overall, Germany’s states slightly lead American ones across the TASICI indicators, while the performance of Canada’s provinces is much more similar to that of Italian regions than to German or American states. Germany demonstrates leadership in innovation competitiveness with a median of 44.1 and average of 50.4 in overall scores and with 6 states placing in the

top 10. Although 4 of the top 10 regions are in the United States, the median score is 33.8

and the average score is 35.6, both of which are significantly behind German levels. Canada and Italy display the least successful performances with median scores of 21.1 and 24.9, and average scores of 27.5 and 25.2, respectively. The performance of Canadian provinces is much more similar to those of Italian regions than to German or American states. In fact, despite its highest- and lowest-scoring provinces outperforming regions in Italy, the median Italian region outscores the median Canadian province.

Canada performs poorly in the innovation capacity category, notching the lowest median score. It performs only middlingly in the other two categories, scoring closer to Italy on knowledge economy indicators than it does to either Germany or the United States. Canada does not possess a single province in the top 10, with its highest-scoring province being Ontario (16th). Ontario performs quite well in the knowledge economy and globalization categories, ranking eighth and third, respectively. However, it falters in the innovation capacity category, ranking only 35th. Canada does not have another province that ranks in the top 10 in any of the three categories.

As a whole, Germany performs very well in each of the three categories. It contains the highest-scoring state in the knowledge economy and innovation capacity categories and the highest-scoring median region in all three categories. Baden-Württemberg and Berlin both score in the top five overall, ranking third and fourth, respectively. Other standouts for Germany are Bavaria, Bremen, Hamburg, and Hesse, which all also rank in the top 10 overall.

Italy’s clear weakness lies in the knowledge economy category, where it has both the lowest median score and lowest-scoring region (Sicily). Globalization proves to be a “tale of two halves” for Italy. It possesses the highest-scoring region in Lombardy while Piedmont and Emilia-Romagna also rank in the top 10. On the other hand, Italy’s southern regions account for 5 of the 10 lowest-scoring regions in the category, with Calabria ranking last. However, innovation capacity is a surprising bright spot for Italy despite its highest-scoring region in the category, Emilia-Romagna, lagging far behind the highest-scoring states in Germany and the United States. Italy’s best overall performer is Emilia-Romagna, which ranks 17th overall. Emilia-Romagna ranks 9th in globalization, 14th in innovation capacity, yet only 48th in knowledge economy.

Despite three of the top-five overall performers being in the United States (Massachusetts, California, and Washington), America does not lead in any of the three categories. However, it is the only other country that matches strength with Germany in the knowledge economy category. The median U.S. state scores slightly better than the median Italian region in innovation capacity. Despite having 3 of the 4 highest-scoring states in the category, it claims 8 of the 10 lowest-scoring states, including all of the bottom 7. Massachusetts is both the United States’ highest-scoring state and the highest-scoring state overall, ranking 2nd in innovation capacity, 3rd in knowledge economy, and 12th in globalization. California and Washington both also score well in knowledge economy (6th and 14th, respectively) and innovation capacity (4th and 3rd), but surprisingly score quite poorly in globalization (42nd and 68th). Maryland is the other U.S. state to score in the top 10, also performing very well in knowledge economy and innovation capacity (5th and 12th, respectively), but much more poorly in globalization (64th).

Table 1: Summary of country performance in overall TASICI and components

|

Median Knowledge Score |

Median Globalization Score |

Median Capacity Score |

Max Overall Score |

Min Overall Score |

||||

|

Germany |

44.1 |

41.5 |

50.6 |

46.9 |

84.9 |

(Baden-Württemberg) |

23.1 |

(Saxony-Anhalt) |

|

USA |

33.8 |

39.3 |

36.3 |

32.9 |

95.1 |

(Massachusetts) |

4.9 |

(Mississippi) |

|

Italy |

24.9 |

23.7 |

37.5 |

32.2 |

50.2 |

(Emilia-Romagna) |

5.8 |

(Calabria) |

|

Canada |

21.1 |

30.2 |

38.8 |

22.8 |

51.9 |

(Ontario) |

12.8 |

(Saskatchewan) |

|

ALL |

33.1 |

34.7 |

39.8 |

33.8 |

95.1 |

(Massachusetts) |

4.9 |

(Mississippi) |

Table 2: Regional performance in overall TASICI and components sorted by overall TASICI

|

Overall |

Region |

Country |

Overall |

Knowledge |

Globalization |

Capacity |

|||

|

Rank |

Score |

Rank |

Score |

Rank |

Score |

||||

|

1 |

Massachusetts |

USA |

95.1 |

3 |

87.4 |

12 |

70.7 |

2 |

93.2 |

|

2 |

California |

USA |

86.9 |

6 |

77.4 |

42 |

43.0 |

4 |

91.6 |

|

3 |

Baden-Württemberg |

DEU |

84.9 |

19 |

54.4 |

4 |

83.1 |

1 |

95.2 |

|

4 |

Berlin |

DEU |

80.3 |

1 |

95.1 |

46 |

40.5 |

5 |

78.2 |

|

5 |

Washington |

USA |

80.1 |

14 |

61.6 |

68 |

29.9 |

3 |

92.6 |

|

6 |

Hamburg |

DEU |

73.5 |

2 |

93.5 |

13 |

69.4 |

10 |

62.2 |

|

7 |

Bavaria |

DEU |

71.6 |

20 |

53.6 |

2 |

90.4 |

6 |

74.6 |

|

8 |

Hesse |

DEU |

66.1 |

15 |

61.6 |

5 |

81.2 |

8 |

63.6 |

|

9 |

Maryland |

USA |

62.8 |

5 |

77.4 |

64 |

31.3 |

12 |

59.6 |

|

10 |

Bremen |

DEU |

58.9 |

10 |

64.5 |

47 |

40.2 |

11 |

60.5 |

|

11 |

New Jersey |

USA |

57.9 |

4 |

82.3 |

80 |

23.5 |

19 |

50.5 |

|

12 |

Oregon |

USA |

57.9 |

30 |

46.1 |

33 |

49.9 |

7 |

65.4 |

|

13 |

Connecticut |

USA |

54.7 |

9 |

65.4 |

24 |

56.5 |

22 |

47.6 |

|

14 |

Colorado |

USA |

53.9 |

12 |

62.3 |

21 |

60.8 |

20 |

49.3 |

|

15 |

Delaware |

USA |

53.0 |

21 |

52.4 |

36 |

48.3 |

15 |

56.4 |

|

16 |

Ontario |

CAN |

51.9 |

8 |

65.4 |

3 |

86.5 |

35 |

40.3 |

|

17 |

Emilia-Romagna |

ITA |

50.2 |

48 |

35.1 |

9 |

74.2 |

14 |

56.5 |

|

18 |

New Hampshire |

USA |

49.9 |

39 |

40.5 |

18 |

66.3 |

16 |

54.1 |

|

19 |

Michigan |

USA |

49.0 |

37 |

40.9 |

59 |

34.5 |

13 |

57.4 |

|

20 |

North Rhine-Westphalia |

DEU |

48.6 |

27 |

47.1 |

19 |

63.5 |

21 |

49.2 |

|

21 |

Minnesota |

USA |

48.6 |

23 |

50.9 |

40 |

43.9 |

18 |

51.1 |

|

22 |

Utah |

USA |

48.1 |

31 |

46.0 |

38 |

47.1 |

17 |

51.9 |

|

23 |

New York |

USA |

47.7 |

16 |

60.1 |

35 |

48.6 |

31 |

41.2 |

|

24 |

New Mexico |

USA |

47.2 |

51 |

33.6 |

70 |

27.4 |

9 |

63.1 |

|

25 |

Virginia |

USA |

46.1 |

7 |

75.2 |

32 |

50.1 |

53 |

32.4 |

|

26 |

Illinois |

USA |

45.7 |

18 |

58.3 |

22 |

58.4 |

37 |

40.0 |

|

27 |

Texas |

USA |

45.6 |

13 |

62.1 |

15 |

68.3 |

50 |

33.3 |

|

28 |

Lombardy |

ITA |

44.9 |

35 |

41.8 |

1 |

94.8 |

33 |

40.8 |

|

29 |

Lower Saxony |

DEU |

44.6 |

33 |

42.7 |

39 |

44.9 |

23 |

47.1 |

|

30 |

British Columbia |

CAN |

44.3 |

17 |

58.8 |

17 |

66.7 |

45 |

36.1 |

|

31 |

Rhineland-Palatinate |

DEU |

43.7 |

41 |

40.0 |

31 |

50.4 |

24 |

46.6 |

|

32 |

Saxony |

DEU |

43.3 |

40 |

40.4 |

23 |

56.6 |

28 |

43.6 |

|

33 |

Saarland |

DEU |

42.1 |

46 |

36.0 |

14 |

69.4 |

26 |

44.2 |

|

34 |

Quebec |

CAN |

40.6 |

28 |

46.8 |

28 |

52.8 |

36 |

40.2 |

|

35 |

Piedmont |

ITA |

40.0 |

63 |

29.4 |

6 |

78.2 |

27 |

43.7 |

|

36 |

Lazio |

ITA |

39.9 |

29 |

46.2 |

44 |

42.9 |

30 |

41.6 |

|

37 |

North Carolina |

USA |

39.6 |

24 |

50.7 |

82 |

20.8 |

40 |

39.2 |

|

38 |

Pennsylvania |

USA |

39.1 |

26 |

47.2 |

52 |

37.9 |

42 |

37.6 |

|

39 |

Friuli-Venezia Giulia |

ITA |

38.2 |

69 |

27.2 |

11 |

71.1 |

29 |

43.2 |

|

40 |

Arizona |

USA |

37.5 |

38 |

40.8 |

48 |

39.8 |

39 |

39.4 |

|

41 |

Thuringia |

DEU |

37.1 |

49 |

34.2 |

30 |

50.8 |

41 |

38.7 |

|

42 |

Idaho |

USA |

36.1 |

74 |

24.6 |

54 |

36.6 |

25 |

46.5 |

|

43 |

Missouri |

USA |

35.6 |

47 |

35.7 |

8 |

74.5 |

52 |

32.6 |

|

44 |

Wisconsin |

USA |

35.5 |

61 |

29.4 |

25 |

56.3 |

38 |

39.8 |

|

45 |

Rhode Island |

USA |

34.9 |

43 |

38.0 |

37 |

48.1 |

46 |

35.6 |

|

46 |

Alberta |

CAN |

34.6 |

11 |

64.4 |

51 |

38.6 |

64 |

24.1 |

|

47 |

Veneto |

ITA |

34.4 |

73 |

24.7 |

20 |

62.1 |

34 |

40.5 |

|

48 |

Schleswig-Holstein |

DEU |

33.4 |

50 |

34.2 |

43 |

42.9 |

47 |

35.0 |

|

49 |

Ohio |

USA |

32.8 |

45 |

37.6 |

55 |

36.6 |

48 |

33.9 |

|

50 |

Tuscany |

ITA |

32.2 |

71 |

26.7 |

49 |

39.7 |

32 |

40.8 |

|

51 |

Indiana |

USA |

30.0 |

55 |

32.0 |

75 |

24.9 |

44 |

36.6 |

|

52 |

Liguria |

ITA |

29.8 |

59 |

30.3 |

34 |

48.9 |

49 |

33.6 |

|

53 |

Mecklenburg-Vorpommern |

DEU |

29.8 |

56 |

31.7 |

62 |

32.5 |

56 |

30.4 |

|

54 |

Kansas |

USA |

29.1 |

36 |

41.4 |

65 |

31.1 |

61 |

27.5 |

|

55 |

Georgia |

USA |

28.3 |

34 |

42.3 |

79 |

23.7 |

59 |

28.0 |

|

56 |

Florida |

USA |

27.3 |

32 |

43.3 |

81 |

23.0 |

63 |

24.3 |

|

57 |

Marche |

ITA |

26.2 |

85 |

19.2 |

63 |

32.2 |

43 |

37.2 |

|

58 |

Abruzzo |

ITA |

25.6 |

77 |

23.6 |

27 |

53.6 |

58 |

29.7 |

|

59 |

Maine |

USA |

25.3 |

64 |

29.1 |

7 |

75.5 |

84 |

19.6 |

|

60 |

Vermont |

USA |

25.1 |

58 |

30.5 |

16 |

67.5 |

76 |

21.3 |

|

61 |

Wyoming |

USA |

25.0 |

25 |

48.7 |

86 |

16.0 |

83 |

19.8 |

|

62 |

Brandenburg |

DEU |

24.7 |

42 |

39.4 |

85 |

16.0 |

60 |

27.7 |

|

63 |

Trentino |

ITA |

24.3 |

53 |

32.4 |

57 |

35.3 |

51 |

32.8 |

|

64 |

Umbria |

ITA |

23.8 |

76 |

23.7 |

66 |

30.6 |

54 |

31.6 |

|

65 |

Saxony-Anhalt |

DEU |

23.1 |

60 |

29.8 |

77 |

24.9 |

79 |

20.2 |

|

66 |

Iowa |

USA |

22.6 |

68 |

27.3 |

83 |

19.9 |

57 |

30.4 |

|

67 |

Tennessee |

USA |

22.2 |

52 |

32.9 |

72 |

27.1 |

70 |

22.6 |

|

68 |

Nebraska |

USA |

22.0 |

44 |

38.0 |

74 |

25.5 |

80 |

20.1 |

|

69 |

Kentucky |

USA |

21.5 |

78 |

23.3 |

10 |

71.9 |

85 |

18.2 |

|

70 |

Nevada |

USA |

21.1 |

70 |

27.2 |

67 |

30.6 |

69 |

22.7 |

|

71 |

Prince Edward Island |

CAN |

21.1 |

81 |

21.5 |

26 |

56.3 |

67 |

23.0 |

|

72 |

Manitoba |

CAN |

21.0 |

57 |

31.0 |

53 |

37.3 |

72 |

21.8 |

|

73 |

Nova Scotia |

CAN |

21.0 |

65 |

28.9 |

50 |

38.9 |

68 |

22.7 |

|

74 |

North Dakota |

USA |

18.8 |

72 |

26.1 |

69 |

29.6 |

75 |

21.6 |

|

75 |

South Carolina |

USA |

18.2 |

67 |

28.1 |

78 |

23.9 |

74 |

21.7 |

|

76 |

Campania |

ITA |

17.5 |

90 |

12.5 |

84 |

17.8 |

55 |

31.2 |

|

77 |

Louisiana |

USA |

17.3 |

22 |

52.2 |

87 |

15.6 |

95 |

8.6 |

|

78 |

Alabama |

USA |

16.3 |

75 |

24.0 |

91 |

13.3 |

65 |

23.4 |

|

79 |

Aosta Valley |

ITA |

15.4 |

84 |

19.2 |

76 |

24.9 |

71 |

22.4 |

|

80 |

Montana |

USA |

15.2 |

54 |

32.0 |

94 |

9.4 |

87 |

17.2 |

|

81 |

Basilicata |

ITA |

15.1 |

87 |

16.3 |

41 |

43.2 |

78 |

20.3 |

|

82 |

Oklahoma |

USA |

14.9 |

79 |

23.0 |

58 |

35.1 |

86 |

17.5 |

|

83 |

New Brunswick |

CAN |

14.4 |

80 |

22.9 |

60 |

32.8 |

88 |

17.0 |

|

84 |

Newfoundland and Labrador |

CAN |

13.7 |

92 |

12.1 |

61 |

32.5 |

73 |

21.8 |

|

85 |

Hawaii |

USA |

13.4 |

66 |

28.3 |

95 |

8.9 |

90 |

15.0 |

|

86 |

Molise |

ITA |

13.2 |

91 |

12.4 |

93 |

13.0 |

62 |

25.8 |

|

87 |

Saskatchewan |

CAN |

12.8 |

62 |

29.4 |

92 |

13.1 |

89 |

15.2 |

|

88 |

Sardinia |

ITA |

12.2 |

89 |

12.8 |

90 |

14.6 |

66 |

23.1 |

|

89 |

South Dakota |

USA |

11.9 |

88 |

16.1 |

45 |

40.8 |

92 |

13.4 |

|

90 |

Alaska |

USA |

11.6 |

82 |

20.4 |

73 |

26.5 |

94 |

11.3 |

|

91 |

Arkansas |

USA |

9.0 |

86 |

17.3 |

71 |

27.2 |

91 |

14.2 |

|

92 |

Apulia |

ITA |

8.6 |

93 |

7.7 |

88 |

14.9 |

77 |

20.8 |

|

93 |

West Virginia |

USA |

8.2 |

83 |

19.3 |

29 |

51.5 |

96 |

4.8 |

|

94 |

Sicily |

ITA |

7.0 |

96 |

4.9 |

89 |

14.8 |

81 |

20.0 |

|

95 |

Calabria |

ITA |

5.8 |

95 |

5.2 |

96 |

5.2 |

82 |

20.0 |

|

96 |

Mississippi |

USA |

4.9 |

94 |

6.2 |

56 |

36.0 |

93 |

11.4 |

|

30 |

Median German state |

44.1 |

37 |

41.5 |

31 |

50.6 |

24 |

46.9 |

|

|

47 |

Median U.S. state |

33.8 |

41 |

39.3 |

56 |

36.3 |

51 |

32.9 |

|

|

61 |

Median Italian region |

24.9 |

77 |

23.7 |

53 |

37.5 |

53 |

32.2 |

|

|

72 |

Median Canadian province |

21.1 |

60 |

30.2 |

51 |

38.8 |

68 |

22.8 |

|

|

28 |

Average German state |

50.4 |

32 |

49.9 |

34 |

53.5 |

28 |

51.1 |

|

|

47 |

Average U.S. state |

35.6 |

44 |

41.9 |

53 |

39.3 |

51 |

36.1 |

|

|

60 |

Average Canadian province |

27.5 |

50 |

38.1 |

44 |

45.6 |

64 |

26.2 |

|

|

62 |

Average Italian region |

25.2 |

73 |

22.6 |

52 |

40.6 |

51 |

32.8 |

|

Knowledge Economy

Why Is It Important?

Knowledge and skills lie at the heart of any country, state, or region’s innovation and competitive potential. A knowledge-based economy possesses a greater relative stock of human capital that can be more efficiently deployed in the research, development, and production of new or improved products, processes, or services. Knowledge-intensive economies are also more likely to be leaders in the discovery of new knowledge, thereby improving their competitiveness in an innovation-driven global economy.

This category comprises four indicators: 1) the share of the 25–64-year-old population with a bachelor’s degree (or equivalent) or higher; 2) the share of the population that is foreign born and has tertiary education; 3) the share of total employees working in PTS activities; and 4) gross value added (GVA) per worker in the manufacturing sector.

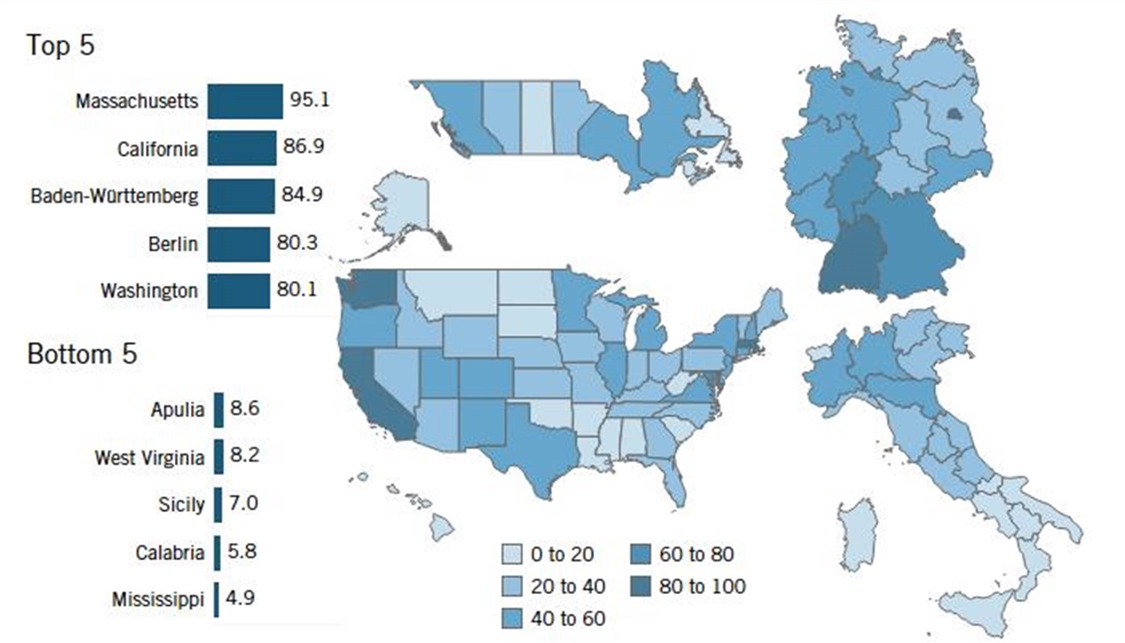

Figure 2: Knowledge Economy category scores

The Rankings

Germany possesses the clear advantage in this category, notching the top spot, the highest median score, and by far the best-scoring worst performer when comparing the lowest-ranked regions in each country. (See Figure 2.) Italy, in contrast, claims the lowest-scoring region of the four countries, the lowest median score, and by far the worst-scoring best performer.

Regional disparities are less pronounced in this category than they are for overall scores, as differences tend to be larger between the countries than within them compared with overall scores. With the exception of the United States, each country’s highest-scoring region in this category is the one that contains the nation’s capital.

Canada’s strength in this category lies in its share of educated immigrants, while its weakness lies in its low manufacturing labor productivity. Canada’s highest-scoring province in this category is Ontario, which ranks 8th. Ontario ranks 1st in skilled immigration; 10th in its share of employees in PTS services; and 16th in university-educated population share. Alberta and British Columbia also rank in the top 20 in the knowledge economy category.

Germany’s strengths lie in its share of employees working in PTS services and in its share of educated immigrants. Germany has no clear weaknesses in this category, though it lags behind the United States and (to a lesser extent) Canada in the share of its population with a university degree. Berlin, Germany’s highest-scoring state in this category, is also the highest-scoring region in the category overall. Berlin ranks in the top five in each of the indicators in this category except for manufacturing labor productivity. Right behind Berlin is Hamburg, which ranks in the top 16 in each of the four indicators and second in PTS employment. Bremen is the only other German state to place in the top 10 in the category.

This is the indicator for which Italy most lags behind the other three countries, claiming the lowest median score, the lowest-scoring best performer, and the lowest-scoring region. Italy lags behind its peers in each of the four indicators that comprise this category, except for PTS employees as a share of total employees. Lazio is Italy’s best performer, though it only ranks 29th in the category. Lazio ranks 4th in PTS employment but no higher than 58th in any of the other three indicators.

The United States is the only country to compete closely with Germany in this category, though American states’ scores range widely, from 87.4 (Massachusetts) to 6.2 (Mississippi). The United States’ strengths come in the share of its population with a university education and in manufacturing labor productivity. The best-performing U.S. states are mostly found along its northeast coast, with Massachusetts, New Jersey, and Maryland each ranking in the top five. Each of these 3 states ranks in the top 10 in each indicator except for manufacturing labor productivity, and Massachusetts ranks first in the share of the population with a university education. Other notable standouts are California, Virginia, and Connecticut.

Table 3: Summary of country scores in overall TASICI Knowledge Economy category

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

30.2 |

65.4 |

(Ontario) |

12.1 |

(Newfoundland and Labrador) |

18.3 |

|

Germany |

41.5 |

95.1 |

(Berlin) |

29.8 |

(Saxony-Anhalt) |

19.5 |

|

Italy |

23.7 |

46.2 |

(Lazio) |

4.9 |

(Sicily) |

11.3 |

|

USA |

39.3 |

87.4 |

(Massachusetts) |

6.2 |

(Mississippi) |

18.4 |

|

ALL |

34.7 |

95.1 |

(Berlin) |

4.9 |

(Sicily) |

19.5 |

Highly Educated Population

Why Is It Important?

This indicator measures the share of a region’s 25–64-year-old (“prime age”) population with a bachelor’s degree (or equivalent) or higher. Education provides citizens with the skills and knowledge necessary to compete and innovate in the modern economy. While more time spent in school does not necessarily guarantee sufficient applied skills for the innovation economy—for example, the Council for Aid to Education found that 44 percent of current U.S. university graduates are not proficient in essential career skills—the proportion of highly educated residents remains a strong indicator of human capital.[10] Moreover, evidence suggests that more-educated individuals are more likely and willing to adopt new technological innovations.[11]

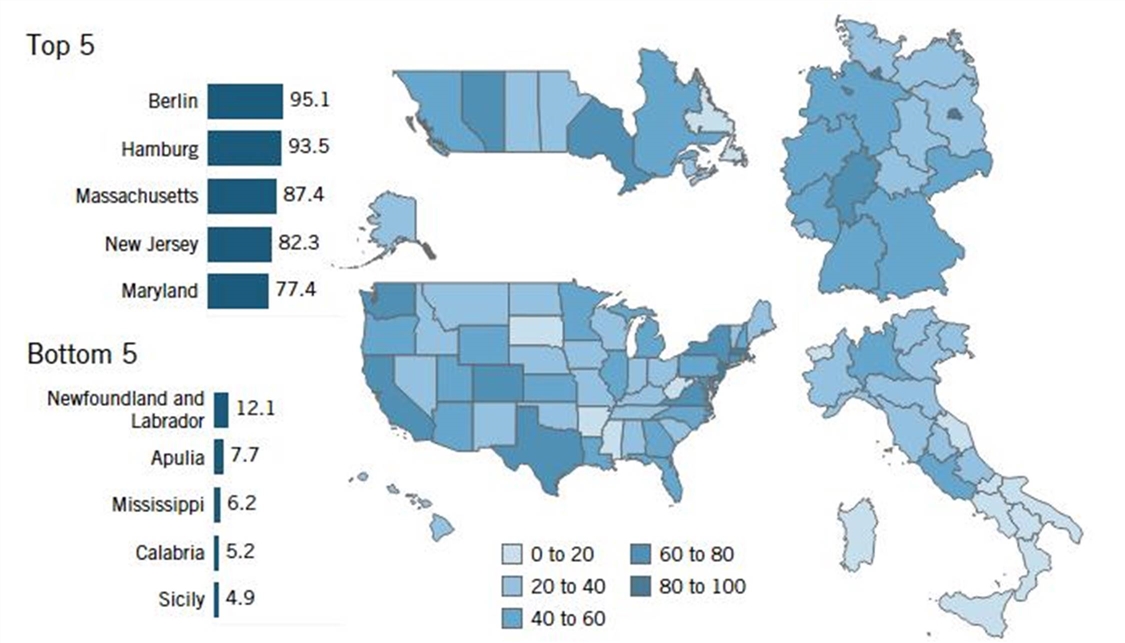

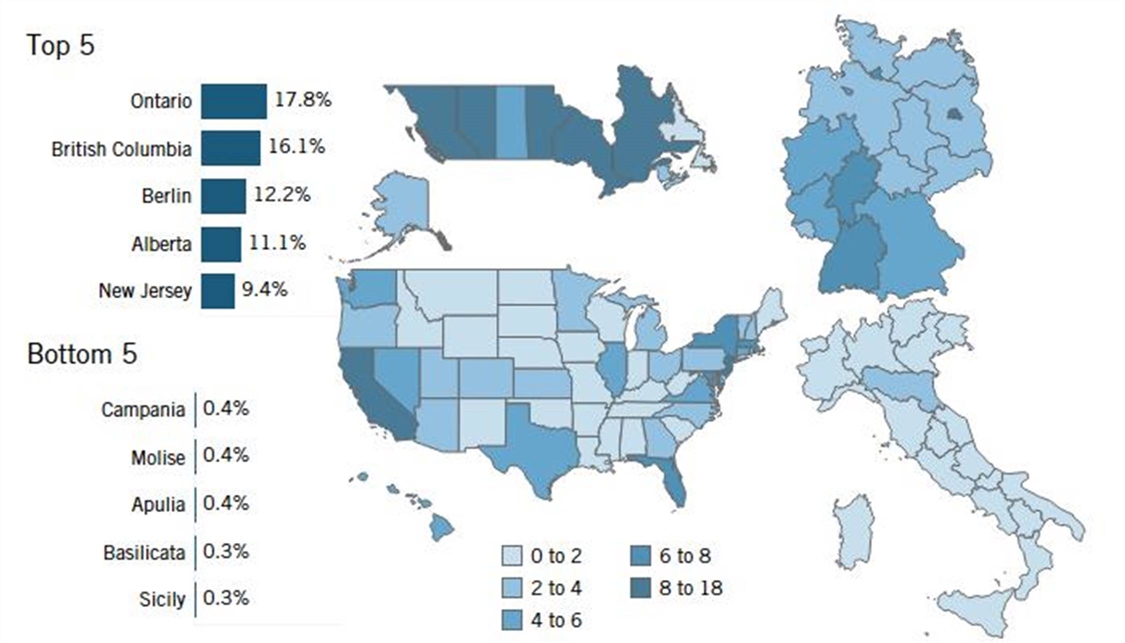

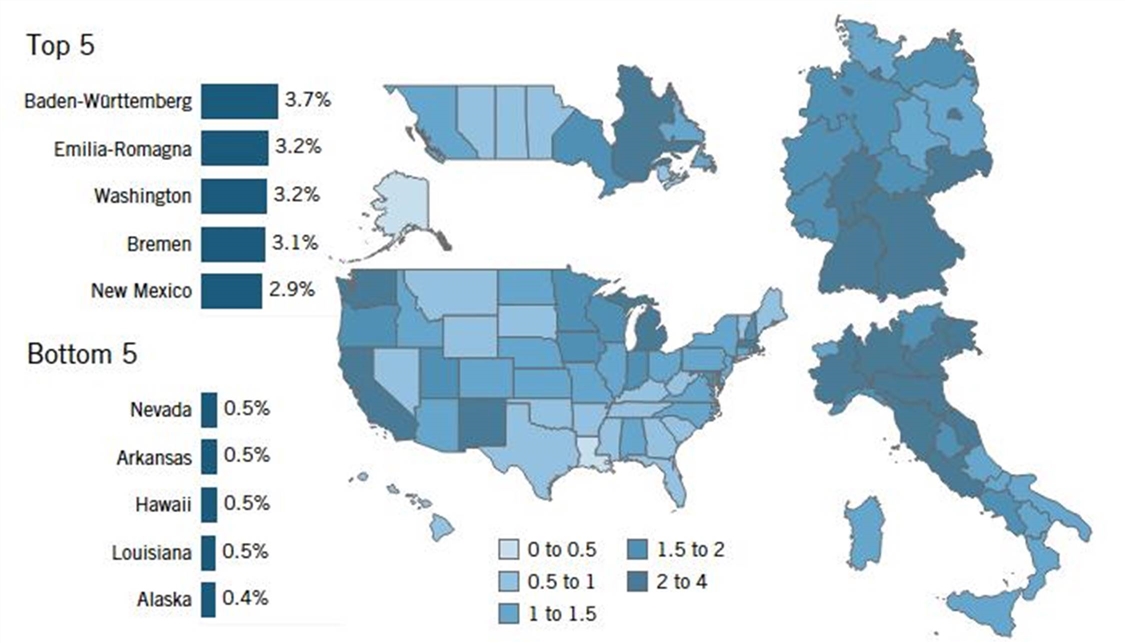

Figure 3: Share of the 25–64-year-old population with a bachelor's degree (or equivalent) or higher, 2019[12]

The Rankings

Massachusetts, Colorado, New Jersey, Berlin, and Maryland lead in this indicator, while Basilicata, Calabria, Campania, Apulia, and Sicily (all from Italy) rank lowest. (See Figure 3.) Overall, American states score better than their peers, while Canadian and German states perform closely in this indicator. Italy, on the other hand, lags far behind the other three countries; only 19.4 percent of prime-age residents in its median region have a bachelor’s degree or higher, compared with 33.5 percent for the median U.S. state.

In more than half of the Italian regions, less than one-fifth of the prime-age population has a bachelor’s degree or higher. North and central Italy perform better than southern Italy. Lazio, with a strong presence of universities and the ability to intercept internal flows of skilled talent, shows a ratio higher than 26 percent. Southern Italian regions do much worse, however, achieving only about 16 percent on average.

While it still scores fairly well, it should be noted that Germany is perhaps at a disadvantage in this indicator due to its promotion of trade schools and other alternatives to universities for much of its youth.

The regions containing the respective nations’ capital city tend to be the best-scoring regions in this indicator, with Massachusetts the sole exception. Nevertheless, Maryland and Virginia still score remarkably well, ranking fifth and seventh overall, respectively.

Table 4: Summary of country performance in TASICI Highly Education Population indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

29.0% |

37.0% |

(Ontario) |

20.0% |

(Newfoundland and Labrador) |

4.7% |

|

Germany |

28.2% |

42.9% |

(Berlin) |

22.6% |

(Saxony-Anhalt) |

5.0% |

|

Italy |

19.4% |

26.1% |

(Lazio) |

14.2% |

(Sicily) |

2.9% |

|

USA |

33.5% |

48.2% |

(Massachusetts) |

22.8% |

(Mississippi) |

5.7% |

|

ALL |

29.6% |

48.2% |

(Massachusetts) |

14.2% |

(Sicily) |

7.5% |

Skilled Immigration

Why Is It Important?

Skilled immigration brings together workers with unique educational experiences and backgrounds as a driver of innovative ideas. Level of skill can be difficult to quantify, so this indicator is instead measured via educational attainment, calculated as a region’s share of foreign-born workers with at least some tertiary education relative to the total regional population. A 2016 ITIF study finds that foreign-born workers living in the United States are highly represented in the number of scientists and engineers producing meaningful innovations, compared with the overall levels of immigration in the United States.[13] Similarly, half of Silicon Valley’s artificial intelligence (AI) start-ups have foreign-born founders.[14]A separate study finds that 52 percent of all Silicon Valley start-ups have at least one foreign-born founder.[15] In addition to contributing to a state’s stock of skilled human capital, highly educated immigrant populations raise wages for both domestic- and foreign-born workers.[16]

Figure 4: Share of population that is foreign born and has some tertiary education, 2019[17]

The Rankings

Canada performs very well in this indicator, counting three provinces—Ontario, British Columbia, and Alberta—among the top five regions, likely due to a favorable immigration system that includes regulatory pathways for hiring foreign-born workers and securing permanent-residency permits.[18] (See Figure 4.)

These rankings also reflect important trends in immigration laws, which might explain why the United States performs relatively worse than its peers. Immigration caps, such as those in the United States that hold H-1B visas to 85,000 per year, negatively impact overall levels of skilled immigration.[19]

With regard to the immigration of foreign-born residents that are highly educated, Italy records extremely low percentages compared with most advanced economies. Certain regions that are equipped with a very specialized industrial system score the highest in Italy; however, Italy’s best performer in this indicator, Emilia-Romagna, still only has a skilled-immigrant population share of just 2.1 percent. Other regions with a strong manufacturing presence follow (Friuli Venezia Giulia, Tuscany, and Lombardy). On the contrary, the southern regions (especially Basilicata, Sicily, and Apulia) have a lower share of highly educated foreign-born residents compared with the total regional population at less than 0.5 percent.

Table 5: Country performance in TASICI Highly Skilled Immigration indicator

|

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

|||

|

Canada |

7.2% |

17.8% |

(Ontario) |

1.1% |

(Newfoundland and Labrador) |

5.4% |

|

Germany |

4.2% |

12.2% |

(Berlin) |

2.1% |

(Saxony-Anhalt) |

2.5% |

|

Italy |

1.1% |

2.1% |

(Emilia-Romagna) |

0.3% |

(Sicily) |

0.6% |

|

USA |

2.4% |

9.4% |

(New Jersey) |

0.5% |

(Mississippi) |

2.1% |

|

ALL |

2.5% |

17.8% |

(Ontario) |

0.3% |

(Sicily) |

3.2% |

Professional, Technical, and Scientific Employment

Why Is It Important?

This indicator measures the share of employees working in PTS activities in each region. This includes, for example, engineers, researchers, and lawyers. PTS services include those needed to facilitate the development, implementation, and commercialization of innovations. Automation and globalization also make high-value-added professional services increasingly important in the modern economy. These occupations are highly knowledge-intensive and therefore harder to offshore. States with greater concentrations in these occupations are thus less threatened by increased levels of globalization.

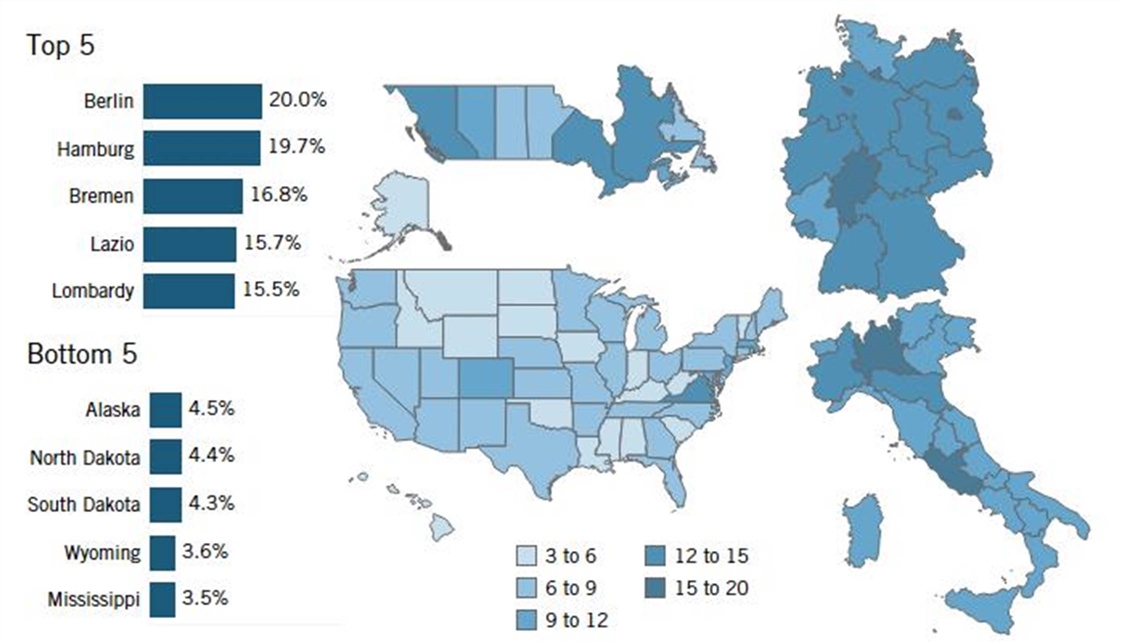

Figure 5: Share of employees in professional, technical, and scientific services fields, 2019[20]

The Rankings

The two European countries score better than their North American counterparts in this indicator. The median German state has 12.9 percent of its employees working in PTS activities, and Germany claims the three highest-scoring regions—Berlin, Hamburg, and Bremen (large cities all)—while Italy produces the other two top-five regions with Lazio and Lombardy. (See Figure 5.)

Ontario is the only province in North America to score in the top 10 (10th), with 13.3 percent of its employees in PTS fields. Notably—though perhaps unsurprisingly—the best-scoring region within each country is the region containing or bordering the country’s capital. The American states of Alaska, North Dakota, South Dakota, Wyoming, and Mississippi fare poorest in this indicator.

Italy performs remarkably well in PTS employment as a share of total employment. Lazio and Lombardy, which benefit from many universities and research centers of national importance, register a share of more than 15 percent, among the highest percentages of the regions covered in this report. However, most of the Italian regions have a ratio of at least 11 percent (the national median is 11 percent), and in some regions of southern Italy, less than 1 out of 10 employees work in PTS sectors.

Table 6: Country performance in TASICI Professional, Technical, and Scientific Employment indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

9.5% |

13.3% |

(Ontario) |

7.4% |

(Saskatchewan) |

2.2% |

|

Germany |

12.9% |

20.0% |

(Berlin) |

10.6% |

(Rhineland-Palatinate) |

2.6% |

|

Italy |

11.0% |

15.7% |

(Lazio) |

9.7% |

(Molise) |

1.6% |

|

USA |

6.9% |

12.3% |

(Virginia) |

3.5% |

(Mississippi) |

1.8% |

|

ALL |

8.5% |

20.0% |

(Berlin) |

3.5% |

(Mississippi) |

3.4% |

Manufacturing Labor Productivity

Why Is It Important?

GVA measures the contribution to GDP made by an individual producer, industry, or sector. This indicator measures the average GVA per manufacturing worker on a purchasing power parity (PPP) basis. Within manufacturing, high-value-added firms are most often capital intensive, producing more technologically complex products and organizing their workers to take better advantage of their skills. They typically pay higher wages because their workers are more productive, generating greater value for each hour worked. All else being equal, firms with higher-value-added levels are more likely to be able to meet global competitiveness challenges. Unfortunately, U.S. manufacturing labor productivity has been in decline for some time, falling by 1.34 percent between 2012 and 2019.[21]

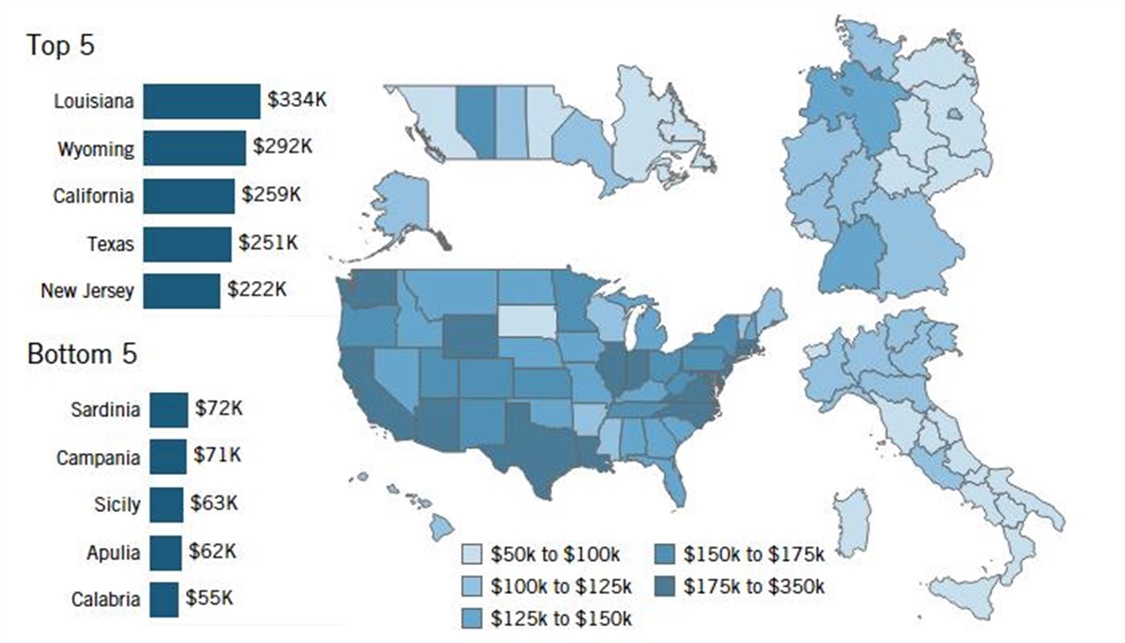

Figure 6: PPP-adjusted gross value added per worker in the manufacturing sector, 2019[22]

The Rankings

Perhaps surprisingly, the United States scores much better than the other three countries in general, with Louisiana, Wyoming, California, Texas, and New Jersey topping this indicator. (See Figure 6.) The median U.S. state recorded a GVA per worker in the manufacturing sector $40,000 higher than the median German state, $58,000 higher than the median Canadian province, and $59,000 higher than the median Italian region.

The Italian regions of Sardinia, Campania, Sicily, Apulia, and Calabria score weakest in this indicator. For many years, the stagnant trend in the added value of Italian workers has been considered one of the main causes of Italy’s sluggish aggregate growth compared with the major Western countries. Even the regions that perform better in Italy (e.g., Lombardy and Emilia Romagna) perform poorly when compared with regions from other high-income countries. Moreover, the Italian regions with a lower performance (Calabria, Apulia, and Sicily) show productivity values that are almost one-half that of the more advanced Italian regions. Therefore, this is one of the areas where the gap between the Italian regions and the others is most significant.

U.S. states likely score so well for two reasons. The first is that the U.S. manufacturing sector is more heavily concentrated in higher-value-added industries in both the high-tech sector (e.g., aerospace, biopharmaceuticals, and semiconductors) and the energy-producing sectors (e.g., petroleum/coal manufacturing and chemical manufacturing). This effect is especially compounded by Europe’s significantly reduced domestic energy production (reflecting, notably, the German manufacturing sector’s large dependence on imported Russian natural gas).

The significance of energy production in this indicator is especially evident in the two perhaps-surprising leading regions: Louisiana and Wyoming. In 2019, the petroleum/coal manufacturing and chemical manufacturing industries accounted for 74 percent of manufacturing output in Louisiana and 67 percent in Wyoming.[23] Workers in these industries also command higher wages. In 2021, the average wage in the petroleum/coal manufacturing industry and chemical manufacturing industry in the United States was $44.98 and $35.17, respectively, compared with $29.70 for the manufacturing sector overall.[24]

Another reason the United States scores so well in this indicator is that, while its manufacturing sector is shrinking and it manufactures fewer goods, it still performs the higher-value-added tasks in the production process. For example, despite its share of global semiconductor fabrication falling from 37 percent in 1990 to 12 percent in 2020, the United States still accounts for nearly 50 percent of global value added in the semiconductor industry thanks to its significant involvement in the design- and R&D-intensive aspects of the semiconductor production process (and statistical data still counts this as manufacturing-sector output).[25]

Table 7: Country performance in TASICI Manufacturing Labor Productivity indicator

|

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

|||

|

Canada |

$93K |

$162K |

(Alberta) |

$79K |

(Nova Scotia) |

$23K |

|

Germany |

$111K |

$173K |

(Hamburg) |

$74K |

(Mecklenburg-Vorpommern) |

$25K |

|

Italy |

$92K |

$117K |

(Liguria) |

$55K |

(Calabria) |

$18K |

|

USA |

$151K |

$334K |

(Louisiana) |

$95K |

(South Dakota) |

$48K |

|

ALL |

$123K |

$334K |

(Louisiana) |

$55K |

(Calabria) |

$49K |

Globalization

Why Is It Important?

Today’s economy is increasingly globalized, relying on international trade, global supply chains, and foreign investment. Maintaining and gaining a competitive edge in the global economy is paramount to the future growth prospects of all countries and regions.

This category comprises two indicators: 1) Inward FDI attracted relative to GDP and 2) high-tech exports (NAICS 333–335 or equivalent) as a share of GDP.

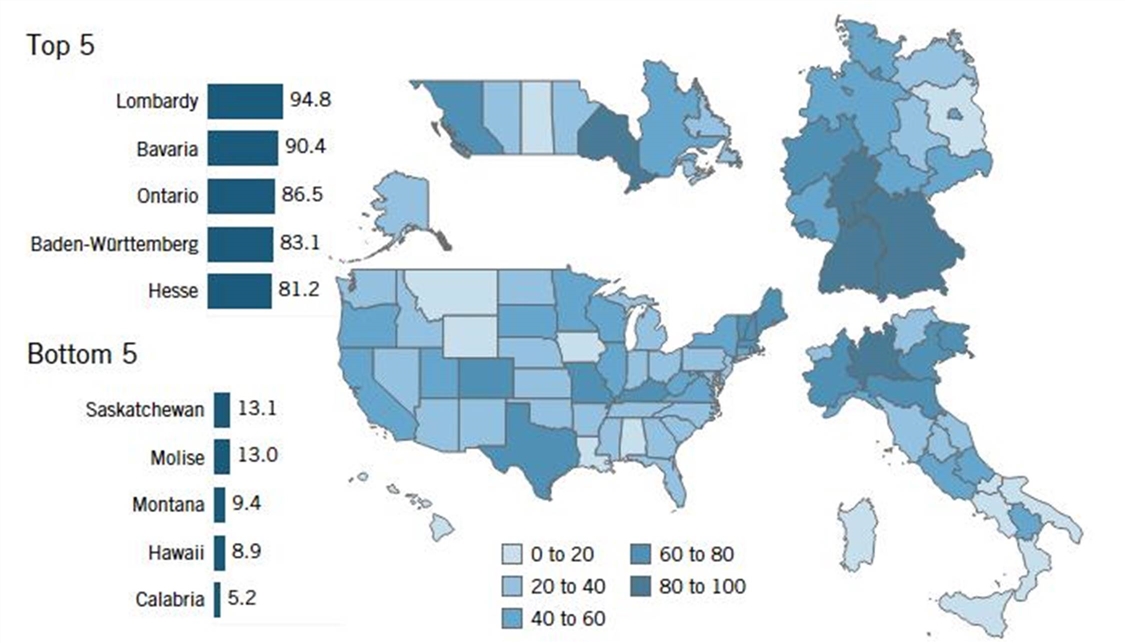

Figure 7: Globalization category scores

The Rankings

Germany scores far better than the other countries overall, which is unsurprising given its place in the European Union’s single market and its high export intensity. However, the top spot goes to Lombardy, which is followed by Bavaria, Ontario, Baden-Württemberg, and Hesse. Saskatchewan, Molise, Montana, Hawaii, and Calabria are the worst-ranking regions in the category. (See Figure 7.)

Canada scores well in this category thanks to its ability to attract FDI. In general, Canada performs best in attracting inward FDI and worst in the high-tech exports indicator. Canada’s best-performing province is again Ontario, which ranks 3rd in FDI relative to GDP and 24th in high-tech exports relative to GDP. Though there are no other Canadian provinces in the top 10, British Columbia ranks 17th due to its top-5 ranking in FDI.

As mentioned, overall German states considerably outperform those from the other three countries in this category (the median score for German states is 50.6, while the median scores for the other countries are each below 40), though Germany only claims 3 of the top-10 regions. Germany’s best performer is Bavaria, which ranks second both in the general globalization category and in high-tech exports. Baden-Württemberg and Hesse both also rank in the top five. In Baden-Württemberg’s case, this is because it ranks first in high-tech exports. Hesse, on the other hand, ranks in the top 15 in both high-tech exports and FDI.

Italy performs only middlingly because of the disparity between its northern and central regions and its southern regions. Lombardy in Italy’s north scores first overall in this category, while Calabria, in Italy’s south, scores last. Lombardy claims the top spot due to ranking 8th in FDI and 12th in high-tech exports. Piedmont and Emilia-Romagna both also rank in the top 10 and Friuli-Venezia Giuli ranks 11th. For all three regions, this is due to their high concentration of high-tech exports.

The United States lags behind the other three countries due to its generally low concentration of high-tech exports. Though it contains 7 of the top-20 scoring regions in the category, Maine is the United States’ best performer in the category, as it ranks 1st in FDI (though only 79th in high-tech exports). Missouri and Kentucky also rank in the top 10 in the category, as both also rank top 5 in FDI.

Table 8: Country performance in TASICI Globalization category

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||||

|

Canada |

38.3 |

86.5 |

(Ontario) |

13.1 |

(Saskatchewan) |

19.6 |

||

|

Germany |

50.6 |

90.4 |

(Bavaria) |

16.0 |

(Brandenburg) |

20.7 |

||

|

Italy |

37.5 |

94.8 |

(Lombardy) |

5.2 |

(Calabria) |

24.6 |

||

|

USA |

36.3 |

75.5 |

(Maine) |

8.9 |

(Hawaii) |

17.8 |

||

|

ALL |

39.8 |

94.8 |

(Lombardy) |

5.2 |

(Calabria) |

20.7 |

||

High-Tech Exports

Why Is It Important?

This indicator measures a region’s exports in the machinery manufacturing, computer, and electronic products manufacturing, and electrical equipment, appliances, and components manufacturing industries (NAICS 333–335 or equivalent) as a share of GDP. These represent high-value-added goods that are crucial in the modern global economy. Considering a state’s exports of these goods as a share of its GDP shows to what extent a region has a comparative advantage in production. Moreover, this indicator represents a region’s position in global value chains to produce these goods.

Figure 8: Exports in NAICS 333–335 (or equivalent) as a share of GDP, 2017[26]

The Rankings

The European countries perform much better than their North American counterparts in general, with Baden-Württemberg, Bavaria, Saarland, Saxony, and Emilia-Romagna taking the top five spots. (See Figure 8.)

The median German state’s exports of these goods accounts for a larger share of GDP than that of the best-performing region in either Canada (Ontario) or the United States (Vermont). This is largely thanks to Germany’s involvement in the European Union’s single market and close proximity to many smaller and therefore more trade-intensive countries. For example, a shipment of high-tech goods from Texas to Indiana (1,100 miles) will not register as an export, but a similar shipment from Bavaria to Salzburg (140 miles) will.

Germany’s worst-performing state (Brandenburg) still scores better than the median Canadian or U.S. region. Regional disparities are especially apparent in the European countries, with the best-performing German states hailing from the country’s south and the best-performing Italian regions from the country’s north. The median German state’s exports of these goods accounts for a larger share of GDP than that of the best-performing region in either Canada (Ontario) or the United States (Vermont).

Italy, well known for its export-led economy, stands out for its innovative exported products. With one of the highest export-to-GDP ratios among advanced countries and northern Italy’s concentration of advanced industries, Italian regions excel in high-tech exports as a share of GDP. Emilia Romagna, Friuli Venezia Giulia, and Piedmont––three regions in the country’s north with a high concentration of advanced industries––record high-tech exports equal to over 8 percent of GDP. The share decreases as one moves toward the south of the Italian peninsula, however. Overall, high-tech exports account for less than 2 percent of GDP in 6 of Italy’s 20 regions.

Table 9: Country performance in TASICI High-tech Exports Indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

1.2% |

4.3% |

(Ontario) |

0.2% |

(Newfoundland & Labrador) |

1.3% |

|

Germany |

6.2% |

14.1% |

(Baden-Württemberg) |

1.9% |

(Brandenburg) |

3.3% |

|

Italy |

3.7% |

8.7% |

(Emilia-Romagna) |

0.2% |

(Calabria) |

2.7% |

|

USA |

1.5% |

6.1% |

(Vermont) |

0.0% |

(Hawaii) |

1.3% |

|

ALL |

2.0% |

14.1% |

(Baden-Württemberg) |

0.0% |

(Hawaii) |

2.8% |

Inward FDI

Why Is It Important?

This indicator measures the inward FDI a region receives relative to its GDP measured as the funds an entity in the region receives from a foreign-based entity to purchase, establish, or expand enterprises. Inward FDI not only spurs domestic economic activity but also facilitates technology transfer between foreign-owned enterprises and local establishments. Foreign owners can also introduce domestic firms to new international markets and help regions carve out positions in global supply chains. Inward FDI has also been associated with greater economic growth in market economies and tends to be more productive and induce greater levels of investment by domestic firms.[27]

Because FDI can be very volatile from year to year, regions’ averages over the period 2017–2019 are considered. Measures for each country required varying degrees of estimation, the methods for which are described in the appendix.

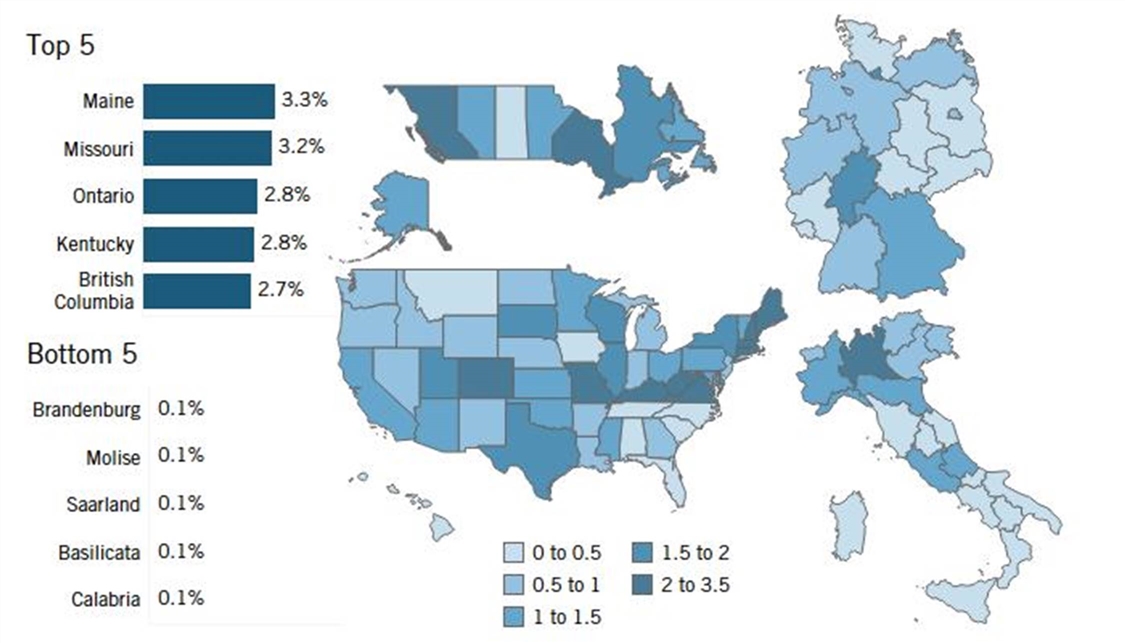

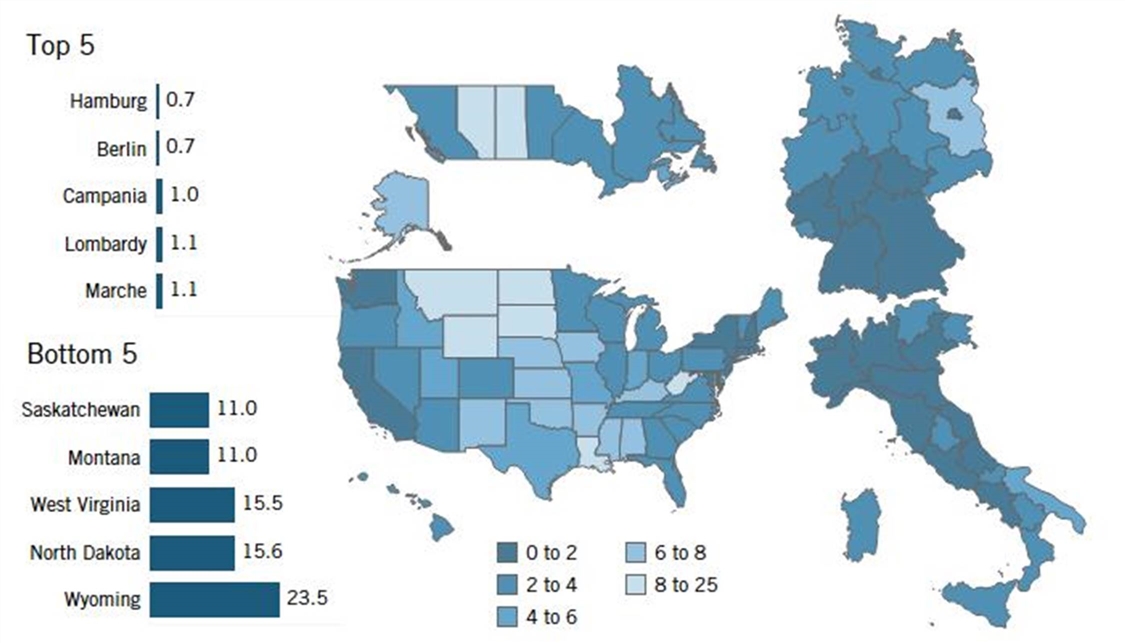

Figure 9: Inward foreign direct investment as a percentage of GDP, 2017–2018 (average)[28]

The Rankings

Canada claims the highest median score, and the United States claims the highest-scoring region, Maine, which is followed by Missouri, Ontario, Kentucky, and British Colombia. (See Figure 9.) Despite their inclusion in the European Union’s single market, the European states receive noticeably less FDI relative to their GDP than their North American counterparts.

FDI inflows are quite low relative to GDP in the Italian regions. Lombardy is the exception, attracting on average 2.5 percent of its GDP in FDI between 2017 and 2019. The divide between north and south is apparent in Italy in terms of FDI, as Italy’s southern regions still clearly perform worse than its northern and central regions.

German regions find themselves in a similar position. The median German state only attracted 0.5 percent of its GDP in FDI on average between 2017 and 2019. Again, even when accounting for the size of the states’ economies, most of the FDI went to Germany’s western and southern states.

Table 10: Country performance in TASICI Inward FDI indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

1.5% |

2.8% |

(Ontario) |

0.3% |

(Saskatchewan) |

0.7% |

|

Germany |

0.5% |

2.0% |

(Hamburg) |

0.1% |

(Saarland) |

0.6% |

|

Italy |

0.6% |

2.5% |

(Lombardy) |

0.1% |

(Calabria) |

0.6% |

|

USA |

1.1% |

3.3% |

(Maine) |

0.2% |

(Montana) |

0.8% |

|

ALL |

0.9% |

3.3% |

(Maine) |

0.1% |

(Calabria) |

0.8% |

Innovation Capacity

Why Is It Important?

A region’s ability to innovate is crucial to its sustainable long-term economic growth. Regions with greater capacities for innovation command a greater competitive advantage in improving and commercializing current technologies and creating disruptive new technologies for the future. A strong innovation capacity relies on investments in research from both the private and public sectors, access to and adoption of modern technologies—particularly information and communication technologies (ICTs) in an increasingly digital world—and a business environment conducive to creative destruction.

The category comprises seven indicators: 1) the share of households adopting broadband Internet; 2) R&D intensity; 3) R&D personnel as a share of total employees; 4) PCT patent applications per capita; 5) enterprise birth rates; 6) greenhouse gas emissions per unit of output; and 7) VC investments received relative to GDP.

Figure 10: Innovation Capacity category scores

The Rankings:

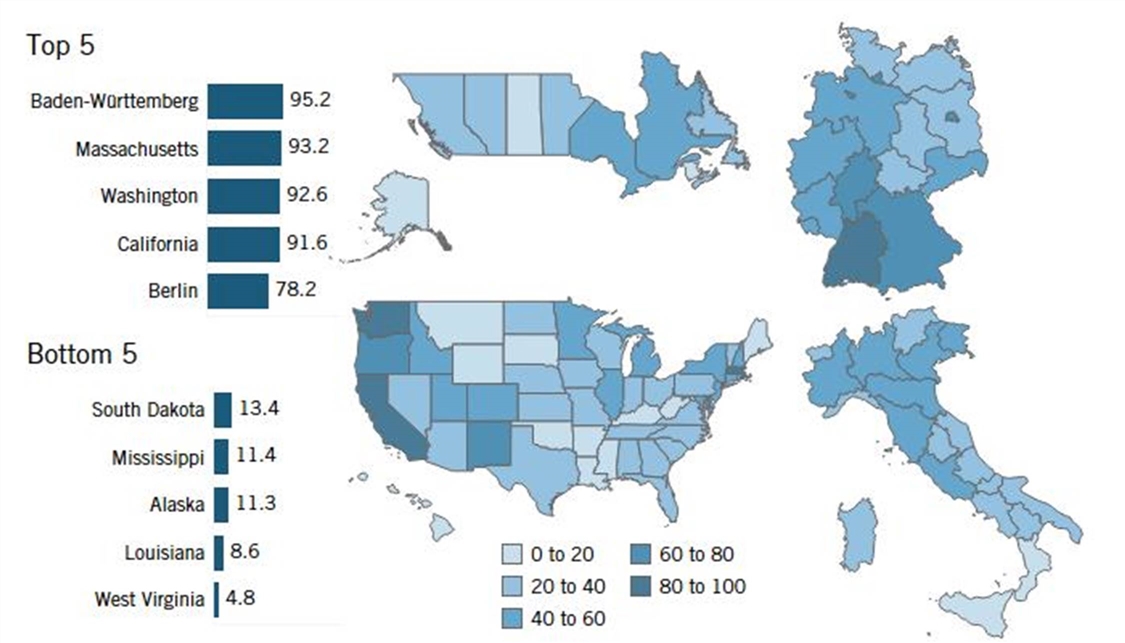

Overall, Baden-Württemberg tops this category, followed by Massachusetts, Washington, California, and Berlin. South Dakota, Mississippi, Alaska, Louisiana, and West Virginia score the worst (giving the United States the five lowest-scoring regions in this category). (See Figure 10.)

Germany performs best in the broadband adoption and R&D-related indicators, and there is no indicator in this category for which Germany performs especially poorly. Baden-Württemberg, the best-performing region in the category, ranks first in R&D personnel, second in patent output, fifth in R&D intensity, and seventh in carbon efficiency. It also ranks 9th in broadband adoption (tied with Bavaria) and 12th in VC received. Berlin joins Baden-Württemberg in the top 5, and Bavaria, Hesse, and Hamburg also place in the top 10 in the category.

Canada clearly scores the weakest overall in this category, though its worst-scoring provinces perform better than the United States’ worst-performing states. Canada especially struggles with respect to R&D (both intensity and personnel), patent output, business creation, and carbon efficiency. Canada’s best-performing province is once again Ontario, though it ranks only 35th. Quebec ranks 36th in the category, and British Columbia ranks 45th.

Italy scores surprisingly well in this category thanks to impressive performances in R&D personnel, business creation, and carbon efficiency, with its median score eclipsing that of the United States. Emilia-Romagna, its highest-scoring region, ranks 13th in the category, driven by a 2nd-place ranking in R&D personnel. Emilia-Romagna also ranks 20th in patent output and 22nd in carbon efficiency.

The United States’ median score and those of its worst-performing states are surprisingly low. This is due to poor overall performances in R&D personnel and carbon efficiency. However, the United States claims several of the top performers, as Massachusetts, Washington, and California all rank in the top five thanks to their high R&D intensities, high patent output, and high VC intensity. The United States also performs very well in business creation. One notable standout in the United States is New Mexico, which ranks 9th in the category thanks to having the highest R&D intensity and 5th-highest R&D personnel concentration due to the presence of the Los Alamos and Sandia National Laboratories in the state. However, New Mexico does not rank higher than 40th in any of the other 5 indicators in the category. Although the United States claims these innovation capacity standouts, it also claims the 7 lowest-scoring regions in the category and 9 of the 11 lowest-scoring.

Table 11: Country performance in TASICI Innovation Capacity category

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

22.8 |

40.3 |

(Ontario) |

15.2 |

(Saskatchewan) |

8.7 |

|

Germany |

46.9 |

95.2 |

(Baden-Württemberg) |

20.2 |

(Saxony-Anhalt) |

19.5 |

|

Italy |

32.2 |

56.5 |

(Emilia-Romagna) |

20.0 |

(Calabria) |

9.9 |

|

USA |

32.9 |

93.2 |

(Massachusetts) |

4.8 |

(West Virginia) |

20.9 |

|

ALL |

33.8 |

95.2 |

(Baden-Württemberg) |

4.8 |

(West Virginia) |

19.2 |

Broadband Adoption

Why Is It Important?

This indicator measures broadband adoption—that is, the share of households within each region that subscribe to a broadband Internet connection, either mobile or fixed.[29] (All measures of broadband adoption used include satellite adoption as well). The Internet is now essential to full participation in today’s increasingly digital economy. The COVID-19 pandemic vividly demonstrated how crucial widespread Internet adoption is for societies, enabling telework, tele-education, telehealth, etc. Increased access to the Internet has also been associated with greater productivity and economic growth.[30]

Figure 11: Share of households that have adopted broadband Internet, 2019[31]

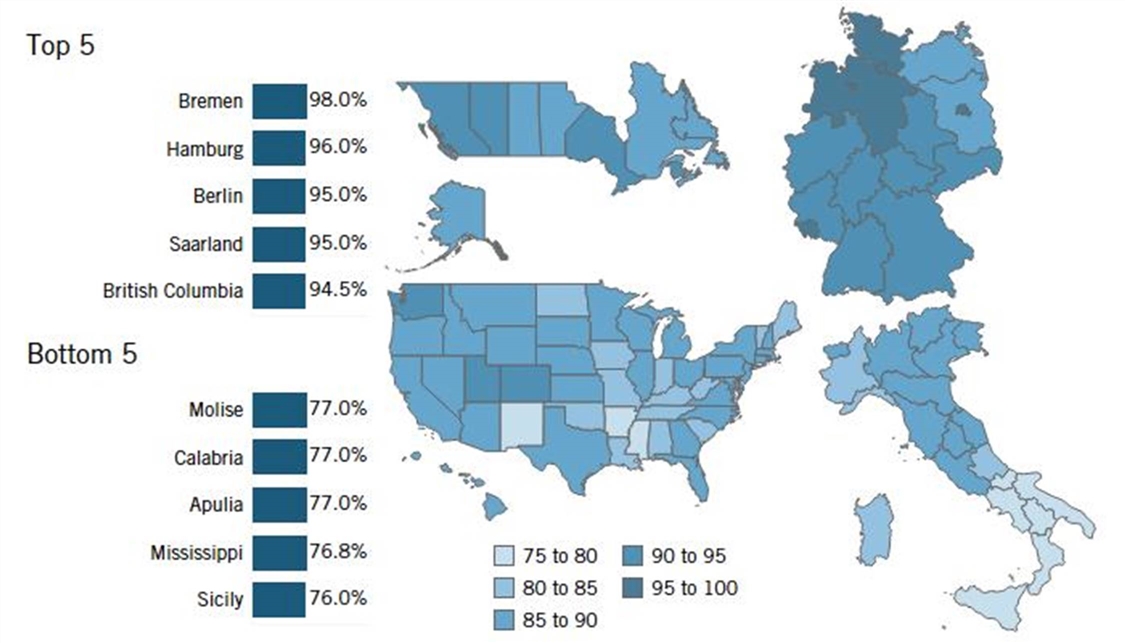

The Rankings

Bremen, Hamburg, Berlin, Saarland, and British Columbia lead this indicator, while Molise, Calabria, Apulia, Mississippi, and Sicily perform the worst. (See Figure 11.)

Germany performs noticeably better than the other countries in this indicator; it has the four best-performing regions and the highest median score of 94.0 percent. Regional disparities are less prevalent for the North American countries and Germany in this indicator than they are for others. In contrast, the north-south divide is still evident in Italy; Italy’s south claims four of the five worst-performing regions (including the worst-performing region). While Italy performs worse than the other three countries, it has made great progress in improving adoption rates in the past few years. Between 2017 and 2019 alone, Italy’s nationwide broadband adoption rate increased from 79 percent of households to 84 percent (compared with an increase from 89 percent to 91 percent for Canada, 92 percent to 94 percent for Germany, and 83.5 percent to 86.4 percent for the United States).

Table 12: Country performance in TASICI Broadband Adoption indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

89.9% |

94.5% |

(British Columbia) |

88.1% |

(Quebec) |

2.1% |

|

Germany |

94.0% |

98.0% |

(Bremen) |

86.0% |

(Brandenburg) |

2.8% |

|

Italy |

84.5% |

88.0% |

(Trentino) |

76.0% |

(Sicily) |

4.2% |

|

USA |

86.0% |

91.2% |

(Washington) |

76.8% |

(Mississippi) |

3.1% |

|

ALL |

87.1% |

98.0% |

(Bremen) |

76.0% |

(Sicily) |

4.8% |

R&D Intensity

Why Is It Important?

This indicator measures R&D expenditures in a region relative to its GDP considering R&D expenditures by all sectors: business, government, and higher education. R&D lies at the heart of innovation, as it represents the source of the new knowledge needed to discover, design, and implement innovative technologies and products. R&D results in slightly higher private returns and much larger social returns than other types of investment as new knowledge and technology spill over to the rest of the economy.[32]

Figure 12: R&D expenditures as a share of GDP, 2019[33]

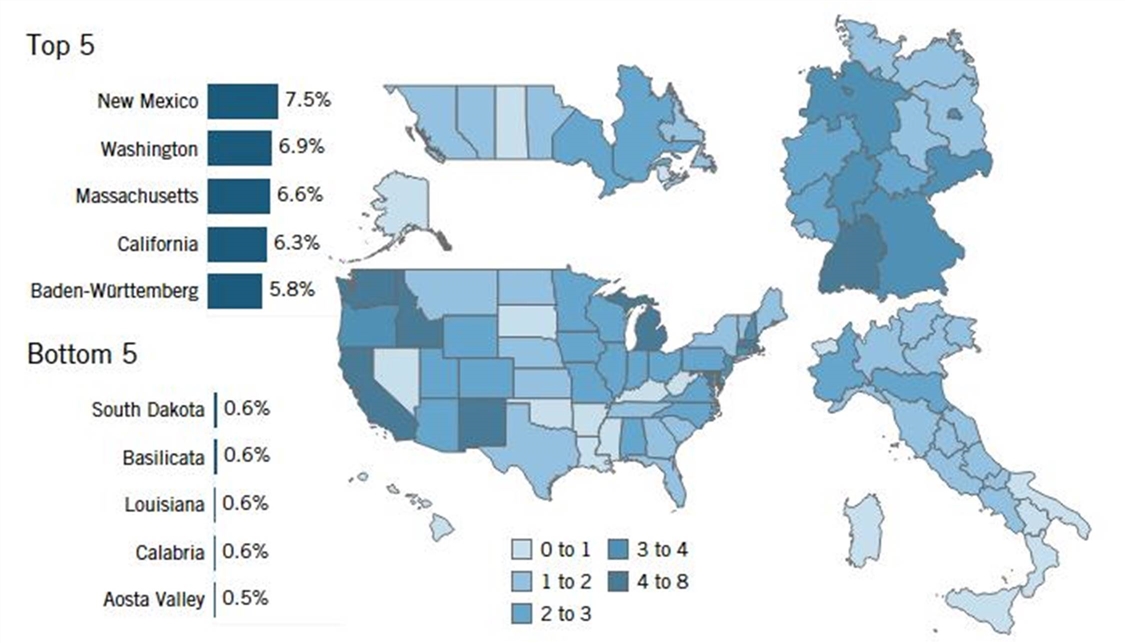

The Rankings

New Mexico, Washington, Massachusetts, California, and Baden-Württemberg top this indicator, while South Dakota, Basilicata, Louisiana, Calabria, and Aosta Valley perform weakest. (See Figure 12.) In Italy, only two regions (Piedmont and Emilia Romagna) have an R&D intensity higher than 2 percent, while there are seven regions with R&D intensities less than 1 percent. While Germany’s median state scores better than the median U.S. state, the United States claims four of the five best performers, including each of the top four. However, R&D intensity varies quite significantly among the U.S. states, and the United States also accounts for three of the five worst performers.

The best-performing region, New Mexico, benefits from large federal R&D investments through the Los Alamos National Laboratory and Sandia National Laboratories. The United States’ other R&D-intense states can typically be found along the east and west coasts (e.g., Washington, Massachusetts, and California), where they benefit from advanced university networks and a high concentration of technology-intensive industries. Baden-Württemberg too benefits from a high concentration of advanced industries, housing companies such as Mercedes-Benz, Porsche, and SAP. Surprisingly, the R&D intensities of the Canadian provinces more closely match those of the Italian regions despite performing far better in the knowledge economy indicators, particularly with respect to higher-education attainment and skilled immigration.

Table 13: Country performance in TASICI R&D Intensity indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

1.3% |

2.2% |

(Quebec) |

0.9% |

(New Brunswick) |

0.4% |

|

Germany |

2.5% |

5.8% |

(Baden-Württemberg) |

1.5% |

(Saxony-Anhalt) |

1.0% |

|

Italy |

1.1% |

2.3% |

(Piedmont) |

0.5% |

(Aosta Valley) |

0.5% |

|

USA |

2.1% |

7.5% |

New Mexico) |

0.6% |

(Louisiana) |

1.7% |

|

ALL |

1.7% |

7.5% |

New Mexico) |

0.5% |

(Aosta Valley) |

1.4% |

R&D Personnel

Why Is It Important?

This indicator measures the number of R&D personnel as a share of all employees in each region. R&D personnel are indispensable to conducting R&D activities and turning investments into new productivity-enhancing knowledge and technologies.

Figure 13: R&D personnel as a share of total employees, 2017–2018[34]

The Rankings

Baden-Württemberg, Emilia-Romagna, Washington, Bremen, and New Mexico lead, while Nevada, Arkansas, Hawaii, Louisiana, and Alaska perform the worst (again giving the United States the five-lowest performing regions in an indicator). (See Figure 13.)

Overall, the European regions perform better than their North American counterparts here. Except for the United States, each country’s best-performing region in R&D intensity is the best-performing region for R&D personnel as well. For the United States, Washington supplants New Mexico, though both score in the top five. Again, New Mexico scores well thanks to its national laboratories, which employ over half of the state’s R&D personnel.

Given its strong performance in R&D intensity, it is unsurprising that Germany performs outstandingly well in R&D personnel. On the other hand, Italy’s and the United States’ positions are somewhat surprising given the strong U.S. and weak Italian performances in R&D intensity (with Italy performing poorly in R&D intensity and well in R&D personnel and the opposite being true for the United States). This may be the result of the productivity factor, as U.S. R&D is generally more productive than R&D performed in Europe.[35] In other words, in general, the United States needs to employ fewer R&D personnel than do European nations to reach a similar level of R&D output.

Table 14: Country performance in TASICI R&D Personnel Intensity indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

0.9% |

2.0% |

(Quebec) |

0.8% |

(New Brunswick) |

0.4% |

|

Germany |

1.9% |

3.7% |

(Baden-Württemberg) |

1.3% |

(Schleswig-Holstein) |

0.7% |

|

Italy |

1.8% |

3.2% |

(Emilia-Romagna) |

1.0% |

(Basilicata) |

0.6% |

|

USA |

1.2% |

3.2% |

(Washington) |

0.4% |

(Alaska) |

0.6% |

|

ALL |

1.4% |

3.7% |

(Baden-Württemberg) |

0.4% |

(Alaska) |

0.7% |

Patent Applications

Why Is It Important?

This indicator measures international Patent Cooperation Treaty (PCT) patent applications filed by residents or entities within a region per one million residents. Patent output measures the “inventiveness” of a population. Patents also secure private returns on investment in R&D activities, which are necessary to incentivize these activities and their socially desirable spillover effects. By considering PCT patents, this indicator focuses on internationally filed patents to mitigate differences in patent qualifications between countries’ patent offices.

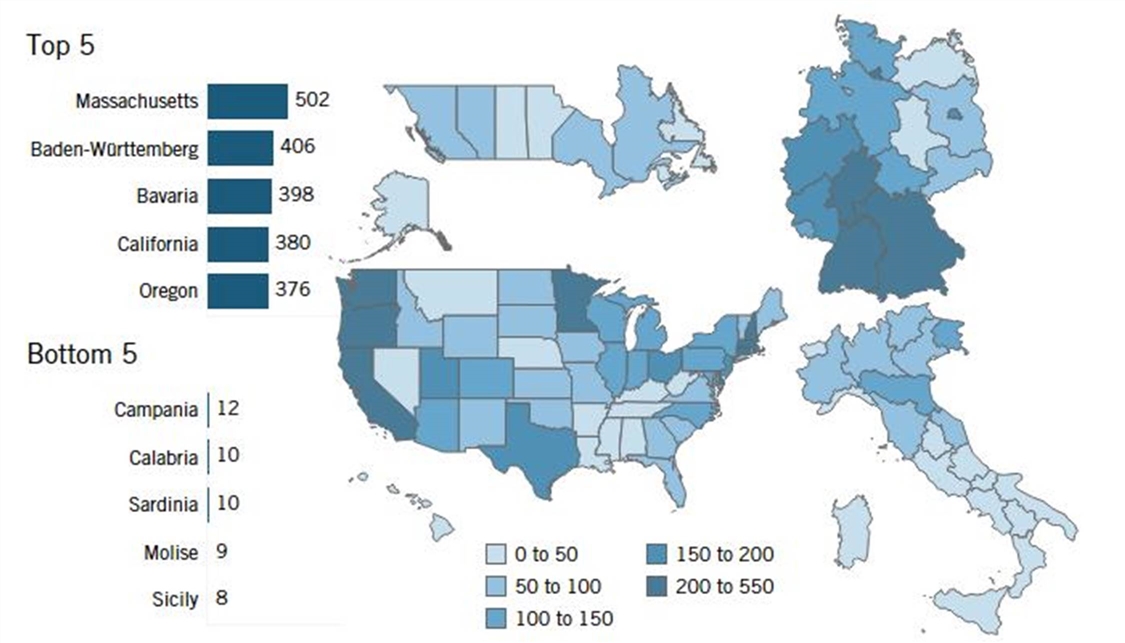

Figure 14: PCT patent applications per million residents, 2015[36]

The Rankings

Germany and the United States perform better than their peers, with Massachusetts, Baden-Württemberg, Bavaria, California, and Oregon ranking in the top five. Italy fielded the five lowest-performing regions in this indicator: Campania, Calabria, Sardinia, Molise, and Sicily. (See Figure 14.)

Notably, however, there exists significant variation and regional disparities in PCT patent intensity among states across Germany and the United States. The best-performing German states are found in the south and west of the country, while the United States’ best performers are found along the west coast and in the northeast. Though the median Italian region scores much worse than the median Canadian province, Italy’s best performer (Emilia-Romagna) outscores Canada’s best performer (Ontario). Only a few Italian regions produce more PCT patents per capita than the average region in the analysis: Emilia Romagna, Friuli Venezia Giulia, Lombardy, Tuscany, and Veneto. Some southern Italian regions, on the other hand, generate almost 10 times fewer patents per capita than the overall average.

Table 15: Country performance in TASICI PCT Patent Applications indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

68 |

97 |

(Ontario) |

16 |

(Newfoundland and Labrador) |

29 |

|

Germany |

139 |

406 |

(Baden-Württemberg) |

32 |

(Mecklenburg-Vorpommern) |

107 |

|

Italy |

43 |

147 |

(Emilia-Romagna) |

8 |

(Sicily) |

39 |

|

USA |

88 |

502 |

(Massachusetts) |

12 |

(Alaska) |

106 |

|

ALL |

82 |

502 |

(Massachusetts) |

8 |

(Sicily) |

97 |

Business Creation

Why Is It Important?

A thriving business ecosystem should experience a high volume of business start-ups. This indicator measures the share of a region’s business enterprises that were established in the past year. The business creation indicator is limited in scope to new businesses, without capturing business turnover resulting from the market disruption and creative destruction that forces incumbents to innovate or leave the market. Thus, the full impact of business competition on innovation is not captured. Moreover, this metric does not differentiate between industries, so there is no differentiation between creation rates in advanced, innovative industries and those in less-advanced industries. Absent a better alternative at the cross-national regional level, this indicator reflects a region’s overall economic resilience and regional competitiveness.

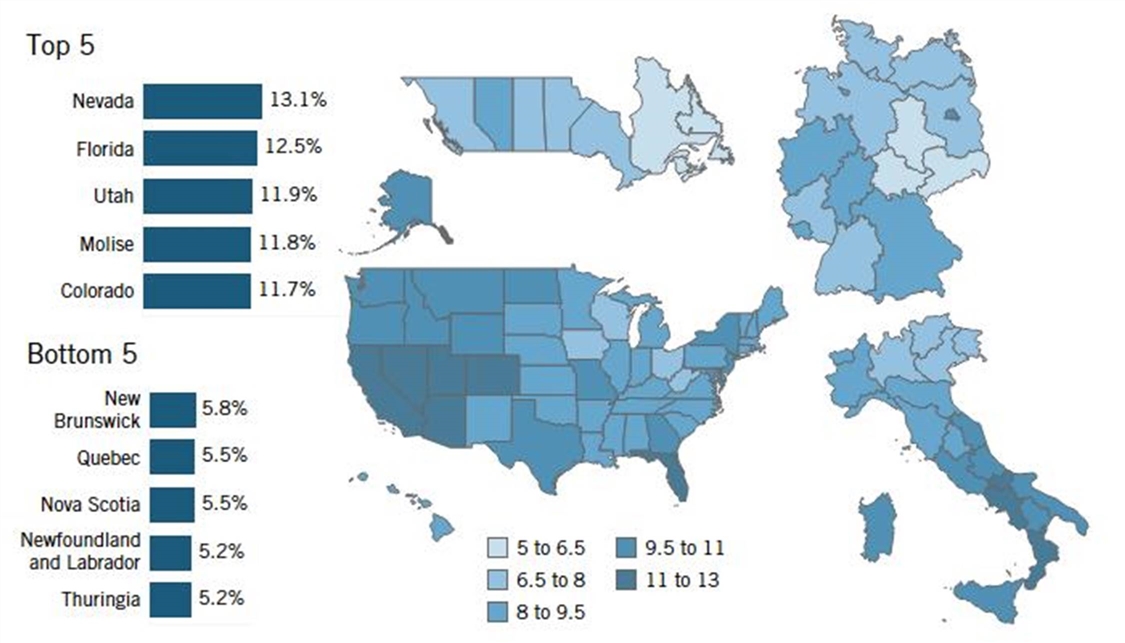

Figure 15: Economy-wide enterprise birth rate, 2016–2018[37]

The Rankings

Nevada, Florida, Utah, Molise, and Colorado lead in this indicator, while New Brunswick, Quebec, Nova Scotia, Newfoundland and Labrador, and Thuringia rank at the bottom. (See Figure 15.) American states claim four of the top five spots, with Italy’s Molise ranking fourth. Expanding the selection to the top 50 regions, the United States and Italy maintain this lead over Germany and Canada, with 33 U.S., 15 Italian, and 2 German states comprising the top 50. While the dispersion of business creation in the United States and Germany is scattered, high business creation is concentrated in southeastern Italy, which is generally less developed than other parts of the nation.

Canada performs poorly relative to peers, claiming four of the bottom five spots. It is unclear why Canada ranks so low, especially given its entrepreneur-friendly regulatory framework and generally favorable attitude toward entrepreneurship.[38] Germany’s results, despite the government’s emphasis on supporting entrepreneurs, are a little less surprising given the cultural attitudes regarding starting a business and the oft-discouraging regulatory environment.[39]

Table 16: Country performance on TASICI Business Creation indicator

|

Country |

Median Score |

Maximum Score |

Minimum Score |

Standard Deviation |

||

|

Canada |

6.6% |

8.5% |

(Alberta) |

5.2% |

(Newfoundland and Labrador) |

1.1% |

|

Germany |

7.9% |

10.1% |

(Berlin) |

5.2% |

(Thuringia) |

1.2% |

|

Italy |

9.4% |

11.8% |

(Molise) |

7.0% |

(Trentino) |

1.3% |

|

USA |

9.1% |

13.1% |

(Nevada) |

7.0% |

(West Virginia) |

1.4% |

|

ALL |

8.6% |

13.1% |

(Nevada) |

5.2% |

(Thuringia) |

1.6% |

Carbon Efficiency

Why Is It Important?