How Innovative Is China in the Chemicals Industry?

China is leading in chemical production, especially basic chemicals. And while it is currently lagging behind on innovation—especially in more complex fine chemicals—all signs suggest it will catch up with the global leaders within the next decade or two.

KEY TAKEAWAYS

Key Takeaways

Contents

Assessing Chinese Chemicals Industry Innovation. 5

Rongsheng Petrochemical Co., Ltd. 12

China’s Chemical Industry Strategy 14

What Should the United States Do? 14

Introduction

The global chemicals industry had sales of $4.7 trillion in 2022.[1] While encompassing a wide array of products, the industry can be classified by four segments: basic chemicals, agricultural chemicals, specialty chemicals, and consumer products (e.g., soaps). This report focuses on basic and specialty chemicals. The latter are generally harder to make and see more product innovation.

China leads the world in terms of chemicals industry sales, accounting for over 40 percent of the global market, with much of this in basic chemicals. The United States is still strong in chemicals, especially with companies such as Dow Chemical and Dupont. Chinese companies, however, are making intense efforts to not only gain competitive advantage in fine chemicals (and consumer chemicals), but also invest more in research and development (R&D) and become more innovative, with the government providing significant support.

And as with so many technologies, China has significant cost advantages in chemicals. But can Chinese chemical firms innovate and reach the quality levels of the world leaders? This report assesses this question.

Background and Methodology

The common narrative is that China is a copier and the United States the innovator. That narrative often supports a lackadaisical attitude toward technology and industrial policy: After all, we lead in innovation, so there is little to worry about, with the exception of perhaps making sure we get more STEM (science, technology, engineering, and math) immigration. First, this assumption is misguided because it is possible for innovators to lose leadership to copiers with lower cost structures, as we have seen in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, and machine tools. As Clayton Christenson has shown, followers often attack at the lower end of the market through copying and significant cost advantages and work their up toward higher value-added and more innovative segments, all the while weakening the leaders. Second, it’s not clear that China is merely a sluggish copier and always destined to be a follower.

To assess how innovative Chinese industries are, the Smith Richardson Foundation asked the Information Technology and Innovation Foundation (ITIF) conduct research on the question. As part of this research, we are examining specific sectors, including chemicals.

To be sure, it is difficult to assess the innovation capabilities of any country’s industries, and it is especially difficult for Chinese industries. In part, this is because, under President Xi, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in chemicals: First, we conducted in-depth case study evaluation of two Chinese chemical companies randomly selected from companies listed on the “EU R&D 2000” list. Second, we held a focus group roundtable with global experts on the Chinese chemicals industry, as well as reviewed the industry and academic literature on the issue. Finally, we assessed global data on chemical innovation, including scientific articles, patents, and innovation awards.

China’s Chemicals Industry

Globally, the chemicals sector has grown more slowly than world gross domestic product (GDP): 149 percent from 1995 to 2020 in nominal U.S. dollars, compared with 174 percent for global GDP. About 49 percent of the sector’s value added was concentrated in Organization for Economic Cooperation and Development (OECD) countries in 2020, down dramatically from 82 percent in 1995.

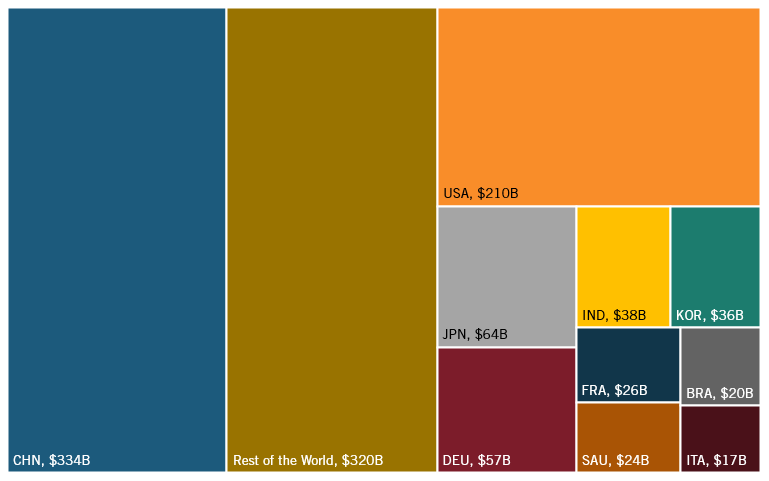

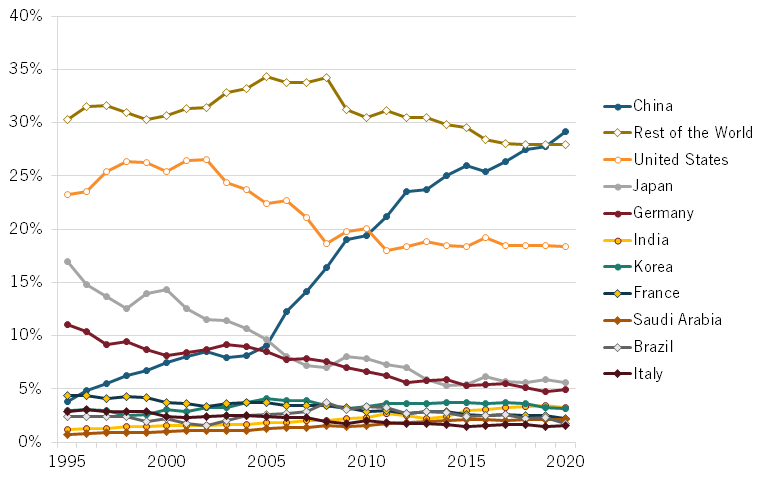

According to OECD, China led the world in 2020 with 29.1 percent of chemicals industry value-added output—up from 3.8 percent in 1995. The next highest-ranking nations were the United States (18.3 percent in 2020, down from 23.2 percent in 1995), Japan (5.6 percent, down from 17 percent), and Germany (5 percent, down from 11.1 percent).

Figure 1: Global value-added output in chemicals by the top 10 producers and rest of world in 2020

Figure 2: Top 10 producers’ historical shares of global value-added output in chemicals

China saw the most growth in its global share of the industry from 1995 to 2020 (up 25.3 percentage points). However, some studies place China’s share of global market sales in 2023 at above 40 percent. One study states that China “accounts for about 55% of the global capacity for acetic acid, about 50% of the global carbon black capacity and about 45% of the global capacity for titanium dioxide. For many such commodity chemicals, China started out as a net importer, then built up domestic capacity and ended up being a major exporter.”[2]

One study examining global chemical sales estimates that China’s share in 2022 was 44 percent.[3] However, much of its production is in “chemicals which only require a limited level of technology and innovation.”[4]

Nonetheless, companies are investing significantly in China. In 2022, 46 percent of global chemical industry capital investment was located in China, with just 10 percent in the USMCA (United States-Mexico-Canada Agreement) region.[5] Moreover, China had the highest share of capital investment intensity as a share of value added of any nation, 2.8 times more than the United States.[6]

China is not only the world’s largest producer of chemicals, but also the world’s market, something that is expected to increase as Chinese production of cars, batteries, and other chemical-intensive products continues to expand.[7] Like the robotics industry, world-leading demand can ultimately lead to world-leading supply.

However, China still runs a trade deficit in chemicals, suggesting that it is less innovative. In 2018, its chemical trade deficit accounted for 16 percent of the total foreign trade deficit, an increase of about twice that in 2015.[8] As one study from 2021 notes, “China’s chemical industry as a whole presents the characteristics of high import dependence and fierce international competition.”[9] It goes on to note that:

China still has the problem of low investment structure and redundant construction, lack of high added value, and have high technical content of chemicals and related products, at the same time full of overproduction of low value-added products market, make domestic demand by the high value-added chemicals mostly rely on foreign imports.[10]

But the Chinese government and industry understand that vulnerability and are seeking to change it, in large part with a push toward more innovative fine chemicals.

Assessing Chinese Chemicals Industry Innovation

For a long time, China was content to produce commodity chemicals with little focus on either process or product innovation. However, after Made in China 2025, China has focused more on new chemicals for new applications, including in batteries, semiconductors, and solar panels, with strong government support. As professor Seamus Grimes wrote, China’s rapid growth in its chemical industry “has increased China’s ambition to become a world leader in the chemical industry through innovation and trade and through growing its market share internationally.”[11]

Foreign companies still dominate many key areas, but their intellectual property has been eroded over time. Multinationals continue to dominate key parts of the value chain, especially related to high tech and more specialty chemicals. However, the consensus among experts ITIF spoke with is that Chinese companies are beginning to erode the market share of large foreign companies. Part of this has stemmed from Western company complacency and assumptions that the Chinese companies cannot challenge them, and also because of strong Chinese government incentives and support for Chinese chemical companies. And relatively lax chemical industry production regulations provide China with a competitive advantage.

Moreover, unlike biotechnology or software, chemicals is a relatively mature industry with overall rates of innovation lower than that of more advanced, innovation-based industries. There are approximately 300,000 chemicals available but only around 2,000 or so new chemicals developed each year, a rate of around just 6 percent.[12] This means that as a slow-innovation industry, it should be easier for China to catch up to the leaders.

In basic chemicals, China is increasing its position as a net exporter. In very few commodity chemical products is China a net importer. For example, China has overcapacity for polypropylene. However, it runs a trade deficit in specialty chemicals. As a result, China’s Ministry of Industry and Information Technology (MIIT) is focused on boosting China’s capabilities in specialty chemicals, because this will determine global chemical industry leadership. In contrast, the EU-27 runs a trade deficit in basic inorganics and petrochemicals, but a trade surplus in specialty chemicals and consumer chemicals.[13]

One advantage for China is that the chemical sector is connected to specific sectors, such as automobiles, electronics, renewable energy, etc. Because Chinese production of many of these products is so large and growing so fast, local chemical companies have an advantage by being close to their customer. As Seamus Grimes notes, “a number of R&D managers acknowledged that more recently their innovation in China was being driven by innovative Chinese customers.”[14] In addition, because of China’s significant coal reserves and a willingness to keep burning coal, China is leading on coal-derived chemicals. China also leads in polysilicon, a relatively high-end chemical.

However, China is highly dependent on other countries for high-quality chemical products, high-end equipment in the chemicals industry, and leading technology. For example, MIIT stated in 2018 that 32 percent of 130 basic chemicals could not yet be produced in China at all, and more than half of all fine chemical products would still have to be imported.[15]

One way China has closed the gap with world leaders, especially in commodity chemicals, is by relying on foreign producers investing in China—a model it has used in multiple industries. For example, of the top 10 coatings companies in China, 4 are local and 6 foreign. Moreover, by one estimate, about one-third to half of the top executives at Chinese chemical companies have had significant experience at multinationals. This skill base clearly helps Chinese companies to catch up.

Experts also pointed to the fact that domestic companies usually have significant price advantages, in part because some are state-owned and don’t have to earn as high a profit as the foreign companies and because multinationals have higher global overhead costs. And many Chinese-owned chemical companies receive government subsidies.

Experts also argued that Western companies are more goal oriented and short term in their orientation. They have specific procedures and slower decision-making models. Chinese companies, in part because they are trying so hard to catch up and because of the encouragement of the state, are more aggressive. For example, if a European chemical company is doing well in China, it may eventually decide to increase capacity by 20 percent. In contrast, a corresponding Chinese company is likely to quickly agree to double its capacity in order to gain market share. Even when times are not good, many Chinese firms will increase capacity, just as they have done in other industries such as solar and steel. And as in steel and solar, this creates overcapacity. Once this happens, some foreign firms divest to private equity because they see it as a cash-draining business that no longer clears their financial hurdles. Indeed, China has killed or shrunk a number of overseas companies by a superior cost position and economies of scale. Chinese companies are not as deterred by short- to medium-term earnings setbacks.

For foreign companies that stay in the business, they are doing more R&D in China, which spills over to domestic Chinese companies. Originally, multinational chemical companies did not perform a lot of R&D in China. But now, with some of their most important customers located in China, more are expanding their R&D spending there. One reason is that, of the top 10 metropolitan areas in the world to locate chemicals industry R&D facilities ranked in terms of quality of the research, three were Chinese (Guangzhou #1, Shanghai #3, and Beijing #6).[16] Strikingly, no Chinese metropolitan areas made the top 10 in terms of cost of operating an R&D facility.

China is also investing significant amounts in chemical research capabilities in universities, which has already paid off in terms of the number of academic papers they have produced. In fact, China has overtaken the United States as the main source of academic papers in the field. However, experts argue that limits on the number of skilled domestic Chinese R&D leadership personnel holds back innovation.

There was a consensus among experts ITIF spoke with: that China will, over time, eventually come to dominate the global chemicals industry and, absent significant market closures by Western nations, there is little that can be done about it.

In many areas, such as lithium battery chemistry, initial advances were made in the United States. But U.S. companies didn’t follow up on them and instead Chinese firms have innovated in ways to manufacturer these batteries and materials at scale and lower cost. And, as in solar panels, China has shown effectiveness at process innovation.

China may be able to make significant strides for innovation, as the industry is facing a global inflection point as it goes through a “greening” process. The Chinese government is focused on helping firms develop chemicals that meet green requirements and are more environmentally friendly. This includes coating materials for transportation equipment, biodegradable materials, and materials in batteries.

Finally, China historically has been a copier of process technology. However, as one article states, “For the past two decades, China has invested heavily in R&D. The research was initially aimed at developing new products, but process development has more recently turned into a major focus.”[17] The article goes on to state that “foreign chemical companies start to see China as a source of manufacturing expertise.”[18]

A good summary of the Chinese position and trends is from Chinese chemical industry expert Kai Pflug, who wrote:

In the past, Chinese pressure on the Western chemical industry came from below—China captured more and more of the market segments with limited innovation and complexity. What is new about the current wave of Chinese domestic investments in chemicals is that these now target precisely the chemical segments that are the most innovative, which tend to also be the fastest growing ones. So far, Western chemical companies survived by out-innovating the Chinese—the latest developments show that this approach is far from certain to work in the future. In a worst-case scenario, this would only leave Western companies with smaller-volume chemicals, in which the scale-oriented Chinese players typically are less interested.[19]

Innovation Data

Various data and metrics on chemicals industry innovation tell the same story: China’s chemical industry is not at the leading edge, but is rapidly catching up.

Chemicals industry R&D performed in China (by domestic or foreign firms) went from 22 percent of the global total in 2012 to 34 percent in 2022.[20] Over the same period, Chinese R&D went from 8 percent greater than U.S. to 72 percent greater. However, its specialization in R&D is still less than the leaders. In terms of global shares, China’s share of research and innovation to industry sales was 0.77, up from 0.70 in 2022. In 2022, the EU’s R&D specialization ratio was 1.2, America’s was 1.79, and Japan’s 3.3.

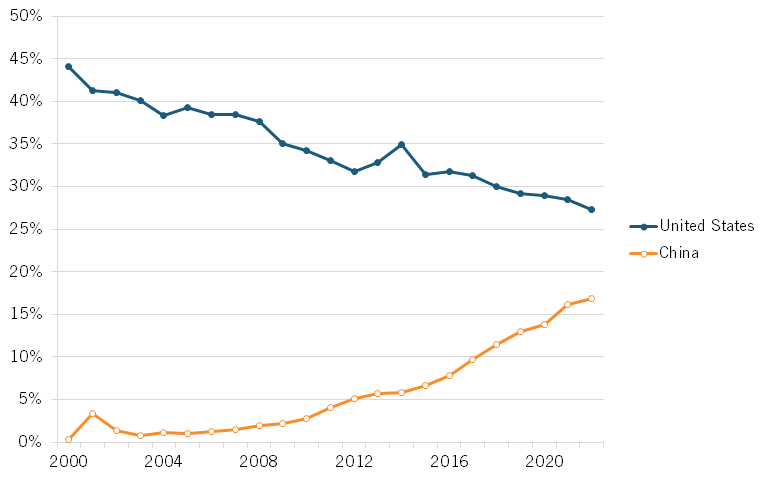

And an increasing amount of R&D spending in China is by Chinese companies (in China or elsewhere). Using data from the EU 2,500 R&D spenders list, in 2013, the U.S. share of global chemicals industry R&D spending was 29.8 percent, while China’s was a miniscule 0.8 percent.[21] However, by 2022, Chinese chemical companies grew to 16.8 percent of global industry R&D, with the U.S. share falling to 18.6 percent. And China was ahead of Germany by 2.2 percentage points. However, at the current rate of Chinese firm growth and American decline in chemical firm R&D, it is expected that the 2023 data will show China ahead of the United States in total R&D, and by 2024 or 2025, to move ahead of global leader Japan.

Moreover, when controlling for the size of the two nations’ economies, by 2022, China was 27 percent more specialized in Chinese chemical firm R&D as a share of GDP than the United States was. In addition, China’s R&D is more diversified from a firm perspective, with just 28 percent of its chemicals industry R&D represented by the top four Chinese firms, in contrast to 61 percent in the United States.

Yet, this R&D has not translated into significant performance in innovation awards. Of the finalists in the ICIS 2023 chemical innovation awards, 50 percent of the winners were American companies, and just 8 percent went to Chinese companies (Wanhua Chemical Group Co., Ltd (WC) won two awards).[22] In 2022 and 2021, China did not win in any category: 0/6 in 2022; 0/5 in 2021.[23]

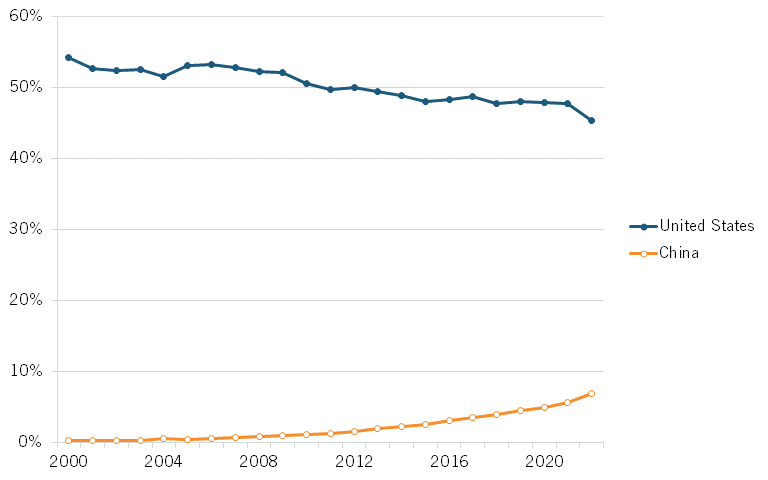

However, this spending has had impacts on patents. The share of U.S. firm patents granted in chemistry in the U.S. Patent Office (USPTO) fell from 54 percent in 2000 to 45 percent in 2022. Over the same period, Chinese patents increased from almost nothing to 7 percent. (See figure 3.)

Figure 3: USPTO utility patents granted in chemistry, by selected region, country, or economy: 2000–2022[24]

China’s progress in patent cooperation treaty applications (more countries than just the United States) was stronger, increasing from around 0 percent in 2000 to 17 percent in 2020, while the U.S. share fell from 44 percent to 27 percent.[25] (See figure 4.)

Figure 4: Patent Coopearation Treaty applications in chemistry, by region, country, or economy[26]

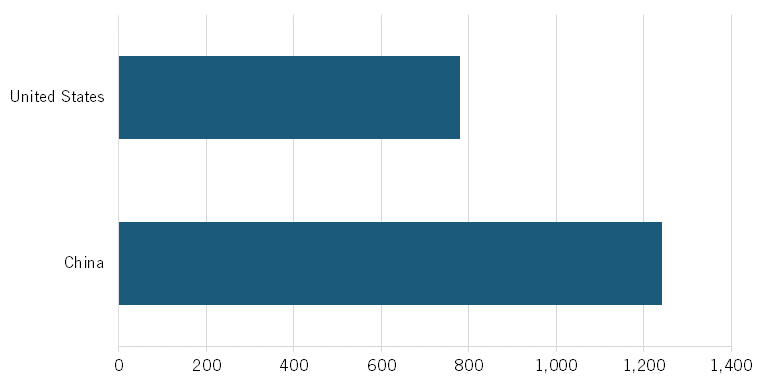

When it comes to scholarly articles in chemistry, China’s performance is quite strong. In the most cited continuous flow chemical synthesis papers, China outperformed the United States by 60 percent. (See figure 5.)

Figure 5: Research papers on continuous flow chemical synthesis[27]

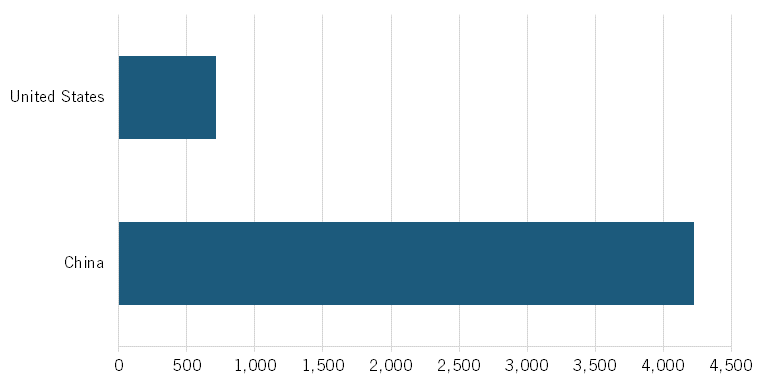

In coatings research, the Chinese advantage over the United States was even greater, at 83 percent. (See figure 6.)

Figure 6: Research papers on chemical coatings[28]

Company Case Studies

ITIF randomly selected two Chinese chemical companies on the EU 2,500 R&D list for in-depth case study analysis: WC and Rongsheng Petrochemical.

Wanhua Chemical Group

WC was established as the state-owned Yantai Synthetic Leather Factory in 1978. Initially, to support its synthetic leather production line, the company imported a 10,000-ton/year MDI (Methylene diphenyl diisocyanate) production unit, designed in 1950 by a Japanese company. However, due to a lack of knowledge in how to operate the line’s hardware and software and core MDI production technology, this line remained mostly inoperative for nearly 15 years.

In 1988, WC developed its own MDI production technology, establishing a research department and collaborating with domestic universities. In 1993, the company launched its first self-developed MDI production line. By 1996, WC’s MDI production capacity reached 15,000 tons. The company underwent corporate and shareholding reforms in 1996 and 1998, respectively, and was listed on the Shanghai Stock Exchange in 2001. In 2003, with an MDI capacity of 160,000 tons, the company expanded its product line to include thermoplastic polyurethane (TPU) and methylenebis (MDBA) production.

In 2006, WC expanded internationally, establishing branches and research centers in the United States, Japan, the Netherlands, and other countries. In 2011, it fully acquired Hungary’s BorsodChem, gaining patents and technical support and entering the field of fine chemicals and new materials. The company continued to expand its capital expenditure in 2014, venturing into C2, C3, and C4 petrochemical businesses, thereby diversifying its products and becoming a global platform chemical enterprise. In 2019, WC acquired 100 percent of the shares of Sweden’s International Chemicals from Cornell and Europa-Energy.

The same year, it established an R&D center in Yantai, integrating the research operations of several subsidiaries. Currently, the company has 3 integrated chemical industrial parks, 6 production bases, 3 R&D centers, and 10 sales organizations worldwide. As of November 2023, its annual MDI and TDI production capacities reached 3.1 million tons and 1.03 million tons, respectively, leading globally with a market share exceeding 30 percent.

WC, still a partially state-owned company, actively develops various high-value specialty chemicals, with a presence in aliphatic diisocyanates (ADI) polyurethane materials, engineering plastics, superabsorbent polymer (SAP) resins, semiconductors, and new energy materials. Its Functional Chemicals Division offers a range of products, including aliphatic isocyanates, special amines, flavors, and special chemicals. The New Materials Division’s main products include TPU elastomers, polymethyl methacrylate (PMMA), water treatment membrane materials, modified polypropylene (PP), and polyolefin elastomers (POE). These products are widely used in clothing and shoes, automotive, home appliances, photovoltaics, optical displays, consumer electronics, etc. The Surface Materials Division focuses on eco-friendly surface materials, SAP, and silicone adhesives. The High-Performance Polymers Division’s business includes polycarbonate, special nylon (PA12), biodegradable materials, other high-end polymers, and related chemicals. These products are widely used in automotive, 5G communications, health care, electronics, high-end optics, green packaging, polymer products, and professional technical services. Its battery technology business mainly includes ternary cathode materials, lithium-ion phosphate cathode materials, anode materials, electrolyte solvents, etc. Finally, its electronic materials business produces chemicals related to the semiconductor, electronic, and electrical fields. The company has also expanded its product line into high-end medical and optical fields.

In 2022, WC signed strategic cooperation agreements with Peking University, East China University of Science and Technology, and Beijing University of Chemical Technology. These partnerships leveraged both parties’ talents and technological platforms, fostering collaboration in new energy and functional materials.

Prior to 2005, WC frequently imported production lines from Japan, South Korea, Germany, and the United States. Wanhua’s primary goal was not to acquire technology but to rapidly increase production capacity. After 2006, WC firmly established its monopoly in the MDI market in China and entered the first tier in the global market. With the revenue from its MDI business, WC was able to maintain high capital expenditures over the following years, including the acquisition of overseas enterprises in upstream and downstream fields and the introduction of production lines. In 2011, the company made a significant acquisition of Hungary’s BorsodChem.

In 2014, WC completed the full acquisition of a domestic petrochemical enterprise and independently developed C2 and C3 petrochemical production processes, officially entering the petrochemical sector. WC is generally considered to have joined the world’s first tier of chemical enterprises by 2017.

In 2022, WC received government subsidies totaling 610 million renminbi (RMB), or $91.5 million. The company’s accounts still hold a balance of 1.68 billion RMB ($252 million) from government subsidies accumulated over previous years.[29]

WC has implemented a three-tiered R&D organizational structure comprising headquarters, regional centers, and production bases, creating an innovative R&D system that integrates basic research, process development, engineering development, and product application R&D.

The Technical Development Center at Wanhua’s Beijing Research Institute conducts basic research. The Technical Development Center and the Pilot Plant Center at the Yantai Research Institute are responsible for process development. Engineering research is carried out by the Process Development Center at the Research Institute in Hungary, in collaboration with the Chemical Design Institute at the Yantai Research Institute. The technical departments at the production bases conduct industrialization and device optimization research.

The Surface Materials Research Center and the High-Performance Materials Research Center at the Beijing Research Institute are engaged in product application R&D. Additionally, WC collaborates with universities and scientific research institutions in industry-education-research partnerships and has established Wanhua Magnetic Mountain University in the Cishan district of Yantai to directly supply the enterprise with professional talent.

WC employs over 4,000 research personnel, accounting for 16.4 percent of its workforce. Among these, more than 210 hold doctoral degrees and over 2,300 possess master’s degrees. Its main R&D institutions include the Wanhua Chemical Global R&D Center, Institute of High-Performance Materials, Polyurethane Application Research Institute, Chemical Design Institute, North American Technical Center, and the Goodrich Technology Center in Europe. Additionally, WC has established multiple high-level innovation platforms, including the National Polyurethane Engineering Technology Research Center, the National Engineering Laboratory for Polymer Surface Material Preparation Technology, the National Enterprise Technology Center, postdoctoral workstations, five nationally accredited analytical laboratories, and seven provincial and industry engineering (technology) centers and key laboratories. It is also diversifying, planning to invest 3.34 billion RMB ($461 million) in battery material projects. It also developed production capacity for beta ionone, a fragrance ingredient, and for polyamide 12 (PA, nylon), a high-end engineering plastic with a variety of industrial applications.[30]

While the company lists innovation prizes it has won in China, we could find no mention of foreign awards.[31] WC has filed 4,718 patents within China and 399 patents overseas. In 2022, R&D expenditures were 3.42 billion yuan ($472 million), a 55 percent increase year over year, with a cumulative five-year scientific research investment totaling 11.94 billion yuan ($1.65 billion). The company’s R&D-to-sales ratio has been maintained at around 2.5 percent since 2016. Following a substantial increase in operating income after 2021, the R&D expense ratio decreased to 2.17 percent in 2022. In comparison, global leader BASF (headquartered in Germany) had an R&D-to-sales ratio of 2.6 percent. However, because of the lower cost of R&D personnel in China, WC has a higher ratio of R&D personnel to total employees (16.5 percent vs. 8.9 percent). In 2011, Wanhua’s revenue was 13.7 billion yuan, about $2.05 billion, which was only 2.2 percent of BASF’s; by 2022, WC’s revenue had risen to 165.5 billion yuan, approximately $24.83 billion, reaching 24.2 percent of BASF’s.

Rongsheng Petrochemical Co., Ltd.

Established in 1989, Rongsheng Petrochemical Co. is the largest privately owned petrochemical corporation in China. It has established a comprehensive industry chain that spans refining and chemical integration to the production of downstream products such as purified terephthalic acid (PTA), monoethylene glycol (MEG), polyester (PET), and polyester filament (POY, FDY, DTY). In 2022, Rongsheng had revenue of 289.1 billion RMB ($43.4 billion), with a net profit attributable to the parent company of 33.4 billion RMB, or around $5.01 billion.[32]

In 2023, Saudi Aramco, through its subsidiary AOC, acquired a 10 percent stake in Rongsheng Petrochemical and agreed to engage in collaborations encompassing raw materials, technology, and chemicals. The Technology Sharing Framework Agreement facilitates the exchange of relevant information and technology (including but not limited to refining and petrochemical technologies) between Rongsheng and Saudi Aramco. This technology complementarity aims to jointly develop new technologies, processes, and equipment that meet market demands.

Rongsheng has extensively utilized foreign technology and products in the construction of its refining and chemical facilities. Notably, Honeywell UOP and Honeywell Process Solutions have provided a range of process technologies, engineering designs, equipment, and advanced automation control for its newly built 40 million tons/year integrated refining and petrochemical complex in Zhejiang Province. This collaboration includes the provision of technologies for two series of aromatics complexes, a residue fluid catalytic cracking (RFCC) complex, a propane dehydrogenation unit, and a pressure swing adsorption (PSA) unit. DuPont Clean Technologies has been responsible for designing the Sulfuric Acid Regeneration (SAR) unit.

Rongsheng received governmental subsidies of around 2.36 billion RMB ($330 million) in 2022. Moreover, Zhoushan Green Petrochemical Base Management Committee and Xiaoshan District Headquarters Economy Special Class contributed to Rongsheng’s fiscal incentives through granted financial rewards throughout 2022.

Rongsheng says it has established many world-class R&D platforms, including a high-tech R&D center, a workstation for academics and experts, an enterprise technology center, and a post-doctoral science and research workstation. Moreover, it engages in technology exchanges and discussions promoting industry-university research collaboration to benefit resource sharing between universities and the community.

Rongsheng’s main manufacturing subsidiaries are all national high-tech enterprises with strong R&D strength and rich process operation experience accumulated during long-term production management. For example, it has selected a new technical route for Zhongjin’s petrochemical project, using fuel oil (cheaper than naphtha) to produce certain aromatic products. Rongsheng says it has finalized the application of large-scale melt direct spinning polyester and spinning technology in the early projects for further development and improvement in the later projects.[33]

Rongsheng invested around 4.4 billion RMB ($600 million) in its R&D activities in 2022, which accounted for 1.5 percent of operating income, a relatively low level. Rongsheng’s R&D team consists of 2,731 employees, which accounts for 14 percent of its personnel. Among the R&D personnel, almost half (1,377) have bachelor’s degrees, 98 have master’s degrees, and just 5 possesses doctorates.[34]

Rongsheng has filed 30 patents with the World Intellectual Property Organization (WIPO).[35] As of 2023, Rongsheng had a total of 479 patents globally. According to Insights by GreyB, a market analysis company, from 2002 to 2023, 473 of Rongsheng’s patents were filed in China, while only 4 patents were filed in the United States, Japan, Canada, and the United Kingdom.[36] This suggests the company is still a copier, not an innovator.[37]

China’s Chemical Industry Strategy

China has long and successfully sought to grow its chemical industry. That success has been mostly in basic, commodity chemicals. However, it is now seeking to achieve the same success in more innovation-based specialty chemicals.

One way it is attempting to do this is by encouraging industry consolidation. The Chinese government knows that without its firms having more scale it will be harder for them to marshal the necessary resources for the needed R&D and to be able to provide the breadth of product catalogs the global leaders have. One way to achieve this is to use stricter regulatory requirements to weed out the smaller and weaker firms. However, according to experts, while there is some consolidation, the pace is still slow.

In addition, the government is making a push to move chemical refineries inland to the heartland where land is cheaper and population densities less. For example, a number of chemical factories have moved from Jansui province to inner Mongolia and Xingang, where there are large supplies of coal. This is a reason for the coal-chemical push in coal regions.

The central government has targeted chemical innovation. The 2023 “Guiding Catalog for Industrial Structure Adjustment” advocates for the development of a number of new materials related to the chemical industry, including low-VOC (volatile organic compound) adhesives, water treatment agents, catalysts, electronic chemicals, silicone materials, and fluorine materials.[38]

Chinese governments provide significant direct and indirect subsidies to chemical firms.[39] In addition, Chinese governments are also upgrading chemical parks. Under this plan, 10 or so leading companies are to be “cultivated” as “national champions.” In addition, as noted, Chinese governments provide a range of financial incentives, including low-interest loans.

The government has also set a goal for the share of fine chemicals in total chemical production in China to be at least 50 percent. China also continues to use foreign investment as a means of technology transfer. As Grimes wrote:

As China become increasingly independent of importing various chemicals, it becomes increasingly selective about encouraging foreign investment only in those segments where it continues to require transfer of technology, and in which international companies can become trusted partners for China’s indigenous innovation.[40]

What Should the United States Do?

While the United States continues to lose global market share in chemicals, it retains significant strengths elsewhere, including in innovation. To ensure that we don’t lose that leadership, Congress should expand funding for chemistry and chemical engineering research through the National Science Foundation, particularly through the establishment of new Engineering Research Centers.[41] Congress should also significantly expand the R&D credit and restore first-year expensing of capital equipment investments. Finally, while environmental regulations are important in the chemical industry, legislators and regulators should ensure that regulations are designed and implemented in ways that limit compliance costs while still achieving legislative goals.

Acknowledgment

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Future reports in this series will cover artificial intelligence, quantum computing, semiconductors, biopharmaceuticals, consumer electronics, commercial space, nuclear power, and motor vehicles. (Search #ChinaInnovationSeries on itif.org.)

Any errors or omissions are the author’s responsibility alone.

About the Author

Dr. Robert D. Atkinson (@RobAtkinsonITIF) is the founder and president of ITIF. His books include Technology Fears and Scapegoats: 40 Myths About Privacy, Jobs, AI and Today’s Innovation Economy (Palgrave McMillian, 2024),Big Is Beautiful: Debunking the Myth of Small Business (MIT, 2018), Innovation Economics: The Race for Global Advantage (Yale, 2012), Supply-Side Follies: Why Conservative Economics Fails, Liberal Economics Falters, and Innovation Economics Is the Answer (Rowman Littlefield, 2007), and The Past and Future of America’s Economy: Long Waves of Innovation That Power Cycles of Growth (Edward Elgar, 2005). He holds a Ph.D. in city and regional planning from the University of North Carolina, Chapel Hill.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Statista Research Department, “Chemical industry worldwide - statistics & facts,” Statista, February 2024, https://www.statista.com/topics/6213/chemical-industry-worldwide/#topicOverview.

[2]. Kai Pflung, “Rising Chinese Investments in New Chemical Segments” (Chemanager, August 2023), https://www.chemanager-online.com/en/news/rising-chinese-investments-new-chemical-segments.

[3]. “Capital & R&I Spending” (CEFIC), https://cefic.org/a-pillar-of-the-european-economy/facts-and-figures-of-the-european-chemical-industry/capital-ri-spending/.

[4]. Ibid.

[5]. Ibid.

[6]. Ibid.

[7]. Jean-Francois Tremblay, “‘Made in China’ now extends to chemical process technology,” Chemical & Engineering News (October 2017), https://cen.acs.org/articles/95/i42/Made-Chinaextends-chemical-process-technology.html.

[8]. Yufeng Yuan, Weifguang Pan, and Di Sha, “Analysis on Export Competitiveness of Chinese Chemical Products” (Open Journal of Social Sciences, Vol 9, No 12), https://www.scirp.org/journal/paperinformation?paperid=113736.

[9]. Ibid.

[10]. Ibid.

[11]. Seamus Grimes, “China’s Evolving Role in the Chemical Global Value Chain,” The Chinese Economy (May 2023), https://www.tandfonline.com/doi/pdf/10.1080/10971475.2023.2213631.

[12]. Ravi Naidu, et al., “Chemical pollution: A growing peril and potential catastrophic risk to humanity” (Environment International, Vol 156, November 2021), https://www.sciencedirect.com/science/article/pii/S0160412021002415.

[13]. “Capital & R&I Spending” (CEFIC) https://cefic.org/a-pillar-of-the-european-economy/facts-and-figures-of-the-european-chemical-industry/capital-ri-spending/.

[14]. Ibid

[15]. Ibid.

[16]. Alex Irwin-Hunt, “Asian megacities stand out as best locations for chemical labs” (FDI Intelligence, August 2022), https://www.fdiintelligence.com/content/data-trends/asian-megacities-stand-out-as-best-locations-for-chemical-labs-81212.

[17]. Jean-Francois Tremblay, “‘Made in China’ now extends to chemical process technology,” Chemical & Engineering News (October 2017), https://cen.acs.org/articles/95/i42/Made-Chinaextends-chemical-process-technology.html.

[18]. Ibid.

[19]. Pflung, “Rising Chinese Investments in New Chemical Segments.”

[20]. “Capital & R&I Spending” (CEFIC), https://cefic.org/a-pillar-of-the-european-economy/facts-and-figures-of-the-european-chemical-industry/capital-ri-spending/.

[21]. Trelysa Long and Robert D. Atkinson, “Innovation Wars: How China Is Gaining on the United States in Corporate R&D” (ITIF, July 2023), https://itif.org/publications/2023/07/24/innovation-wars-how-china-is-gaining-on-the-united-states-in-corporate-rd/.

[22]. “ICIS Innovation Awards 2023,” Independent Commodity Intelligence Services, https://eu.eventscloud.com/ehome/innovationawards/200542435/.

[23]. “ICIS Innovation Awards 2022,” Independent Commodity Intelligence Services, https://www.linkedin.com/posts/icis_title-activity-6957303888794238976-aSH3/; “ICIS Innovation Awards 2021,” Independent Commodity Intelligence Services, https://www.linkedin.com/posts/carl-richardson-41305417_icisinnovationawards21-innovation-icis-activity-6866769103961636864-yRXp/.

[24]. National Science Board, Science & Engineering Indicators 2024: Invention, Knowledge Transfer, and Innovation, NSB-2024-1, Table SINV-5, “USPTO utility patents granted in chemistry, by selected region, country, or economy: 2000–22,” February 29, 2024, https://ncses.nsf.gov/pubs/nsb20241/table/SINV-5.

[25]. It is important to note that these are applications, and not grants, and that the Chinese government provides incentives to its firms to file patents outside of China.

[26]. National Science Board, Science & Engineering Indicators 2024: Invention, Knowledge Transfer, and Innovation, NSB-2024-1, Table SINV-12, “Patent Cooperation Treaty applications in chemistry, by region, country, or economy: 2000–22,” February 29, 2024, https://ncses.nsf.gov/pubs/nsb20241/table/SINV-12.

[27]. “Continuous flow chemical synthesis research” (Australian Strategic Policy Institute: Critical Technolgy Tracker), https://techtracker.aspi.org.au/tech/continuous-flow-chemical-synthesis/?colours=true.

[28]. “Who produces the most research within Coatings?” (Australian Strategic Policy Institute: Critical Technolgy Tracker), https://techtracker.aspi.org.au/tech/coatings/?colours=true.

[29]. These government subsidies include various specific purposes and amounts:

|

Purpose |

Amount |

$USD Equivalent |

|

Industrial Support Subsidy |

680 million RMB |

~$102 million |

|

Industrial Upgrade Subsidy |

480 million RMB |

~$72 million |

|

Special Funds for Supporting Key Advantageous Industries |

107 million RMB |

~$16.05 million |

|

Subsidies for Industrial Revitalization and Technological Transformation |

103 million RMB |

~$15.45 million |

|

Special Funds for Supporting Enterprise Development |

91 million RMB |

~$13.65 million |

|

Special Funds to Enhance the Core Competitiveness of Manufacturing |

73 million RMB |

~$10.95 million |

|

Environmental Protection Special Subsidy |

35 million RMB |

~$5.25 million |

|

Subsidy for Upgrading and Transforming Industrial Parks |

33 million RMB |

~$4.95 million |

|

Special Funds for Optimizing Industrial Structure |

21 million RMB |

~$3.15 million |

|

Interest Subsidy for Key Industry Technological Transformation Projects |

14 million RMB |

~$2.1 million |

|

Special Funds for Construction of Two Areas |

11 million RMB |

~$1.65 million |

[30]. Pflung, “Rising Chinese Investments in New Chemical Segments.”

[31]. Wanhua Chemical’s achievements in 2022 also include receiving the Shandong Province Science and Technology Progress Special Prize for the complete technology of hydrochloric acid catalytic oxidation for chlorine production and its industrial application. Additionally, Wanhua Chemical has won six national scientific and technological awards, including the National Science and Technology Progress First-Class Award and the National Technological Invention Second-Class Award. In terms of innovation rankings:

In 2012, it ranked third on China’s Top 100 Innovative Enterprises list.

In 2016, it was selected as one of the first batch of nine enterprises for the National Top 100 Innovative Enterprises Pilot Project.

In 2018, it topped the Shandong Province High-Tech Enterprise Innovation Capability ranking.

In 2020 and 2021, it led the Shandong Province Science and Technology Enterprise Leadership ranking for two consecutive years.

In 2023, it was awarded the 7th China Industrial Award, a testament to its continuous innovation and leadership in the industrial sector.

[32]. Rongsheng Petrochemical, “2022 Annual Report”, April 2023, 21, https://www.szse.cn/disclosure/listed/bulletinDetail/index.html?bd67dd03-7704-4042-b150-c9b6f49e299d.

[33]. Ibid., 19–20.

[34]. Ibid., 33.

[36]. Insights by GreyB, “Rongsheng Petrochemical Patents—Key Insights and Stats,” 2023, https://insights.greyb.com/rongsheng-petrochemical-patents/.

[37]. Ibid.

[38]. Pflung, “Rising Chinese Investments in New Chemical Segments.”

[39]. Capital Trade Incorporated, “An Assesment of China’s Subsidies to Strategic and Heavyweight Industries” (submitted to the US-China Economic and Security Review Commission), https://www.uscc.gov/sites/default/files/Research/AnAssessmentofChina’sSubsidiestoStrategicandHeavyweightIndustries.pdf.

[40]. Grimes, “China’s Evolving Role in the Chemical Global Value Chain.”

[41]. “Centers for Chemical Innovation (CCI) Active Awards” (U.S. National Science Foundation), https://www.nsf.gov/awards/award_visualization.jsp?org=NSF&pims_id=13635&ProgEleCode=035Y%2C1995&from=fund#region=US-CO&instId=0013508000.