The Digital Advantage: How Digital Services Boost Consumer Welfare

Given how many times per day we rely on digital services in our daily lives—for everything from news and information to maps, social spaces, and marketplaces—it should go without saying that these services provide tremendous benefits to consumers, the economy, and societal welfare. But therein lies a problem: Too often, it does go without saying. In fact, the critical roles these services play in our daily lives are taken almost entirely for granted. And instead of being celebrated, the big technology companies that provide digital services are now objects of fear, resentment, and withering criticism from many policymakers, pundits, and advocates. So, as we go online to finish our holiday shopping, it’s a good time to pause and measure the tangible value we gain from digital services.

Online services as we now know them date to the second half of the 1990s, and the scholarly research and evidence about their value to consumers goes back at least half as far. A 2011 McKinsey survey of U.S. and European web users found that consumers gain about 100 billion euros annually from free Internet services such as email, search, social networks, and instant messaging. Another contemporaneous study by MIT’s Erik Brynjolfsson and Joo Hee Oh estimated that the consumer gain from free global digital services was even higher. They found the United States alone benefitted from a consumer surplus of $106 billion annually, translating to a welfare gain of about $500 per individual per year. In other words, consumers in the United States were willing to pay that much for the services they were getting, but they didn’t have to because the services were free. Moreover, the value of these services increases the companies that provide them innovate and introduce new features that further cater to consumers’ needs. This is a key point worth bearing in mind in the current debate about large online platforms’ business practices: The business practices that enable tech companies to provide services for free are creating immense value for consumers.

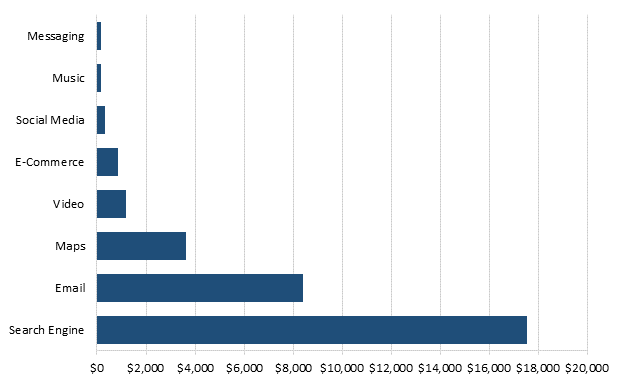

While these services all generate value, consumers obviously value some free digital services more than others. For instance, many jobs require research that is most effectively conducted online through search engines. A 2019 research paper by Brynjolfsson, Collis, and Eggers calculated the monetary value that U.S. users placed on a range of digital services as of 2017, including, from highest to lowest: search engines, email, maps, video, e-commerce, social media, music, and messaging. (See figure 1.) The median user was unwilling to forego their access to search engines unless they were paid $17,530 per year, and they were unwilling to give up email unless they were paid $8,414.

Users were more willing to forego free Internet music services, valuing it at $168 per year. This is partly because the average consumer relies less on free music services than search services in their daily activities. However, it should be noted that these estimates may be inflated or skewed because of the limited sample size (about 500 participants for each price point). Nevertheless, they clearly show the importance of free digital services in the aggregate, meaning that the business models of large technology companies provide a source of value to consumers.

Figure 1: Consumers’ expected monetary compensation for annual loss of access to a digital good, 2017

Additionally, some digital goods are valued more than others partly because they have more traditional substitutes that consumers still use. For example, e-commerce is not valued as highly as other digital goods because consumers still buy 80 percent of goods in brick-and-mortar stores. Nonetheless, online shopping is growing. A Feedvisor study of 2,000 consumers found that 57 percent of consumers do more online shopping now than before the pandemic. Moreover, 53 percent of consumers buy products online at least once per week. As a result, e-commerce platforms such as Amazon are becoming increasingly valuable to consumers. Indeed, the same study found that 56 percent of consumers visited Amazon daily or at least a few times a week in 2021, a 9 percentage point increase from 2019. In other words, even if some digital services still compete with offline rivals, they are nonetheless becoming more valuable to consumers over time.

Moreover, even when some free Internet services charge a subscription fee, consumers still capture surplus value. For example, video streaming services require an annual subscription fee of about $120 to $240. Yet, Brynjolfsson, Collis, and Eggers found consumers valued these services at $1,173 annually, meaning that consumer surplus was still “5 to 10 multiples of what they actually pay.” Technology companies offer these services at such low costs because they face a two-sided market where they must attract users on one side and content providers and advertisers on the other. This means they cannot charge high prices because users would not be interested in their services; in turn, having fewer users would discourage content providers and advertisers from entering because they wouldn’t be able to reach large numbers of users. In other words, the business models of large market platforms create incentives for them provide value that improves consumer welfare—because they are rewarded for offering their services at low prices and punished for charging higher prices.

Although the consumer welfare derived from free digital services is not captured in official GDP measures, their value nevertheless contributes to a nation’s wellbeing. From 2007 to 2011, the consumer surplus gained from free digital services worth $106 billion corresponded to about 0.74 percent of GDP. Indeed, Brynjolfsson, Collis, and Egger found that “Facebook alone contributed about $225 billion worth of uncounted value for consumers.” Meanwhile, Brynjolfsson and other colleagues concluded that the uncounted value from Facebook would have added about 0.11 percentage points annually to GDP growth in the United States from 2004 to 2017. Moreover, these free services also increase consumer welfare at the global level. Another study Brynjolfsson led examined 10 digital services and found they contributed a cumulative $2.52 trillion to the welfare of 13 countries, which corresponded to 5.95 percent of their combined GDP. The key point to note here is that the business practices of large tech companies are providing value to the consumers in both low- and high-income nations.

Yet, despite providing services that clearly benefit consumers and economies, big technology companies continue to be demonized. Specifically, firms like Google, Meta, and Amazon are said to be monopolies, using their market power to harm smaller competitors and consumers. For example, in United States v. Google, whose trial just concluded, the Department of Justice claimed that Google has monopolized the general search market using anticompetitive business contracts to maintain its dominance. However, this overlooks the bigger picture that Google got to the top of the mountain by challenging incumbents such as Yahoo! with a vastly superior search engine, and it maintains its lead because it continues to be better than the alternatives. That’s why Apple chose Google Search as its default on the Safari browser. (It’s worth noting that Google also has successfully challenged dominant incumbents in other markets by providing a vastly superior product to the one they were offering. See the story of MapQuest.)

Similar to the federal case against Google, the FTC now claims that Amazon is a monopolist because of its pricing practices and fulfillment program even though it engages in robust competition with online and brick-and-mortar stores, and despite the fact that it offers cheaper goods that are easier and more convenient to access, thereby increasing consumer welfare.

Policymakers should not blindly follow the lead of the anticorporate neo-Brandeisians and others who demonize big technology companies and their business practices because breaking up these companies would only harm consumers and the economy. These companies provide consumers with high-quality, often free services that increase their overall welfare. In turn, this increase in welfare boosts the broader economy and improves living standards.