Foreign Sales’ Influence on Assessing Corporate Market Power

When evaluating the extent of market power in any industry, it is essential to first determine the level of market concentration. However, academics far too frequently focus just on domestic companies while ignoring those based in other countries. As a result, they grossly underestimate the competitiveness of markets, particularly those that are open to competition from abroad.

Data on foreign sales in the United States is often inaccessible, so researchers routinely overlook foreign firms when analyzing market concentration. Many of the most prominent antitrust researchers, such as Thomas Philippon and John Van Reenen, have made this omission. Because so many analyses exclude foreign firms and exaggerate the market share of American firms, pundits frequently use these analyses to defend misguided calls for stronger antitrust enforcement. Even the Biden administration and the Federal Trade Commission have cited such research in their calls for antitrust reform.

A recent Census Bureau paper showed that accounting for foreign firms can significantly change how concentrated a market appears. The researchers studied the U.S. manufacturing sector using confidential Census data covering the universe of all domestic sales. Using 5-digit NAICS industry levels, the authors found that the domestic concentration of the top 20 firms rose by 5 percentage points, from roughly 60 percent in 1992 to over 65 percent in 2012. However, when the researchers included imports, the market share of the top 20 firms remained flat at a much lower 53 percent between 1992 and 2012.

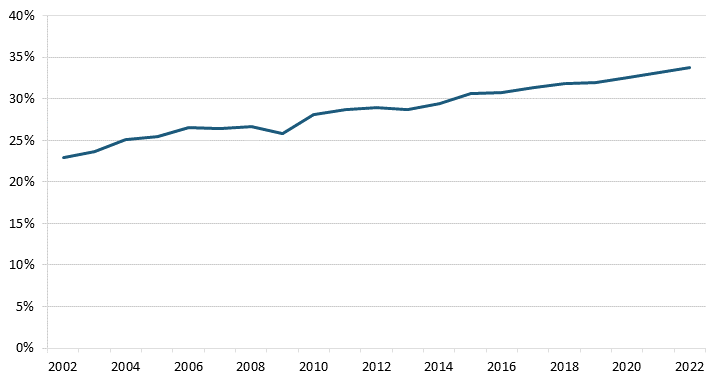

The authors argued that the consolidation of U.S. manufacturing firms was a competitive response to greater global competition. Indeed, import penetration (the proportion of domestic demand captured by imported goods) in the manufacturing sector increased by nearly 10 percentage points, from 10 percent in 1992 to almost 20 percent in 2012. This trend of rising manufacturing imports has continued in recent years, with import penetration reaching 33.8 percent by 2022, as shown in Figure 1, based on data from IBISWorld.

Figure 1: Import penetration in U.S. manufacturing sales

Additional research suggests that the greater availability of low-cost foreign substitutes results in the redistribution of sales to the most efficient American companies, which are typically larger, causing smaller, less efficient firms to go out of business. Thus, consolidation appears to be critical to the competitiveness of the U.S. manufacturing industry.

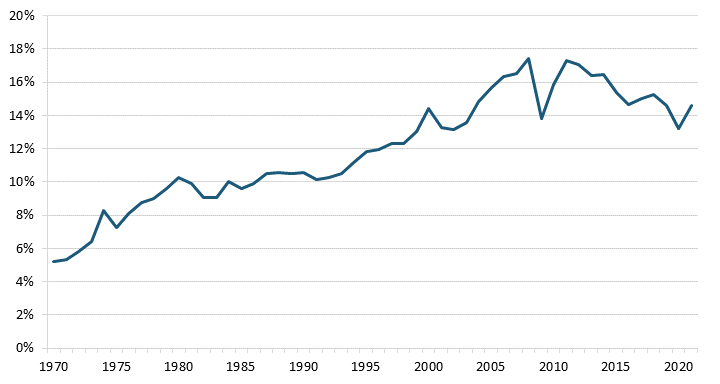

In the case of manufacturing, any industry subject to foreign trade can consolidate as a natural response to foreign competition. Evidence shows that all traded sectors are subject to growing foreign rivalry. According to World Bank data, Figure 2 shows that imports as a share of GDP have nearly tripled since the 1970s, from 5 percent of GDP in 1970 to 15 percent today. This suggests that foreign firms increasingly compete with American firms for goods and services. Consolidation is the best response to this new competitive force in many industries.

Figure 2: U.S. imports of goods and services as a share of GDP

When evaluating the state of competition in today’s increasingly interconnected world, a focus solely on domestic concentration may not necessarily provide an accurate picture. Because market concentration is frequently regarded as a significant indicator of market power, antitrust enforcers cannot rely on these mismeasurements in their work. If regulators continue to depend on these flawed assessments, they will erroneously come to the conclusion that American companies have a greater degree of market power than is actually the case. As American markets are increasingly exposed to competition from other countries, this is no time to purposefully damage some of America’s most prominent and competitive businesses.