An Unenergized America: A Midterm Assessment of U.S. Energy Funding

ITIF and the Center on Global Energy Policy at Columbia University’s School of International & Public Affairs (SIPA) in 2020 published Energizing America, which provides a roadmap for the United States government to speed the progress of clean energy technologies in reducing emissions. This mission would triple annual investments in energy innovation to $25 billion by 2025. As we approach the halfway point, now is a good time to check in on its progress.

The FY 2023 omnibus bill provides $46.2 billion to the Department of Energy, $1.4 billion more than in FY 2022. Along with provisions from the Bipartisan Infrastructure Law (IIJA) and the Inflation Reduction Act (IRA), the future of clean energy innovation should be bright. Yet, a closer look at DOE’s energy research, development, and demonstration (RD&D) programs reveals areas of notable funding gaps.

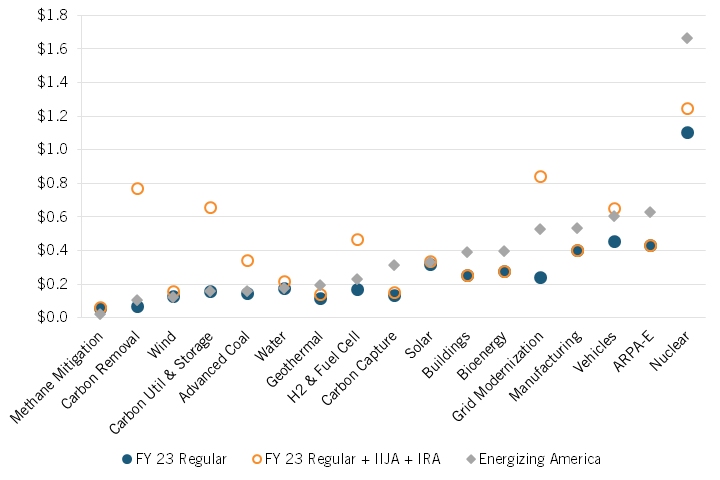

Figure 1: Tracking DOE’s energy RD&D programs, FY 2023 appropriations cycle ($billions)

Figure 1 compares the funding levels of DOE’s RD&D programs against Energizing America’s recommendations at the midway point. Funding for most programs lags behind the recommendations. In particular, ARPA-E and nuclear are the biggest areas of funding deficiencies. Although funding for solar is on par with Energizing America’s recommendation, its manufacturing competitiveness subprogram received similar funding to the previous year, despite major conversations on boosting solar supply chain capacity. Manufacturing, buildings, and bioenergy funding are also below the recommendations. Vehicles, hydrogen & fuel cell, grid modernization, carbon utilization & storage, and carbon received more than the recommendations—thanks to IIJA and the IRA. More details will be available in ITIF's updated Energy Tracker.

No Cutting-Edge Funding for Cutting-Edge R&D

ARPA-E advances high-potential and high-impact energy technologies that are in the early stages of R&D. Since its establishment in 2009, ARPA-E projects have attracted more than $11 billion in private sector funding and received 934 patents. The program recognizes the challenge of scaling innovations to meet market needs with the SCALEUP program which provides larger awards to aid this transition. So far, 131 companies have been with ARPA-E projects, 26 have exited the program with a market evaluation of $21.8 billion, and there have been 289 innovations licensed as a result of ARPA-E innovation support.

Given ARPA-E’s proven track record of catalyzing innovation (as reflected in patents and the launch of innovative technology companies), the low funding jeopardizes America’s position as the energy innovation leader. Moreover, ARPA-E has had limited success in ensuring its awardees are able to scale their inventions from the proof-of-concept stage into commercial-scale products. Additional funding would help address the “scale-up gap.”

Although ARPA-E received a 4.4 percent increase, the amount ($470 million) is one-third lower than the amount requested ($700 million)—Energizing America recommended $630 million. The amount provided is also lower than the $575 million FY 2023 authorization in the Energy Act of 2020.

Sorry Nuclear, Renaissance Delayed

The Office of Nuclear Energy’s RD&D programs are staring at a steep 16.2 percent cut compared to FY 2022 levels. Altogether, funding for FY 2023 is about $400 million less than Energizing America’s recommendation of $1.7 billion.

Advanced Reactors Demonstration Program (ARDP) got the steepest funding cut (-66 percent). Its Risk Reduction for Future Demonstrations subprogram, established in 2020 to address technical risks in advanced reactor designs, accounts for the lion’s share of ARDP’s cut. Although this subprogram received over $100 million in FY 2022 to ramp up activities, it got nothing this year.

High assay, low enriched uranium (HALEU), a subprogram of Fuel Cycle R&D, received $0 in FY 2023 from the omnibus bill, yet the IRA appropriated $140 million per year from FY 2022 to FY 2026. There are no commercial suppliers of HALEU in the United States (Russia is the only global supplier). The United States will eventually need much larger quantities when advanced reactors requiring HALEU fuel are commercialized. Recent geopolitical developments further highlight the need to speed up domestic commercial enrichment and deconversion capacity online.

Advanced nuclear energy is key to addressing energy security needs. While the case for nuclear energy security is building elsewhere in the world, these funding cuts make a nuclear comeback in America more difficult to achieve.

The Empty Promise: Solar Manufacturing Competitiveness

In addition to energy security needs, manufacturing competitiveness in solar energy was a major discussion topic in 2022, which failed to translate to heightened support from Congress. In early 2022, DOE’s Solar Energy Technologies Office (SETO) published a report on the U.S. supply chain and manufacturing capacity, calling for significant financial support to reestablish a domestic solar manufacturing supply chain. The FY 2023 President’s Budget Report followed up by proposing a new Solar Manufacturing Accelerator and a substantially higher funding amount requested for SETO’s Manufacturing and Competitiveness subprogram ($225 million, compared with the $100 million requested for FY 2022.) But in the end, the subprogram only received $70 million, and the omnibus explanatory statement provided zero language on solar manufacturing and supply chain.

China’s dominance on solar has decimated domestic R&D and patenting, slowing innovation. Its innovation mercantilismand intellectual property practices, forced technology transfers, massive industrial subsidies, and the dominance of the solar supply chain creates steep hurdles for domestic solar R&D and manufacturing without the above-mentioned support.

As policymakers commence the FY 2024 appropriations season amid stifled funding for cutting-edge energy R&D, the ongoing energy security issues, and manufacturing and supply chain challenges, the United States has an imperative need to elevate energy innovation as a national priority.