Oops! It Turns Out Aggressive Antitrust Would Increase Business Lobbying

The common refrain that big business wields disproportionate political power is overblown. Lobbying data indicates that large firms spend relatively less on lobbying than do smaller firms.

KEY TAKEAWAYS

Key Takeaways

Contents

Previous Research Examining the Political Influence of Corporations 3

Omitted Variable Bias: Industry Growth. 4

Omitted Variable Bias: Overall Trends in Lobbying. 5

The Political Influence of Small Businesses 7

Reassessing the Connection Between Firm Size and Lobbying. 8

The Relationship Between Firm Size and Lobbying. 9

The Relationship Between Profits, Market Value, and Lobbying. 10

Do Mergers Increase Lobbying? 11

Do Corporate Spin-Offs Decrease Lobbying? 12

Introduction

Antitrust is back with a vengeance, driven by a surge of advocacy hearkening to the legacy of Supreme Court Justice Louis Brandeis, the antimonopolist hero of the Progressive Era who often bemoaned the “curse of bigness,” which he viewed as inherently bad.[1] Neo-Brandeisians argue not just that large companies hurt the economy, small business, and consumers, but also that they are a per se threat to democracy because concentrated economic power begets concentrated political power. Ergo, they view antitrust as both a policy tool and a philosophical underpinning of democracy itself.[2] Many political leaders now channel that view in their calls for more aggressive antitrust action. President Biden’s 2021 executive order on competition warned that “excessive market concentration threatens … democratic accountability.”[3] Presidential advisor Tim Wu, who helped draft the order, previously warned in a New York Times column that we should “Be Afraid of Economic ‘Bigness.’ Be Very Afraid,” because extreme concentration creates conditions “ripe for dictatorship.”[4] (Never mind that, as ITIF has shown, U.S. markets are not really becoming more concentrated.[5]) Meanwhile, the leadership of the U.S. Department of Justice (DOJ) and the Federal Trade Commission (FTC) have each released statements committing to use antitrust to preserve democracy.[6] And Senator Amy Klobuchar’s (D-MN) recent book declares, “If Americans are to rebalance our democracy, we must recapture the spirit of the antitrust movement.”[7]

Given Americans’ deep commitment to a democratic republic, this line of attack is likely to be more effective for neo-Brandeisian than an economic one. Raising the alarm that big businesses of all kinds, not just select online information platforms, subvert the democratic will of the people touches a core nerve. So it comes as little surprise that neo-Brandeisians assert that large businesses spend a larger proportion of their revenue on lobbying than do smaller businesses, and an America with far fewer large businesses would better reflect the will of the people.[8] For them, stricter antitrust—both stricter merger enforcement and breakups of existing companies—is a powerful tool to restore the health of American democracy. But while seductive, this view is factually incorrect for a number of reasons.

ITIF’s analysis rebuts the notion that a neo-Brandeisian approach to antitrust based on a “big is bad” ethos would be an effective tool to restrict business lobbying. Such an approach would likely instead increase overall lobbying expenditures.

First, many of the most powerful players in Washington are associations of small companies, such as realtors, car dealers, insurance agents, community banks, and small rural Internet service providers. And more to the point, as this report demonstrates, large firms spend less on lobbying per dollar of revenue than do smaller firms. In addition, mergers are associated with decreased lobbying as a proportion of revenue, and corporate spin-offs are associated with increased lobbying. Taken together, ITIF’s analysis rebuts the notion that a neo-Brandeisian approach to antitrust based on a “big is bad” ethos would be an effective tool to restrict business lobbying. Such an approach would likely instead increase overall lobbying expenditures.

Previous Research Examining the Political Influence of Corporations

American Economic Liberties Project (AEL) is a neo-Brandeisian activist organization working “to challenge monopolies’ dominance over markets and society.”[9] In its 2021 report “Democracy for Sale,” the organization claims to show that more market power leads to more lobbying. The report concludes that “not only is big business good at lobbying, but that bigger business leads to more lobbying. That means monopoly is a threat to representative democracy—and that protecting our democracy requires effective antitrust.”[10] To be clear, it argues that one big business with revenue equal to two mid-size businesses spends more on lobbying than do the two businesses.

The authors reached this conclusion by comparing changes in the Herfindahl–Hirschman index (HHI) of three industries (Internet companies, pharmaceuticals, and oil and gas production) to changes in their total lobbying expenditures. They found that as HHI grew, so too did the industries’ total lobbying expenditure. The study observes this positive relationship when comparing the lobbying expenditure of one year with the HHI of four years earlier. According to the authors, this lag results from the “process of turning concentration into profits and then spinning those profits into lobbying in Washington.”[11] However, as discussed ahead, this study has a number of significant flaws that do not support the report’s conclusions.

Not surprisingly, the report calls for stricter antitrust because “[t]he consumer welfare standard simply does not capture the full suite of harms of concentration and cannot provide a full solution.”[12] In other words, the report argues that, even though economies of scale can lower prices and make consumers better off, the threat of large corporations to democracy is sufficient to warrant stronger antitrust. This is the key. Neo-Brandeisians have a slender reed when they argue against big on the basis of consumer welfare. Most voters instinctively realize that large corporations got large by providing consumers with value. So the neo-Brandeisians rely on the political-threat argument.

Industry Selection Bias

The first flaw in the AEL study is it overlooks that changes in the industries’ regulatory environments might be occurring simultaneously to increasing concentration. Internet companies, pharmaceutical companies, and oil/gas production are all increasingly at the forefront of American regulatory debates. These regulatory debates naturally generate more lobbying expenditures. Ample evidence shows that because poorly designed regulations harm firms, threats of regulation tend to increase lobbying expenditures.[13] By failing to control for this factor, the authors could be misattributing some of the effects of increasing regulatory scrutiny to increasing concentration. This would lead the authors to overstate the effect of concentration on lobbying. In addition, the authors cannot hold these three industries to be representative of the entire economy. A much wider sample of firms is necessary to support the authors’ conclusions.

Market Definition Problems

The study also suffers from market definition problems. For example, it groups vastly different companies, such as “Internet job listing services, auctions and Internet retail, Internet publishing, web search portals, data processing and hosting, electronic shopping, and mail-order houses” under a single “Internet companies” category.[14]

The study does not share the complete list of companies it includes in each industrial classification, but it cites a few of the companies that they classified as “Internet companies.” These include Amazon, Google, Facebook, Microsoft, and Oracle.[15] For the most part, these companies are not in the same markets, so using HHI is misleading. Oracle, for example, does not compete with Facebook and Amazon, and Oracle and Amazon compete on cloud offerings but not on the rest of their business models. The study also overlooks foreign substitutes and nonpublicly traded companies for all three industries it considers, therefore overstating concentration.[16]

Omitted Variable Bias: Industry Growth

Industries that see increasing total revenues and the entry of new firms could see more lobbying over time that is unrelated to concentration. But if these industries are growing and becoming more concentrated at the same time, the report could be misattributing lobbying increases from industry growth to concentration.

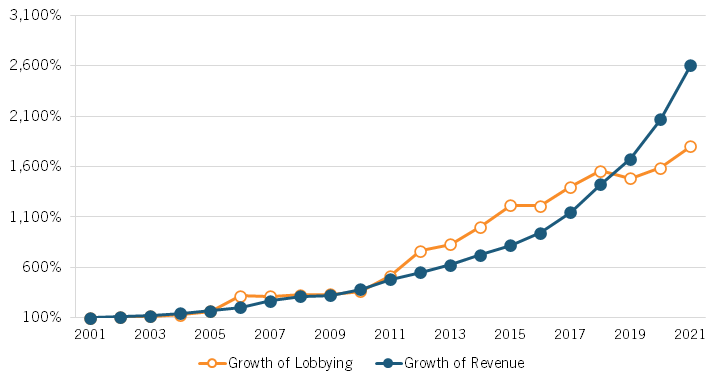

For example, the report points out that HHI grows in the Internet industry but does not control for the fact that the industry is growing at the same time.[17] Figure 1 charts the growth in revenue and lobbying of five Internet companies the report includes in its analysis. As we would expect, lobbying expenditures grow as sales revenue grows. But because the report does not control for industry growth, the authors misattributed causality to concentration when, in all likelihood, at least some of the lobbying increase results from the sheer growth in the size of the industry.

Figure 1: Internet industry lobbying expenditures and aggregate revenue of Amazon, Google, Facebook, Microsoft, and Oracle (indexed; 2001 = 100%)[18]

Omitted Variable Bias: Overall Trends in Lobbying

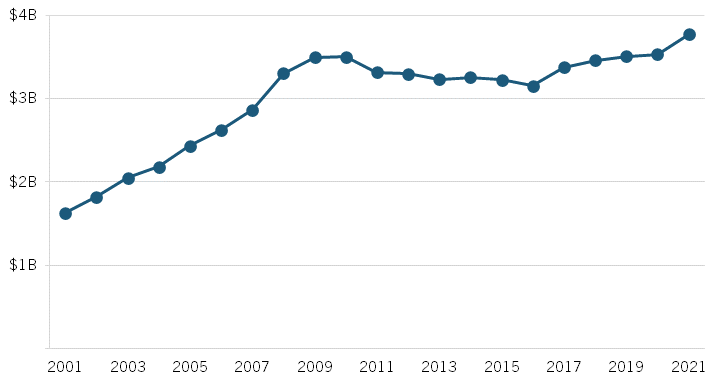

We also compared total lobbying trends with these three sectors’ lobbying trends. As figure 2 illustrates, total lobbying in the United States increased from 1998 to 2008 and has roughly stabilized since.

Figure 2: Total lobbying expenditures in the United States[19]

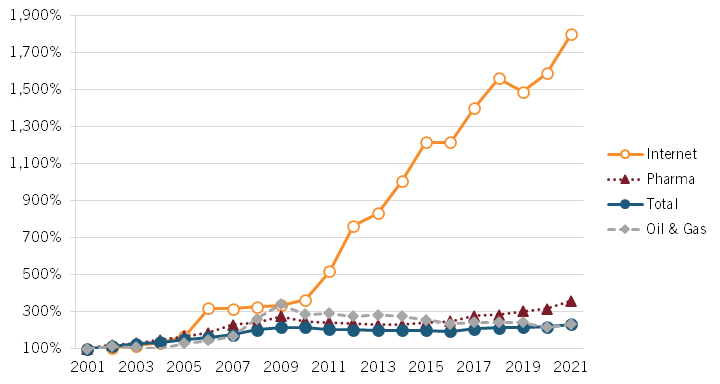

Figure 3 compares the growth of lobbying across these industries. We notice that pharmaceuticals and oil and gas companies have lobbying patterns that mostly mirror the overall trend for businesses. This suggests that overall trends in lobbying might explain some of the observed changes in lobbying expenditure over time. In contrast, Internet companies saw immense lobbying growth from 2001 to 2021. The disproportionately large growth of the Internet sector during this period likely explains why the sector so sharply deviates from the overall trendline. But even so, controlling for overall trends in lobbying during the sample period could improve the report’s estimates.

Figure 3: Growth of lobbying by industry (indexed; 2001 = 100%)[20]

Faulty Regression Analysis

HHI values are also remarkably low for both pharmaceuticals and oil/gas companies. Both industries’ HHIs peak significantly below 1,500, which means both industries have low market concentration according to the DOJ’s standards.[21] The Internet companies’ HHI barely exceeds 1,500, but even so, these concentration values are overstated because the authors improperly defined the market.[22] In other words, none of these three industries are highly concentrated.

The selection of models in the report is also problematic. The authors built several models with different HHI lags and seemed to arbitrarily pick the model with the highest R-squared. For instance, the coefficient of their combined model with no lag has an R-squared of only 0.01, which suggests no relationship.[23] The authors went on to lag the HHIs by four years for all industries but ultimately settled on a model with a four-year HHI lag for Internet and oil/gas and a three-year HHI lag for pharmaceuticals because this combination of lags yields the highest R-squared among all the models they assessed in their report. The authors justified what seems like the arbitrary selection of a model by claiming that “there may be a specific sweet spot for how long it takes for concentration to manifest any changes in lobbying,” yet they provided no evidence that the process of turning market power into profits and profits into political capital takes “three or four years.”[24] In fact, some of the evidence in the report directly suggests that this relationship is unlikely. For example, the p-value of the three-year lag model goes from 0.6, far from significant, to a highly statistically significant value for a four-year lag.[25] If the true relationship is the one they were suggesting, we would not expect such a sudden, pronounced drop in statistical significance when the lag shifts by just one year. It seems like the authors were cherry-picking the best-fit model without proper justification and using it to advance their anticorporate agenda.

For all these reasons, this report does not provide a convincing argument that corporate concentration increases lobbying. In fact, the report itself states, “While the correlation is of a single industry and not enough to make a sweeping claim about the relationship generally, it remains noteworthy.”[26] If the authors themselves admitted that their findings are insufficient to draw sweeping claims, it would be unreasonable for them to frame their results as an alarming justification for sweeping antitrust enforcement.

The Political Influence of Small Businesses

Literature highlighting the influence of big business often fails to recognize the mechanisms through which small businesses influence policymakers. Because they have more resources, large businesses often hire in-house lobbyists to advocate for their interests in Washington. Small businesses can individually exert a similar influence on policymakers but often do so by pooling resources into trade associations. In table 1, we list just a few of the trade associations representing small businesses and their lobbying expenditure in 2021:

Table 1: Lobbying expenditures of trade associations representing small companies in 2021

|

Trade Association |

Lobbying Expenditure |

|

National Association of Realtors |

$44.0 million |

|

America’s Health Insurance Plans |

$10.8 million |

|

National Auto Dealers Association |

$4.5 million |

|

Independent Community Bankers of America |

$4.2 million |

Car dealerships provide an example of the massive influence small businesses can achieve by coming together through a trade association. The National Auto Dealers Association represents more than 16,000 auto dealers and spent over $4 million in lobbying in 2021.[27] Car dealer associations have spearheaded legislation at the state and local levels for decades in the United States.[28] A 2014 Cato Institute report outlines how dealership lobbies successfully prevented Tesla from using a direct-to-consumer distribution model in several states because this model bypasses traditional franchised dealer networks.[29] As this case demonstrates, small businesses can wield large political influence by uniting under trade associations.

Moreover, looking only at lobbying data likely exaggerates the influence of large companies and downplays the influence of small businesses. In Big Is Beautiful, Atkinson and Lind showed that much of the influence of small business arises from geography:

In every congressional district and every state there are family farmers, franchise owners, automobile dealers, realtors, and others whose support politicians cannot ignore. In contrast, the headquarters and production facilities of major national and global corporations are found in a relatively small number of places. Every American state has family farmers and realtors; far fewer have automobile or aerospace manufacturers.[30]

Reassessing the Connection Between Firm Size and Lobbying

Methods

ITIF conducted its own analysis to assess the influence of firm size on lobbying.

Lobbying Expenditure Data

Like the AEL study, this report uses OpenSecrets lobbying expenditure data. OpenSecrets compiles expenditure data from required disclosures filed with the Secretary of the Senate’s Office of Public Records under the Lobbying Disclosure act of 1995.[31] This data is subject to several limitations: The disclosures are rounded to the nearest $10,000 for each quarter, and lobbying firms only need to report contributions from donors who spend more than $3,000 in one quarter. A 2018 Government Accountability Office report also finds that a significant number of lobbyists incorrectly disclosed their lobbying income.[32]

Firm Revenue Data

For the analysis of firm size and lobbying, data on firm revenue comes from the 2021 Fortune 500 list, which ranks publicly traded American companies by their revenue.

For the analysis of mergers and corporate spin-offs, we matched company names to revenue data in the CRSP/Compustat merged dataset. CRSP/Compustat compiles historical firm performance data, including revenue data, on firms that are or were publicly traded in the United States.[33] When revenue figures were unavailable through CRSP/Compustat, we used companies’ annual disclosures to complete our dataset.

One limitation of this study’s design is it only considers public companies. Because private firms account for a slight majority of revenue in the United States, this report’s findings might not generalize to the entire U.S. economy.[34] But it is unclear how a company’s status as a public or private company would affect its lobbying activity. Accordingly, it is unknown how this limitation biases our findings if it does so at all.

Merger and Corporate Spin-Off Data

The merger and corporate–spin-off analyses compile data on the highest-value deals for which we could find data from 2000 to 2019. This portion of the study looks at company lobbying as a share of aggregate revenue one year before the merger or spin-off and two years following the merger or spin-off. We analyzed data on 25 mergers and 15 corporate spin-offs.

Measurement Issues

One important caveat to our findings is they are not causal. There are a few exogenous reasons that could affect both revenues and share of revenue to lobbying at the same time. For example, companies in nascent, innovative industries could see high revenues but also increasing regulatory scrutiny, which would incentivize lobbying. In this case, we might overestimate how much revenues increase lobbying because a third factor, industry growth, would be affecting both firm revenue and lobbying simultaneously.

This report’s findings on mergers and corporate spin-offs could also have endogeneity problems. For example, mergers and spin-offs can sometimes accompany corporate strategy changes that also affect lobbying. In such cases, our analysis might misattribute the effects of corporate leadership on lobbying to corporate scale. Nonetheless, if the relationship between corporate scale and lobbying is as strong and positive as some previous researchers suggest, we would at least expect to observe a positive correlation between scale and lobbying when looking at mergers and spin-offs.

Finally, this analysis paints only a partial picture of the relationship between firm size and political influence. Companies can influence policy through routes other than lobbying, including campaign finance and think tank donations.[35]

The Relationship Between Firm Size and Lobbying

We collected data on the 200 American firms with the highest revenues for the 2021 fiscal year to identify the link between firm revenue and total lobbying expenditure. We then manually matched each firm’s revenue data to its lobbying expenditure in 2021.

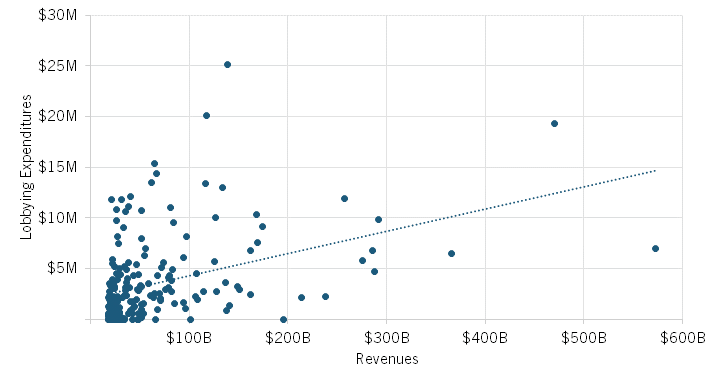

Based on our analysis, the correlation between firm revenue and lobbying expenditure has a value of 0.40, which is moderate and positive. In other words, large firms tend to have a higher total lobbying expenditure than do their smaller competitors.

Figure 4: Relationship between firms’ revenues and lobbying expenditures in 2021

At first glance, this finding seems like it would bolster the AEL’s claim that heightened antitrust could suppress corporate influence in Washington: “Stronger antitrust premised on reducing corporate concentration should be understood not just as a mechanism to address market power problems, but as an anti-corruption measure in itself.”[36] But this relies on the unproven assumption that the two smaller companies originating from a breakup would spend a smaller combined amount on lobbying than would the original, large firm.

Splitting one large firm into two smaller ones that spend the same share of revenue on lobbying as the large firm would not change total lobbying expenditure, assuming the daughter firms’ aggregate revenue remained unchanged. Total lobbying could even increase if the smaller companies devoted a higher share of revenue to lobbying.

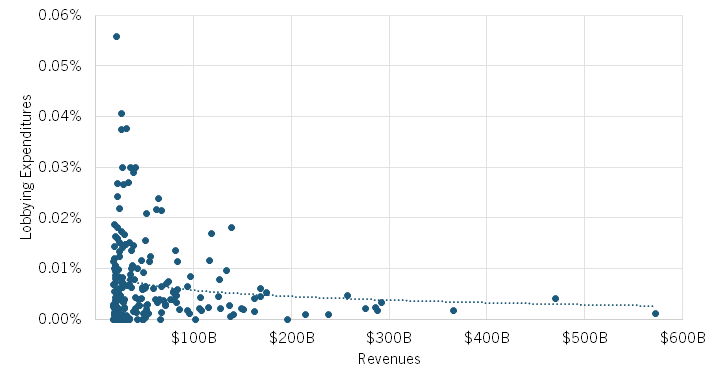

Accordingly, the next portion of this report analyzes whether large firms spend more on lobbying per dollar of revenue. Using data on the 200 highest-revenue firms in 2021, we determined that the correlation between total revenue and the percentage of revenue to lobbying was in fact negative (-0.17). In other words, contrary to the neo-Brandeisian claim, larger firms devote a smaller share of revenue to lobbying than do their smaller counterparts.

As such, we do not have evidence that breaking up large firms would do anything to decrease lobbying. These findings instead imply that breaking up a larger corporation into smaller entities could increase the total lobbying expenditure of an economy.

Figure 5: Relationship between firms’ revenues and the percentage spent on lobbying in 2021

The Relationship Between Profits, Market Value, and Lobbying

Using tabulated Fortune 500 data, we next calculated the correlations between profits and lobbying as well as market value and lobbying for the 200 highest-revenue American firms in 2021.

Results are consistent with our analysis of firm revenues. Firms with higher profits or market value have a higher total lobbying expenditure, with respective correlations of 0.35 and 0.34. But when it comes to lobbying expenditures as a share of revenue value, there is essentially no correlation: -0.03 and -0.01 respectively. In other words, more profitable and more valuable firms do not spend relatively more on lobbying, in contrast to the neo-Brandeisian claim.

Table 2: Correlations between profits, market value, and lobbying expenditure for the 200 top revenue American firms in 2021

|

Firm Data |

Correlation |

|

Profits and Lobbying Expenditure |

0.35 |

|

Profits and Percentage of Revenue to Lobbying |

-0.03 |

|

Market Value and Lobbying Expenditure |

0.34 |

|

Market Value and Percentage of Revenue to Lobbying |

-0.01 |

Do Mergers Increase Lobbying?

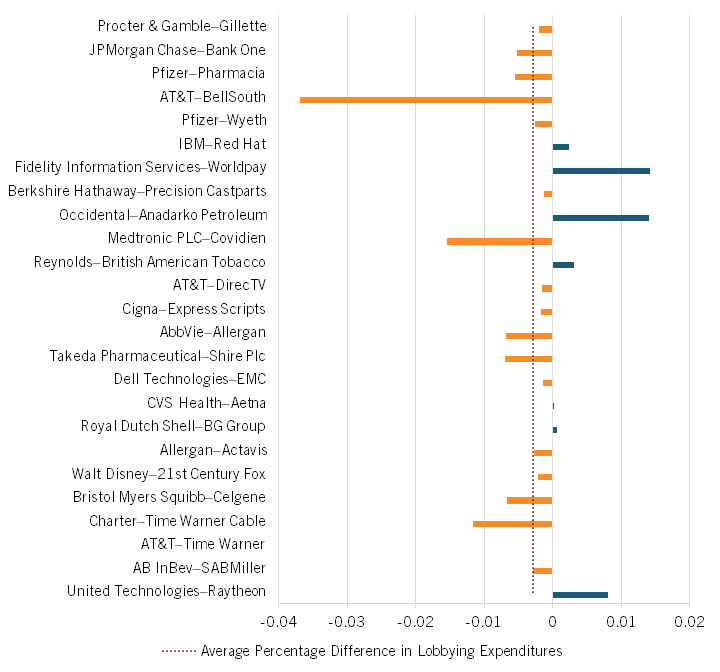

Mergers combine two smaller companies into a larger one. If bigger firms lobby more, mergers should increase lobbying. But our analysis suggests the opposite. Using data on some of the largest mergers from 2000 to 2019, we found that mergers decreased the lobbying expenditure of merged firms by an average of $1,634,816 two years after the merger compared with the two merging firms’ combined expenditures one year before the merger.

Merged firms also spent less on lobbying per dollar of revenue two years post-merger than merging firms did one year pre-merger. The percentage of aggregate revenue they spent on lobbying declined by 0.00284 percentage points, or 19.35 percent. Only 5 firms out of the 25 firms in our sample saw an increase in their share of aggregate revenue spent on lobbying.

In other words, even though mergers increase the size of the merging companies, they lead to a reduction in both total lobbying expenditures and lobbying relative to size. This evidence directly contradicts the claim that blocking mergers will save democracy from corporate control. If the neo-Brandeisians want to reduce lobbying and corporate power, they should advocate for more mergers and dramatically fewer antitrust breakups.

Figure 6: Change in the share of revenue spent on lobbying one year before and two years after mergers

Do Corporate Spin-Offs Decrease Lobbying?

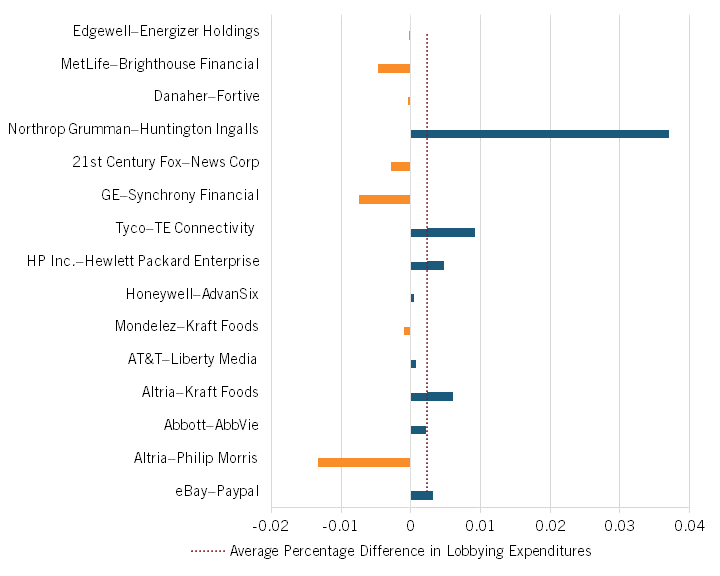

A corporate spin-off occurs when a company sells off a specific business unit or division to create a new standalone company. If bigger firms lobby more, corporate spin-offs should decrease lobbying. But our analysis suggests the opposite. To identify this, we used data on some of the largest corporate spin-offs from 2000 to 2019, including Altria Group’s 2008 spin-off of Phillip Morris International as well as Abbott Laboratories’ 2013 spin-off of AbbVie.[37]

Based on our study, corporate spin-offs increased the aggregate lobbying expenditure of the now two firms by an average of $57,202 two years post-spin-off compared with the parent company one year pre-spin-off. The two firms also spent more on lobbying per dollar of aggregate revenue than the parent company did. The percentage of aggregate revenue they spent on lobbying increased by 14.2 percent. An increase in the percentage of aggregate revenue to lobbying was seen in 8 out of 15 (i.e., a majority) of spin-off instances.

Therefore, even though spin-offs reduce the size of corporations, they correlate with increases in both total lobbying and lobbying relative to size. This is further evidence that aggressive antitrust enforcement will not reduce corporate power in Washington.

Figure 7: Change in the share of revenue spent on lobbying one year before and two years after spin-offs

Conclusion

At the end of the day, most anticorporate neo-Brandeisians will admit, at least privately or on forums directed at each other, that large corporations benefit consumers through lower prices. As Roosevelt Institute scholar Sabeel Rahman wrote, “If consumer prices are our only concern, it is hard to see how Amazon, Comcast, and companies such as Uber need regulation.”[38] But consumer prices are not their only concern, or even any concern. Rather, their concern is big business itself. And aggressive antitrust enforcement is the best way to rid America of large corporations. Arguing that doing so would reduce the excessive influence of business in American politics is simply a rhetorical device to convince Americans of the righteousness of their claim.

In reality, the opposite is true. Firms with more revenue, higher profits, and greater market value engage in relatively less lobbying activity per revenue, profits, and value than do smaller ones. Similarly, mergers reduce lobbying while corporate spin-offs increase it, on average. This suggests that breaking up large firms into smaller units would actually increase overall lobbying expenditures, not reduce them.

Because large firms pay higher wages, provide better benefits, and are more productive than are small firms, they benefit both workers and consumers more on average than do smaller and mid-sized firms.[39] Using antitrust to attack large corporations would do little to reduce business influence in political decision-making.

After you take away the argument that large firms are bad for consumers and workers and lead to more political influence in Washington, ultimately, neo-Brandeisians are left with just their visceral animus against large corporations.

Acknowledgments

The author would like to thank Rob Atkinson and Aurelien Portuese for their help on this report.

About the Author

Hadi Houalla is a research assistant for antitrust policy at ITIF. He holds a B.A. in economics and statistics from the University of Virginia.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent, nonprofit, nonpartisan research and educational institute focusing on the intersection of technological innovation and public policy. Recognized by its peers in the think tank community as the global center of excellence for science and technology policy, ITIF’s mission is to formulate and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit us at itif.org.

Endnotes

[1]. Robert D. Atkinson and Michael Lind, “The Neo-Brandeisian Attack on Big Business,” National Review, October 2, 2017, https://www.nationalreview.com/magazine/2017/10/02/large-corporations-good-for-society/.

[2]. Lina Khan, “The New Brandeis Movement: America’s Antimonopoly Debate,” Journal of European Competition Law & Practice, Volume 9, Issue 3, March 2018, Pages 131–132, https://doi.org/10.1093/jeclap/lpy020; “Democracy & Monopoly,” Open Markets Institute, accessed November 17, 2022, https://www.openmarketsinstitute.org/learn/democracy-monopoly (arguing that democracy and freedom can flourish only where excess economic consolidation is avoided); Clara Hendrickson and William Galston, “Big Technology Firms Challenge Traditional Assumptions About Antitrust Enforcement” (Brookings, December 2017), https://www.brookings.edu/blog/techtank/2017/12/06/big-technology-firms-challenge-traditional-assumptions-about-antitrust-enforcement/ (noting the importance of preventing consolidation of political power in American antitrust legislative history).

[3]. President Joe Biden, “Executive Order on Promoting Competition in the American Economy,” The White House, July 9, 2021, https://www.whitehouse.gov/briefing-room/presidential-actions/2021/07/09/executive-order-on-promoting-competition-in-the-american-economy/.

[4]. Tim Wu, “Be Afraid of Economic ‘Bigness.’ Be Very Afraid,” The New York Times, November 10, 2018, https://www.nytimes.com/2018/11/10/opinion/sunday/fascism-economy-monopoly.html.

[5]. Joe Kennedy, “Monopoly Myths: Are Markets Becoming More Concentrated?” (ITIF, June 2020), https://itif.org/publications/2020/06/29/monopoly-myths-are-markets-becoming-more-concentrated/.

[6]. “Assistant Attorney General Jonathan Kanter Delivers Remarks on Modernizing Merger Guidelines,” Department of Justice (Jan. 18, 2022), https://www.justice.gov/opa/speech/assistant-attorney-general-jonathan-kanter-delivers-remarks-modernizing-merger-guidelines (“The FTC and DOJ are fighting on the front lines to preserve competitive markets, which are essential to a vibrant and healthy democracy.”).

[7]. Amy Klobuchar, Antitrust: Taking on Monopoly Power from the Gilded Age to the Digital Age (New York: Knopf, 2021), 213.

[8]. Lee Drutman, “How Corporate Lobbyists Conquered American Democracy,” The Guardian, April 20, 2015, https://www.theatlantic.com/business/archive/2015/04/how-corporate-lobbyists-conquered-american-democracy/390822/; Reed Showalter, “Democracy for Sale: Examining the Effects of Concentration on Lobbying in the United States” (American Economic Liberties Project, August 2021), 6, http://www.economicliberties.us/wp-content/uploads/2021/08/Working-Paper-Series-on-Corporate-Power_10_Final.pdf.

[9]. “About Us,” American Economic Liberties Project, accessed December 2, 2022, https://www.economicliberties.us/about/#.

[10]. Reed Showalter, “Democracy for Sale: Examining the Effects of Concentration on Lobbying in the United States” (American Economic Liberties Project, August 2021), 9–24, http://www.economicliberties.us/wp-content/uploads/2021/08/Working-Paper-Series-on-Corporate-Power_10_Final.pdf.

[11]. Ibid, 6.

[12]. Ibid., 31.

[13]. Deniz Igan, Prachi Mishra, and Thierry Tressel, “A Fistful of Dollars: Lobbying and the Financial Crisis,” NBER Macroeconomics Annual 2012 26:195–230, https://doi.org/10.1086/663992.

[14]. Showalter, “Democracy for Sale: Examining the Effects of Concentration on Lobbying in the United States,” 7.

[15]. Ibid., 9.

[16]. Ibid., 6.

[17]. Ibid., 10.

[18]. “Industry Profile: Internet,” OpenSecrets, accessed December 2, 2022, https://www.opensecrets.org/federal-lobbying/industries/summary?cycle=2021&id=B13.

[19]. Ibid.

[20]. Ibid.

[21]. “Herfindahl-Hirschman Index,” Department of Justice, accessed November 30, 2022, https://www.justice.gov/atr/herfindahl-hirschman-index.

[22]. Showalter, “Democracy for Sale: Examining the Effects of Concentration on Lobbying in the United States,” 10.

[23]. Ibid., 25.

[24]. Ibid., 16.

[25]. Ibid., 26.

[26]. Ibid., 12.

[27]. “National Auto Dealers Association Lobbying Profile,” OpenSecrets, 2021, https://www.opensecrets.org/orgs//summary?toprecipcycle=2022&contribcycle=2022&lobcycle=2022&outspendcycle=2022&id=D000000080&topnumcycle=2022.

[28]. Justin Fischer, “How did Car Dealerships Become so Powerful in America,” YAA, June 15, 2019, https://joinyaa.com/guides/how-did-car-dealerships-become-so-powerful/.

[29]. Daniel Crane, “Tesla and the Car Dealers’ Lobby” (Cato Institute, 2014), https://www.cato.org/regulation/summer-2014/tesla-car-dealers-lobby.

[30]. Robert D. Atkinson and Michael Lind, Big Is Beautiful: Debunking the Myth of Small Business (Cambridge: MIT Press, 2018), 373.

[31]. “Methodology,” OpenSecrets, accessed November 17, 2022, https://www.opensecrets.org/federal-lobbying/methodology.

[32]. Government Accountability Office (GAO), Observations on Lobbyists’ Compliance with Disclosure Requirements (Washington DC: GAO, 2018), https://www.gao.gov/assets/gao-19-357.pdf.

[33]. “CRSP/Compustat Merged Database,” Center for Research in Security Prices (CRSP), accessed November 17, 2022, https://www.crsp.org/products/research-products/crspcompustat-merged-database.

[34]. John Asker, Joan Farre-Mensa, and Alexander Ljungqvist, “Corporate Investment and Stock Market Listing: A Puzzle,” Review of Financial Studies 28, no. 2 (February 2015): 342–390. DOI: https://dx.doi.org/10.2139/ssrn.1603484.

[35]. Eric Lipton and Brooke William, “How Think Tanks Amplify Corporate America’s Influence,” The New York Times, August 7, 2016, https://www.nytimes.com/2016/08/08/us/politics/think-tanks-research-and-corporate-lobbying.html.

[36]. Showalter, “Democracy for Sale: Examining the Effects of Concentration on Lobbying in the United States,” 30.

[37]. Peter Frost, “More than splitting pills: Health Care Giant Abbott Laboratories ready to spin-off AbbVie”, The Chicago Tribune, December 30, 2012, https://www.chicagotribune.com/business/ct-xpm-2012-12-30-ct-biz-1230-bf-abbott-spin-20121230-story.html; Vanessa O’Connell, “Altria Clears Spinoff Of Phillip Morris International,” The Wall Street Journal, January 31, 2008, https://www.wsj.com/articles/SB120170329309628697.

[38]. Sabeel Rahman, “Curbing the New Corporate Power,” Boston Review, May 4, 2015, https://www.bostonreview.net/forum/sabeel-rahman-curbing-new-corporate-power/.

[39]. Robert Atkinson, “Reality Check: Facts About Big Versus Small Businesses” (ITIF, March 2021), https://itif.org/publications/2021/03/12/reality-check-facts-about-big-versus-small-businesses/.