Why Congress Should Restore Full Expensing for Investments in Equipment and Research and Development

The tax law allowing firms to fully expense their research and development (R&D) costs expired at the end of 2021, and full expensing of equipment costs will begin phasing out in 2023. This decreases firms’ incentive to invest in these key drivers of economic growth and competitiveness. Congress should restore and make permanent full expensing for these investments.

KEY TAKEAWAYS

Key Takeaways

Contents

Full Expensing: What It Is and Why It Matters 3

The Benefits of Equipment and R&D Investments 5

Introduction

As the 2017 Tax Cut and Jobs Act (TCJA) expires, two changes to the tax code will disincentivize investments in innovation and production and reduce the country’s long-term economic growth and competitiveness:

1. Full expensing of qualified equipment will start phasing out in 2023

2. A five-year amortization schedule for R&D expenses starting in 2022

By not allowing businesses to deduct the full real value of their expenditures on capital equipment and R&D from their income when filing taxes, the federal government is decreasing the financial incentive firms have to make these investments. This is especially concerning given the benefits of these investments and how they accrue to society more broadly and not just to the investing firms. Increased investments in production equipment lead to greater worker productivity and therefore wages and economic growth. R&D is necessary for the development of new products and processes that increase efficiency and well-being. Moreover, evidence suggests that the investing firms capture only a fraction of the benefits of these investments, with the rest accruing to society more broadly, and investment levels are thus below the socially optimal level. This market failure alone justifies restoring these provisions.

Doing away with these incentives also makes the United States a less attractive destination for investment, especially compared with other high-income countries. The last few decades have been marked by declines in corporate tax rates and expansions of investment subsidies across Organization for Economic Cooperation and Development (OECD) countries to become more globally competitive and attractive to multinational corporations. In an increasingly globalized world, corporate tax changes do not exist in a vacuum. Policymakers need to consider international as well as domestic effects.

Arguments in favor of doing away with full expensing of certain investments (and accelerated depreciation more generally) center primarily around the idea of minimizing “inefficient” distortions of the allocation of resources and concern about forgone tax revenue. However, market failures already ensure that a less-than-socially-optimal level of equipment and R&D investment exists, as firms are unable to capture the full returns on such activity. Thus, by providing incentives to make these investments, the government is helping correct an existing market failure. And forgone revenue is partially offset by an increased tax base resulting from greater economic growth. What is not offset can be made up for by expanding the taxes that are less likely to harm economic growth, be passed along to workers and consumers, or both, such as higher taxes on dividend income or the personal income of high-income earners.

Full Expensing: What It Is and Why It Matters

Full expensing is the ability to deduct the full value of an expense from taxable income in the year the expense occurred (or, in the case of capital equipment, the same year the equipment was placed in service). For example, if a firm purchased a $50,000 machine for its factory, full expensing allows the firm to deduct the full $50,000 from its taxable income the first year in which the machine is placed in service.[1]

This is different from how these expenses are handled for accounting and financial reporting purposes, which require that the expense be depreciated annually over the course of the machine’s working life. Specifically, reporting under generally accepted accounting principles (GAAP) usually entails using a “straight-line” depreciation schedule, which means equal values are written off each period. If the machine is determined to have a working life of ten years, the firm deducts $5,000 from its income each year in the form of depreciation expenses—at the end of the machine’s working life, the firm will have written off the full $50,000.

In both cases (full expensing and straight-line depreciation), the firm deducts $50,000 from its taxable income. So, what’s the problem? The issue stems from erosion of the actual value of the deductions due to inflation and the time value of money. Because purchasing power is eroded through inflation, and because $1 now is preferred to $1 in the future (even absent inflation), a longer or more backloaded depreciation schedule means firms can deduct a smaller share of the real value of an expense from its taxable income. This is illustrated in table 1, which compares the present real values of the scheduled depreciation expenses under a full-expensing schedule against a straight-line depreciation schedule assuming a discount rate of 5 percent (i.e., $1 now is worth the same as $1.05 a year from now, not accounting for inflation) and an inflation rate of 2 percent.

Under full expensing, since the firm can deduct the full $50,000 in the first year, it is able to deduct the full real value of the expense from its taxable income. Under a straight-line depreciation schedule, however, the deductions must be spread out in 10 $5,000 deductions. But because $5,000 in the future will be worth less than $5,000 now, those deductions decrease in real value. Thus, the depreciation expense in the final year of the machine’s working life only has a present real value of $2,697, and the present real value of the cumulative depreciation expenses is only $37,438. Under the straight-line depreciation schedule, the firm can only write off 75 percent of the present real value of the expense. The straight-line depreciation schedule therefore disincentivizes the purchase of the machine relative to the full-expensing schedule.

Table 1: Present real value of depreciation expenses under full expensing and straight-line depreciation, assuming a 5 percent discount rate and a 2 percent inflation rate

|

Period |

Full Expensing |

Straight-Line Depreciation |

|

Year 1 |

$50,000 |

$5,000 |

|

Year 2 |

$0 |

$4,669 |

|

Year 3 |

$0 |

$4,359 |

|

Year 4 |

$0 |

$4,070 |

|

Year 5 |

$0 |

$3,800 |

|

Year 6 |

$0 |

$3,548 |

|

Year 7 |

$0 |

$3,313 |

|

Year 8 |

$0 |

$3,093 |

|

Year 9 |

$0 |

$2,888 |

|

Year 10 |

$0 |

$2,697 |

|

Present Real Value of Cumulative Deduction |

$50,000 |

$37,438 |

|

Share of Real Value of Expense |

100% |

74.9% |

Prior to the temporary full-expensing provision in the TCJA, this disincentivizing effect was mitigated through “accelerated depreciation” schedules, which front-load depreciation expenses and therefore increase the real present value of the deductions a firm can claim (though this is still less than under full expensing). The current Modified Accelerated Cost Recovery System (MACRS) was introduced with the Tax Reform Act of 1986, in part to reduce the negative impact on capital investment from eliminating the prior and more generous investment tax credit. The MACRS serves two purposes: 1) it shortens depreciation schedules for many types of capital expenses, and 2) it front-loads depreciation expenses. As the table shows, both these changes increase the real value of an expense a firm can write off relative to straight-line depreciation. In 2017, the year before the TCJA’s full-expensing provision went into effect, MACRS allowed firms to write off (or “recover”) 93.8 percent of the real value of their expenses on machinery and equipment on average.[2] While this is certainly preferable to the straight-line depreciation schedule, the 6.2 percentage-point difference between 100 percent and 93.8 percent can have a large effect on firms’ investment decisions—especially those of profitable firms. Full expensing therefore incentivizes investments in equipment and machinery more than MACRS does, which in turn incentivizes investment more than straight-line depreciation does.

The Benefits of Equipment and R&D Investments

Certain types of investments, such as investments in R&D and machinery and equipment, deserve to be incentivized because of their effects on productivity, technological development, and, ultimately, economic growth.

Economists Brad DeLong and Larry Summers documented a strong positive relationship between investments in equipment and machinery and productivity growth in a 1990 paper.[3] Specifically, they found that the social return from such investments is as much as 30 percent per year, well above the private returns captured by the individual firms. The authors summarized the issue well by asserting, “The gains from raising equipment investment through tax or other incentives dwarf losses from any non-neutralities that would result.”[4]

These findings have since been widely corroborated. Jonathan Temple and Hans-Joachim Voth came to similar conclusions about the relationship between equipment investment and economic growth—particularly from the perspective of developing economies—as well as about the benefits of government intervention to subsidize such investments.[5] More recently, Mélisande Cardona et al. found a positive relationship between investments in information and communication technologies (ICTs), specifically, and economic growth.[6] Moreover, they found that this relationship has strengthened over time.

The social return from investments in equipment and machinery is as much as 30 percent per year, well above the private returns captured by individual firms.

Similarly, it is well documented that R&D yields returns that are largely captured by society and not just the investing firm.[7] While intellectual property protections rightfully secure a private return for firms, many of the rewards for such discoveries and developments go to other firms in the form of knowledge and technology spillovers; consumers in the form of lower prices and/or improved products and processes; and workers in the form of higher wages, expanded employment, or both. Economists Charles Jones and John Williams determined that the social return on R&D investments is quite large and the privately optimal level of R&D investment is at least four times lower than the socially optimal level.[8] In a subsequent paper, the two determined that this underinvestment is primarily due to firms being unable to capture the full returns of R&D and the privately optimal level of R&D investment is below the socially optimal level so long as interest rates are not very high and the tendency to turn R&D investments into new products is not very low.[9]

Tax incentives can play a role in increasing these types of investments. A recent paper finds that, among the third of firms benefitting the most from accelerated depreciation schedules between 2001 and 2011, investment flows were 15.8 percent higher, capital stocks were 7.8 percent greater, and employment was 9.5 percent higher relative to the other firms as a result of the policy.[10] The Tax Foundation estimated that making full expensing permanent would increase the United States’ capital stock by 0.7 percent, boost long-run economic output by 0.4 percent, and result in 73,000 more jobs.[11] It is more difficult to measure the effects of full expensing for R&D investments, since these expenses have been fully deductible in the first year since 1954. Nevertheless, the R&D tax credit has proven especially adept at spurring R&D activity. For every dollar in lost revenue from the R&D tax credit, at least one additional dollar is invested in R&D activity.[12]

Given the widely documented benefits of investments in capital equipment and R&D and the effectiveness of incentives in the tax code in spurring these activities, why has Congress weakened these incentives? The two primary reasons are the misguided belief that all distortions of economic activity are inherently bad and concern about forgone tax revenues.

Many economists (usually of the neoclassical school) are almost religiously opposed to any government action that may change firms’ behaviors. Free-market forces are the best allocators of resources available, they argue, and any deviation from their allocation is necessarily suboptimal. Left to their own devices, firms will surely invest the optimal amount in equipment and R&D, they say. But this directly contradicts the findings of economists over the last few decades that firms underinvest in equipment and R&D given the social returns on such investments. Absent externally imposed price signals, economic actors fail to properly internalize the effects of their actions when externalities exist—that is, when those actions directly affect others (either positively or negatively). In the case of equipment and R&D investment, this translates into suboptimal levels of investment. Defining the optimal allocation of resources to be that which maximizes societal well-being, it is clear that tax incentives to boost investments in capital equipment and R&D are optimal. As economist Aled ab Iorweth explained, “Distortions that favor the contributors to long-run growth will be welfare-enhancing.”[13]

The privately optimal level of R&D investment is at least four times lower than the socially optimal level.

While restoring full expensing would lower tax revenues (at least in present-real-value terms), this would be partially offset by an expanded tax base as a result of added economic growth. What is not offset can be accounted for by increasing and expanding different types of taxes that are not as harmful to economic growth as those on corporate income. In a 2008 review of the relevant literature, Åsa Johannson et al. determined that taxes on corporate income are most harmful to economic growth, followed by individual income taxes, consumption taxes, and property taxes.[14] Moreover, tax increases on corporate income (which a move from full expensing to accelerated or straight-line depreciation schedules represents) are largely passed on to workers and consumers in the form of lower wages and employment and higher prices.[15] More economically sound alternatives to replace the forgone revenue include higher marginal tax rates for the wealthy, higher tax rates for capital gains and dividend income, a value-added tax, and a land value tax, which would both be less harmful to economic growth and incentivize more productive uses of land.

International Competition

Tax policies should also be considered from an international point of view. In an increasingly global and mobile economy, corporate tax rates and credits should be set such that they are competitive with those of other countries. This is especially true for incentives for equipment and R&D investment. If U.S. firms receive smaller incentives to invest in productivity-enhancing capital equipment and R&D than do their foreign counterparts, they are put at an unnecessary disadvantage in the global economy. Higher domestic relative rates also incentivize large U.S. firms to shift activity overseas and make the United States a less attractive destination to foreign investments that not only would expand the country’s productive capacities but also spark more investment by domestic firms.[16]

A return to MACRS would decrease the United States’ generosity with respect to the recovery of capital expenses—on equipment, structures, and intangible capital. Thanks to the transition from accelerated depreciation to full expensing, the U.S. average capital cost recovery (CCR) rate increased from 65 percent to just under 68 percent between 2017 and 2018—that is, firms could write off 65 percent of the present real value of capital expenses (on average) as of 2017 and almost 68 percent as of 2018.[17] Without full expensing, the CCR rate would have stayed at around 65 percent.[18]

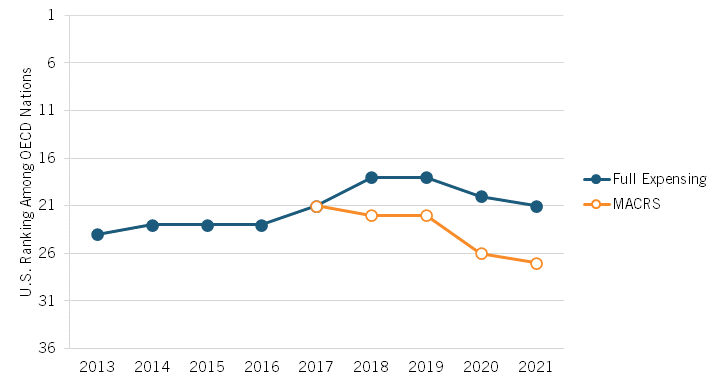

Full expensing helped the United States increase from having the 21st-highest CCR rate among the 38 OECD countries in 2017 to having the 18th-highest in 2018—that is, the United States went from having the 21st-most generous capital expensing schedule to the 18th. (See figure 1.) However, after 2019, the United States began to lose ground as other countries increased their CCR rates, and in 2021, it returned to having the 21st-highest CCR rate. But without full expensing, it would have had only the 27th-highest rate. In 2017, Estonia was the only country in the OECD with full expensing for machinery and equipment. In 2021, six OECD countries allowed full expensing of machinery and equipment: Canada, Chile, Estonia, Latvia, the United Kingdom, and the United States.

Figure 1: U.S. ranking among OECD nations in capital cost recovery rates (a lower rank implies a less generous expensing schedule)[19]

This is not to claim that the United States’ poor rankings are entirely—or even primarily—the fault of its recovery rates for equipment and machinery; the 2017 rate of 93.8 percent would rank sixth-highest in 2021. However, the past few years have been marked by a trend whereby the U.S. tax code has become less generous to business investments compared with other OECD countries. As figure 1 illustrates, a return to MACRS would only exacerbate this trend.

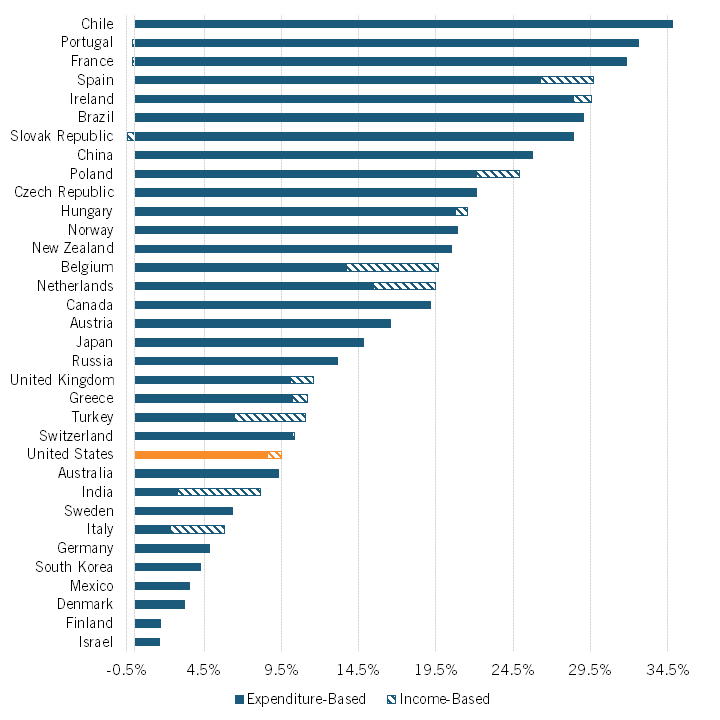

The situation is even bleaker for R&D generosity. As mentioned previously, prior to 2022, R&D expenses were fully deductible in the first year going back to 1954. Even so, the United States has one of the lowest implied tax subsidy rates for R&D among developed economies. Per a previous ITIF report, the United States had just the 24th-most generous implied R&D tax subsidy for large profitable firms out of 34 countries in 2020. (See figure 2.) The figures for large firms are especially important, as these are the firms that relocate their R&D activity based on differences between countries’ tax codes.[20] The United States’ implied rate of 9.5 percent for large profitable firms is well below the group average of 16.4 percent and the Chinese rate of 25.8 percent. Thus, rather than decreasing the tax incentives for R&D in the United States, policymakers should be expanding them to remain an attractive destination for such activity.

Figure 2: Implied tax subsidy rates for large profitable firms, 2020[21]

Policy Recommendations

Congress should permanently extend the TCJA’s full expensing provision and reinstate the full expensing of R&D expenses. Fortunately, legislation has been introduced to do just that: The ALIGN Act (S.1166 and H.R.2558), sponsored by Sen. Toomey (R-PA) and by Rep. Arrington (R-TX), would restore full expensing for qualified equipment on a permanent basis, and Sen. Hassan’s (D-NH) American Innovation and Jobs Act (S.749) would restore immediate expensing for R&D investments (not including purchases of land or property).[22] Senator Hassan’s bill also expands the R&D tax credit for small businesses and enjoys bipartisan support with 18 Republican co-sponsors. Qualifying small businesses would see the maximum credit they can claim in a year increase to $750,000 by 2032 (up from $500,000 starting next year), and their alternative simplified credit would increase to 20 percent (up from 14 percent) of R&D expenditures in excess of 50 percent of their average R&D expenditures over the last five years (up from three years).

The United States had just the 24th-most generous implied R&D tax subsidy for large firms out of 34 countries in 2020.

Conclusion

The full expensing of investments in equipment and machinery introduced under the TCJA is set to begin phasing out after this year. Also, R&D expenses must be amortized on a five-year schedule starting this year. These changes decrease the incentives firms have to invest in productivity-enhancing equipment and engage in R&D. Because these activities contribute to economic growth and technological development, they yield returns that largely accrue to society as a whole and not just to the investing firms and therefore receive too little investment as is. Rather than cutting back on tax incentives for these activities, policymakers should expand these incentives to create a more innovative, productive, and competitive economy.

Legislation has already been introduced to restore full expensing for equipment and R&D expenses on a permanent basis: the ALIGN Act (S.1166 and H.R.2558) and the American Innovation and Jobs Act (S.749), respectively. Policymakers should pass these bills and see that they are signed into law. They should also build on them to further incentivize socially desirable investments and enhance U.S. global competitiveness. Moreover, policymakers should design the tax code such that it maximizes the United States’ economic growth, competitiveness, and societal well-being.

About the Author

Ian Clay is a research assistant for ITIF’s Global Innovation team. He holds a B.S. in mathematics and economics from the University of Iowa and an M.S. in economics from the University of St. Andrews in the United Kingdom.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent, nonprofit, nonpartisan research and educational institute focusing on the intersection of technological innovation and public policy. Recognized by its peers in the think tank community as the global center of excellence for science and technology policy, ITIF’s mission is to formulate and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit us at itif.org.

Endnotes

[1]. Note that a salvage value of $0 is assumed. That is, this example assumes that the machinery cannot be scrapped and sold for some amount at the end of its working life.

[2]. Tax Foundation, Capital Cost Recovery (Final Data, Net Present Value), accessed August 31, 2022, https://github.com/TaxFoundation/capital-cost-recovery/blob/master/final-data/npv_all_years.csv.

[3]. J. Bradford DeLong and Lawrence H. Summers, “Equipment Investment and Economic Growth,” NBER Working Paper Series, no. 3515 (November 1990), https://www.nber.org/system/files/working_papers/w3515/w3515.pdf.

[4] Ibid.

[5]. Jonathan Temple and Hans-Joachim Voth, “Human Capital, Equipment Investment, and Industrialization,” European Economic Review, vol. 42 (July 1998): 1343–1362, https://www.sciencedirect.com/science/article/abs/pii/S0014292197000822.

[6]. Mélisande Cardona, Tobias Kretschmer, and Thomas Strobel, “ICT and Productivity: Conclusions from the Empirical Literature,” Information Economics and Policy, vol. 25 (September 2013): 109–125, https://www.sciencedirect.com/science/article/abs/pii/S0014292197000822.

[7]. Zvi Griliches, “The Search for R&D Spillovers,” NBER Working Paper Series, no. 3768 (July 199), https://www.nber.org/system/files/working_papers/w3768/w3768.pdf.

[8]. Charles I. Jones and John C. Williams, “Measuring the Social Return to R&D,” The Quarterly Journal of Economics, vol. 113 (November 1998), https://academic.oup.com/qje/article-abstract/113/4/1119/1916988.

[9]. Jones and Williams, “Too Much of a Good Thing? The Economics of Investment in R&D,” NBER Working Paper Series, no. 7283 (August 1999), https://www.nber.org/system/files/working_papers/w7283/w7283.pdf.

[10]. E. Mark Curtis et al., “Capital Investment and Labor Demand,” NBER Working Paper Series, no. 29485 (November 2021; revised June 2022), https://www.nber.org/system/files/working_papers/w29485/w29485.pdf.

[11]. Erica York et al., “The Economic, Revenue, and Distributional Effects of Permanent 100 Percent Bonus Depreciation” (Tax Foundation, August 2022), https://files.taxfoundation.org/20220830121826/The-Economic-Revenue-and-Distributional-Effects-of-Permanent-100-Percent-Bonus-Depreciation-v2.pdf.

[12]. Robert D. Atkinson, “The Research and Experimentation Tax Credit: A Critical Policy Tool for Boosting Research and Enhancing U.S. Economic Competitiveness” (ITIF, September 2006), https://www2.itif.org/R&DTaxCredit.pdf.

[13]. Aled ab Iorweth, “Machines and the Economics of Growth,” Canadian Department of Finance Working Paper (2005), https://publications.gc.ca/collections/collection_2009/fin/F21-8-2005-5E.pdf.

[14] Åsa Johannson et al., “Tax and Economic Growth,” Organization for Economic Cooperation and Development Working Paper, no. 620 (May 2008), https://www.oecd-ilibrary.org/content/paper/241216205486.

[15]. Scott R. Baker, Stephen Teng Sun, and Constantine Yannelis, “Corporate Taxes and Retail Prices,” NBER Working Paper Series, no. 27058 (April 2020), https://www.nber.org/system/files/working_papers/w27058/w27058.pdf; Jennifer Gravelle, “Corporate Tax Incidence: Review of General Equilibrium Estimates and Analysis,” National Tax Journal, vol. 66 no. 1 (March 2013), https://www.journals.uchicago.edu/doi/10.17310/ntj.2013.1.07.

[16]. W.N.M. Azman-Saini, Ahmad Zubaidi Baharumshah, and Siong Hook Law, “Foreign Direct Investment, Economic Freedom and Economic Growth: International Evidence,” Economic Modelling, no. 27 (2010): 1079–1089, https://www.sciencedirect.com/science/article/abs/pii/S0264999310000635.

[17]. The average capital cost recovery rates for OECD countries are provided by the Tax Foundation. They are the weighted average of the recovery rates for buildings, machinery, and intangibles, where the weights are the asset classes’ shares of the total capital stock.

[18]. This is estimated by assuming that the U.S. recovery rate for machinery is equal to 93.8 percent, the 2017 rate.

[19]. Ibid.

[20]. Bodo Knoll et al., “Cross-border Effects of R&D Tax Incentives,” Research Policy, vol. 50 (November 2021), https://www.sciencedirect.com/science/article/pii/S0048733321001268.

[21]. John Lester and Jacek Warda, “Enhanced Tax Incentives for R&D Would Make Americans Richer,” (ITIF, September 2020), https://www2.itif.org/2020-enhanced-tax-incentives-rd.pdf.

[22]. Accelerate Long-term Investment Growth Now Act, S.1166 and H.R.2558, 117th Cong. (2021–2022); American Innovation and Jobs Act, S.749, 117th Cong. (2021–2022).