How Innovative Is China in the Robotics Industry?

China does not yet appear to be leading in robotic innovation, but its domestic production and adoption are growing rapidly, and the Chinese government has prioritized the industry. It is likely only a matter of time before Chinese robotics companies catch up to the leading edge.

KEY TAKEAWAYS

Key Takeaways

Contents

Importance of Robotics and the U.S. Role. 4

China’s Robotics Industry and Market 4

Introduction

A robot is a machine that can perform complex actions automatically. With advances in both hardware and software, including artificial intelligence (AI), MEMS (micro-electromechanical system), and vision recognition, robots are becoming ever more capable and versatile. As such, they are likely to be one of the most important technologies of the next few decades. Robots are already used in a wide range of applications and industries, including manufacturing, logistics, hospitality, healthcare, construction and many other areas—and hold great promise for reversing the current global productivity slowdown.

Yet, robotics is the Rodney Dangerfield of the technology field: It gets no respect. That is a mistake because, going forward, robots increasingly will be used in most areas involving shaping, making, or moving physical items. In addition, humanoid robots will likely be adopted to help humans with a wide array of tasks. And they are an important defense and dual-use technology.

While the United States invented robotics, it is now an also-ran—at least in production—with the leading robotics companies located in engineering powerhouses of Germany, Japan, and Switzerland. However, by volume, both of production and use, China leads the world. And as with so many technologies, China has significant cost advantages. But can Chinese robotics firms innovate and reach the same level of quality as that of the world leaders? This report assesses this question.

Figure 1: A smart distribution warehouse with automated robot welding and robotic arms

Background and Methodology

The common narrative is that China is a copier and the United States the innovator. That narrative often supports a lackadaisical attitude toward technology and industrial policy. After all, we lead in innovation, so there is nothing to worry about. First, this assumption is misguided because it is possible for innovators to lose leadership to copiers with lower cost structures, as we have seen in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, and machine tools. Second, it’s not clear that China is a sluggish copier and always destined to be a follower.

To assess how innovative Chinese industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. As part of this research, we are focusing on particular sectors, including robotics.

To be sure, it is difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in robotics. First, we conducted in-depth case study evaluations of three Chinese robotics companies randomly selected from robotics companies listed on the EU R&D 2000 list. Second, we conducted interviews and held a focus group roundtable with global experts on the Chinese robotics industry. And third, we assessed global data on robotics innovation, including scientific articles and patents.

Importance of Robotics and the U.S. Role

The United States invented robotics, but like so many other industries, it lost leadership to foreign competitors, in part due to a lack of patient capital; companies in other nations were willing to invest for the long haul. Today, the leading robotics producers are in Germany, Japan, and Switzerland, with China working vigorously to catch up. According to one study, Japan accounted for 46 percent of global robotics output and 36 percent of global exports in 2022.[1] In contrast, the United States accounted for just 5.4 percent of global exports, despite having a gross domestic product (GDP) that was more than three times larger. In other words, Japan had a robot export intensity 20 times greater than America’s.

Today, there are no foundries making industrial robots in the United States. While major robotics firms such as ABB and Fanuc have a presence in the United States, most of their research and development (R&D) and advanced production takes place in their home countries. Moreover, few component suppliers are in the United States. This is why, in 2022, the United States ran a $1.26 billion trade deficit in robotics, with exports being just 28 percent of the value of imports.[2]

Notwithstanding the overall U.S. lag in robotics production, the United States is home to such companies. For example, Productive Robotics, a California-based robotics company that manufactures 95 percent of its parts in America, creates multi-axis collaborative robots that aid in automating the machining process.[3] In addition, Ingersoll Machine Tools, headquartered in Illinois, developed the Master Print Robotic, which effectively combines 3D printing and computer numerically controlled (CNC) milling into one machine. The United States also has many innovative robotics start-ups, in part because of strong software capabilities; and U.S. companies such as Rockwell Automation (an ITIF supporter) are strong on the services side of this business. Nonetheless, innovation does not always translate into production and sales leadership, especially if fast followers in other nations can quickly and effectively copy, and have a price premium.

China’s Robotics Industry and Market

According to data from the International Federation of Robotics (IFR), China is the world’s largest consumer of industrial robots. In 2021, China had installed 18 percent more robots per manufacturing worker than did the United States. And when controlling for the fact that Chinese manufacturing wages were significantly lower than U.S. wages, in 2021, China had 12 times the rate of robot use in manufacturing than did the United States. The reason for this was not market forces, but rather government policy. The Chinese Communist Party (CCP) has made manufacturing robot adoption a top priority, backing it up with generous subsidies.

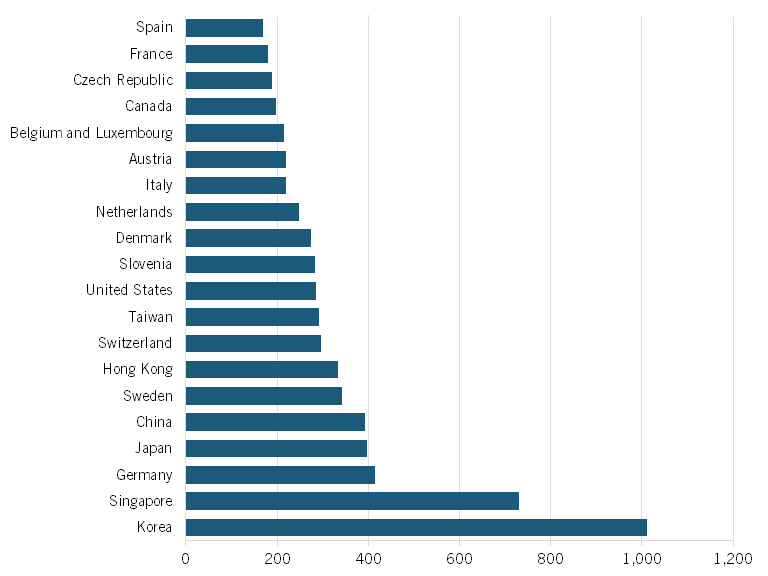

IFR provides data on robot use in manufacturing by various nations. Korea was the world’s largest adopter of industrial robots, with over 1,000 robots per 10,000 manufacturing workers, while Singapore was second with 730, followed by Japan and Germany with close to 400 each. The United States had 285 robots per 10,000 workers, while China had 392. (See figure 2.)

Figure 2: Industrial robots per 10,000 manufacturing workers, 2022[4]

But the decision to install and run a robot is usually based on the cost savings that can be achieved when a robot can perform a task instead of a human worker—and those cost savings are directly related to the compensation levels of manufacturing workers. It should therefore come as no surprise that high-wage Germany has a higher penetration rate of robots than does low-wage India. But the interesting question is how national economies perform in robot adoption when controlling for wage levels, given that the payback time for a robot gets shorter as manufacturing labor costs increase. For a full description of ITIF’s methodology on this question, see the 2018 report “Which Nations Really Lead in Industrial Robot Adoption?”[5]

In 2022, 52 percent of all industrial robots installed in the world were installed in China, up from 14 percent a decade earlier.

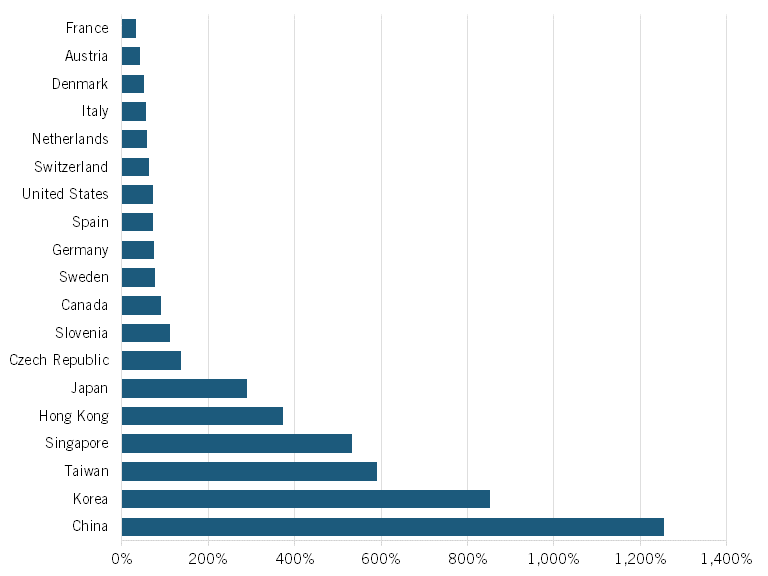

Comparing robot adoption rates as a share of the adoption rates that would be expected based on countries’ manufacturing wage levels, we can see that China leads the world with an astounding 12.5 times more robots adopted than would be expected, up from 1.6 times more in 2017.[6] (See figure 3.) The United States had just 70 percent of expected robots adoption given its manufacturing wages.

Figure 3: Actual robot adoption rate as a share of expected robot adoption rate, 2022[7]

Indeed, when it comes to robot adoption, China appears to be in a class of its own, with its national and provincial governments committing massive amounts of money to subsidize adoption of robots and other automation technology. This is one reason why, according to IFR, China has been the world’s largest market for industrial robots for eight consecutive years.[8] In 2022, 52 percent of all industrial robots in the world were installed in China, up from 14 percent a decade earlier.[9] The fact that the Chinese automobile industry is now the largest in the world is also a boon to Chinese robotic adoption, as the auto industry is a major purchaser of industrial robots.

Assessing Chinese Robotics Innovation

This enormous and rapidly growing demand for robotics in China means that most of the major Western robot manufacturers have set up production operations there, existing Chinese companies have expanded, and many new start-ups have been created.

In Shanghai, ABB and Fanuc have built the largest robot production factories in the world, with facilities even more advanced than what Fanuc has in Japan. Japan’s Yaskawa Electric Corporation has built three factories in China that can produce 18,000 units of robots annually. And if recent history is any guide, China is using this foreign investment to capture knowledge and force technology transfer to Chinese robot makers. Even when foreign investors put tight controls on intellectual property theft, there are spillover effects in terms of industrial knowledge that help Chinese firms close the innovation gap.[10]

China has many domestic robotics companies, such as Geek Robotics, Hikvision, and Blue Sword (robots for China’s military). In fact, since 2017, there have been over 3,400 robotics start-ups in China—not just industrial robots, but also autonomous mobile robots (AMRs). This was part of China’s “100 Million Robot Program.” Moreover, China has made very rapid progress in the development of robotics companies in the last year. For example, Tracxn lists 188 Chinese robotics start-ups.[11] Of the top 10, 8 have venture investors from outside China, indicating their innovative potential.[12]

Many of these start-ups are from Songshan Lake, an industrial development zone south of Dongguan, China, that has hundreds of robotics companies, both start-ups and established.[13] While some of this may be hype, one Hong Kong professor stated that “people here [at Dongguan] can develop a new tech product 5 to 10 times faster than in Silicon Valley or Europe, at one-fifth or one-fourth the cost.”[14]

Notwithstanding this growing domestic production, China is still the largest importer of industrial robots, which suggests that it is still relying heavily on foreign technologies.[15] In 2019, 71 percent of new robots in China were sourced from overseas, including from Japan, South Korea, Europe, and the United States. Core components are dominated by Japan and other firms.[16] For example, Chinese firms hold just 25 percent of the market for harmonic gear reducers. Indeed, China is dependent on many imported components. As one Chinese analyst stated, “The value of imported parts is still very high in the robots exported by China.”[17] In 2022, China exported just 36 percent of the value of robotics that it imported.[18] Another study looked at three key upstream systems going into industrial robots, robot gear reducers, robot controllers, and robot servo systems.[19] These three key inputs account for almost 70 percent of production costs of industrial robots. In 2020, these were predominantly made by foreign companies, particularly Japan, Germany, and Switzerland. The study suggests that most of China’s industrial robot firms are system integrators, performing lower-value-added work.

However, China lags behind in at least two areas. The first is software. About 80 percent of the value of today’s robotics is software, and one differentiator of robot quality and versatility is software. And China still lags behind in industrial software capabilities. As one expert we interviewed noted, “We see a lot of copycat hardware, but most of what differentiates vehicle warehouse robots, especially in terms of throughput capacity, is driven by the software capabilities, and China is behind there.” The second is integrated systems development and robotics as a service as a business model, where China is weaker than Western companies.

Moreover, many Chinese robotics companies are copiers. One expert reported that Japanese robot producer Fanuc found its foundry cast mark on a Chinese competitor’s robot. As another example, after Boston Robotics developed its dog-like walkable robot, several years later, Chinese companies copied it.

While Chinese robots generally do not match the quality of the best Western companies, they usually have a price advantage, and for many companies, particularly not in high-income countries, such a cost-quality trade-off is one worth making. For these customers who are less demanding, the low price is attractive. As one expert told us, many Chinese robots are 80 percent as good as the best foreign ones, but are much cheaper. This price point drives sales. According to Dr. Anwar Majeed, associate professor at the School of Robotics, XJTLU Entrepreneur College, “It is worth noting that its products are estimated to be 30 percent cheaper than their European and Japanese counterparts allowing them to be more attractive to rising economies.”[20] For example, Chinese firm Humanoid’s price point is around $90,000, five times less than Western firms. As one article states, Chinese robot producers are currently competing on cost.[21] Indeed, the strategy appears to be to trade quality for price to achieve scale. Gain sales at the low and medium end of the market (from the leading players) and then reinvest (along with help from the government) in higher-end, more innovative offerings.

China is, however, innovating in certain markets. For example, experts have argued that Chinese firms such as Geek and HAI are innovators in the materials handling space. Leader Drive is strong in components. Unitree is a robotics start-up moving fast to close to the gap. Their robots, such as BD, are not quite as good, but they are much cheaper, so they are adopted by universities and other organizations that do not need the same level of quality. China is also making progress in emerging areas of robotics, especially humanoid robots. China’s Ministry of Industry and Information Technology (MIIT) has announced its plan to dominate this by 2027 and is providing significant state funding to companies for this.[22] Indeed, leaders say it has a plan to, within two years, mass produce humanoid robots that can “reshape the world.”[23]

China has also used foreign acquisition to gain capabilities. Most notably, in 2016, Midea Group announced its acquisition of Germany robot maker KUKA.[24] Likewise, EFORT bought or invested in three robotics companies in Italy, including CMA, Evolut, Robox, and WFC Group.[25] Chinese industrial robot maker Estun acquired or invested in several foreign robot companies, including BARRETT (a U.S. exoskeleton drive system company) and fMAi (Germany), while partnering with a leading European robot producer, CLOOS.[26]

On the whole, it appears that China and Chinese robotic companies recognize that they need to pivot from being fast followers and copying to being innovators. One way they are doing this is by focusing on many projects that are cutting edge. Moreover, the government is forcing robotics researchers at universities to rub shoulders with companies. As such, while China is still largely a follower in robotics, it is becoming a fast follower.

At the same time, China has followed this path in other technologies to become innovation leaders. A case in point is DJI, the world-leading drone maker. DJI dominated drones by using thousands of engineers and a scale of manufacturing and R&D that was well beyond anything any other company was doing elsewhere. Similarly, as one study of Chinese robotics argues:

Upgrading trajectory of industrial robots … is similar to the development of the mobile phone sector in China: at first, the domestic firms provided slightly lower quality but much cheaper alternatives to foreign produced high-end phones; and later on, when the domestic firms accumulated enough resources, they could make significant technological breakthroughs and become internationally competitive.[27]

As such, there are different views of China’s innovative capabilities. One expert told ITIF that because of this fast progress, “China is at least on-par, and possibly ahead, of the United States and Europe in robotics. China’s firms are strong on the hardware side of robots, especially for automotive.”

One participant stated, “The Chinese companies are innovators in the materials handling space.” They’ve launched products we haven’t in the United States. HAI Robotics would be a good example. But it appears the domestic Chinese firms are getting the most penetration in the second- and third-tier markets, at least on the AMRs and robots for retail applications.”

However, another expert told us that in the field of AMRs, “China is deploying a fast follower strategy, but they are rapidly catching up. Right now, their robots aren’t as good as ours, but are much cheaper, so are being adopted by educational institutions or the less serious commercial customers. But that gap is closing.”

Another expert said that “China will be able to close the gap, just a question of how long it takes.”

One reflection of how China is not leading in terms of innovation (and quality) is the fact that foreign firms probably account for 75 percent of the Chinese robotic market today, with domestic firms about 25 percent. Core components are dominated by Japanese firms.

Innovation Data

Innovation data is useful to assess innovation capabilities but still has significant limitations. Academic publications don’t necessarily translate into commercial innovation capabilities performance. Similarly, patents don’t distinguish between high-value patents and low. Nonetheless, they can provide insights, especially with regard to trends.

China leads the world in robotics patents, accounting for 35 percent of the world’s total between 2005 and 2019.[28] By comparison, the United States accounted for about 13 percent of total robotics patents. Interestingly, a report on robotic patenting by CSET finds that 92 percent of the robotic patents filed in China are from universities, while that rate is only 8 percent in the United States.[29] In contrast, just 4 percent of robotic patents in China are filed from companies, versus 82 percent in the United States. But China files almost three times more robotic patents than does the United States. Of the top 20 organizations filing robotic patents between 2005 and 2019, none were American and 7 were Chinese.[30] However, patents filed in China are not equivalent to those in the United States, with many being lower quality. As the CSET study suggests, there is “reason to believe that for high-quality, high-quantity Chinese assignees, granted robotics patents are indeed reflective of significant robotics research/work.”[31]

China also leads in academic publishing in the field, especially in sensors/sensing. A study by the Australian Strategic Policy Institute looked at the most cited robotics research articles and found that China accounted for 27.9 percent and the United States 24.6 percent.[32] Interestingly, the United States produces slightly more robotics papers, but a greater share of the Chinese papers is among the most cited.

However, in terms of innovative products, China appears to lag behind. One publication, The Robot Report, issues an annual innovation award to the most innovative 50 robotics products globally. In 2022, just 3 were from China, while 35 were from the United States.[33] In 2023, just one was from China.[34] Some of this difference may be because the publication is based in the United States, but still, the difference is significant.

Company Case Studies

While, overall, most Chinese robotics companies seem to be copiers, there are a number of Chinese companies exhibiting innovative features and potentials. Cleaning-robots maker, Narwal, for example, was the first team to come to a Chinese robotics start-up incubator in 2015, and closed two rounds of fundraising within two months, with investors including Sequoia, Source Code Capital, Hillhouse, and ByteDance.[35] Similarly, Dongguan-based AgileX, a five-year-old start-up that manufactures robot chassis, raised over $15 million in a round of investment from top venture capitalists such as Sequoia Capital, 5Y Capital, and Vertex Ventures, a subsidiary of Singapore sovereign wealth fund Temasek.[36] Another example is SIASUN, a robotic enterprise that belongs to the Chinese Academy of Sciences. As a leading enterprise in Automatic Guided Vehicles (AGVs), SIASUN was among the first enterprises to apply AGV in real-life situations such as automobile assembling. Another Chinese research team won an international award for a robot that mimics the way various animals walk. The “robot, named Origaker, can change its shape to simulate the movement of various types of reptiles, mammals and even arthropods within a single mechanical structure.”[37] Chinese Mech-Mind Robotics, an industrial robot company, meanwhile, has formed partnerships with leading Japanese companies including Yaskawa Electric, Denso Corporation, and Kawasaki.[38]

In 2020, Chinese industrial robot maker Estun had an R&D intensity (R&D relative to revenue) of 5.9 percent, higher than ABB’s, a leading Swedish-Swiss automation corporation, whose R&D intensity was 4.2 percent.[39] Estun has also been implementing a number of overseas mergers and acquisition transactions dedicated mainly to R&D. In 2017, it acquired TRIO in the United Kingdom (motion controller), and 20 percent of Euclid Labs in Italy (visionics). Meanwhile, Leaderdrive has been lauded by the Chinese Institute of Electronics for its success in achieving breakthroughs in “bottleneck” technologies and developing robotics core technologies.[40] The company has developed long-term collaborative partnerships with several universities and was involved in four National Key R&D programs between 2017 and 2019.

ITIF examined four Chinese robotics companies in depth: Ecovacs Robotics, Beijing Roborock, Estun Automatic, and Saisun.

Ecovacs Robotics

Founded in 1998 and headquartered in Suzhou, Jiangsu Province of China, Ecovacs Robotics specializes in developing and manufacturing robotic home appliances, primarily robotic vacuum cleaners, floor cleaning robots, and window cleaning robots. Ecovacs strives to invest in technology basics for the long term—in home robotics’ R&D and its value chain of technologies from integration of chips and sensors to managing data and AI applications. Its vision is of “creating a service robot with all scenes of life, production and ecology, and bringing a brand-new experience of wisdom, convenience and humanization to all mankind.”[41]

Ecovacs has sold over 22 million robots in 145 countries around the world. It has expanded from its home market in China to establish strong sales subsidiaries in Japan, Germany, and the United States.[42] In terms of Ecovacs’s automated technology innovation, its “Smart Navi” mapping system, for example, uses lasers to map out a room and create an efficient cleaning path for its robots.[43]

Ecovacs has been investing heavily in developing its R&D capacity and strategy. Since 2006, the company has invested to develop more than 20 new robotic products each year.[44] Ecovacs employs around 1,000 engineers and holds over 1,200 patents in China and overseas.[45] In 2022, the company invested about $78 million in R&D, which accounted for 6.1 percent of expenses. With an operating income in 2021 of $18.9 billion, the company ranked first in the global sweeping robotics industry.[46] But just 36 percent of its revenue came from foreign sales in 2021.[47]

Ecovacs has also established its own research institutions dedicated to R&D and innovation. In 2018, it established the Robotics Artificial Intelligence Research Institute in Nanjing.[48] In 2022, Ecovacs launched its Innovation Model Research Institute (IMRI), the predecessor of which was the first robot-themed museum in China established in 2016.[49] IMRI is a differentiated business model for entrepreneurs and internal and external senior management groups that “aims to balance the inheritance and development of the innovative spirit and help more innovative practices to be implemented in reality.”[50] In 2023, Ecovacs signed a cooperation agreement with Huazhong University of Science and Technology to establish the Huazhong University of Science and Technology-Ecovacs Joint Research Center to conduct research in photoelectric sensors, intelligent algorithms, robot platforms, and other technical fields; promote the deep integration of scientific research and industry; and serve the national innovation-driven development strategy.[51] The two parties will jointly train doctoral (master’s) graduate students with professional degrees and jointly build postdoctoral workstations in related technical fields; meanwhile, Ecovacs will build an off-campus internship practice platform for Huazhong University of Science and Technology, developing special recruitment and talent reservation programs for students at the university.[52]

Looking at the global market of the robotics sweeping industry, leading U.S. global home service robot company iRobot dominates while Ecovacs Robotics and Stone Technology are catching up. iRobot’s share in the main consumer markets of sweeping robots in the world, such as North America, Japan, and Europe, the Middle East, and Africa, has reached 75 percent, 76 percent, and 50 percent respectively.[53] In comparison, Ecovacs Robotics’ global market share outside China is only 6 percent, suggesting that its products may lag behind the global leaders in innovation and quality.

However, the company’s products have won international innovation awards. For example, its DEEBOT X1 OMNI robot won the Consumer Electronic Show Innovation Award in 2022.[54] Ecovacs has also partnered with companies outside China in developing their products. For example, Ecovacs Robotics cooperated with Jacob Jensen Design Studio, a Nordic design firm headquartered in Denmark and with additional studios in Bangkok and Shanghai that partners with companies worldwide to develop products.[55]

Moreover, in May 2020, Ecovacs Robotics reached a cooperation agreement with iRobot Corporation.[56] According to Securities Daily, the cooperation aims to “improve the performance and comprehensive competitiveness of their respective brand products in the global market and improve the penetration rate of sweeping robots with many years of technology accumulation, engineering capabilities and patent layout in the field of product research and development.”[57] The agreement stipulates that iRobot will exclusively purchase a sweeping robot product based on Ecovacs Robotics’ design. At the same time, iRobot will license its exclusive Aeroforce technology and related intellectual property to Ecovacs Robotics.[58]

Ecovacs has reported receiving subsidies from both local and central governments, for example, $1.8 million in 2020 to support 32 projects for the purpose of stimulating technological innovation and alleviating talent shortage.[59]

Beijing Roborock Technology Co., Ltd.

Founded in 2014, Roborock also specializes in robotic sweeping and mopping devices.[60] Roborock is backed by the tech giant Xiaomi, which invested in the company a few months after its establishment; Roborock since became part of the ecological chain of Xiaomi, for which it makes automatic vacuum cleaners.[61] The company’s main products are Xiaomi’s custom-made brands Mi Home Intelligent Cleaning Robot and Mi Home Handheld Wireless Vacuum Cleaner, and its own brands Roborock Intelligent Cleaning Robot and Xiaowa Intelligent Cleaning Robot.[62]

In 2023, Roborock launched its new S7 model, S7 Max Ultra, which, according to The Verge, is a mopping and vacuuming robot with a charging base that also empties the vacuum’s bin, refills the water tank, and washes and dries the mop with warm air. The main difference aside from the warm air is that S7 MaxV uses ReactiveAI 2.0 technology to avoid clutter in homes, whereas the new S7 Max uses Roborock’s Reactive Tech. Largely, AI-powered object avoidance generally means the robot can learn specific objects to avoid, such as pet waste and socks, whereas reactive tech simply avoids any object in its path.[63]

In 2020, the company had about 9 percent share of the global robotic vacuum cleaner industry, up from 10 percent in 2017. In contrast, iRobot’s share fell from around 63 percent in 2017 to 46 percent in 2020.[64]

The core technical employees are experts with R&D experience, having worked with tech companies such as Microsoft, Huawei, Intel, Advanced Robotics Manufacturing (ARM), and Nokia.[65] In terms of R&D spending, Roborock invested $68 million in 2022, which witnessed around an 11 percent year-on-year increase. Regarding R&D personnel, over half of the company employees engage in R&D; specifically, 493 of its employees were on the R&D team as of the end of 2022, accounting for 54.5 percent of the company’s total employees.[66] As shown in its 2022 annual report, Roborock had filed 3,306 patent applications in total by the end of 2022, with 1,664 of them being granted. Among the granted patents, 451 were invention patents.[67] By late 2023, “Roborock,” had filed 730 patent applications with the World Intellectual Property Organization (WIPO), and 81 with the United States Patent and Trademark Office (USPTO).[68]

Roborock has some unique advantages in China; for example, Chinese privacy regulations and enforcement are not as strict as in most developed nations. Enterprises can use data collected by networked devices to continuously optimize AI algorithms, thus making technological progress at a faster rate.

Throughout 2022, the company’s domestic revenue accounted for 47.5 percent, and the overseas market revenue 52.5 percent. The company established divisions in the United States, Japan, the Netherlands, Poland, Germany, and South Korea, among others, opened online brand stores on Amazon, Home Depot, Target, Best Buy, Wal-Mart, and other online platforms in the United States, and gained wide consumer recognition through continuous brand investment.[69] In 2020, the company had about 17 percent of the global robotic vacuum cleaner company in the world, up from 0 percent in 2017. In contrast, iRobot’s share fell from around 63 percent in [70]2017 to 46 percent in 2020.[71]

The company’s products have won a number of international innovation awards. Time magazine had Roborock’s S7 MaxV Ultra robotic vacuum in its list of Best Inventions of 2022.[72] Its products have also been awarded the “International IF Design Award” and the “Taiwan Golden Pin Award.”[73] Roborock’s S8 Pro Ultra was named a Global Honoree of the IHA Global Innovation Awards in the Household + Home Electronics category for its innovative product design.[74] Since launching at CES 2023, the Roborock S8 Pro Ultra has won awards and accolades including “Best of CES” recognitions such as Digital Trends’ Top Tech CES 2023, TechHive’s Best of CES 2023, TWICE Picks Award, Best Products’ Best of CES, among others.[75] In March 2022, Roborock S7+ was recognized by Innovation & Tech Today, a Denver-based company specializing in commemorative publications,as a Top 50 Most Innovative Product.[76]

Estun Automatic

Estun was founded in 1993 in Nanjing and has evolved from focusing on CNC systems for machine tools to becoming a leading force in China’s industrial robot market. In 2022, Estun’s revenue was approximately $540 million, with the industrial robot business generating about 66 percent of it. The business predominantly operates in China, making up about two-thirds of its operations, while the remaining third is from international activities, mainly in Europe and Southeast Asia.

Estun offers 64 types of industrial robot products, including general-purpose six-axis robots, four-axis palletizing robots, SCARA robots, and customized robots for specific industries, with working loads ranging from 3 kg to 600 kg. The company provides over 20 categories of standardized robotic work units.

The company has undertaken several major projects from the Ministry of Science and Technology, MIIT R&D projects, as well as provincial science and technology achievement transformation projects. In 2022, Estun was designated by MIIT as a national-level specialized and new “Little Giant” enterprise.

Estun has acquired a number of foreign companies in order to gain technological capabilities. In 2016, for instance, it acquired a 20 percent stake in the Italian company Euclid, a global leader in 3D vision technology. This acquisition provided Estun with 3D vision technology for robots, steering its robot products toward intelligent robotics. In 2017, Estun acquired U.K. firm TRIO, one of the top ten global brands in motion controllers, for 15 million GBP. This acquisition gave Estun advanced multi-axis motion control technology capabilities for simultaneously managing multiple servos, vision systems, and mechanical units, allowing for the control of numerous axes, such as 64 or 128 axes. Also in 2017, Estun also invested $9 million in Barrett, a U.S. company, enhancing its robots’ human-machine collaboration capabilities and enabling intelligent functions such as learning, perception, and feedback. It also acquired the German company M.A.i for €8.87 million, leveraging its product and technology platform to transform integrated robot applications from the mid-low-end to the mid-high-end market. In 2020, Estun completed the acquisition of a 32.5 percent stake in German CLOOS, a leader in welding robots, quickly becoming a frontrunner in China’s welding robot sector through CLOOS’s technology.

Beyond its capital activities overseas, Estun has established an R&D center and manufacturing plant in Milan, Italy, while collaborating with local academic institutions on scientific research projects.

In 2022, world leading robot maker Fanuc, Estun’s Japanese peer, reported revenue of $5.7 billion and a net profit of $1.14 billion. Compared with Estun, Fanuc’s revenue was more than tenfold, with a gross profit margin in its robotics business exceeding 42 percent, significantly higher than Estun’s approximately 20 percent. Fanuc’s R&D-to-sales ratio reached 7.2 percent, 9.6 percent, and 10.3 percent of its revenue in 2020, 2021, and 2022, respectively—the same rate as Estun’s in 2022. While Fanuc’s absolute R&D expenditure is more than ten times that of Estun, its 2,100 R&D personnel is only about double that of Estun, showing the purchasing power of low R&D wages in China.

By the end of 2023, Fanuc had applied for 9,820 patents and received 4,874 authorizations. From 2014 to 2020, Fanuc’s patent applications were evenly distributed across Japan, China, the United States, and Europe. Among Estun’s patents, 371 were registered in Mainland China, while the remaining 190 were international patents, primarily in Germany and Southeast Asia. A search in the USPTO database reveals that Estun has 12 patents registered in the United States, showcasing the company’s strong emphasis on innovation and its strategic approach to safeguarding its technological advancements globally. Compared with Estun’s 561 patent authorizations, Fanuc demonstrates a more substantial patent foundation, reflecting its extensive R&D and innovation efforts across global markets.

SIASUN

Established in 2000 and headquartered in Liaoning Province, SIARSUN Robot & Automation Co., Ltd. is a listed high-tech company belonging to the Chinese Academy of Science (a government research body), mainly engaging in robotics technology and intelligent manufacturing solutions. SIASUN’s main products include industrial robots, mobile robots, and special robots. SIASUN has expanded to the global market and established overseas subsidiaries in Singapore, Thailand, Malaysia, and Germany, among other places. Overseas sales accounted for 18.6 percent of operating income in 2022.[77]

SIASUN’s main products and technologies include industrial robot, mobile robot, special robot, welding automation, assembly automation, and logistics automation. Its recent technological developments in intelligent and automated manufacturing leverage emerging technologies including robotics, 5G, AI, big data, cloud computing, and the Internet of Things.

The company invested approximately 351 million RMD ($49 million) in its R&D activities in 2022, which is around a 53 percent year-on-year increase, accounting for around 10 percent of sales. Surprisingly, in 2022, the company had 2,537 employees working in R&D, accounting for approximately 65 percent of the company’s total employees—an amazingly high number. But it only pays its R&D workers an average of $19,314 per year, which is one reason it can afford so many. However, it is likely that the company overstates the number of R&D workers it employs, as 61 percent of its R&D workers have just a bachelor’s degree, and are likely technicians rather than R&D workers. Chinese companies appear to overstate the number of R&D workers they employ, as well as the amount of R&D they conduct, in order to please the central government.

China’s Robotics Strategy

Unlike the United States, where policy generally either ignores or disparages robotics, Chinese governments have made global leadership in robotics development, production, and use a top priority. it is a top industrial priority. China understands that it is behind in robotics and still runs a trade deficit, which is why it has set a goal of moving into higher-end robotics, including humanoid robots, robots to replace workers in dangerous conditions, and high-precision industrial robots. China’s Robotics Industry Development Plan (2016–2020) set a goal for China to become the source of innovation for global robot technology and the center of a high-end manufacturing cluster with integrated applications by the year 2025—and the country’s comprehensive strength of the robotics industry is to reach the international leading level where robots become an important component of economic development, people’s lives, and social governance.[78] The Plan outlines tasks such as improving the innovation capability of the robotics industry, consolidating the industrial development foundation, increasing tax and financial support, enhancing the protection of intellectual property, strengthening the talent training systems, and deepening international exchanges and cooperation.[79]

The government has also set national goals for the use of robotics, laying out 11 key areas where it would like more robotic innovation and adoption, including in healthcare, education, and energy.[80] Overall, it set a goal of expanding robot use tenfold by 2025. As a result, many provincial governments have provided generous subsidies for firms to buy robots—although the accuracy of reported figures is perhaps dubious, as their size defies comprehension. For example, in 2018, Guangdong province planned to invest 943 billion yuan (approximately $135 billion) to help firms carry out “machine substitution.”[81] Likewise, the provincial government of Anhui stated it will be investing 600 billion yuan (approximately $86 billion) to subsidize industrial upgrading of manufacturers in its province, including through robotics.[82] To put this in perspective, it is the equivalent, on a per-GDP basis, of the United States investing $4 trillion. However, these numbers maybe wildly inflated, as the Boston Consulting Group reported that figure to be only around $6 billion in subsidies, a mere fraction of what was reported.[83] China also provides tax incentives for equipment investment.[84] And it has established its second five-year plan for the robotics industry.[85] Either way, China appears to provide greater subsidies for robot adoption than does any other nation, both in absolute terms and per robot.

Like it has done in so many other industries and technologies China is using its domestic market advantage, particularly with state-owned enterprises, to try to force more domestic consumption from domestic manufacturers over time. Indeed, there’s a broad push to localize robot production in China to securitize their economy against external shocks and geopolitical competition with the United States.[86]

The Chinese government has also established regional innovation hubs and research institutes focused on robotics that receive support from both national and provincial governments. It also incentivizes manufacturers to locate near research centers to help adopt new technology. In particular, China has copied the Manufacturing USA system and set up a number of public-private research institutes, including one in robotics. But one difference is that, in China, activities—institutes, companies, R&D players—are co-located in one place. One of these is the Dongguan robot city, where there is a government-supported robotics research institute at the core and a host of Chinese robotics companies located around it. (See figure 4.)

Figure 4: Dongguan robot city[87]

China has also established the Shenyang robotics and smart manufacturing cluster. As the Merics institute reports, the anchor tenant is “Siasun, a rising robotics company that was spun out of the Shenyang Institute of Automation (SIA), a branch of the Chinese Academy of Sciences (CAS) with a long history in robotics research.”[88] The goal of the company and the cluster is to eliminate China’s reliance on imports.

China has one other advantage: The media, academics, and government officials don’t constantly whine about robots taking jobs as they do in the United States. In China, robots are seen as critical to the future development of the nation. In the United States they are either seen as immiseration of the proletariat or “Terminator” machines. In the long run, innovation is easier in a society that welcomes robots than in one that demonizes them.

What Should America Do?

As noted, the United States appears to perform well in robotic innovation, but very poorly at robotic production. This is not a sustainable strategy, and in fact resembles the history of many advanced technologies where the U.S. innovates and other countries produce, eventually significantly reducing U.S. innovation capabilities.

The U.S. Department of Commerce should convene a robotics industry advisory group to advise the government on industry needs to be able to rebuild the U.S. robotics industry. Some of that will surely be focused on the need to rebuild our electrical and mechanical engineering university programs, especially their ability to graduate Americans. Congress and the administration need to expand funding for robotics research, especially at ARM which has completed over 120 advanced technology projects, including for new tooling, sensors, and software.

At the same time, we need companies in the United States that can scale robotics. Although some companies, such as Boston Dynamics, are trying to do that, we still need more. One key step will be to enable large American companies to buy smaller U.S. robotics firms in order to provide the patient capital needed to match China’s companies. As such, it was a major error by the EU antitrust authorities to reject Amazon’s proposed purchase of U.S. firm I-Robot. Amazon doesn’t compete in this space, so there is no competitive impact. But Amazon does have the capital to support I-Robot in its intense global battle with Chinese cleaner robots. In addition, Congress should institute a robot factory tax credit, akin to the semiconductor tax credit established in 2022, to encourage domestic and foreign companies to establish robot-producing factories in America. And the United States and allies should ban all Chinese investments in or purchases of their domestic robot companies.

But America will not restore its robotics industry if most of the demand for robotics is outside the United States. As such, Congress should increase funding for the National Institute of Standards and Technology’s (NIST’s) Manufacturing Extension Partnership (MEP) program specifically targeted to help small manufacturers adopt robotics. It should establish a tax code that rewards investment in capital equipment, ideally by instituting an investment tax credit on new machinery and equipment; and absent that, by restoring first-year expensing on capital goods investment. In addition, a higher minimum wage and less low-skill migration would provide companies with more incentives to install robots rather than hire workers at rock-bottom wages.

Finally, policymakers need to reject the anti-robot swarm that constantly complains about robots, and instead paint a robot-intensive vision for America wherein robotics plays a key role in boosting productivity, increasing safety, and enhancing quality of life.

Acknowledgment

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Other reports in this series will cover chemicals, artificial intelligence, quantum computing, semiconductors, biopharmaceuticals, consumer electronics, and autos. (Search #ChinaInnovationSeries on itif.org.)

Any errors or omissions are the author’s responsibility alone.

About the Author

Dr. Robert D. Atkinson (@RobAtkinsonITIF) is the founder and president of ITIF. His books include Technology Fears and Scapegoats: 40 Myths About Privacy, Jobs, AI and Today’s Innovation Economy (Palgrave McMillian, 2024), Big Is Beautiful: Debunking the Myth of Small Business (MIT, 2018), Innovation Economics: The Race for Global Advantage (Yale, 2012), Supply-Side Follies: Why Conservative Economics Fails, Liberal Economics Falters, and Innovation Economics Is the Answer (Rowman Littlefield, 2007), and The Past and Future of America’s Economy: Long Waves of Innovation That Power Cycles of Growth (Edward Elgar, 2005). He holds a Ph.D. in city and regional planning from the University of North Carolina, Chapel Hill.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Robotics 24/7 Staff, “World Robotics Report 2023 Shows Ongoing Global Growth in Installations, Find IFR,” Robotics 24/7, September 2023, https://www.robotics247.com/article/world_robotics _report_2023_shows_ongoing_global_growth_installations_finds_ifr; Daniel Workman, “Top Industrial Robots Exporters,” World’s Top Exports, September 2023, https://www.worldstopexports.com/top-industrial-robots-exporters/.

[2]. Trade Data, UN Comtrade Database, https://comtradeplus.un.org/TradeFlow.

[3]. Brent Donaldson and Peter Zelinski, “Made in the USA - Season 2 Episode 3: The Robots Come Home,” Modern Machine Shop, February 21, 2023, https://www.mmsonline.com/podcast/episode/made-in-the-usa---season-2-episode-3-the-robots-come-home.

[4]. International Federation of Robotics (IFR), Global Robotics Race: Korea, Singapore and Germany in the Lead (Frankfurt am Main: IFR, 2024), https://ifr.org/ifr-press-releases/news/global-robotics-race-korea-singapore-and-germany-in-the-lead.

[5]. Robert Atkinson, “Which Nations Really Lead in Industrial Robot Adoption” (ITIF, November 2018), https://itif.org/publications/2018/11/19/which-nations-really-lead-industrial-robot-adoption/.

[6]. For more on this methodology, see: Rober D. Atkinson, “Robots and International Economic Development,” (ITIF, January 2021), https://itif.org/publications/2021/01/25/robots-and-international-economic-development/.

[7]. International Federation of Robotics (IFR), “Global Robotics Race: Korea, Singapore and Germany in the Lead” (Frankfurt am Main: IFR, 2024), https://ifr.org/ifr-press-releases/news/global-robotics-race-korea-singapore-and-germany-in-the-lead; ILO Statistics, “Labor cost, Mean nominal hourly labour cost per employee by economic activity, 2015, 2022,” accessed February 16, 2024, https://ilostat.ilo.org/data/#; “International Comparisons of Hourly Compensation Costs in Manufacturing, 2016-Summary Tables,” The Conference Board, accessed February 14, 2023, https://www.conference-board.org/ilcprogram/index.cfm?id=38269; Statista, “Manufacturing labor costs per hour for China, Vietnam, Mexico from 2016 to 2020 (in U.S. dollars),” accessed February 20, 2024, https://www.statista.com/statistics/744071/manufacturing-labor-costs-per-hour-china-vietnam-mexico/.

[8]. “Understanding the new five-year development plan for the robotic industry in China” (International Federation of Robotics, January 2022).

[9]. Marina Bill et al., “World Robotics 2023” (International Federation of Robotics, September 2023), https://ifr.org/img/worldrobotics/2023_WR_extended_version.pdf.

[10]. Lauren Belsie, “The Spillover Effects of International Joint ventures in China” (National Bureau of Economic Research, No 8, August 2018), https://www.nber.org/digest/aug18/spillover-effects-international-joint-ventures-china.

[11]. “Industrial Robotics Startups in China” (Tracxn, June 2023), https://tracxn.com/d/explore/industrial-robotics-startups-in-china/__AlisTT9OisX6tlAYQyqJ68VK7u-QlZKa5JXnqyI_aPI/companies.

[12]. Unitree (Sequoia Capital and Hexagon), Agile robots (Softbank Vision Fund and Sequoia Capital), Mech Mind (Intel Capita and Sequoia Capital), Jaka Robotics (Temasek, Softbank Vision Fund, and Prosperity7 Ventures, Truelight Capital, and Aramco), Dobot (Plug and Play Tech Center and Kickstarter), Mech-Mind (Intel Capital and Sequoia Capital), MegaRobo (GGV Capital, Robert Bosch Venture Capital, Goldman Sachs Asset management, Asia investment Capital, Bosch, and Pavilion Capital Partners), and Cowarobot (Asia Investment Capital) “Industrial Robotics Startups in China” (Tracxn, June 2023), https://tracxn.com/d/explore/industrial-robotics-startups-in-china/__AlisTT9OisX6tlAYQyqJ68VK7u-QlZKa5JXnqyI_aPI/companies.

[13]. Zeyi Yang, “This Chinese city is now the Silicon Valley of robotics startups,” Protocol, August 2021, https://www.protocol.com/china/dongguan-robotics-startup.

[14]. Ibid.

[15]. Trade Data, UN Comtrade Database, https://comtradeplus.un.org/TradeFlow.

[16]. Daisy Zhang, “Why China is focused on a robotic future” (Macquarie, May 2022), https://www.macquarie.com/au/en/insights/why-china-is-focused-on-a-robotic-future.html#footnote-2.

[17]. Mark Andrews, “China’s Top 5 Industrial Robot Producers,” Direct Industry, September 2022, https://emag.directindustry.com/2022/09/29/chinas-top-5-industrial-robot-producers/.

[18]. Trade Data, UN Comtrade Database, https://comtradeplus.un.org/TradeFlow.

[19]. Shuangzhi Zhang, “Impact of industrial robot applications on global value chain participation of China manufacturing industry: Mediation effect based on product upgrading” (PLOS One, Chengdu University, November 2023), https://journals.plos.org/plosone/article/file?type=printable&id=10.1371/journal.pone.0293399.

[20]. Mark Andrews, “China’s Top 5 Industrial Robot Producers,” Direct Industry, September 2022, https://emag.directindustry.com/2022/09/29/chinas-top-5-industrial-robot-producers/.

[21]. Ibid.

[22]. Yuanyue Dang, “China says humanoid robots are new engine of growth, pushes for mass production by 2025 and world leadership by 2027,” South China Morning Post,” November 2023, https://flip.it/Q.JirV

[23]. Jyoti Mann, “China boldly claims it has a plan to mass-produce humanoid robots that can ‘reshape the world’ within 2 years,” Yahoo Finance, November 2023, https://finance.yahoo.com/news/china-boldly-claims-plan-mass-131551362.html

[24]. Papiya Basu, “Midea completes acquisition of German robot maker Kuka” (S&P Global Market Intelligence, January 2017), https://www.spglobal.com/marketintelligence/en/news-insights/trending/GJozjWvrKhepx0Jql2SsHw2.

[25]. Mark Andrews, “China’s Top 5 Industrial Robot Producers,” Direct Industry, September 2022, https://emag.directindustry.com/2022/09/29/chinas-top-5-industrial-robot-producers/.

[26]. Gary Gereffi et al., China’s new Development Strategies: Upgrading from Above and from Below in Global Value Chains (Palgrave Macmillan, 2022).

[27]. Ibid., 15

[28]. Xinmei Shen, “Rising automation power China aims to be a world robot champion by 2025” (South China Morning Post, December 2021) https://www.scmp.com/tech/policy/article/3161408/rising-automation-power-china-aims-be-world-robot-champion-2025.

[29]. Sara Abdulla, “China’s Robotics Patent Landscape” (Center for Security and Emerging Technology, August 2021), https://cset.georgetown.edu/publication/chinas-robotics-patent-landscape/

[30]. Ibid.

[31]. Ibid, p. 15

[32]. “How is China performing against Japan in Advanced Robotics” (Australian Strategic Policy Institute, Critical Technology Tracker,), https://techtracker.aspi.org.au/tech/advanced-robotics/?c1=cn&c2=jp

[33]. The three Chinese companies were Forward Robotics, Hai Robotics, and Libiao; “2022 RBR50 Robotics Innovation Award Honorees” (The Robot Report, April 2022), https://www.therobotreport.com/2022-rbr50-robotics-innovation-award-honorees/.

[34]. The one Chinese company was Tuskrobots; “2023 RBR50 Robotics Innovation Award Honorees” (The Robot Report, December 2023).

[35]. “Sequoia Leads Series C Round In Chinese Cleaning Robot Developer Narwal,” China Money Network, June 2020), https://www.chinamoneynetwork.com/2020/06/23/sequoia-leads-series-c-round-in-chinese-cleaning-robot-developer-narwal.

[36]. Ben, “‘Songling Robot’, Chassis Manufacturer develops a autonomous driving mobile robot. Completed a 100 million yuan Series A financing” (36Kr, August 2021), https://www.36kr.com/p/1337343095412743.

[37]. Lilian Zhang, “China unveils new plan for wider robot use from manufacturing to agriculture, as population shrinks,” South China Morning Post, January 2023, https://www.scmp.com/tech/policy/article/3207622/china-unveils-new-plan-wider-robot-use-manufacturing-agriculture-population-shrinks?module=inline&pgtype=article.

[38]. Editah Patrick, “Chinese Innovations Shine at International Robot Exhibition in Japan,” Cryptopolitan, December 2023, https://www.cryptopolitan.com/chinese-shine-at-robot-exhibition-in-japan/.

[39]. “Estun Automation Co. Ltd. A. Company annual report,” Wall Street Journal, https://www.wsj.com/market-data/quotes/CN/XSHE/002747/financials.

[40]. Alexander Brown, Francois Chimits, and Gregor Sebastian, “Accelerator state: How China fosters ‘Little Giant’ companies,” Merics, https://merics.org/en/report/accelerator-state-how-china-fosters-little-giant-companies.

[41]. Ecovacs, “About, Brand Story,” 2023, https://www.ecovacs.cn/about/brand-story.

[42]. Ibid.

[43]. Ibid.

[44]. Ibid.

[45]. Ibid.

[46]. Huaan Securities, “Ecovacs Research Report 2022: Global leader in home service robots and smart living appliances” (Vzkoo, November 2022), https://www.vzkoo.com/read/2022110137aa2a17fdb02f6fb375e68c.html.

[47]. Ibid.

[48]. “Ecovacs Robotics Nanjing Artificial Intelligence Research Institute was officially established to build an innovation platform for top talents in the industry” (Ecovacs, July 2018), https://www.ecovacs.cn/news/detail-800.html.

[49]. “Metaverse insight into the future | Directly hit the launch site of the Ecovacs Group Innovation Model Research Institute” (Ecovacs, November 2022), https://mp.weixin.qq.com/s/_kaIapq1UZ4pFE2MYHzGYw (note: the article was posted by Ecovacs’s official account on WeChat).

[50]. Ibid.

[51]. Pacific Computer Network, “Ecovacs Robotics and Huazhong University of Science and Technology reached a cooperation to jointly carry out research on robot technology and industrial innovation” (Sina Weibo, March 2023), https://finance.sina.com.cn/tech/roll/2023-03-14/doc-imykvkrx8464951.shtml (note: the article was originally posted on Sina Weibo in mandarin.).

[52]. Ibid.

[53]. Ibid.

[54]. “The DEEBOT X1 OMNI from Ecovacs is a smart home robot that intelligently and deeply cleans, like nothing seen before. Designed by Jacob Jensen Design Studio, the premium X1 OMNI includes a floor cleaning robot with an OMNI Station for auto-cleaning & auto-emptying. It intelligently vacuums, mops, empties, fills and cleans itself - and takes user commands via natural language processing (NLP) - without a third-party device. Add in advanced vacuuming & mopping, mapping and navigation technology, and it’s truly a hands-free” in “CES 2022 Innovation Award Product: Deebot X1 OMNI” (Consumer Technology Association) https://www.ces.tech/innovation-awards/honorees/2022/honorees/d/deebot-x1-omni.aspx.

[55]. Jacob Jensen Design Studio, “About,” 2023, https://jacobjensendesign.com/about.

[56]. Chen Hong, “Ecovacs Robotics and American giant IROBOT have joined forces to reshape the competitive landscape of the industry” (Ecovacs, May 2020), http://www.zqrb.cn/gscy/gongsi/2020-05-24/A1590198511275.html.

[57]. Ibid.

[58]. Ibid.

[59]. “Ecovacs Robotics Co., Ltd. Announcement on receiving government subsidies,” Securities Daily, September 2020, http://static.sse.com.cn/disclosure/listedinfo/announcement/c/2020-12-25/603486_20201225_1.pdf.

[60]. Financial Times, “Beijing Roborock Technology Co Ltd, About the company,” Financial Times, 2023, https://markets.ft.com/data/equities/tearsheet/profile?s=688169:SHH; Roborock, “About Us” (2023) https://global.roborock.com/pages/about-us.

[61]. Financial Times, “Beijing Roborock Technology Co Ltd, About the company,” Financial Times, 2023, https://markets.ft.com/data/equities/tearsheet/profile?s=688169:SHH.

[62]. Ibid.

[63]. Jennifer Pattison Touhy, “These robot vacuums are getting smarter / New models from Roborock and Ecovacs can dry their robotic mops and lift them higher. Plus, the new Q Revo brings oscillation to the floor.,” The Verge, June 2023, https://www.theverge.com/2023/6/1/23745238/roborock-ecovacs-deebot-new-robot-vacuum-models-price-specs-release-date.

[64]. “Robot Vacuum Cleaner Market share worldwide from 2014 to 2020, by brand,” Statista, https://www.statista.com/statistics/934089/worldwide-robotic-vacuum-cleaner-market-share/.

[65]. “Roborock won the 2021 Outstanding Listed Company Award” (Hexun Securities, December 2021), http://stock.hexun.com/2021-12-10/204909008.html# (Note: the article was reposted by Hexun Securities in mandarin).

[66]. “Beijing Roborock Technology Co., Ltd. 2022 Annual Report” (Roborock, April 2023), 26, 30, http://static.sse.com.cn/disclosure/listedinfo/announcement/c/new/2023-04-27/688169_20230427_FZSB.pdf.

[67]. Ibid., 26.

[68]. “Roborock” (WIPO PATENTSCOPE, July 2023), https://patentscope.wipo.int/search/en/result.jsf?_vid=P10-LKQY8T-01030; “Roborock” (USPTO, July 2023), https://ppubs.uspto.gov/pubwebapp/static/pages/ppubsbasic.html.

[69]. “Robot Vacuum Cleaner Market share worldwide from 2014 to 2020, by brand,” Statista, https://www.statista.com/statistics/934089/worldwide-robotic-vacuum-cleaner-market-share/.

[70]. Ibid.

[71]. Ibid.

[72]. Guadalupe Gonzalez, “Beyond a Robot Vacuum, Roborock S7 MaxV Ultra,” TIME, November 2022, https://time.com/collection/best-inventions-2022/6224870/roborock-s7-maxv-ultra/.

[73]. “Roborock won the 2021 Outstanding Listed Company Award” (Securities Star, December 2021), http://stock.hexun.com/2021-12-10/204909008.html# (Note: the article was reposted by Hexun Securities in mandarin).

[74]. “Announcing the 2023 gia Winners for Product Design” (The Inspired Homes Show, March 2023), https://www.theinspiredhomeshow.com/blog/announcing-the-2023-gia-winners-for-product-design/.

[75]. “Roborock Honored With IHA Global Innovation Award For Excellence In Product Design At The Inspired Home Show 2023” (PR Newswire, March, 2023), https://en.prnasia.com/releases/global/roborock-honored-with-iha-global-innovation-award-for-excellence-in-product-design-at-the-inspired-home-show-2023-397579.shtml.

[76]. “Innovation & Tech Today” (LinkedIn, 2023), https://www.linkedin.com/company/innovation-&-technology-today; “Roborock S7+ Earns “Top 50 Most Innovative Products” Award” (AI Tech Park, PR Newswire, March 2022), https://ai-techpark.com/roborock-s7-earns-top-50-most-innovative-products-award/.

[77]. SIASUN, “SIASUN 2022 Annual Report,” April 2023, 20, https://www.szse.cn/disclosure/listed/bulletinDetail/index.html?e76ae556-418c-4c9b-8b70-302d182cc59c.

[78]. Ibid.

[79]. Ibid.

[80]. Lilian Zhang, “China unveils new plan for wider robot use from manufacturing to agriculture, as population shrinks” (South China Morning Post, January 2023), https://www.scmp.com/tech/policy/article/3207622/china-unveils-new-plan-wider-robot-use-manufacturing-agriculture-population-shrinks?utm_source=rss_feed.

[81]. Xinhua, “China’s Guangdong province invests billions in robot factories,” Global Times, March 2015, https://www.globaltimes.cn/content/914262.shtml.

[82]. Department of Human Resources and Social Security of Anhui Province, September 2023, http://english.ah.gov.cn/content/detail/581009cc8513f3e1bf1991df.html.

[83]. Justin Rose et al., “Advancing Robotics to Boost US Manufacturing Competitiveness” (BCG, October 2018), https://www.bcg.com/publications/2018/advancing-robotics-boost-us-manufacturing-competitiveness.

[84]. “China, People’s Republic of” (PWC Worldwide Tax Summaries, January 2024), https://taxsummaries.pwc.com/peoples-republic-of-china/corporate/tax-credits-and-incentives.

[85]. Business Advisory Section, “China Releases 14th Five-Year Plan for Robotics Industry” (HKTDC Research, January 2022), https://research.hktdc.com/en/article/OTYwODcyNDY2.

[86]. Jing Zhao and Gary Gereffi, “Upgrading of Chinese Domestic Firms in Advanced Manufacturing: Evidence from Industrial Robots and High-Tech Medical Devices” (Duke, September 2022), https://dukespace.lib.duke.edu/items/d65b818d-19ae-4916-815f-ce7690f9f0d6.

[87]. “‘Robot City’ in Dongguan: they can do everything” (Dongguan Today, May 2022), https://twitter.com/DongguanZ/status/1527919934210158593/photo/.

[88]. Jeroen Groenewegen-Lau and Michael Laha, “Controlling the innovation chain” (Mercator Institute for China Studies, February 2, 2023), https://merics.org/en/report/controlling-innovation-chain.