Big Announcements, Small Results: FDI Falls Yet Again

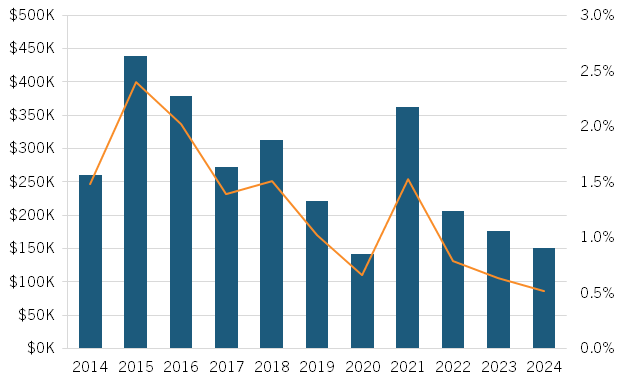

For the third year in a row, foreign direct investment (FDI) into the United States has dropped sharply, according to new data from the Bureau of Economic Analysis (BEA). Despite continued expectations for FDI to bounce back following several investment announcements from large firms such as TSMC, Hyundai, and LG, FDI has fallen by 14 percent since 2023, contributing just 0.5 percent to U.S. gross domestic product (GDP). In absolute terms, inward U.S. FDI totaled $151 billion, down from $176 billion last year, marking one of the steepest downturns in U.S. foreign investment in recent years, even as policymakers highlight efforts to attract new capital (figure 1).

Figure 1: Inward FDI, 2014-2024

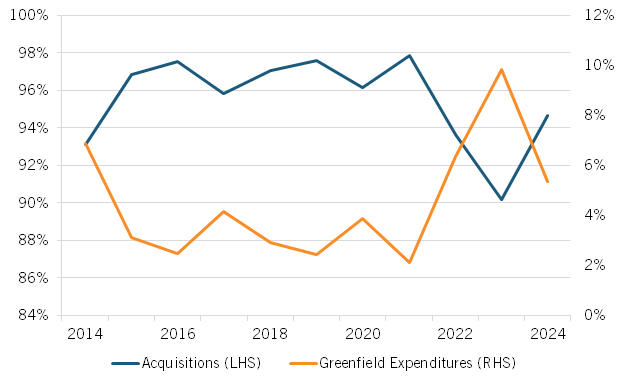

Moreover, not only is overall investment down, but greenfield investment has also collapsed. Greenfield investment, as part of overall FDI, is an investment in the establishment or expansion of foreign business operations within the United States, and it presents additional benefits beyond simple acquisitions of foreign businesses. Greenfield investments result in greater job growth and increased capital stock, which has a positive effect on productivity and thus a catalytic impact on economic growth.

Yet, greenfield FDI has declined sharply. After experiencing a resurgence last year, greenfield investment has fallen from nearly 10 percent of total FDI to about 5 percent (figure 2).

Figure 2: Acquisitions vs. greenfield investment (as a percentage of total FDI)

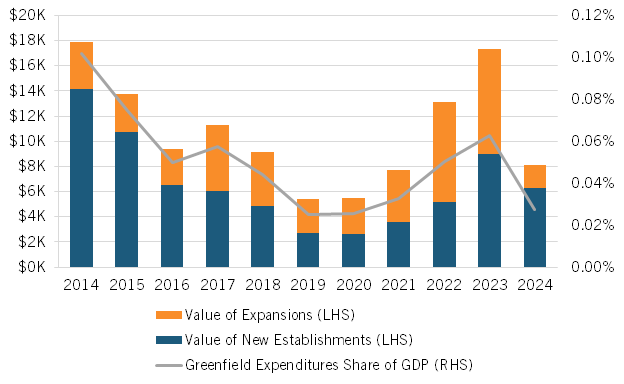

In absolute terms, greenfield investment has plunged from over $17 billion to $8 billion, with the majority of this reduction in business expansions, which fell by 78 percent over the last year. Greenfield investment in the form of new establishments also declined. As a percentage of GDP, greenfield investment has fallen to just 0.03 percent of GDP.

Figure 3: Greenfield investment by type (millions of dollars)

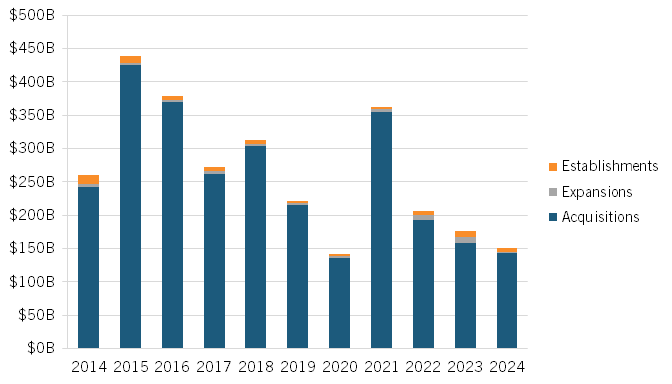

Make no mistake, acquisitions are still a valuable and necessary piece of FDI composition in the United States. Acquisitions represent the bulk of foreign investment and constitute an irreplaceable tool for U.S. economic growth. Acquisitions can deliver quicker returns, making them more appealing to foreign investors. They often boost a firm’s productivity, driving additional growth. However, acquisitions have also been declining since 2021, reaching a recent low of $143 billion (figure 4).

Figure 4: Total FDI investment by type

But how is investment declining even as businesses have been announcing billions of dollars in U.S. investments? The answer has to do with the way the BEA collects its data. The BEA collects investment data when the investments actually occur, meaning that even if a company announces a $50 billion investment in an automobile factory in South Carolina, the investment won’t be counted by the BEA until the money is spent. Since greenfield investments often take years to complete, the totality of the investment may not be recorded in a single year, but over several years.

Of the investments that have been made in 2024, nearly half ($68 billion) have come from the manufacturing industry. Within manufacturing, the chemical and pharmaceutical industries were the largest contributors. Meanwhile, only $526 million, or 0.3 percent of total FDI, was invested in the semiconductor industry despite major announcements from several firms.

Going forward, businesses will most likely continue to announce large investments in the United States, especially considering President Trump’s push to increase domestic manufacturing capabilities. Until high profile announcements translate into actual capital flows, the much-anticipated surge in FDI will remain more rhetoric than reality.

Related

September 11, 2023