Biden’s Assertion of Excessive Biopharma Industry Concentration Is a Flawed Rationale for a Flawed Policy

The Biden administration released a suite of proposals on December 7 with the purported intent of cracking down on “Big Pharma” and practices such as “price gouging” that it says make drugs too expensive for Americans. But the actual effect of the administration’s proposals will be to significantly undermine America’s world-leading life-sciences innovation system, particularly by disrupting 40 years of established practice under which march-in rights in the Bayh-Dole Act could not be used on the basis of prices. ITIF will have more to say in coming days about the consequences of twisting Bayh-Dole, but for now it’s also worth noting that one of the administration’s justifications for these proposals—the assertion that America’s biopharmaceutical industry is excessively concentrated—is wholly fallacious.

The administration palpitates that America’s 25 largest pharmaceutical companies command around 70 percent of industry revenues. Yet that is hardly evidence of an overconcentrated market. To see one that truly is, just look at the pharmacy benefit managers (PBM) market, where just four companies—Express Scripts, OptumRx, Prime Therapeutics, and Kaiser Pharmacy—commanded 68 percent of the revenue in 2021. That’s a concentrated market; America’s pharmaceutical sector is not.

Moreover, America’s biopharmaceutical industry has, if anything, gotten less concentrated over time. For instance, in 2006, the top 10 U.S. drug producers accounted for 56 percent of global sales in the industry, while the top 60 U.S. producers accounted for 92 percent. But by 2019, the top 10 U.S. producers accounted for 43 percent, and the top 60 accounted for 86 percent.

Further, consider the combined output (not imports) for U.S. firms in the in the pharmaceutical preparation manufacturing industry and the biological product manufacturing industry (NAICS codes 325412 and 325414, respectively). Data from the U.S. Census Bureau’s 2020 Economic Census shows the sales for the top four in each industry (the C4 ratio) increased only modestly from 36 percent in 2002 to 43 percent in 2017. Meanwhile, the C8 ratio increased from 54 to 58 percent, and the C20 ratio fell slightly from 77 percent to 76 percent.

Moreover, given that drugs are sold internationally, a more accurate measure of market concentration should take into account all drug firms. In 2019, the top 4 firms globally had just 21 percent of the market; the top 8 had 37 percent; and the top 20 had 64 percent. While the C4 and C8 ratios were up slightly from 2006, when they were still just 18 percent and 31 percent, respectively, and the C20 ratio actually fell to 64 percent.

So, the Biden administration is flat wrong that America’s biopharmaceutical industry is excessively concentrated. It’s also flat wrong that U.S. drug prices are rising out of control. For instance, data released by Drug Channels found that brand-name drugs’ net prices dropped in 2022 for an unprecedented fifth consecutive year and, after adjusting for overall inflation, brand-name drug net prices fell by almost 9 percent in 2022.

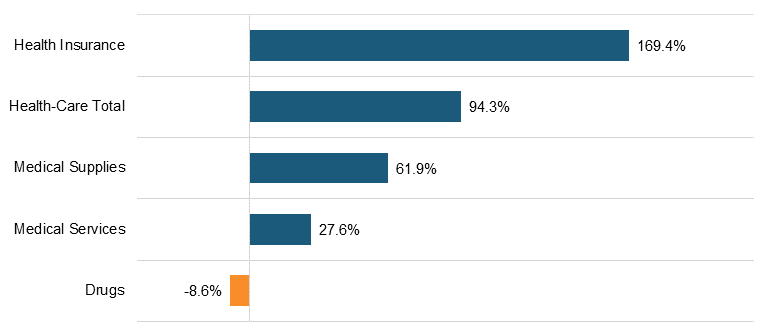

Nor is this recent trend unique. In fact, as calculated by the U.S. Bureau of Labor Statistics, Americans’ reported expenditures on health insurance increased by over 160 percent from 2005 to 2020, while their total health-care expenditures increased 94 percent. But consumer expenditures on drugs actually fell by almost 9 percent over that period. (See figure 1.)

Figure 1: Percent change in consumers’ reported health-care expenditures, 2005–2020

The administration’s new proposals represent yet another salvo on behalf of “drug populists” to discredit the successful private-sector-led industry model that has made America the world leader in biopharmaceutical innovation. The goal of such efforts is to fundamentally transform America’s drug development system through strict price controls, weakened patents, or a government-run drug-development system, any of which would slow the development of new life-saving drugs.

In essence, drug populists champion a redistributionist agenda that values drug prices over drug innovation and are willing to advance alarmist concentration theories in service of their cause. Such advocates frame the issue as “cheaper drug prices today in exchange for lower drug company profits.” But because America’s life-sciences industry is the world’s most R&D-intensive and depends on profits from one generation of innovations to finance investment in the next, the real tradeoff is between cheaper drugs today and fewer drugs tomorrow.

It’s a tradeoff the drug populists continuously refuse to recognize. It’s thus perhaps not a surprise that the Biden administration has elected to use a wholly flawed rationale as the justification for a wholly flawed policy.