Why Healthy Trade Relations Matter for Advanced-Technology Industries

Global trade is key to U.S. competitiveness in many advanced traded sectors that have high fixed costs for R&D and engineering. Trade lets firms in these industries access larger markets to achieve scale economies, decrease marginal costs, and gain customer feedback. Healthy trade relations are therefore essential to national competitiveness in advanced industries because access to global markets gives firms a strong incentive to continue producing and innovating.

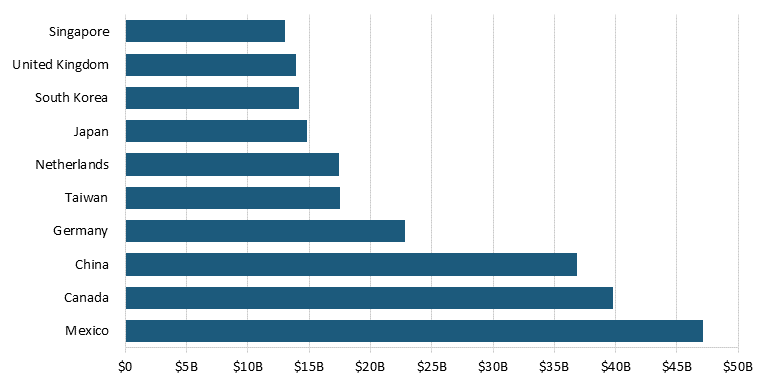

In 2021, the United States exported $391 billion in advanced-technology products (ATP) around the globe. Of that $391 billion, $124 billion (32 percent) was to three trading partners: Mexico, Canada, and China. (See figure 1.) More than half of exports in advanced-technology products went to just 10 nations. The United States needs to maintain uninhibited market access with these and other nations because strategically important advanced industries rely on selling products there to maintain their global competitiveness.

Figure 1: Top importers of U.S. advanced-technology products

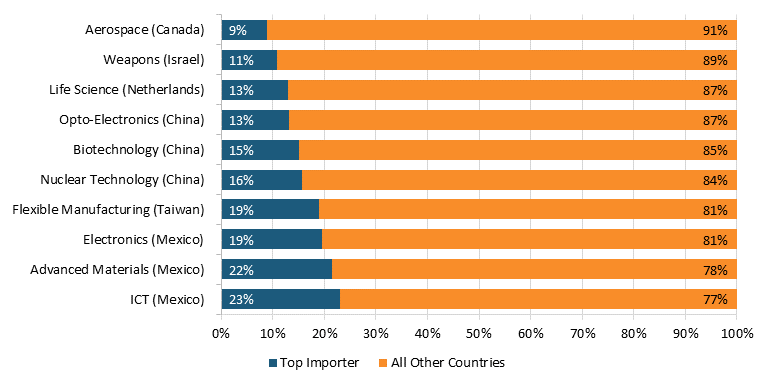

For 10 of America’s most strategically important advanced industries, ranging from aerospace to biotechnology, there were six nations in 2021 that served as top export markets: China, Israel, Canada, Mexico, Taiwan, and the Netherlands. (See figure 2.) Mexico was the top importer of advanced-technology products from three U.S. industries, accounting for 21.6 percent, 19.5 percent, and 23.1 percent of U.S. ATP exports of advanced materials, electronics, and information and communications products and services, respectively. All other top advanced-technology trading partners accounted for between 8.9 percent and 18.9 percent of ATP exports in at least one of the other seven top U.S. advanced-technology industries. Prioritizing healthy trade relations with these countries while opening up market access to other potential trading partners will be key to maintaining competitiveness in advanced industries.

Figure 2: Share of U.S. advanced-technology exports to the top importer (in parentheses), 2021

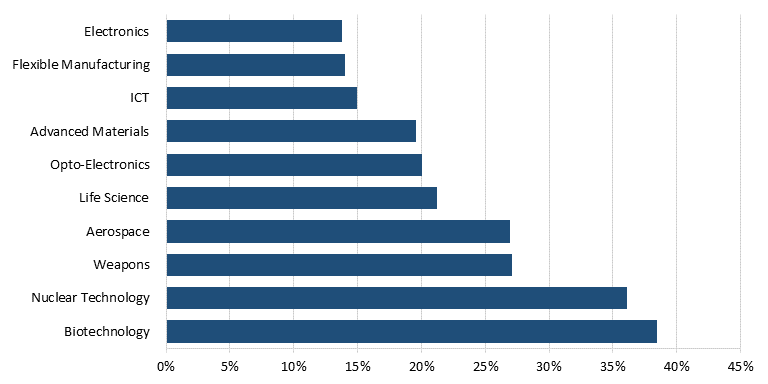

The European Union is also a key trading partner for U.S. advanced-technology industries. In 2021, it accounted for at least 14 percent of exports for all of the 10 advanced industries covered in this analysis, and as much as 38 percent. (See figure 3.) America’s biotechnology and nuclear industries shipped more than one-third of their respective exports to the European Union, while the weapons and aerospace industry exported almost 30 percent.

Figure 3: EU share U.S. advanced-technology exports

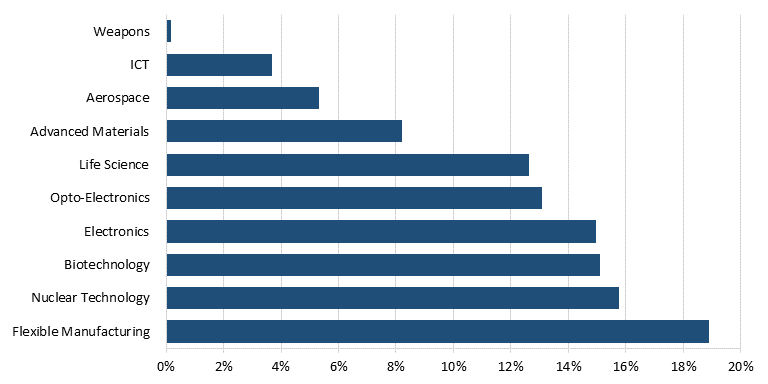

Although the United States has strong relations with five of the aforementioned top-importer countries, and with the EU, its trade relations with China are tense, partly because of China’s innovation mercantilist policies. Limited access to the Chinese market is detrimental to U.S. competitiveness because China is the top importer for three of the advanced-technology industries covered here, and it is among the top three importers for seven of these industries.

In the flexible manufacturing, nuclear technology, and biotechnology industries, China took in at least 15 percent of exports, thus accounting for a sizeable share of the sales these industries rely on to fund the development of their next generations of advanced technologies. (See figure 4.) This underscores why it is important to push China harder to open its markets to U.S. advanced industries, which entails striking the right balance with U.S. export control policies to achieve national security goals while limiting damage to U.S. exports as much as possible.

Figure 4: China’s share of U.S. advanced-technology exports

U.S. global market share for advanced-industry sectors has been declining, as ITIF showed last year in “The Hamilton Index: Assessing National Performance in the Competition for Advanced Industries.” From 1995 to 2018, U.S. global market shares declined in five critical industries: pharmaceuticals; computer, electronic, and optical products; machinery and equipment; motor vehicles; and electrical equipment. ITIF is set to publish an expanded update of the Hamilton Index next month, which will show little improvement overall.

It is important for U.S. policymakers to help these industries win back market share. One way to do that is to maintain good relations with trading partners so firms in these industries have sufficient access to global markets to incentivize further innovation, growth, and competitiveness in the global economy. Otherwise, these industries will stagnate, hurting future exports, innovation, and jobs in the U.S. economy.