Comments to the National Institutes of Health on “Maximizing NIH’s Levers to Catalyze Technology Transfer”

Contents

The History of U.S. Life Sciences Competitiveness. 2

Innovative U.S. Tech-Transfer and Commercialization Policies. 6

Bayh-Dole March-In Rights Were Never Intended to Address Drug Price Concerns 9

Applying March-In Rights to Address Pricing Would Lead to Significantly Reduced Innovation. 11

Introduction and Summary

This submission represents the views of the Information Technology and Innovation Foundation (ITIF), a non-profit, non-partisan think tank focused on the intersection of technological innovation and public policy. ITIF offers them in response to a “Workshop on Transforming Discoveries Into Products: Maximizing NIH’s Levers to Catalyze Technology Transfer” held on July 21, 2023, to which the National Institutes of Health (NIH) subsequently solicited public comment.[1]

Broadly, ITIF contends that the technology transfer regime the United States has implemented over the past four decades, largely as enabled through the Bayh-Dole Act, has been tremendously effective in stimulating innovation, especially in the life-sciences. While all such processes should be continuously streamlined or tweaked where improvement is possible, the current system is not nearly broadly in need of serious modification or reform, which would likely be counterproductive to a largely well-functioning technology transfer dynamic that effectively transmits technologies to private-sector companies, especially entrepreneurial small businesses, which are willing to assume the risk and expense of turning NIH-supported inventions into useful therapies. This matters especially in light of new ITIF research finding that America is home to 85 percent of the world’s small, research-intensive biopharma firms.[2] Such companies account for nearly two-thirds (66 percent) of U.S. biopharmaceutical firms, have an average R&D intensity of 62 percent, and account for more than seven in ten drug candidates currently in Phase III clinical trials.[3]

The History of U.S. Life Sciences Competitiveness

The United States has come to be the world’s leader in life-sciences innovation, as it is across a number of advanced-technology industries. Indeed, in every five-year period since 1997, the United States has produced more new chemical or biological entities than any other country or region in the world. From 1997 to 2016, U.S.-headquartered enterprises accounted for 42 percent of new chemical or biological entities introduced in the world, far outpacing relative contributions from European Union (EU) member countries, Japan, China, or other nations.[4] Moreover, the United States has become the world’s largest funder of biomedical research and development (R&D) investment in recent decades, with one (2008) study estimating that the U.S. share of global biomedical R&D funding reached as high as 80 percent over the preceding two decades.[5] Put simply, since the start of this millenium, U.S.-headquartered biopharmaceutical enterprises have accounted for almost half of the world’s new drugs.

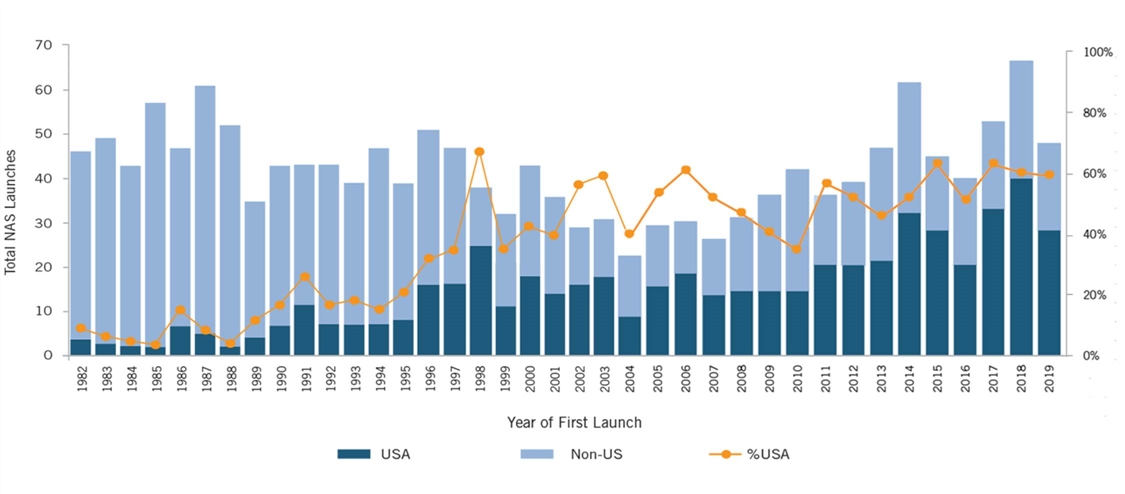

But U.S. leadership in life-sciences innovation wasn’t always a given; in fact, for most of the post-World War II-era, the United States was a global “also-ran” in life-sciences innovation. Between 1960 and 1965, European companies invented 65 percent of the world’s new drugs, and in the latter half of the 1970s, European-headquartered enterprises introduced more than twice as many new drugs to the world as did U.S.-headquartered enterprises (149 to 66).[6] In fact, throughout the 1980s, fewer than 10 percent of new drugs were introduced first in the United States.[7] (See Figure 1.) America wasn’t inventing new-to-the world drugs, let alone getting them to its citizens first.

Figure 1: U.S. share of new active substances launched on the world market, 1982–2019[8]

That the United States subsequently flipped the script and has become the world’s life-sciences innovation leader has not been accidental or incidental. Rather, as ITIF argues in “Why Life-sciences Innovation Is Politically Purple,” U.S. life-sciences leadership today is rather the result of a series of conscientious and intentional public policy decisions designed to make America the world’s preeminent location for life-sciences research, innovation, and product commercialization.[9] The United States did so with robust and complementary public and private investment in biomedical R&D; supportive incentives, including tax policies, to encourage biomedical investment; robust intellectual property (IP) rights; an effective regulatory and drug-approval system; a drug-pricing system that allows innovators to earn sufficient revenues to enable continued investment into future generations of biomedical innovation; and, lastly, the world’s best system to support technology transfer and commercialization, especially with regard to translating technologies stemming from federally funded R&D to the private sector.

World-Leading Public and Private R&D Investment

America’s world-leading life-sciences innovation policy environment starts with world-leading levels of public and private investment in R&D.[10] For instance, in fiscal year (FY) 2022, America’s National Institutes of Health invested the majority of its $45 billion of appropriations into research that seeks to enhance life while reducing illness and disability.[11] Meanwhile, America’s life-sciences industry is the single most R&D-intensive industry in the world, in 2019 investing nearly one-quarter of its revenues in back into R&D, and in 2020 investing $122 billion in R&D.[12] In total, companies in global health industries invested about €235 billion ($255 billion) in R&D in 2021, accounting for 21.5 percent of total business R&D expenditure worldwide.[13]

But it’s not just that America’s public and private sectors lead the word in investing in biomedical research, it’s that these public and private R&D investments and activities are highly complementary—and indispensable—to America’s successful life-sciences innovation system. Historically, public-sector researchers have performed the upstream, earlier-stage research elucidating the underlying mechanisms of disease and identifying promising points of intervention, whereas corporate researchers have performed the downstream, applied research resulting in the discovery of drugs for the treatment of diseases and have carried out the development activities necessary to being them to market.[14] Federally funded basic life-sciences research tends to be concentrated in the basic science of disease biology, biochemistry, and disease processes, with a major goal of the research being the identification of biomarkers and biologic targets that new drugs could treat.[15] While the private sector does invest in basic scientific research, including at U.S. universities, the preponderance of its activity is applied R&D focused on the discovery, synthesis, testing, and manufacturing of candidate compounds intended to exploit biologic targets, for the purpose of curing medical conditions.[16]

A number of studies have elucidated this dynamic. For instance, a 2000 study by the U.S. Senate Joint Economic Committee found that, “Federal research and private research in medicine are complementary. As medical knowledge grows, federal research and private research are becoming more intertwined, building the networks of knowledge that are important for generating new discoveries and applications.”[17] Similarly, as an Organization for Economic Cooperation and Development (OECD) study asserted, “It is particularly important for government-funded research to continue to provide the early seeds of innovation. The shortening of private-sector product and R&D cycles carries the risk of under-investment in scientific research and long-term technologies with broad applications.”[18]

Similarly, a 2017 National Bureau of Economic Research study examined whether there was evidence of NIH investments either “crowding out” or “crowding in” private-sector investment. As the authors wrote, their findings were “consistent with the absence of crowd out” and “suggest that NIH funding spurs private patenting by either increasing total firm R&D expenditure or increasing the efficiency of these expenditures.”[19] Additionally, they wrote, “Even if NIH funding crowds out some private investment, it is offset by increases in the number of patents related to NIH funding through indirect citation channels, or by increases in the productivity of private R&D investments.”[20]

Concurring findings were reported in a 2012 Milken Institute study, which found that $1 of NIH funding boosted the size of the bioscience industry by $1.70 and that the long-term impact may be as high as $3.20 for every dollar spent.[21] Likewise, a 2013 report by Battelle found that, looking solely at federal support for the Human Genome Project between 1988 and 2012, every dollar of federal funding helped generate an additional $65 dollars in genetics-related private activity.[22] Rutgers University Professor A.A. Toole identified a quantifiable correlation between investment in publicly funded basic research and corporate-funded applied research wherein an increase of 1 percent in the funding of public basic research led to an increase of 1.8 percent in the number of successful applications for new molecular entities (compounds that have not been approved for marketing in the United States) after a lag of about 17 years. Toole concluded that a $1 investment in public-sector basic research yielded $0.43 in annual benefits in the development of new molecular entities in perpetuity—a remarkable return on investment.[23]

In short, as Chakravarthy et al. aptly conclude in a 2016 study, “Industry’s contributions to the R&D of innovative drugs go beyond development and marketing and include basic and applied science, discovery technologies, and manufacturing protocols”…“without private investment in the applied sciences there would be no return on public investment in basic science.”[24]

Oher Factors Contributing to U.S. Life Sciences Leadership

Other factors have contributed substantially to U.S. life-sciences leadership. For instance, the United States’ introduction of the world’s first R&D tax credit in 1981 played a catalytic role in spurring greater levels of private-sector R&D. In the life-sciences sector, this was complemented by the 1986 introduction of the orphan drug tax credit, which allowed drug manufacturers to claim a tax credit on research costs for orphan drugs (i.e., drugs for rare diseases affecting 200,000 or fewer U.S. patients). The 1992 introduction of the bipartisan Prescription Drug User Fee Act (PDUFA), which authorized the Food and Drug Administration (FDA) to collect user fees associated with applications from the biopharmaceutical industry for regulatory approval of new human-drug submissions, has played a pivotal role in reducing the time it takes the FDA to make safety and efficacy determinations for new drugs—from the over 30 months it took on average in the mid-1980s to less than 10 months today.[25] The FDA’s innovative use of breakthrough designations for novel drugs have also speeded time-to-market for promising therapies. The breakthrough-therapy designation has helped expedite the development and review of drug and biological products for serious or life-threatening diseases or conditions when preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies.

The United States has also benefitted greatly from having a drug-pricing system that permits companies to earn sufficient revenues from one generation of biomedical innovation to reinvest in the next.[26] That matters greatly because, as the OECD has clearly stated, “There exists a high degree of correlation between pharmaceutical sales revenues and R&D expenditures.”[27] For instance, a correlation ITIF ran between net sales and R&D expenditures for 478 pharmaceutical companies (using 2021 data) resulted in a very strong coefficient of 0.92.[28]

Indeed, virtually all academic assessments find strong links between life-sciences company profits and R&D investments.[29] For instance, one study found that a real 10 percent decrease in the growth of drug prices would be associated with an approximately 6 percent decrease in pharmaceutical R&D spending as a share of net revenues.[30] Similarly, Lichtenberg found that a 10 percent decrease in cancer drug prices would likely cause a 5 to 6 percent decline in both cancer regimens and research articles.[31] Most recently, 2021 research by Tomas Philipson and Troy Durie at the University of Chicago estimated that a 1 percent reduction in pharmaceutical industry revenue leads on average to a 1.54 percent decrease in R&D investment.[32]

This is why the drug price controls recently introduced in the Inflation Reduction Act (IRA) are likely to be so delterious to U.S. biopharmaceutical innovation. All assessments agree the legislation will reduce life-sciences innovation and the discovery of new drugs; the only question is by how much. The Congressional Budget Office (CBO) estimated in July 2022 that the propsosed prescription drug legislation (that eventually largely became the IRA legislation) would cost the development of just 15 drugs over 30 years.[33]

But other analyses were far less sanguine. For instance, in examining the drug price controls proposed in HR 5376 (the Build Back Better Act), Philipson and Durie found the legislation would reduce revenues by 12 percent through 2039, with the reduced revenues meaning R&D spending would fall by about 18.5 percent, or $663 billion. The authors found that this reduction in R&D activity would lead to135 fewer new drugs, predicating that this drop in new drugs would generate a loss of 331.5 million life years in the United States. Similarly, Vital Transformations has modeled the impacts of the drug pricing provisions of President Biden’s 2024 budget proposal, now proposed as legislation by Senator Baldwin (D-MN) as the “Smart Prices Act (SPA),” which would impose government price setting for selected Medicare drugs at only five years after initial FDA approval. Vital Transformations estimates that this expanded government price setting could result in roughly 230 fewer FDA approvals of new medicines over a 10-year period, once the impacts are fully reflected in the pipeline. They further estimate a loss of 146,000 to 223,000 direct biopharmaceutical industry jobs. Moreover, they find that had the drug pricing provisions of the SPA been in place prior to the development of today’s top-selling medicines, 82 of the 121 therapies they identified as selected for price setting would likely have not been developed.[34]

And while these were just econometric modeling exercises, the real-world impact of IRA drug price controls are arriving quickly, and rapidly blasting through the 15 drugs CBO estimated would be lost over a 30-year period. One analysis found that in the first four months of 2023, at least 24 companies made announcements to curtail drug development because of the IRA.[35] For instance, in November 2022, Bristol-Myers Squibb announced it would cancel plans for some drug development programs and cancer treatments, citing the effects of the IRA.[36] Eli Lilly informed Endpoints News that it would abandon work on a blood-cancer drug in light of the IRA.[37] And Astra Zeneca has said that it, “may defer U.S. cancer drug launches in response to IRA.”[38] In light of these announcements, a mere 15 drugs lost over 30 years as a result of the IRA—let alone more-aggressive drug price legislation—is likely to be a woeful undercount. Yet it highlights a broader point: the system America has put in place over the prior quarter century to support life-science innovation has yielded tremendous results; calls to substantially reform it now—whether through drug price controls or by substantially altering existing, effective technology transfer policies, such as by including reasonable pricing provisions in license agreements—are likely to have deleterious and counterproductive effects.

And that brings the discussion to the final major factor that has allowed the United States to become the world’s life-sciences innovation leader: imaginative and effective technology transfer and commercialization policies, particularly as embodied in the Bayh-Dole Act.

Innovative U.S. Tech-Transfer and Commercialization Policies

As with life-sciences innovation, the United States was long a laggard in technology transfer and commercialization practices, especially with regard to the licensing of technologies stemming from federally funded R&D. As late as 1978, the federal government had licensed less than 5 percent of the as many as 30,000 patents it owned.[39] Likewise, throughout the 1960s and 1970s, many American universities shied away from direct involvement in the commercialization of research.[40] Indeed, before the passage of Bayh-Dole, only a handful of U.S. universities even had technology transfer or patent offices.[41]

Aware as early as the mid-1960s that the billions of dollars the federal government was investing in R&D was not paying the expected dividends, President Johnson in 1968 asked Elmer Staats, then the comptroller general of the United States, to analyze how many drugs had been developed from NIH-funded research. Johnson was stunned when Staats’s investigation revealed that “not a single drug had been developed when patents were taken from universities [by the federal government].”[42] As his report to Congress elaborated:

At that time we reported that HEW [the Department of Health, Education, and Welfare, predecessor of the Department of Health and Human Services] was taking title for the Government to inventions resulting from research in medicinal chemistry. This was blocking development of these inventions and impeding cooperative efforts between universities and the commercial sector. We found that hundreds of new compounds developed at university laboratories had not been tested and screened by [the] pharmaceutical industry because the manufacturers were unwilling to undertake the expense without some possibility of obtaining exclusive rights to further development of a promising product.[43]

The Congressional response to this conundrum was the Bayh-Dole Act, passed in 1980, which afforded contractors—such as universities, small businesses, and nonprofit research institutions—rights to the intellectual property generated from federal funding. The legislation’s impact was immediate, powerful, and long-lasting. It has been widely praised as a significant factor contributing to the United States’ “competitive revival” in the 1990s.[44] In 2002, The Economist called Bayh-Dole:

Possibly the most inspired piece of legislation to be enacted in America over the past half-century. Together with amendments in 1984 and augmentation in 1986, this unlocked all the inventions and discoveries that had been made in laboratories throughout the United States with the help of taxpayers’ money. More than anything, this single policy measure helped to reverse America's precipitous slide into industrial irrelevance.[45]

Allowing U.S. institutions to earn royalties through the licensing of their research has provided a powerful incentive for universities and other institutions to pursue commercialization opportunities.[46] Indeed, the Bayh-Dole Act almost immediately led to an increase in academic patenting activity. For instance, while only 55 U.S. universities had been granted a patent in 1976, 240 universities had been issued at least one patent by 2006.[47] Similarly, while only 390 patents were awarded to U.S. universities in 1980, by 2009, that number had increased to 3,088—and by 2015, to 6,680. Another analysis found that in the first two decades of Bayh-Dole (i.e., 1980 to 2002) American universities experienced a tenfold increase in their patents, and created more than 2,200 companies to exploit their technology.[48] In total, over 100,000 U.S. patents have been issued to academic research institutions over the past 25 years.[49] Moreover, academic technology transfer has supported the launch of over 13,000 start-ups since 1996 alone.[50] According to a report prepared for the Association of University Technology Managers (AUTM) and the Biotechnology Industry Organization (BIO), from 1996 to 2015, academic patents and their subsequent licensing to industry—substantially stimulated by the Bayh-Dole Act—bolstered U.S. gross domestic product by up to $591 billion, contributed to $1.3 trillion in gross U.S. industrial output, and supported 4,272,000 person years of employment.[51] Perhaps most importantly for public health, more than 200 drugs and vaccines have been developed through public-private partnerships since the Bayh-Dole Act entered force in 1980.[52]

On average, three new start-up companies and two new products are launched in the United States every day as a result of university inventions brought to market, in part thanks to the Bayh-Dole Act.[53] And as Harvard University’s Naomi Hausman has written, “The sort of large scale technology transfer from universities that exists today would have been very difficult and likely impossible to achieve without the strengthened property rights, standardized across granting agencies, that were set into law in 1980.”[54]

The Bayh-Dole Act has produced a number of additional benefits. For example, Hausman analyzed the impact of Bayh-Dole in shaping university relations with local economies and found that the increase in university connectedness to industry under the IP regime created by Bayh-Dole produced important local economic benefits. In particular, Hausman found that long-run employment, payroll, payroll per worker, and average establishment size grew differentially more after the 1980 Bayh-Dole Act in industries more closely related to innovations produced by a local university or hospital.[55] There is also evidence that the Bayh-Dole Act contributed to university faculty responding to royalty incentives by producing higher-quality innovations.[56] Evidence further suggests that patenting increased most after Bayh-Dole in lines of business that most value technology transfer via patenting and licensing.[57]

Finally, countries throughout the world—including Brazil, China, Indonesia, Japan, Korea, Malaysia, the Philippines, Singapore, South Africa, and Taiwan—have since followed the United States’ lead in establishing policies that grant their universities IP ownership rights.[58] Even Kazakhstan and Zimbabwe are currently looking at implementing Bayh-Dole-like legislation, recognizing its power to help turn their universities into engines of innovation and commercialization. Likewise, the California Senate Office of Research conducted a comprehensive analysis of the Bayh-Dole Act and concluded: “After reviewing the literature and interviewing key experts, we recommend the Legislature consider adopting a statewide IP policy replicating the principles of the Bayh–Dole Act for research granting programs.”[59] U.S. states and foreign countries have supported adoption of Bayh-Dole-like policies because they recognize that Bayh-Dole works. Simply put, the Bayh-Dole Act has created a powerful engine of practical innovation, producing many scientific advances that have extended human life, improved its quality, and reduced suffering for millions of people.[60]

The Risks Inappropriate Use of March-In Rights Pose to the Bayh-Dole Act

In short, the Bayh-Dole Act has been an unparalleled success. Yet some have advocated for policies that would undermine some of its key provisions and effects. At issue are so-called march-in rights, a provision within the Bayh-Dole Act that permits the U.S. government, in specified, proscribed, and limited circumstances, to require patent holders to grant a “nonexclusive, partially exclusive, or exclusive license” to a “responsible applicant or applicants.”[61] As the following section explains, the architects of the Bayh-Dole Act principally intended for march-in rights to be used to ensure patent owners commercialized their inventions.[62] As Senator Birch Bayh explained:

When Congress was debating our approach fear was expressed that some companies might want to license university technologies to suppress them because they could threaten existing products. Largely to address this fear, we included the march-in provisions.[63]

Yet a number of civil society organizations and some members of Congress have called on NIH to exploit Bayh-Dole march-in rights to “control” allegedly unreasonably high drug prices. (Though, as ITIF has written, these advocates’ assertions that U.S. drug prices, on net, are unreasonably high are fundamentally unwarranted and unsubstantiated.)[64] Nevertheless, at least seven petitions requesting NIH to “march in” with respect to a particular pharmaceutical drug have been filed (six as of the referenced CRS report).[65] In four of these cases, the petition was filed by civil society organizations alleging that a company was pricing a drug too high.[66] Some 50 members of Congress, led by Representative Lloyd Doggett (D-TX), have called on the NIH to cancel exclusivity when patented drugs are not available with reasonable terms.[67] Senator Angus King (I-ME) proposed legislation in 2017 that would require the Department of Defense (DOD) to issue compulsory licenses under Bayh-Dole “whenever the price of a drug, vaccine, or other medical technology is higher in the U.S. than the median price charged in the seven largest economies that have a per capita income at least half the per capita income of the U.S.”[68] In other words, DOD would force a licensor to divulge their intellectual property so that a drug could be manufactured by other licensees, and in theory be sold at a lower price. (While it was not enacted, a similar provision was unfortunately included in the FY 2018 National Defense Authorization Act (NDAA) Senate Armed Services Committee report.) Yet the Bayh-Dole Act’s designers did not intend for march-in rights to be used to control drug prices.

Bayh-Dole March-In Rights Were Never Intended to Address Drug Price Concerns

The Bayh-Dole Act proscribes four specific instances in which the government is permitted to exercise march-in rights:

1. If the contractor or assignee has not taken, or is not expected to take within a reasonable time, effective steps to achieve practical application of the subject invention;

2. If action is necessary to alleviate health or safety needs not reasonably satisfied by the patent holder or its licensees;

3. If action is necessary to meet requirements for public use specified by federal regulations and such requirements are not reasonably satisfied by the contractor, assignee, or licensees; or

4. If action is necessary, in exigent cases, because the patented product cannot be manufactured substantially in the United States.[69]

In other words, lower prices are not one of the rationales laid out in the act. In fact, as senators Bayh and Dole have themselves noted, the Bayh-Dole Act’s march-in rights were never intended to control or ensure “reasonable prices.”[70] As the twain wrote in a 2002 Washington Post op-ed titled, “Our Law Helps Patients Get New Drugs Sooner,” the Bayh-Dole Act:

Did not intend that government set prices on resulting products. The law makes no reference to a reasonable price that should be dictated by the government. This omission was intentional; the primary purpose of the act was to entice the private sector to seek public-private research collaboration rather than focusing on its own proprietary research.[71]

The op-ed reiterated that the price of a product or service was not a legitimate basis for the government to use march-in rights, noting:

The ability of the government to revoke a license granted under the act is not contingent on the pricing of a resulting product or tied to the profitability of a company that has commercialized a product that results in part from government-funded research. The law instructs the government to revoke such licenses only when the private industry collaborator has not successfully commercialized the invention as a product.[72]

Rather, Bayh-Dole’s march-in provision was designed as a fail-safe for limited instances in which a licensee might not be making good-faith efforts to bring an invention to market, or when national emergencies require that more product is needed than a licensee is capable of producing. As Joseph P. Allen, a senate staffer for Bayh who played a key role in shaping the legislation, explains, Congress’s introduction of Bayh-Dole was intended “to decentralize patent management from the bureaucracy into the hands of the inventing organizations, while retaining the long-established precedent that march-in rights were to be used in rare situations when effective efforts are not being made to bring an invention to the marketplace or enough of the product is not being produced to meet public needs.”[73]

Likewise, the National Institute of Standards and Technology (NIST) report “Return on Investment Initiative: Draft Green Paper” agreed, noting, “The use of march-in is typically regarded as a last resort, and has never been exercised since the passage of the Bayh-Dole Act in 1980.”[74] The report noted that, “NIH determined that that use of march-in to control drug prices was not within the scope and intent of the authority.”[75]

In fact, there has only been one case in which Bayh-Dole’s march-in criteria truly would have been met: a 2010 case in which Genzyme encountered difficulties in manufacturing sufficient quantities of Fabrazyme/agalsidase beta, an orphan drug for the treatment of Fabry disease.[76] Genzyme had to shut down the plant making the drug due to quality control issues and was therefore unable to manufacture the drug in sufficient quantities. NIH investigated the situation but did not initiate a march-in proceeding because it found that “Genzyme was working diligently to resolve its manufacturing difficulties” and that the company was likely to get back into production faster than a new licensee could get FDA approval to make the drug.[77]

March-in rights have never been exercised during the now over-40-year history of the Bayh-Dole Act.[78] NIH has denied all seven petitions to apply march-in rights, noting that the drugs in question were in virtually all cases adequately supplied and that concerns over drug pricing were not, by themselves, sufficient to provoke march-in rights.[79] NIH itself has expressed skepticism about the use of march-in rights to control drug prices, noting:

Finally, the issue of the cost or pricing of drugs that include inventive technologies made using federal funds is one which has attracted the attention of Congress in several contexts that are much broader than the one at hand. In addition, because the market dynamics for all products developed pursuant to licensing rights under the Bayh-Dole Act could be altered if prices on such products were directed in any way by NIH, the NIH agrees with the public testimony that suggested that the extraordinary remedy of march-in is not an appropriate means of controlling prices.[80]

As Rabitschek and Latker wrote in “Reasonable Pricing—A New Twist for March-in Rights Under the Bayh-Dole Act” in the Santa Clara University High Technology Law Journal, “A review of the [Bayh-Dole] statute makes it clear that the price charged by a licensee for a patented product has no direct relevance to march-in rights.”[81] As the authors concluded:

There is no reasonable pricing requirement under 35 U.S.C. §203(l)(a)(1), considering the language of this section, the legislative history, and the prior history and practice of march-in rights. Rather, this provision is to assure that the contractor utilizes or commercializes the funded invention.[82]

The argument that Bayh-Dole march-in rights could be used to control drug prices was originally advanced in an article by Peter S. Arno and Michael H. Davis.[83] They contended that “[t]he requirement for ‘practical application’ seems clear to authorize the federal government to review the prices of drugs developed with public funding under Bayh-Dole terms and to mandate march-in when prices exceed a reasonable level” and suggested that under Bayh-Dole, the contractor may have the burden of showing that it charged a reasonable price.[84] While Arno and Davis admitted there was no clear legislative history on the meaning of the phrase “available to the public on reasonable terms,” they still concluded that, “[t]here was never any doubt that this meant the control of profits, prices, and competitive conditions.”[85]

But as Rabitschek and Latker explain, there are several problems with this analysis. First, the notion that “reasonable terms” of licensing means “reasonable prices” arose in unrelated testimony during the Bayh-Dole hearings. Most importantly, they note, “If Congress meant to add a reasonable pricing requirement, it would have explicitly set one forth in the law, or at least described it in the accompanying reports.”[86] As Rabitschek and Latker continue, “There was no discussion of the shift from the ‘practical application’ language in the Presidential Memoranda and benefits being reasonably available to the public, to benefits being available on reasonable terms under 35 U.S.C. § 203.”[87] As they conclude, “The interpretation taken by Arno and Davis is inconsistent with the intent of Bayh-Dole, especially since the Act was intended to promote the utilization of federally funded inventions and to minimize the costs of administering the technology transfer policies…. [The Bayh-Dole Act] neither provides for, nor mentions, ‘unreasonable prices.’”[88]

Again, the Bayh-Dole Act’s march-in provisions were included with commercialization in mind. Related to this, another reason the Bayh-Dole Act’s architects inserted march-in right provisions was because, at the time the law was introduced, very few universities were experienced in patent licensing. The march-in provision therefore served as a fail-safe for cases in which universities were not effectively monitoring their agreements.[89] But universities have in fact proven proactive and effective in enforcing their licensing agreements, regularly including development milestones in their licenses—and when these milestones aren’t being met without satisfactory reason (e.g., development is more difficult than expected), universities often terminate the deal and look for another developer. In other words, universities are enforcing their licensing agreements, not letting licenses just sit on the technologies—another example of why there has been no reason for the government to march in.

Applying March-In Rights to Address Pricing Would Lead to Significantly Reduced Innovation

Even if Congress were to amend Bayh-Dole to allow the federal government to use march-in rights to force lower pricing, the result would be a reduction of life-sciences innovation, as past experience clearly shows.

The debate around “reasonable pricing” of drugs stemming from licensed research goes back some time. The Federal Technology Transfer Act of 1986 (FTTA) authorized federal laboratories to enter into Cooperative Research and Development Agreements (CRADAs) with numerous entities, including private businesses. NIH has found that CRADAs “significantly advance biomedical research by allowing the exchange and use of experimental compounds, proprietary research materials, reagents, scientific advice, and private financial resources between government and industry scientists.”[90]

In 1989, NIH’s Patent Policy Board adopted a policy statement and three model provisions to address the pricing of products licensed by public health service (PHS) research agencies on an exclusive basis to industry, or jointly developed with industry through CRADAs. In doing so, the Department of Health and Human Services (DHHS) became the only federal agency at the time (other than the Bureau of Mines) to include a “reasonable pricing” clause in its CRADAs and exclusive licenses.[91] The 1989 PHS CRADA Policy Statement asserted:

DHHS has a concern that there be a reasonable relationship between pricing of a licensed product, the public investment in that product, and the health and safety needs of the public. Accordingly, exclusive commercialization licenses granted for the NIH/ADAMHA [Alcohol, Drug Abuse, and Mental Health Administration] intellectual property rights may require that this relationship be supported by reasonable evidence.

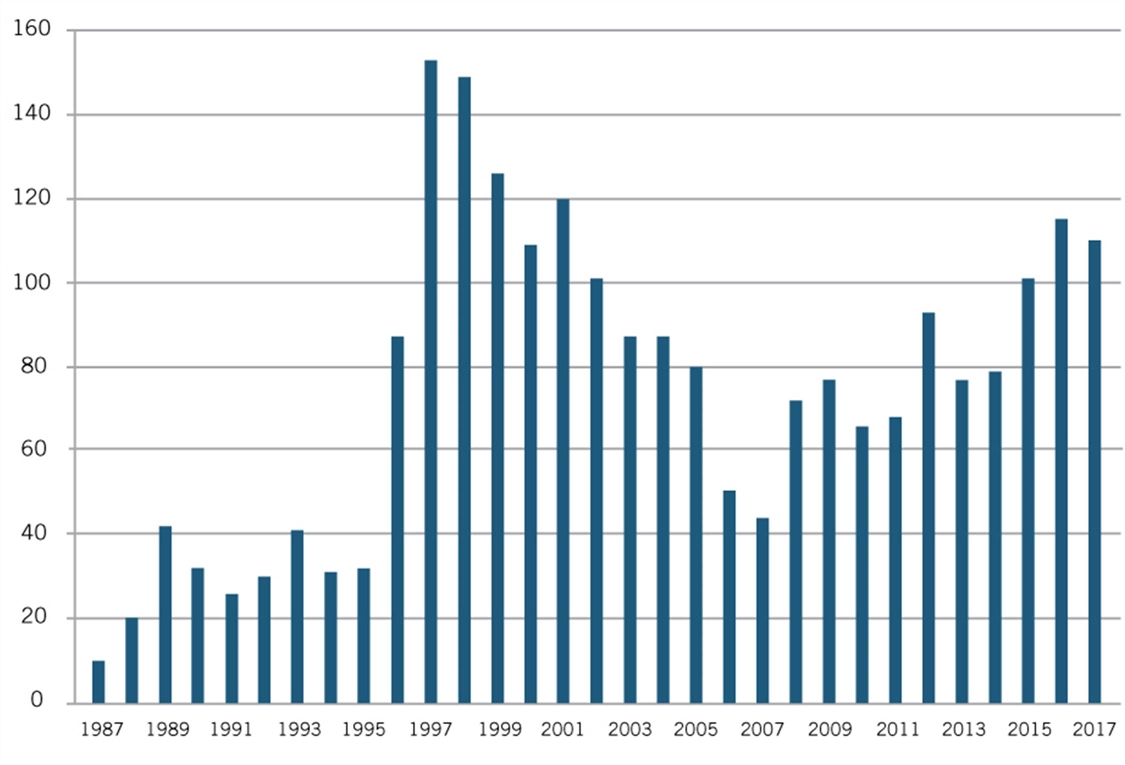

But as Joseph P. Allen notes, such “attempts to impose artificial ‘reasonable pricing’ requirements on developers of government supported inventions did not result in cheaper drugs. Rather, companies simply walked away from partnerships.”[92] Use of CRADAs began in 1987 and rapidly increased until the reasonable pricing requirement hit in 1989, after which they declined through 1995 (see Figure 2).

Figure 2: Private-Sector CRADAs With NIH, 1987–2017[93]

Recognizing that the only impact of the reasonable pricing requirement was undermining scientific cooperation without generating any public benefits, NIH eliminated the reasonable pricing requirement in 1995. In removing the requirement, then NIH director Dr. Harold Varmus explained, “An extensive review of this matter over the past year indicated that the pricing clause has driven industry away from potentially beneficial scientific collaborations with PHS scientists without providing an offsetting benefit to the public. Eliminating the clause will promote research that can enhance the health of the American people.”[94] As Figure 2 shows, after NIH eliminated the requirement in 1995, the number of CRADAs immediately rebounded in 1996, and grew considerably in the following years.[95] The case represents a natural experiment showing the harm pricing requirements can inflict. Somewhat similarly, as the California Senate Office of Research has noted, “Granting agencies such as the National Institutes of Health (NIH) ultimately have abandoned policies that require a financial return to the government after concluding that removing barriers to the rapid commercialization of products represents a greater public benefit than any potential revenue stream to the government.”[96]

A more recent case involved biopharmaceutical company Sanofi possibly taking a license from the U.S. Army to develop a vaccine for the Zika virus. U.S. Army scientists from the Walter Reed Army Institute of Research developed two candidate vaccines for the Zika virus and posted a notice in the federal register offering to license them on either a nonexclusive or exclusive basis. No company responded to the nonexclusive license, and Sanofi was the only company that submitted a license application for the Army’s Zika candidate vaccine, with the U.S. Army and Sanofi reaching a licensing agreement in June 2016 that would enable Sanofi to continue the development and clinical trial work necessary to turn the candidate vaccine into a market-ready product. As a U.S. Army official noted, “Exclusive licenses are often the only way to attract a competent pharma partner for such development projects,” and are needed because the military lacks “sufficient” research and production capabilities to develop and manufacture a Zika vaccine.[97] Sanofi received a $43 million government grant to start undertaking clinical trial work on the virus candidate.

In July 2017, supported by Knowledge Economy International, an organization opposed to robust intellectual property rights, Sens. Bernie Sanders (D-VT) and Dick Durbin (D-IL) argued that the U.S. Army and Sanofi should insert reasonable pricing language into the exclusive license. Sanders even called on President Trump to cancel the deal.[98] In response, Army officials noted that they were not in a position to “enforce future vaccine prices.” For its part, Sanofi representatives noted, “We can’t determine the price of a vaccine that we haven’t even made yet,” and argued that “it’s premature to consider or predict Zika vaccine pricing at this early stage of development. As noted earlier, ongoing uncertainty around epidemiology and disease trajectory make any commercial projections theoretical at best.”[99] Sanofi noted that it had committed over 60 researchers to the effort, invested millions of dollars itself, and was “committed to leveraging its flavivirus vaccine development and manufacturing expertise to deliver and ultimately price a Zika vaccine in a responsible way.”[100]

Sanofi also noted that the proposed license would require it to pay milestone and royalty payments back to the government, and its exclusive license would not prevent other companies—such as GlaxoSmithKline, Takeda, and Moderna, which also had all struck their own Zika vaccine partnerships with U.S. agencies—from bringing competing products to market, and allow for robust competition in the market for Zika vaccines.[101] However, with both partners continuing to be attacked in the media, in September 2017, Sanofi announced it would “not continue development of, or seek a license from, the Walter Reed Army Institute of Research for the Zika vaccine candidate at this time.”[102] This is yet another case wherein certain policymakers’ insistence on pricing requirements stifled innovation and the potential for a firm to bring a promising innovation to market.

It also takes the debate back to the central point that, in their push for lower drug prices through weaker private IP rights stemming from federally funded research, advocates fail to acknowledge that no drugs were created from federally funded inventions under the previous (to Bayh-Dole) regime.[103] In contrast, over 200 new drugs and vaccines have been developed through public-private partnerships facilitated in part by the Bayh-Dole Act since its enactment in 1980.[104]

Conclusion

America’s innovation system is fragile, and while America today leads the world in life-sciences innovation, that was not always the case, nor is it guaranteed to be the case in the future. As ITIF wrote in a 2021 report, “Going, Going, Gone? To Stay Competitive in Biopharmaceuticals, America Must Learn From Its Semiconductor Mistakes,” “Taking the industry for granted and believing that government can impose regulations with no harmful effect—common policy views in Washington—will almost certainly mean passing the torch of global leadership to other nations, especially China, within a decade or two.”[105]

As ITIF commented to the Senate HELP Committee as it considered the Pandemic and All-Hazards Preparedness Act (PAHPA), policymakers should reject the inclusion of reasonable pricing clauses in that (or other related) legislation, recognizing the long history of failure with efforts to include reasonable pricing clauses in NIH licensing activities.[106] Reasonable or reference pricing clauses should not be included in NIH grants, licenses, or CRADAs. Similarly, with regard to the broader cross-agency application of the Bayh-Dole Act, the price of resulting products should not be considered as a basis for the application of march-in provisions. Not only did Congress never establish price as a basis for march-in, such a practice would be deleterious to the effective mechanisms America has designed to promote the transfer of technologies stemming from federally funded R&D and to the broader cause of U.S. biomedical innovation.

Weakening the certainty of access to IP rights provided under Bayh-Dole by employing march-in or reasonable pricing requirements to address drug pricing issues—especially if it meant a government entity could walk in and retroactively commandeer innovations private-sector enterprises invested hundreds of millions, if not billions, to create—would significantly diminish private businesses’ incentives to commercialize products supported by federally funded research.[107] As David Bloch notes, “The reluctance of such [biopharmaceutical] companies to do business with the government is almost invariably tied up in concerns over the government’s right to appropriate private sector intellectual property.”[108] As he continues, “Each march-in petition potentially puts at risk the staggeringly massive investment that branded pharmaceutical companies make in developing new drug therapies.”[109] In conclusion, ITIF believes that any proposals to add “reasonable pricing” requirements to agreements between the NIH and private companies would be strongly misguided and deleterious to the cause of biopharmaceutical innovation.

Thank you for your consideration and the opportunity to comment.

Endnotes

[1]. National Institutes of Health (NIH), “Workshop on Transforming Discoveries into Products: Maximizing NIH’s Levers to Catalyze Technology Transfer” (NIH, July 31, 2023), https://osp.od.nih.gov/events/workshop-on-transforming-discoveries-into-products-maximizing-nihs-levers-to-catalyze-technology-transfer/.

[2]. Trelysa Long, “Preserving U.S. Biopharma Leadership: Why Small, Research-Intensive Firms Matter in the U.S. Innovation Ecosystem” (ITIF, August 2023), 1, https://itif.org/publications/2023/08/21/preserving-us-biopharma-leadership-why-small-research-intensive-firms-matter/.

[3]. John Wu and Robert D. Atkinson, “How Technology-Based Start-Ups Promote U.S. Economic Growth” (ITIF, November 2017), https://itif.org/publications/2017/11/28/how-technology-based-start-ups-support-us-economic-growth; Congressional Budget Office (CBO), “Research and Development in the Pharmaceutical Industry” (CBO, April 2021), https://www.cbo.gov/system/files/2021-04/57025-Rx-RnD.pdf.

[4]. Joe Kennedy, “How to Ensure That America’s Life-sciences Sector Remains Globally Competitive” (ITIF, March 2018), 37, https://itif.org/publications/2018/03/26/how-ensure-americas-life-sciences-sector-remains-globally-competitive; European Federation of Pharmaceutical Industries and Associations (EFPIA), “The Pharmaceutical Industry in Figures, Key Data 2017,” 8, https://www.efpia.eu/media/219735/efpia-pharmafigures2017_statisticbroch_v04-final.pdf.

[5]. Justin Chakma et al., “Asia’s Ascent—Global Trends in Biomedical R&D Expenditures” New England Journal of Medicine 370, No. 1 (January 2014); ER Dorsey et al., “Funding of US Biomedical Research, 2003-2008” New England Journal of Medicine 303 (2010): 137–43, http://www.ncbi.nlm.nih.gov/pubmed/20068207.

[6]. Neil Turner, “What’s gone wrong with the European pharmaceutical industry,” Thepharmaletter, April 29, 1999, https://www.thepharmaletter.com/article/what-s-gone-wrong-with-the-european-pharmaceutical-industry-by-neil-turner; David Michels and Aimison Jonnard, “Review of Global Competitiveness in the Pharmaceutical Industry” (U.S. International Trade Commission, 1999), 2-3, https://www.usitc.gov/publications/332/pub3172.pdf.

[7]. John K. Jenkins, M.D., “CDER New Drug Review: 2015 Update” (PowerPoint presentation, U.S. Food and Drug Administration/CMS Summit, Washington, D.C., December 14, 2015), http://www.fda.gov/downloads/AboutFDA/CentersOffices/OfficeofMedicalProductsandTobacco/CDER/UCM477020.pdf.

[8]. Jenkins, “CDER New Drug Review,” 23; Ian Lloyd, “Pharma R&D Annual Review 2020 NAS Supplement,” PharmaIntelligence, April 2020, 3, https://pharmaintelligence.informa.com/~/media/informa-shop-window/pharma/2020/files/whitepapers/rd-review-2020-nas-supplement-whitepaper.pdf.

[9] Robert D. Atkinson, “Why Life-Sciences Innovation Is Politically “Purple”— and How Partisans Get It Wrong” (ITIF, February 2016), https://www2.itif.org/2016-life-sciences-purple.pdf.

[10] Ranjana Chakravarthy et al., “Public- and Private-Sector Contributions to the Research and Development of the Most Transformational Drugs in the Past 25 Years: From Theory to Therapy” Therapeutic Innovation and Regulatory Science Vol. 50, Issue 6 (July 2016), https://www.ncbi.nlm.nih.gov/pubmed/30231735.

[11]. National Institutes of Health, “Grants & Funding,” https://www.nih.gov/grants-funding.

[12]. Beth Snyder Bulik “The top 10 ad spenders in Big Pharma for 2020,” Fierce Pharma, April 2021, https://www.fiercepharma.com/special-report/top-10-ad-spenders-big-pharma-for-2020.

[13]. European Federation of Pharmaceutical Industries and Associations, “The Pharmaceutical Industry in Figures, 2023” (EFPIA, 2023), 10, https://www.efpia.eu/media/rm4kzdlx/the-pharmaceutical-industry-in-figures-2023.pdf.

[14]. Ashley J. Stevens et al., “The Role of Public-Sector Research in the Discovery of Drugs and Vaccines” The New England Journal of Medicine Vol. 364, Issue 6 (February 2011): 1, https://www.nejm.org/doi/full/10.1056/NEJMsa1008268.

[15]. Benjamin Zycher, Joseph A. DiMasi, and Christopher-Paul Milne, “The Truth About Drug Innovation: Thirty-Five Summary Case Histories on Private Sector Contributions to Pharmaceutical Science” (Center for Medical Progress at the Manhattan Institute, June 2008), 3–4, https://www.manhattan-institute.org/html/truth-about-drug-innovation-thirty-five-summary-case-histories-private-sector-contributions.

[16]. Ibid.

[17]. U.S. Senate Joint Economic Committee, “The Benefits of Medical Research and the Role of the NIH,” May 17, 2000, https://www.faseb.org/portals/2/pdfs/opa/2008/nih_research_benefits.pdf.

[18]. Organization for Economic Cooperation and Development (OECD), “Science, Technology and Innovation in the New Economy” (OECD: 2000), http://www.oecd.org/science/sci-tech/1918259.pdf.

[19]. Bhavan N. Sampat and Frank R. Lichtenberg, “What Are The Respective Roles Of The Public And Private Sectors In Pharmaceutical Innovation?” Health Affairs 30, No. 2 (2011): 332–339, https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2009.0917.

[20]. Ibid.

[21]. Anusuya Chatterjee and Ross C. DeVol, “Estimating Long-Term Economic Returns of NIH Funding on Output in the Biosciences” (Milken Institute, 2012, 4), http://www.milkeninstitute.org/publications/view/535.

[22]. “The Impact of Genomics on the U.S. Economy” (Battelle Technology Partnership Practice, UMR, June 2013), http://www.unitedformedicalresearch.com/advocacy_reports/the-impact-of-genomics-on-the-u-s-economy.

[23]. Andrew A. Toole, “The Impact of Public Basic Research on Industrial Innovation: Evidence from the Pharmaceutical Industry,” Research Policy Vol. 41, Issue 1 (February 2012): 1–12, https://www.sciencedirect.com/science/article/abs/pii/S004873331100117X.

[24] Ranjana Chakravarthy et al., “Public- and Private-Sector Contributions to the Research and Development of the Most Transformational Drugs in the Past 25 Years: From Theory to Therapy” Therapeutic Innovation and Regulatory Science Vol. 50, Issue 6 (July 2016), https://www.ncbi.nlm.nih.gov/pubmed/30231735.

[25]. Stephen Ezell, “How the Prescription Drug User Fee Act Supports Life-Sciences Innovation and Speeds Cures” (ITIF, February 2017), http://www2.itif.org/2017-pdufa-life-sciences-innovation.pdf; United States General Accountability Office (GAO), “FDA Drug Approval: Review Time Has Decreased in Recent Years” (Washington, D.C.: GAO, October 20, 1995), http://www.gao.gov/assets/230/221919.pdf; Jenkins, “CDER New Drug Review.”

[26]. Stephen Ezell, “Comments to the Centers for Medicare & Medicaid Services on an International Pricing Index Model for Medicare Part B Drugs” (ITIF, December 2018), http://www2.itif.org/2018-CMS-pricing-index-comments.pdf.

[27]. Organization for Economic Cooperation and Development, “Pharmaceutical Pricing Policies in a Global Market” (OECD, September 2008), 190, http://www.oecd.org/els/pharmaceutical-pricing-policies-in-a-global-market.htm.

[28]. Trelysa Long and Stephen Ezell, “The Hidden Toll of Drug Price Controls: Fewer New Treatments and Higher Medical Costs for the World” (ITIF, July 2023), https://itif.org/publications/2023/07/17/hidden-toll-of-drug-price-controls-fewer-new-treatments-higher-medical-costs-for-world/.

[29] Joe Kennedy, “The Link Between Drug Prices and Research on the Next Generation of Cures” (ITIF, September 2019), https://itif.org/publications/2019/09/09/link-between-drug-prices-and-research-next-generation-cures.

[30]. Carmelo Giaccotto, Rexford E. Santerre, and John A. Vernon, “Drug Prices and Research and Development Investment Behavior in the Pharmaceutical Industry” The Journal of Law & Economics Vol. 48, Issue 1 April 2005, https://www.jstor.org/stable/10.1086/426882.

[31]. Frank R. Lichtenberg, “Importation and Innovation,” NBER Working Paper No. 12539, September 2006, https://www.nber.org/papers/w12539.

[32]. Tomas J. Philipson and Troy Durie, “Issue Brief: The Impact of HR 5376 on Biopharmaceutical Innovation and Patient Health” November 9, 2021, https://cpb-us-w2.wpmucdn.com/voices.uchicago.edu/dist/d/3128/files/2021/08/Issue-Brief-Drug-Pricing-in-HR-5376-11.30.pdf.

[33] U.S. Congressional Budget Office, “Estimated Budgetary Effects of Subtitle I of Reconciliation Recommendations for Prescription Drug Legislation” (CBO, July 8, 2022), https://www.cbo.gov/publication/58290.

[34]. Daniel Gassull, Harry Bowen, and Duane Schulthess, “The Impact of IRA Policy Expansion Proposals on the US Biopharma Ecosystem” (Vital Transformations, June 2023), https://vitaltransformation.com/2023/06/the-impact-of-ira-policy-expansion-proposals-on-the-us-biopharma-ecosystem/.

[35]. Tomas J. Philipson, “The Deadly Side Effects of Drug Price Controls,” The Wall Street Journal, April 5, 2023, https://www.wsj.com/articles/medicare-drug-price-controls-will-make-america-sicker-research-innovation-negotiations-private-insurers-b503b4ba.

[36]. Paige Twenter, “Inflation Reduction Act will restrict oncology drug development, Bristol-Myers Squibb CEO says,” Becker’s Hospital Review, November 21, 2022, https://www.beckershospitalreview.com/pharmacy/inflation-reduction-act-will-restrict-oncology-drug-development-bristol-myers-squibb-ceo-says.html.

[37]. Max Gelman, “Updated: Eli Lilly blames Biden's IRA for cancer drug discontinuation as the new pharma playbook takes shape,” Endpoint News, November 1, 2022, https://endpts.com/eli-lilly-rolls-snake-eyes-as-it-axes-two-early-stage-drugs-including-a-40m-cancer-therapy-from-fosun/.

[38]. Steve Usdin, “AstraZeneca may defer U.S. cancer drug launches in response to IRA,” Biocentury, November 10, 2022, https://www.biocentury.com/article/645834/astrazeneca-may-defer-u-s-cancer-drug-launches-in-response-to-ira.

[39]. B. Graham, “Patent Bill Seeks Shift to Bolster Innovation,” The Washington Post, April 8, 1978; Stevens, “The Role of Public Sector Research,” 536.

[40]. Naomi Hausman, “University Innovation, Local Economic Growth, and Entrepreneurship,” U.S. Census Bureau Center for Economic Studies Paper No. CES-WP- 12–10 (July 2012): 5, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2097842.

[41]. Louis G. Tornatzky and Elaine C. Rideout, “Innovation U 2.0: Reinventing University Roles in a Knowledge Economy” (State Science and Technology Institute, 2014) 165, https://ssti.org/report-archive/innovationu20.pdf.

[42]. Joseph P. Allen, “When Government Tried March In Rights to Control Health Care Costs,” IPWatchdog, May 2, 2016, http://www.ipwatchdog.com/2016/05/02/march-in-rights-health-care-costs/id=68816/.

[43]. Statement of Elmer B. Staats, comptroller general of the United States, Before the Committee on the Judiciary United States Senate, “S. 414-The University and Small Business Patent Procedures Act,” May 16, 1979, https://www.gao.gov/assets/100/99067.pdf.

[44]. David Mowery, “University-Industry Collaboration and Technology Transfer in Hong Kong and Knowledge-based Economic Growth,” (working paper, University of California, Berkeley, 2009), http://www.savantas.org/cmsimg/files/Research/HKIP/Report/1_mowery.pdf.

[45]. “Innovation’s Golden Goose,” The Economist, December 12, 2002, http://www.economist.com/node/1476653.

[46]. Wendy H. Schacht, “Patent Ownership and Federal Research and Development (R&D): A Discussion of the Bayh-Dole Act and the Stevenson-Wydler Act” (Congressional Research Service, 2000), http://ncseonline.org/nle/crsreports/science/st-66.cfm.

[47]. Hausman, “University Innovation, Local Economic Growth, and Entrepreneurship,” 7. (Calculation based on NBER patent data.)

[48]. John H. Rabitschek and Norman J. Latker, “Reasonable Pricing—A New Twist for March-in Rights Under the Bayh-Dole Act” Santa Clara High Technology Law Journal Vol. 22, Issue 1 (2005), 150, https://digitalcommons.law.scu.edu/cgi/viewcontent.cgi?article=1399&context=chtlj; The Economist, “Innovation’s Golden Goose.”

[49]. AUTM, “Driving the Innovation Economy: Academic Technology Transfer in Numbers,” https://autm.net/AUTM/media/Surveys-Tools/Documents/AUTM_FY2018_Infographic.pdf.

[50]. Ibid.

[51]. Lori Pressman et al., “The Economic Contribution of University/Nonprofit Inventions in the United States: 1996–2015” (Report prepared for AUTM and Biotechnology Industry Organization (BIO), June 2017), 3, https://www.bio.org/sites/default/files/June%202017%20Update%20of%20I-O%20%20Economic%20Impact%20Model.pdf.

[52]. AUTM, “Driving the Innovation Economy.”

[53]. Phone interview with Joe Allen, July 24, 2018.

[54]. Hausman, “University Innovation, Local Economic Growth, and Entrepreneurship,” 8.

[55]. Ibid.

[56]. Saul Lach and Mark Schankerman, “Incentives and Invention in Universities,” RAND Journal of Economics Vol 39, No. 2 (2008): 403–433, https://onlinelibrary.wiley.com/doi/pdf/10.1111/j.0741-6261.2008.00020.x.

[57]. Scott Shane, “Encouraging University Entrepreneurship? The Effect of the Bayh-Dole Act on University Patenting in the United States” Journal of Business Venturing 19 (2004): 127–151, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1495504.

[58]. Robert D. Atkinson, Stephen J. Ezell, and Luke A. Stewart, “The Global Innovation Policy Index” (ITIF and the Ewing Marion Kauffman Foundation, March 2012), 65, http://www2.itif.org/2012-global-innovation-policy-index.pdf.

[59]. California Senate Office of Research, “Optimizing Benefits From State-Funded Research” Policy Matters (March 2018), 12, https://sor.senate.ca.gov/sites/sor.senate.ca.gov/files/0842%20policy%20matters%20Research%2003.18%20Final.pdf.

[60]. Rabitschek and Latker, “Reasonable Pricing,” 150.

[61]. John R. Thomas, “March-In Rights Under the Bayh-Dole Act” (Congressional Research Service, August 2016), 7, https://fas.org/sgp/crs/misc/R44597.pdf.

[62]. David S. Bloch, “Alternatives to March-In Rights” Vanderbilt Journal of Entertainment and Technology Law, Vol. 18:2:247 (2016): 253, http://www.jetlaw.org/wp-content/uploads/2016/03/Bloch_SPE_6-FINAL.pdf.

[63]. Statement of Senator Birch Bayh to the National Institutes of Health (May 24, 2004), https://www.ott.nih.gov/sites/default/files/documents/2004NorvirMtg/2004NorvirMtg.pdf.

[64]. Stephen Ezell, “No, America’s Drug Prices Aren’t Climbing Radically Out of Control,” The Innovation Files, June 17, 2022, https://itif.org/publications/2022/06/17/no-americas-drug-prices-arent-climbing-radically-out-of-control/.

[65]. Thomas, “March-In Rights Under the Bayh-Dole Act,” 11.

[66]. Ibid.

[67]. Ibid, 14.

[68]. Joseph Allen, “Proposal from Senator King Won’t Reduce Drug Prices, Just Innovation,” IPWatchdog, July 17, 2017, https://www.ipwatchdog.com/2017/07/17/senator-king-reduce-drug-prices-innovation/id=85702/.

[69]. Thomas, “March-In Rights Under the Bayh-Dole Act,” 10.

[70]. Birch Bayh, “Statement of Birch Bayh to the National Institutes of Health,” May 25, 2014, http://www.essentialinventions.org/drug/nih05252004/birchbayh.pdf.

[71]. Birch Bayh and Bob Dole, “Our Law Helps Patients Get New Drugs Sooner,” The Washington Post, April 11, 2002, https://www.washingtonpost.com/archive/opinions/2002/04/11/our-law-helps-patients-get-new-drugs-sooner/d814d22a-6e63-4f06-8da3-d9698552fa24/.

[72]. Ibid.

[73]. Allen, “When Government Tried March In Rights to Control Health Care Costs.”

[74]. National Institute of Standards and Technology (NIST), “Return on Investment Initiative: Draft Green Paper” (NIST, December 2018), 30, https://nvlpubs.nist.gov/nistpubs/SpecialPublications/NIST.SP.1234.pdf.

[75]. Ibid, 30.

[76]. Thomas, “March-In Rights Under the Bayh-Dole Act,” 9.

[77]. Ibid.

[78]. Ibid.

[79]. Thomas, “March-In Rights Under the Bayh-Dole Act,” 11–12.

[80]. Elias A. Zerhouni, director, NIH, “In the Case of Norvir Manufactured by Abbott Laboratories, Inc.,” July 29, 2004, http://www.ott.nih.gov/sites/default/files/documents/policy/March-In-Norvir.pdf.

[81]. Rabitschek and Latker, “Reasonable Pricing,” 160.

[82]. Ibid, 167.

[83]. Peter Amo and Michael Davis, “Why Don’t We Enforce Existing Drug Price Controls? The Unrecognized and Unenforced Reasonable Pricing Requirements Imposed upon Patents Deriving in Whole or in Part from Federally Funded Research,” Tulane Law Review Vol. 75, 631 (2001), https://engagedscholarship.csuohio.edu/cgi/viewcontent.cgi?article=1754&context=fac_articles.

[84]. Ibid.

[85]. Rabitschek and Latker, “Reasonable Pricing,” 162–163.

[86]. Ibid, 163.

[87]. Ibid. Here, the Presidential Memoranda refers to memoranda produced by the Kennedy and Nixon administrations that pertained to government policy related to contractor ownership of inventions.

[88]. Ibid.

[89]. Stephen Ezell interview with Joseph P. Allen, November 18, 2018.

[90]. National Institutes of Health, “NIH News Release Rescinding Reasonable Pricing Clause,” news release, April 11, 1995, https://www.ott.nih.gov/sites/default/files/documents/pdfs/NIH-Notice-Rescinding-Reasonable-Pricing-Clause.pdf.

[91]. Ibid.

[92]. Allen, “Compulsory Licensing for Medicare Drugs—Another Bad Idea from Capitol Hill.”

[93]. National Institutes of Health, “OTT Statistics,” accessed January 13, 2019, https://www.ott.nih.gov/reportsstats/ott-statistics.

[94]. National Institutes of Health, “NIH News Release Rescinding Reasonable Pricing Clause.”

[95]. Allen, “Compulsory Licensing for Medicare Drugs—Another Bad Idea from Capitol Hill.”

[96]. California Senate Office of Research, “Optimizing Benefits From State-Funded Research,” 11.

[97]. Eric Sagonowsky, “Sanofi Pulls Out of Zika Vaccine Collaboration as Feds Gut its R&D Contract,” FiercePhrma, September 1, 2017, https://www.fiercepharma.com/vaccines/contract-revamp-sanofi-s-Zika-collab-u-s-government-to-wind-down; Ed Silverman, “Sanofi Rejects U.S. Army Request for ‘Fair” Pricing’ for a Zika Vaccine,” PBS, May 20, 2017, https://www.pbs.org/newshour/health/sanofi-army-request-pricing-Zika-vaccine.

[98]. Bernie Sanders, “Trump Should Avoid a Bad Zika Deal,” The New York Times, March 10, 2017, https://www.nytimes.com/2017/03/10/opinion/bernie-sanders-trump-should-avoid-a-bad-Zika-deal.html?_r=0.

[99]. Eric Sagonowsky, “Sanofi Executive Lays Out Case For Taxpayer Funding—And Exclusive Licensing—on Zika Vaccine R&D,” FiercePhrma, May 25, 2017, https://www.fiercepharma.com/vaccines/exec-says-corporate-responsibility-not-potential-profits-drove-sanofi-s-Zika-vaccine-r-d.

[100]. Jeannie Baumann, “Sanofi Never Rejected Fair Pricing for Zika Vaccine: Exec,”BloombergNews, July 18, 2017, https://www.bna.com/sanofi-rejected-fair-n73014461930/.

[101]. Sagonowsky, “Sanofi Executive Lays Out Case For Taxpayer Funding—And Exclusive Licensing—on Zika Vaccine R&D.”

[102]. Sagonowsky, “Sanofi Pulls Out of Zika Vaccine Collaboration as Feds Gut its R&D Contract.”

[103]. Joseph Allen, “Bayh-Dole Under March-in Assault: Can It Hold Out?” IP Watchdog, January 21, 2016, http://www.ipwatchdog.com/2016/01/21/bayh-dole-under-march-in-assault-can-it-hold-out/id=65118/.

[104]. AUTM, “Driving the Innovation Economy.”

[105]. Stephen Ezell, “Going, Going, Gone? To Stay Competitive in Biopharmaceuticals, America Must Learn From Its Semiconductor Mistakes” (ITIF, November 2021), https://itif.org/publications/2021/11/22/going-going-gone-stay-competitive-biopharmaceuticals-america-must-learn-its/.

[106]. Stephen Ezell, “Comments Before the US Senate Help Committee Regarding the “Pandemic and All-Hazards Preparedness Act” (ITIF, July 2023), https://itif.org/publications/2023/07/10/comments-regarding-the-pandemic-and-all-hazards-preparedness-act/.

[107]. Stephen J. Ezell, “Why Exploiting Bayh-Dole ‘March-In’ Provisions Would Harm Medical Discovery,” The Innovation Files, April 29, 2016, https://www.innovationfiles.org/why-exploiting-bayh-dole-march-in-provisions-would-harm-medical-discovery/.

[108]. Bloch, “Alternatives to March-In Rights,” 261.

[109]. Ibid.