Federal Energy RD&D: Building on Momentum in Fiscal Year 2019

Congress should continue on the path toward doubling federal energy RD&D funding, which would fulfill a commitment the United States made along with 19 other countries to accelerate the global transition to cleaner, more affordable, more reliable energy.

CONTENTS (PDF)ARPA-ERenewablesTransportationEnergy EfficiencyOffice of ElectricityNuclearFossil EnergyOffice of Science |

When Congress passed appropriations bills for fiscal years (FY) 2017 and 2018, it wisely rejected extreme cuts to the Department of Energy’s (DOE) research, development, and demonstration (RD&D) budget proposed by the Trump administration. Yet, the administration has persisted, making similar proposals again this year. Its FY 2019 budget request reflects a fundamental skepticism about public RD&D investment. If enacted, the administration’s proposed cuts would jeopardize U.S. energy innovation, threatening national imperatives in energy security, economic competitiveness and productivity, and environmental stewardship.

Congress should continue on the path it has set, supporting what the Senate Appropriations Committee described as “a comprehensive and real-world strategy that includes medium- and later-stage research and development; deployment and demonstration...” This path leads to a doubling of federal energy RD&D funding, which would fulfill a commitment made by the United States along with 19 other countries to accelerate the global transition to cleaner, more affordable, more reliable energy.

Within this doubling pathway, the Information Technology and Innovation Foundation (ITIF) urges particular attention be paid to these programs, which have been analyzed in prior reports:

- Grow the Advanced Research Projects Agency-Energy (ARPA-E) budget to $1 billion.

- Build a robust, diverse portfolio of technology-demonstration projects.

- Sustain and expand the Clean Energy Manufacturing Innovation Institutes.

- Double the budget of DOE’s Energy Innovation hubs.

In this report, we first describe the key role of the federal government in the U.S. energy innovation system. We then provide a high-level overview of both DOE’s overall budget and its RD&D budget. The bulk of the report drills down into the programs and subprograms that make up DOE’s RD&D budget, detailing what would be put at risk by the administration’s proposal, and opportunities that might be realized through its expansion.

THE KEY ROLE OF THE FEDERAL GOVERNMENT IN THE U.S. ENERGY INNOVATION SYSTEM

Accelerating the pace of energy innovation is essential to U.S. national security, economic competitiveness and productivity, and environmental stewardship. The Department of Defense is the single largest consumer of energy in the United States and must have reliable and efficient access to energy resources for operations and facilities at home and abroad. Energy is an enormous and vital economic sector, and innovation in this sector is key to reducing volatility and costs in the future. In energy-related manufacturing, the United States has fallen behind key competitors in many market segments that show the greatest growth potential, such as solar panels, batteries, next-generation nuclear power, and technologies to capture carbon. As emissions from the consumption of fossil fuels continue to drive climate change, the fight to avoid potential worst-case scenarios could lead to onerous regulations and taxes that limit consumer choice and reduce living standards—unless energy innovation is accelerated.

The United States has historically been a global energy-innovation leader. Many technologies that now make major contributions to both the U.S. and global energy systems were created through federal investments and public-private cooperation. Federally funded nuclear power RD&D, for instance, led to large-scale private investment in commercial power plants that now account for 20 percent of U.S. electricity generation and 54 percent of zero-carbon power generation. Federal support for shale-gas resource characterization and directional drilling—in tandem with industry-matched applied research and a federal production tax credit—led to the dramatic rise of shale gas production from less than 1 percent of domestic gas production in 2000 to nearly 60 percent in 2016. Decades of federal investment in solar power have culminated in the early achievement of the DOE SunShot Initiative program’s 2020 goal of utility-scale solar PV power at six cents per kilowatt-hour ($0.06/kWh).

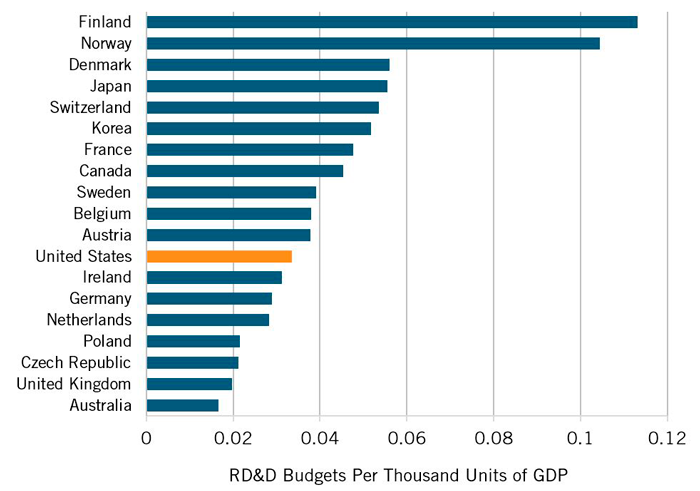

Despite this record of success, federal investment that supports energy innovation has gyrated up and down over time, reducing the odds of new breakthroughs. Adjusted for inflation, DOE’s energy RD&D budget for FY 2018 remains more than 26 percent below what it was when the department was established in 1978. As a share of gross domestic product (GDP), DOE’s energy RD&D is down more than 75 percent in the same period. This decline is inconsistent with the view of a large majority of voters across the political spectrum who support increased funding for research into clean energy technologies. Energy RD&D spending is far below comparable federal spending for space, health, and defense. It also falls short in comparison with other countries around the globe. Eleven other countries invest more in energy RD&D as a percentage of GDP than the United States (figure 1).

Figure 1: Government Energy RD&D Investment as a Percentage of GDP, 2015

The shortfall in public energy RD&D investment contributes to a similar shortfall in the private sector. R&D spending as a share of sales in the U.S. energy industry is only 0.4 percent, compared with 8.5 percent in aerospace and defense, 9.8 percent in computers and electronics, and 2.4 percent in the automotive industry. Venture capital and private-equity investment in U.S. renewable energy companies has declined, and only a handful of U.S. companies developing advanced nuclear reactors and carbon capture technologies have raised enough private capital to scale up their innovations. U.S. investors are wary of funding technology scale-up, leading domestic energy entrepreneurs to look overseas for funding, while slow-moving incumbents in this industry tend to support only modest, incremental innovation.

Public investment and private investment play complementary roles along the pathway to commercialization for new energy technologies. Federal investment frequently serves as a catalyst for industry, as government RD&D tends to incent additional private R&D dollars, rather than crowding them out. In fact, ITIF has found that firms funded by federal programs like ARPA-E and Small Business Innovation Research (SBIR) are more likely to receive follow-on private support than comparable firms.

The synergy between public and private investment has motivated the 20 countries that are the largest public investors in energy RD&D, led by the United States, to commit to doubling of their support and inspired a counterpart commitment by private investors led by Bill Gates to put more than a billion dollars to work behind innovative energy technologies stemming from the increase in public funding.

Research by ITIF has identified gaps in the energy innovation ecosystem that the U.S. government is best-positioned to address and cannot be filled solely by the private sector. While public support is required at varying levels throughout the entire energy innovation process, from full public support for basic research to time-limited, modest subsidies for early deployment, the following gaps are particularly prominent:

- High-risk, high-impact, cross-cutting energy R&D in areas industry alone cannot address;

- Technology demonstration projects for first-of-a-kind technologies that are too risky for private industry to fund;

- Technology transfer and advanced manufacturing programs that partner with industry to infuse innovation into U.S. manufacturing; and

- Interdisciplinary, integrative centers of excellence that bring together researchers from across all sectors to work toward meeting ambitious and targeted technology goals with industry applications in mind.

Congress has taken important steps to fill these gaps. It created ARPA-E to “sponsor creative, out-of-the-box, transformational, generic energy research.” It supported a suite of demonstration projects across a wide range of energy technologies as part of the 2009 economic stimulus package. It established the clean energy manufacturing innovation institutes to foster industry-led innovation and workforce development in key sectors. And it set up energy innovation hubs to focus a critical mass of experts on key long-term challenges.

These steps highlight the progress, albeit uneven, that was made under presidents George W. Bush and Barack Obama. But those gains were threatened after the election of President Trump. The new administration proposed cuts to federal energy RD&D that would not merely have undermined efforts to address weaknesses in the U.S. energy innovation system, but would have put the whole system at risk. In its FY 2018 budget, however, Congress definitively and wisely rejected the administration’s approach, increasing energy RD&D by 12 percent. Although the administration has once again proposed deep cuts for FY 2019, Congress should now seize the opportunity it has created to sustain the momentum toward an energy-innovation policy that will meet the security, economic, and environmental challenges of the 21st century.

The Department of Energy...And Lots of Other Stuff

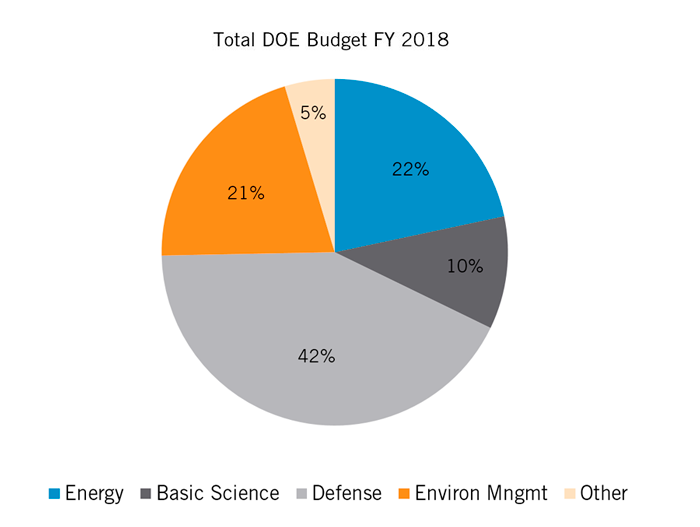

The name “Department of Energy” may leave the mistaken perception that DOE’s primary function is overseeing and improving the nation’s energy system. In fact, as figure 2 shows, when the other activities of DOE—defense, environmental clean-up, and non-energy-focused basic science—are taken into account, only a small minority of its budget supports energy innovation. Yet, the administration’s budget proposal targets this small slice for its largest cuts.

Figure 2: Total DOE Budget Divided by Major Function

DOE was assembled in 1977 from previously scattered federal agencies, the biggest of which was the Atomic Energy Commission (AEC), which had managed the military’s nuclear-weapons program since just after World War II. DOE’s National Nuclear Security Administration (NNSA) carries out such defense responsibilities today. NNSA and other defense programs housed within DOE comprise more than 42 percent of the agency’s roughly $30 billion budget. In addition, DOE’s Office of Environmental Management (EM) is tasked with cleaning up the massive pollution left behind by the weapons program. EM’s budget is more than $6 billion, comprising 21 percent of DOE’s budget. Together, these two slices make up almost two-thirds of the department’s entire budget pie.

DOE is the third-largest source of federal funding for basic research—surpassing the National Aeronautics and Space Administration (NASA) and the Department of Defense (DOD), and it is the largest source of physical sciences and engineering research funding. Much of this funding flows through the $5 billion budget of DOE’s Office of Science (SC), which is a particularly important funding source for high-energy physics, carrying forward a research program that can be traced back to the World War II-era Manhattan Project. Although much of the research that this office funds may ultimately have applications to the energy mission, less than half of its budget, about $2.2 billion for basic energy sciences and fusion, is specifically devoted to advancing that mission.

DOE houses 17 national laboratories, which account for about half of its budget and carry out a significant portion of its science and technology activities. The labs, which include iconic Manhattan Project installations at places like Los Alamos, New Mexico, and Oak Ridge, Tennessee, are unique concentrations of technical expertise. They also maintain large-scale facilities, such as particle accelerators, that are used by researchers from academia and industry as well as government. The labs receive the vast majority (roughly 80 percent) of their $15 billion annual funding through DOE offices like NNSA, SC, and the applied energy offices described below. Public-private R&D partnerships amount to less than 20 percent of the labs’ total funding.

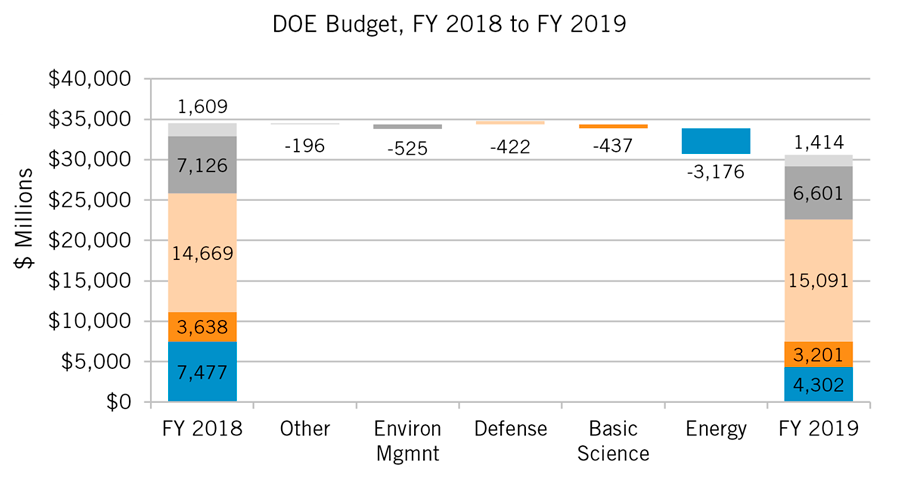

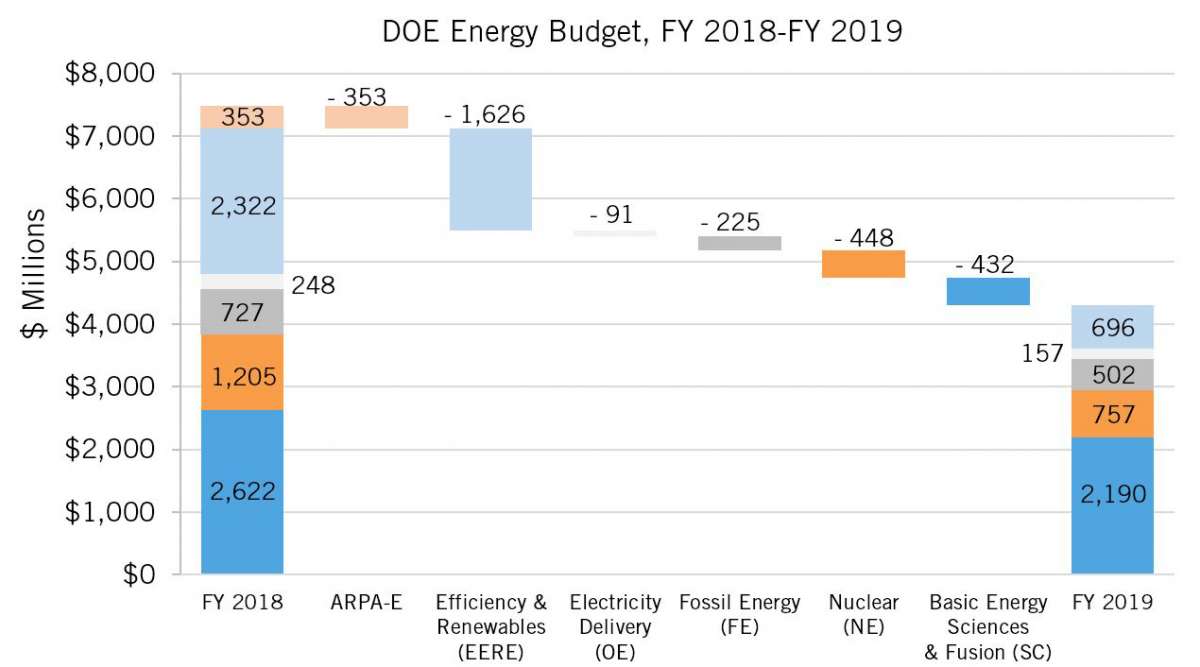

Just 22 percent of DOE’s budget encompasses all of the technical areas a reasonable person might infer to be focal points for a department called “Energy”: renewables, efficiency, sustainable transportation, advanced fossil energy, nuclear power, grid modernization, ARPA-E, basic energy sciences, and fusion. Figure 3 compares DOE’s budget in 2018 to the president’s FY 2019 request. The president proposes a slight increase in defense, to over $15 billion, while cutting environmental cleanup by 7 percent and basic science by 12 percent. The budget for energy programs would be cut by 42 percent, from $7.5 billion to $4.3 billion.

Figure 3: Proposed Changes in Trump’s DOE Budget by Major Function

ENERGY RD&D IN THE PRESIDENT’S FY 2019 BUDGET: HISTORIC CUTS

Energy RD&D funding makes up the bulk of DOE’s energy programs, so the significant cuts proposed by the administration in these programs for FY 2019 would have substantial impacts on that funding. The cuts would fall hardest on energy RD&D programs that help technologies mature fully so that they can attain sufficient scale to significantly impact the national and global energy systems.

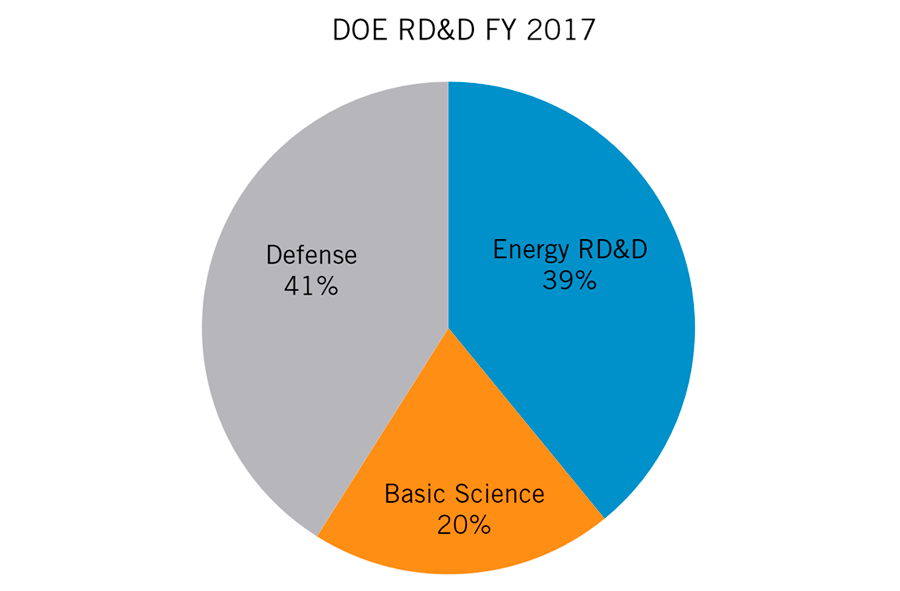

Figure 4: DOE RD&D Budget

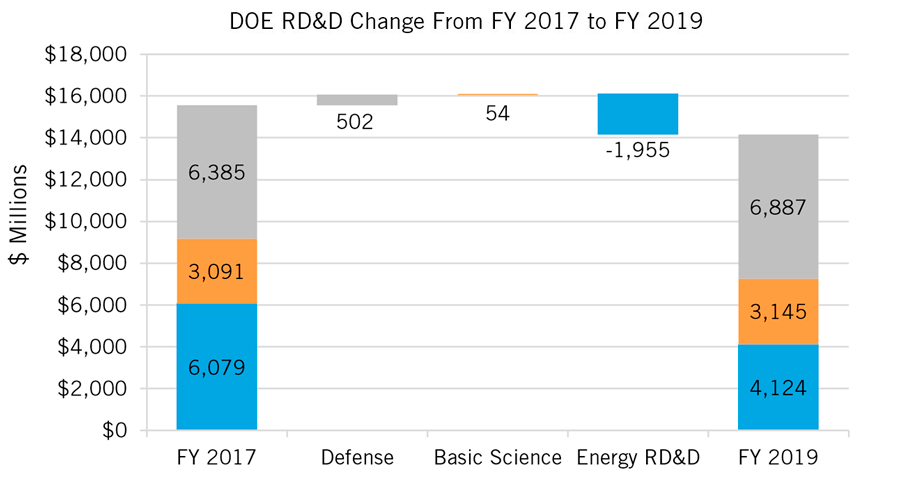

Figure 4 shows energy RD&D programs within DOE’s total RD&D budget. (FY 2017 figures are displayed here; FY 2018 figures are not yet available at this level of detail.) Defense RD&D makes up 41 percent of this budget, and non-energy-focused basic science research 20 percent. Energy RD&D is only 39 percent, a proportion that would shrink precipitously if the president’s budget request were to be approved, as figure 5 shows.

Figure 5: DOE RD&D, President’s Proposal Compared to FY 2017

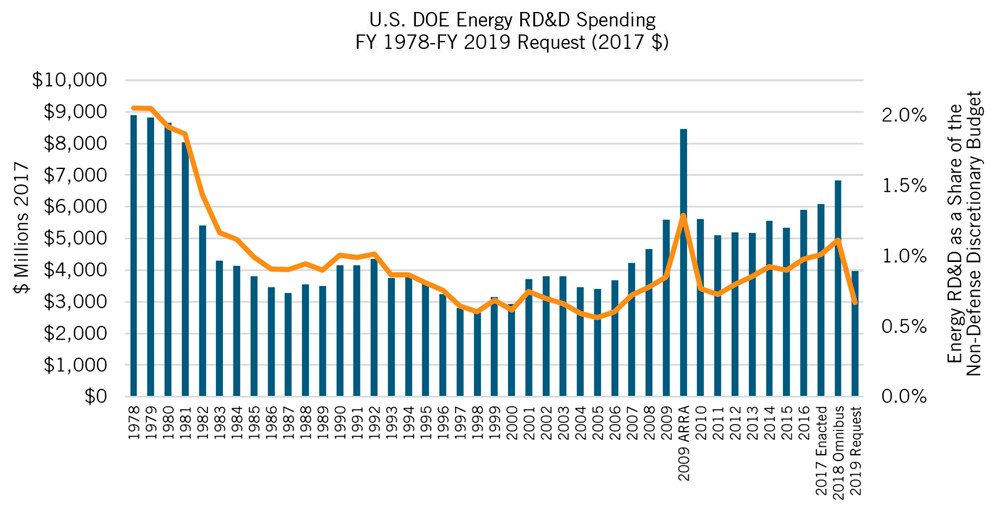

As figure 6 shows, the president has proposed that the energy RD&D budget be reduced to its lowest level (in inflation-adjusted dollars) since it began regaining momentum during the George W. Bush administration. The proposed cut would be the largest single-year decrease (40 percent below FY 2018) in the history of the department, surpassing even the Reagan-era cut of 33 percent in 1982. (The 2009 figure includes funding from the American Recovery and Reinvestment Act (ARRA) stimulus program, which was separate from and additional to the normal appropriations process.)

Figure 6: Federal Energy R&D Funding, FY 1978 to FY 2019 Request

The FY 2019 budget request reflects a fundamental skepticism of federal energy RD&D programs, and a shift away from public investment in energy innovation. The Office of Management and Budget (OMB) has directed agencies to focus RD&D spending on early-stage research and has issued guidance that “federally-funded energy R&D should continue to reflect an increased reliance on the private sector to fund later-stage research, development, and commercialization of energy technologies.”

The request therefore falls most heavily on applied research, development, pilot, and demonstration projects as well as tech-to-market, technology transfer, commercialization, and advanced manufacturing programs, as we describe in detail below. These projects and programs seek to address market failures that typically block innovative energy technologies from reaching full maturity.

CONGRESSIONAL PERSPECTIVES ON ENERGY INNOVATION

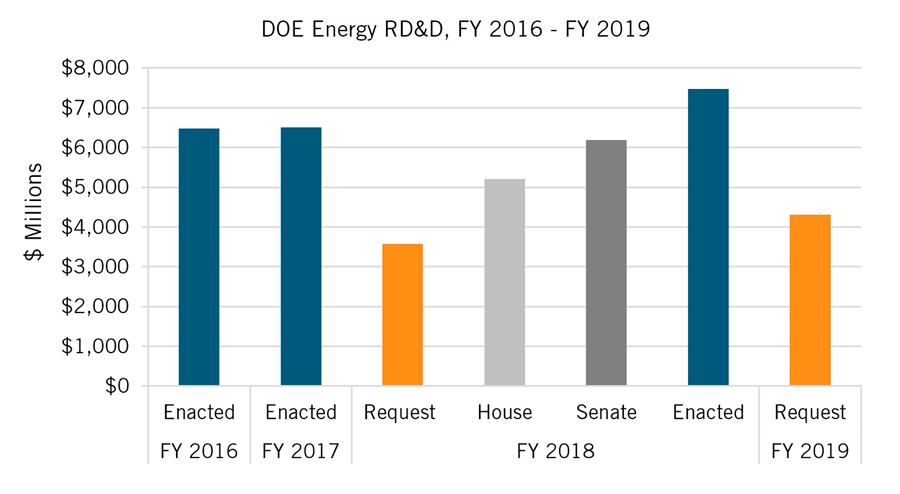

The president’s budget request is only the first step in the appropriations process. Congress makes the final disposition of funds. The House and Senate have had differing perspectives on energy RD&D investment in the recent past. The Senate’s view is more supportive of energy innovation—and, fortunately, it has prevailed, as figure 7 shows.

Figure 7: Energy RD&D in the Appropriations Process, FY 2016–2019

House appropriators have taken their lead from OMB, writing that, “The Committee is appreciative of [DOE] efforts to focus on early-stage research and development and begins a gradual approach to achieve this goal.”

The Senate Appropriations Committee, by contrast, writes that it

[B]elieves that [the president’s] approach will not successfully integrate the results of early-stage research and development into the U.S. energy system and thus will not adequately deliver innovative energy technologies, practices, and information to American consumers and companies. Notably, this is the case with complex systems and structures such as America’s homes, offices and other buildings. The Committee provides funding to support a comprehensive and real-world strategy that includes medium- and later-stage research and development; deployment and demonstration activities…

With respect to grid-modernization R&D, for example, the committee finds that, “Most utilities have limited research and development budgets, primarily due to regulatory constraints designed to keep electricity costs low for consumers. Additionally, utilities are unlikely to implement new concepts because most utilities would need to use their own systems for testing and evaluation, which could impact consumers … The Department [of Energy] plays a vital role, not only in early-stage research, but also in deployment, field testing, and evaluation.”

THE ENERGY RD&D PORTFOLIO: WHAT’S AT RISK

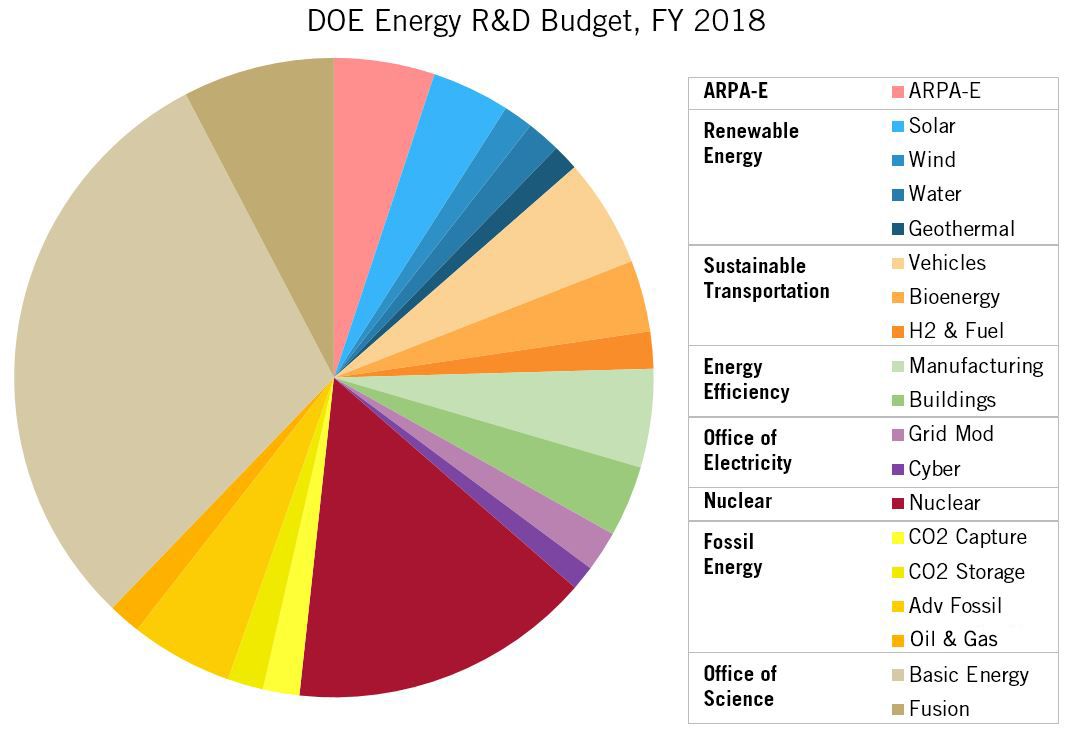

The energy RD&D portfolio supports 19 science and technology exploration programs that tackle a diverse set of challenges: mature domains that need to be reenergized, such as building technologies; sectors that are growing rapidly, like solar power; and innovations yet to be commercialized, such as fusion. Two programs, Basic Energy Sciences and ARPA-E, cut across diverse areas of RD&D.

Figure 8: Energy RD&D by Program Office

Figure 8 displays the distribution of funds across this portfolio, with programs aggregated into groups according to the DOE office that manages them. The bulk of the funding lies in DOE’s applied energy offices: Electricity Delivery and Energy Reliability (OE); Energy Efficiency and Renewable Energy (EERE), with R&D programs organized into renewable energy, sustainable transportation, and energy efficiency; Fossil Energy (FE); and Nuclear Energy (NE). The Trump administration is setting up a new Office of Cybersecurity, Energy Security, and Emergency Response (CESER) as well, which will take over OE’s programs in cybersecurity R&D and energy infrastructure emergency response. Fusion and Basic Energy Sciences lie within SC, while ARPA-E is a stand-alone, semiautonomous agency.

Figure 9: Proposed Changes in the DOE Energy Budget

Figure 9 shows how these areas are treated in the FY 2019 budget request. Key proposals illustrated include:

- Elimination of ARPA-E;

- Significant reductions within EERE RD&D, ranging from 49.6 percent (for hydrogen and fuel cells) to 83.3 percent (for bioenergy);

- Scaling back of FE’s RD&D on carbon capture, utilization, and storage by 79.9 percent;

- Cutting NE RD&D by 49 percent;

- Reducing OE’s RD&D on grid modernization by 71.2 percent;

- Reducing CESER’s RD&D on cybersecurity by 7.7 percent; and

- Reducing the Office of Science’s energy RD&D (including Basic Energy Sciences and Fusion) by 16.5 percent.

The rest of this report delves deeply into each of the 19 programs.