Concentrated Markets Are More Productive

To be fair, there is an argument that large businesses are detrimental to overall economic welfare. The simplest economic models teach that monopolies charge higher prices and restrict output. However, models closer to reality acknowledge that some monopolies arise due to innovation from “superstar” firms that offer superior prices and products, or large-scale economies that decrease prices and raise output.

The Census Bureau published a recent paper providing compelling evidence that increases in market concentration are linked to higher productivity and output. Combining data from the Census Bureau’s Economic Censuses and the Bureau of Economic Analysis, the authors found that a 10 percent increase in the market share of the four largest firms (C4) led to a 1 percent increase in output, flat prices, a 2 percent increase in labor productivity, and a 0.5 percent increase in wages. In other words, growing market leaders produce more output with fewer, higher-paid workers. The lack of price increases indicates that productivity benefits are sufficient to offset the market power gains. Other evidence shows that dominant firms were more effective at introducing new and improved products.

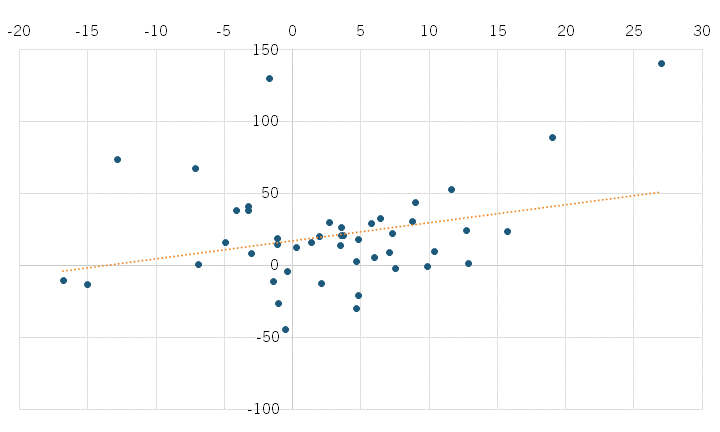

ITIF analyzed concentration and productivity between 2002 and 2017 using census data on concentration and Federal Reserve labor productivity data, which were available for 59 industries at the six-digit NAICS level. We looked at changes in C4 concentration ratios in each industry and related them to changes in worker productivity. Changes in C4 concentration and labor productivity had a correlation of 0.28, as illustrated in Figure 1. In other words, as sectors became more concentrated, they became more productive. This is congruent with economies of scale: as businesses grow in size, they become more productive.

Figure 1: Percentage point change in C4 concentration (horizontal) and change in labor productivity (dollars per hour worked, vertical), 2002-2017

If antitrust agencies were to take the advice of neo-Brandeisians and challenge dominating corporations solely based on their size, they would be ignoring the circumstances that contributed to those companies' successes and how they achieved their position in the market. The major retail firms Amazon and Walmart have long been accused of being monopolies. In reality, both exploited economies of scale to lower their marginal costs and passed on savings to consumers. Their products were well-received by American consumers, which increased their market share. While market power may have grown in some instances, consumers benefited from lower prices and more options.

It is inappropriate to use antitrust laws, established to protect consumers, to punish productive firms that have boosted market output and lowered prices. Strengthening antitrust laws purely based on a big-is-bad ethos will not benefit consumers and, in many circumstances, will impede the most effective businesses from expanding their operations and developing new products. The elimination of the most productive enterprises in the United States will not only hinder long-term economic progress, but will also reduce the purchasing power of Americans and help foreign competitors at the expense of workers in the United States.

Regarding antitrust enforcement, enforcers ought to take a more even-keeled approach. The potential benefits of market consolidation must be weighed against the adverse effects of prospective market share acquisition by regulators. When this is done, both customers and businesses can flourish in a highly competitive and dynamic market.